2018 Rate Hikes: North Carolina: BCBSNC reduces request from 22.9% to 14.1%

In late May, I noted that Blue Cross Blue Shield of North Carolina, which holds a near monopoly on the individual market in NC with around 95% of total enrollment, had submitted an initial rate hike request for 2018 averageing 22.9% overall. What was remarkable at the time is that while most carriers were pussyfooting around using euphamisms about the reasons for their excessive increase requests, BCBSNC was among the first to come right out and state point-blank that it's the Trump Administration's deliberate sabotage of the market--primarily via the threats to cut off CSR payments and to not enforce the individual mandate--that are responsible for over 60% of the increase. This is from their blog, not mine:

Another rate increase above 20 percent is a tough message to deliver to customers who depend on the Individual market for health care coverage. The good news is that federal subsidies will again help lower premiums for customers in 2018. In fact, most of our ACA customers may see little to no premium increase in 2018. Many may even see a decrease depending on their financial situation.

Still, cost-sharing reductions have a big impact on North Carolinians. That became clear to our actuaries as we looked at proposed rates for 2018. If the federal funding continued, we would have filed an average increase of just 8.8 percent for 2018.

That’s a difference of almost 14 percentage points – similar to what’s happening across the nation. A recent analysis by the Kaiser Family Foundation said that the average Silver plan premium would be 19 percent higher without cost-sharing reduction payments to insurers.

They explained the breakout in pretty clear detail, but that's what it came down to: If the Trump administration would stop jerking everyone around, ensure CSR reimbursements continue, the mandate is enforced and stop freaking people out, they'd only be asking for an 8.8% rate hike.

Well, guess what just happened today (h/t Aryana Khalid for the heads up)?

WHY WE ASKED REGULATORS FOR A SMALLER PREMIUM INCREASE ON OUR 2018 AFFORDABLE CARE ACT PLANS

The individual market in North Carolina has become less volatile. At Blue Cross NC, we have gotten a better handle on the anticipated medical costs of people covered in this group which has made it easier for us to estimate the necessary price of our ACA health plans.

Put simply, we got information in June and July that made us confident we could reduce our requested rate increase for 2018.

Adjusting our ACA rate request is nothing new for us. In each of the last 3 years, we revised our rate filing to take into account additional claims experience or new developments. In a few of those years, the adjustment increased our rate request. This time, the adjustment is to reduce our request.

We notified the Department of Insurance that we are reducing our requested increase to 14.1 percent as they complete their review. We think this increase will allow our ACA plans to be financially viable while being more affordable for our customers.

Does this mean all the challenges associated with the ACA have gone away? No.

There is still a great deal of uncertainty surrounding the law. Many customers, particularly those not receiving Federal subsidies, will face challenges affording any premium increase. But for now, we believe we can continue to offer ACA plans in 2018 with a lower premium increase than we initially projected.

Hmmmm...a reduction of around 14 points. Is that a coincidence? Not exactly:

Blue Cross Blue Shield of N.C. plans to lower its premium rate hike request for 2018 individual Affordable Care Act insurance plans from 22.9 percent to 14.1 percent, the insurer said Wednesday.

...Mark Hall, a law professor at Wake Forest University and a national health-care experts, said the Blue Cross decision "is encouraging news. It indicates that the individual health insurance market in North Carolina has become more stable, which means there is less reason to repeal the Affordable Care Act."

Blue Cross said May 25 that the 22.9 percent rate increase was based on the subsidies ending, along with claims data from the first quarter of 2017. It projected an 8.8 percent rate increase with the subsidies remaining in place.

...Spokesman Lew Borman said the 8.8 percent rate increase proposal from May "basically goes away" with the amended request.

"We think this (14.1 percent) increase will allow our ACA plans to be financially viable, while being more affordable for our customers," Tajlili said.

The underlying 8.8% rate hike basically goes away.

In other words, BCBSNC is would be making a profit (or at least breaking even) on the individual market...if not for Trump/GOP sabotage.

Put another way: The non-Trump sabotage rate increase for BCBSNC would be...0%. Flat. Zilch.

In fact, technically speaking, this means they slightly overshot their 2017 rate hike, because 2018 rates include a one-time 2-3% increase to cover the reinstatement of the ACA carrier tax. Actual medical inflation by itself wold apparently have resulted in a slight lowering of their rates.

Blue Cross reaffirmed its plans to cover all 100 counties.

...Cigna HealthCare of N.C. filed for a 31.9 percent rate increase to cover a projected 21,396 customers in five Triangle counties.

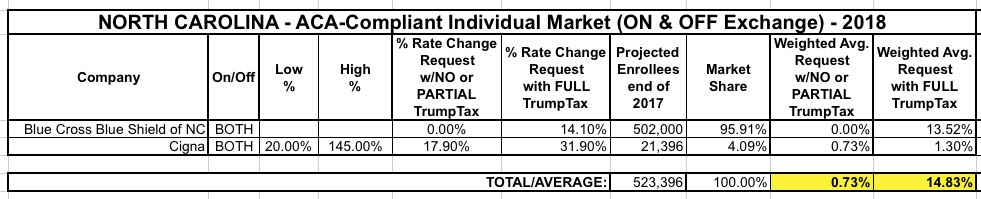

Cigna's 31.9% request hasn't changed. Assuming a similar 14 point CSR factor (Kaiser Family Foundation pegged NC at 20 points, but that only applies to Silver plans), here's what the NC weighted unsubsidized average increase requests should now look like:

That's 14.8% overall with the full Trump Tax in place...or less than 1% without it (and really, that still includes a bit of mandate enforcement uncertainty).