Congressional Republicans now just throwing stuff at the wall to see if anything sticks (updated)

Hot on the heels of Republican Senators Bill Cassidy of Louisiana & Mike Crapo of Idaho presenting their so-called "Health Care Freedom for Patients Act" which would do almost nothing to actually help ACA enrollees while causing more harm to transgender individuals (of course) and undocumented immigrants (of course), at least two more "The clock is ticking, we have to come up with SOMETHING!" bills have been rolled out today by Congressional Republicans.

First up is this one from former centrist Democrat-turned-MAGA-Republican Congressman Jeff Van Drew of New Jersey (h/t Andrew Sprung for bringing it to my attention):

Washington, DC -Today, Congressman Van Drew joined a bipartisan coalition of House members calling for a short-term extension of the Affordable Care Act's (ACA) tax credits with targeted modifications of the system. The group also sent a letter to House and Senate leadership asking for a meeting to discuss a clear path forward for health insurance.

"Extending these credits affects millions of Americans," said Congressman Van Drew. "I have spoken with countless constituents who will be hit hard if we do not act. I am not a supporter of the ACA by any means. It has fraud, corruption, and it has failed to truly bring down costs. But families trying to get by did not create this problem. Politicians in Washington did. Now it is our responsibility to fix it. People cannot afford to lose their coverage while we work on a better plan. We need time to put together a system that is more responsible and more affordable than the ACA, and we need to protect coverage for the men, women, and children of America in the meantime. This bipartisan framework is a good first step. We have a lot more work to do, and we are going to keep at it until we reach a plan that works for the American people."

OK, sounds semi-reasonable so far (he's overstating the fraud/corruption stuff of course, but that's to be expected). But wait, what's this?

Congressman Van Drew has also introduced the Tax Credit Extension Act, which would extend the enhanced ACA premium tax credits through 2027 and raise the maximum household income eligibility to 700% of the federal poverty line.

Hmmm...again, 700% FPL is a lot lower than I'm comfortable with (I was moderately OK with the HOPE Act's 935% FPL), but it's still a lot better than 400% FPL. Is there anything else in it, however?

SEC. 3. ADVANCE PAYMENT OF PREMIUM TAX CREDIT MADE DIRECTLY TO INDIVIDUALS OR TO PERSONAL HSA.

Hoo boy. This appears to allow enrollees the option of having all of their federal tax credits (not just the enhanced portion) paid into, once again, a Health Savings Account or directly into their own pocket. At least that's my read of this portion (I'm cleaning up the legislative text to make it more readable):

In general...the PPACA is amended...by striking "credit or reductions to the issuers" and inserting the following: "credit or reductions...on the election of the individual, to the issuer, and in the case of an individual who is covered under a plan in the bronze level, or a catastrophic plan, and who so elects, to the personal HSA of the individual, in the absence of either such election, to individuals."

It then goes on to add the GOP's insistence on not allowing anyone to have a $0-premium plan no matter what by adding a "MINIMUM PREMIUM RESPONSIBILITY" (the phrasing of this is a bit ironic given how batshit insane Republicans used to go over the ACA including an "INDIVIDUAL SHARED RESPONSIBILITY" provision until they zeroed it out back in 2019).

The good news is that Van Drew's bill wouldn't require a minimum premium of $5/month like Trump and other GOP members have been insisting on. The bad news is that he wants to leave the minimum amount up tot he discretion of the Treasury and HHS Secretary, which means that RFK Jr. and Scott Bessent would get to decide the minimum amount you'd have to pay no matter what your income is. Wheeeeee!

The next section would appropriate funding for Cost Sharing Reduction reimbursement payments over 15 years after the ACA was signed into law and over 11 years after House Republicans successfully sued the Obama Administration to prevent funding of Cost Sharing Reduction reimbursement payments.

And yes, doing this would eliminate Silver Loading, meaning that unsubsidized Silver plan premiums would drop somewhat...but subsidized BRONZE, GOLD and PLATINUM premiums would increase dramatically. So that's fun.

Finally, the Van Drew bill would take one more swipe at immigrants by requiring Bessent, RFK Jr. and our favorite dog murderer, DHS Secretary Kristi Noem to "assist" the exchanges in determining whether "alien individuals" are "eligible aliens" for ACA exchange enrollment purposes.

Next up is this one from GOP U.S. Senators Bernie Moreno of Ohio and Susan Collins of Maine: (h/t Dave Anderson for the heads up)

Today, Senator Bernie Moreno (R-Ohio) and Senate Appropriations Committee Chairwoman Susan Collins (R-Maine) will introduce the Consumer Affordability and Responsibility Enhancement (CARE) Act to cap income eligibility and eliminate zero-premium plans.

“Barack Obama and the Democratic Party created this disaster, lining the pockets of massive insurance companies while healthcare costs for everyday Americans skyrocketed,” said Senator Moreno. “But I refuse to let the American people pay the price for the Democrats’ incompetence. I am willing to work with anyone to finally bring down costs for all Americans and hope my colleagues across the aisle will commit to doing the same.”

“Families in Maine and across the country are struggling with the high cost of health care, and we need to pursue practical solutions that increase affordability without creating sudden disruptions in coverage,” said Senator Collins. “This bill would help prevent unaffordable increases in health insurance premium costs for many families by extending the Affordable Care Act enhanced premium tax credits for two years and putting a reasonable income cap on these subsidies to ensure they are going to the individuals who need them.”

Okayyyyy....

Senator Moreno’s CARE Act will provide a temporary Affordable Care Act premium tax credit extension by giving Americans a two-year glidepath off the COVID-era subsidies,...

Okayyyyy...

end premium tax credits once household income hits $200,000...

Hmmmm..."household income hits $200K?" For one person? Two? Four? Six? That's kind of important, since $200K for one person would be 1278% FPL (perfectly reasonable) while $200K for a family of four would only be 622% FPL (far too low in my view, but whatever)...

and require a $25 per month premium.

You've got to be shitting me.

I clicked the "read more" link but the PDF it links to literally just says the following:

Senator Bernie Moreno

Consumer Affordability and Responsibility Enhancement (CARE) Act

- Provide a temporary ACA Premium Tax Credit extension — but responsibly. Give Americans a two-year glidepath off the COVID-era giveaways.

- Phase out subsidies for high earners. End premium tax credits once household income hits $200,000 — because wealthy Americans don’t need Uncle Sam’s help buying insurance.

- End $0 premiums. Require a $25 minimum monthly payment so everyone has skin in the game — and to shut down the fraud and abuse that zero-premium plans invite.

For more information, contact andrew_rothe@moreno.senate.gov

That's it. No details on how many people the $200K "household income" includes, and sure enough, they want to require people who earn as little as $15,651/year (remember, 10 states haven't expanded Medicaid) to pay $25/month in premiums alone. $15,651/year is just $1,304/month.

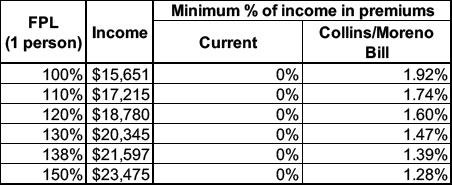

In other words, this would not keep the enhanced premium tax credits the same as they are now, even for those under $200,000/year. Here's what it would look like:

That's right: The poorest enrollees would have to pay the highest minimum percent of their income.

For what it's worth, over 75% of ACA enrollees earn less than 150% of the Federal Poverty Level.

As I've said before: If they went with the HOPE Act's 935% FPL and knock the minimum premium down to $1/mo I could accept it...but if I advised saying no to $5/mo I'd absolutely say no to $25/mo.

Anyway, I'm sure there will be another half-dozen plans desperately slapped together over the next few days. After all, as Missouri GOP Senator Josh Hawley just said:

"Republicans had better offer something. I mean, what signal will it send if Republicans say, 'we're going to say no to the Democrats' plan. but we're not gonna offer anything?' The message that will send is: 'Good luck to the American people, we don't really care.'"

Well...these are "something" I guess...

Update 12/09/25: OK, there's another bill which is being rolled out from the House; this one has bipartisan support and actually isn't nearly as bad as the Cassidy/Crapo bill or the Van Drew bill above, although it's a lot worse than the HOPE Act which I gave my stamp of approval to a week or so ago:

A bipartisan group of House members is introducing a bill to extend the enhanced Obamacare subsidies for two years with new income limits and anti-fraud measures.

Rep. Brian Fitzpatrick (R-Pa.) is leading the effort, along with GOP Reps. Don Bacon (Neb.), Rob Bresnahan (Pa.) and Nicole Malliotakis (N.Y.), plus Democratic Reps. Jared Golden (Maine), Tom Suozzi (N.Y.), Don Davis (N.C.) and Marie Gluesenkamp Perez (Wash.). The legislation — summarized here — would also crack down on pharmacy benefit managers and expand health savings accounts.

The bipartisan group is considering trying to force a House vote through a discharge petition. And they have a legislative vehicle they could use to speed up the process.

Yet using a discharge petition would be a long shot. It’s not clear if House Democratic leadership would back this compromise, which would need heavy support from their side to succeed. But lawmakers seeking an ACA patch — even if it can’t happen until after the subsidies expire on Dec. 31 — are turning to last-ditch plans as the deadline approaches.

The tax credit formula table changes are confusingly worded, but it basically boils down to:

- A $5/month minimum premium even if the main formula would normally make you eligible for $0/mo premiums

Republicans seem to be obsessed with the idea that a minimum premium is necessary to combat fraud as well as to ensure that "everyone has skin in the game" which is a talking point they've been fixated on for decades. Again, I don't like it and there's ample evidence that it would cause legitimate enrollment to drop by up to a million people (nearly all of whom would be very low income)...but if it has to be included, making it even $1/month would accomplish the same "anti-fraud" goal.

- The rest of the formula would stay at the currently-enhanced levels up to 600% FPL: Good.

- From 600 - 700% FPL the sliding scale would increase from 8.5% to 9.25% of income: Not ideal, but...OK.

- 700% FPL would become the new Subsidy Cliff (roughly $110K/yr for one person or $225K/yr for a family of four

Again, 700% is obviously a lot better than 400%, but it's still too low: I'd be fine if it was 1000% or higher, and even the 935% FPL cut-off in the HOPE Act would work...but 700% is just too low IMHO.

I should also note that the confusingly-worded section (in order to work in the $5 minimum premium) may have been phrased in such a way that only enrollees who earn less than 200% FPL would have a $5 minimum. This would be batshit insane, of course, but I could also be wrong about it.

Beyond that, it would include similar measures to crack down on broker/agent fraud as the ones included in the HOPE Act, which is fine (and which would also pretty much make the "minimum premium" talking point moot).

It would also bump out the final deadline for the 2026 Open Enrollment Period through March 1st, which is also fine (why 3/01 instead of 2/28 I have no idea).

There's two other sections on Pharmacy Benefit Mangers (PBMs) which I'm not familiar enough with to really comment on, but I know there's been a lot of bipartisan work being done on PBMs lately so this might be reasonable.

The next section is one which sets off a low-level red flag:

Section 7: Qualified Exchange Enrollees Eligible to Establish Health Savings Accounts

This section establishes an option for enrollees in a qualified health plan, who select the lowest cost bronze plan available, or if previously enrolled in the Marketplace select a plan that is lower in monthly premium payments than the previous year, to establish and contribute to an HSA. 50% of the credit for the eligible enrollees will be deposited into a Health Savings Account, and this account can be used to pay for health insurance premiums as well as other defined health care costs.

Traditional HSA funds can't be used to pay premiums, and in fact it would be kind of pointless to convert your premium tax credits (which help pay your premiums) into HSA funds which you then use to...pay your premiums.

The larger problem with this, however, is that it would be one more method of pushing people into the last-comprehensive Bronze plans available...as opposed to encouraging them to enroll in highly comprehensive plans, especially high CSR Silver plans for enrollees under 200% FPL.

(sigh) Again, there will likely be more bills tossed around over the next 48 hours before the big Senate vote on Thursday. I won't be able to do write-ups on all of them and there isn't much point in doing so anyway since none of them are gonna pass, but...whatever.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.