Arkansas 2026 Avg. Gross Rate Changes: The Final Chapter (?): +22.2%

(sigh) OK, I'm not sure if we've reached the 5th or 6th chapter in this ongoing saga, but I hope it's the last one.

When we last left our story (just 5 days ago), I noted that both the current number of enrollees as well as the average rate increases for each of the carriers on the Arkansas individual market had jumped all over the place at least 4 times, and that while it's common for these numbers to change a bit here and there throughout the multi-month filing process, both the degree of some of the changes as well as the circumstances surrounding them were often far beyond what I've typically seen in over a decade of tracking this stuff:

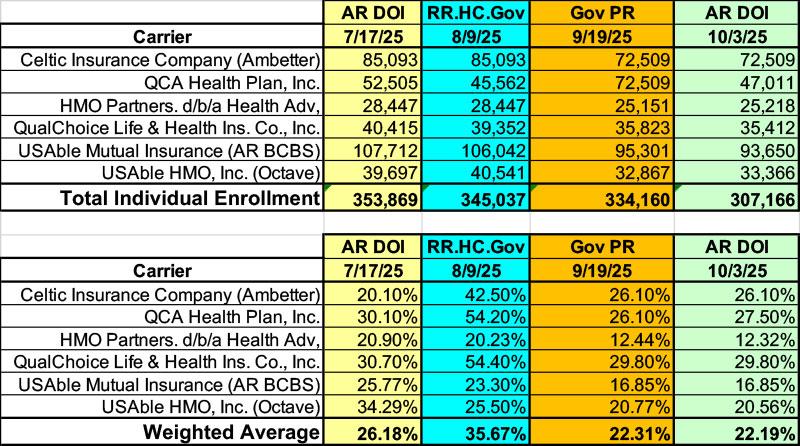

Given all the confusing numbers I've posted before, I've boiled it all down to the simplified tables below which illustrate the mess:

- Arkansas Dept. of Insurance website on 7/17/25

- Federal Rate Review website on 8/08/25

- AR Gov. Sanders press release on 9/19/25

- Arkansas Dept. of Insurance website on 10/03/25

Here's what the four look like side by side:

Again, the enrollment changes from the first to the second columns don't set off any alarms for me as the carriers often make slight tweaks to these when they resubmit their filings.

However, the additional ~11,000 reduction as of the Governor's press release on 9/19 does set off a red flag, especially given that the press release itself claims the total to be far lower still, at 308,662.

This is now followed up by the Arkansas Insurance Dept. now claiming there's even fewer enrollees than that, at just 307,166.

If so, this would be a greater than 13% drop in current enrollment for data which is (as I understand it) supposed to be locked in as of last March or April. That is, I'm pretty sure the actuaries are supposed to stick with their enrollment numbers from last spring even if they resubmit filings a few months later in the year.

Put another way: What the hell happened to the "missing" 46,703 enrollees??

The next part of this mystery is found in the second table: The carriers initially submitted filings for 2026 averaging over 26%...then, a month later, resubmitted dramatically higher average rate hikes of nearly 36%.

So far, this can be partially explained by the AR Insurance Dept's decision to go all in on robust Premium Alignment...except that this still doesn't make much sense since the Premium Alignment policy had been announced via an official bulletin sent out way back in early March. So unless they were shrugging it off or something, why wouldn't the carriers have included Premium Alignment in their inital filings?

Then, a couple of weeks ago, Gov. Sanders issues her press release boasting about somehow causing the final 2026 filings to plummet to just 22% (using enrollment numbers which duplicate each other and which manage to "lose" 11,000 enrollees)...and finally, today, the state insurance dept seems to have belatedly "caught up with" the Governor by updating their website to mostly match the weighted average rate hike her press release claimed...while simultaneously changing their enrollment count to be ~27,000 fewer than the press release table added up to and ~1,500 fewer than the precise number Sanders claims in the press release text.

ON TOP OF ALL OF THIS, I have to go back to the whole Premium Alignment (PA) thing: If the initial 26.2% average didn't include PA but the revised 35.7% average did, then what does it mean if the final weighted average is either 22.2% or 22.3% (depending on whether you go by Sanders' press release or today's AR DOI website)? That isn't just much lower than 35.7%, it's several points lower than the supposedly non-PA initial submission.

I think I've figured out the answer to the first part of the mystery: The reason for some of the "Individual Enrollment" numbers jumping around over time appears to be due to either the Arkansas Insurance Dept. or the insurance carriers themselves confusing the number of covered lives with the number of policyholders.

As you can see below, a few days ago the table on the AR Insurance Dept. website listed the total enrollment as 307,166 people...but today each is higher and they add up to 352,672. This is a ratio of 1.15 people per policy, which is pretty much in line with ACA exchange enrollment nationally (I think it's usually closer to 1.3 or so).

This is something I've run into a number of times over the years with both carrier filings and insurance dept. websites; it's irritating but there's nothing nefarious going on.

So that clears up that mystery.

Now we move on to the much larger question: What the hell actually happened with the actual rate changes?

And this is where both Hardy and I think Arkansas' unique "Private Medicaid Option" comes into play. Again, we could be wrong about this, but it would certainly explain a lot of the surreal stuff swirling around the Arkansas rate filings over the past few months.

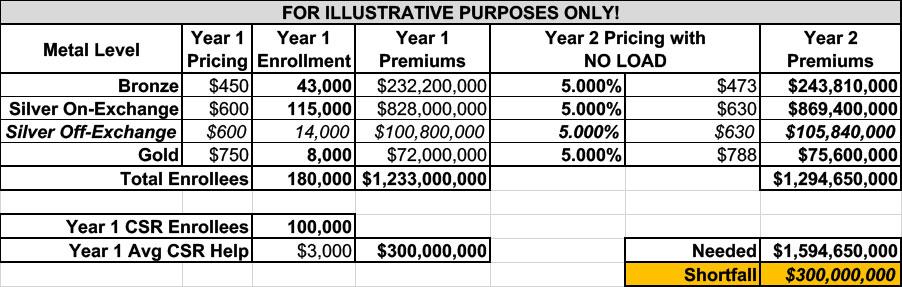

In order to explain, bear with me as I repost revised versions of the tables from 3 weeks ago which I used to explain how CSR subsidies, "Silver Loading," "Silver Switching" and "Premium Alignment" work.

In these versions I've updated the enrollment estimates to be much closer to the actual Arkansas numbers as reported by CMS in the 2025 OEP Public Use File.

The exact numbers for 2025 OEP are:

- 43,535 Bronze enrollees

- 115,265 Silver enrollees (of which 102,908 had CSR assistance)

- 7,839 Gold enrollees

- NO Catastrophic enrollees (not even available in AR)

- NO Platinum enrollees (not even available in AR)

I'm rounding these off like so (I'm also assuming perhaps 8% of the total market are in off-exchange Silver plans...around 14,000), for a nice even 180,000 total. I'm also assuming the average amount of CSR "load" which the carriers have to make up is around $3,000 per CSR enrollee.

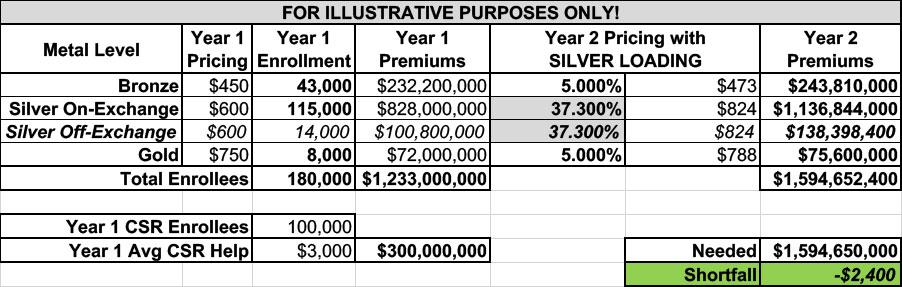

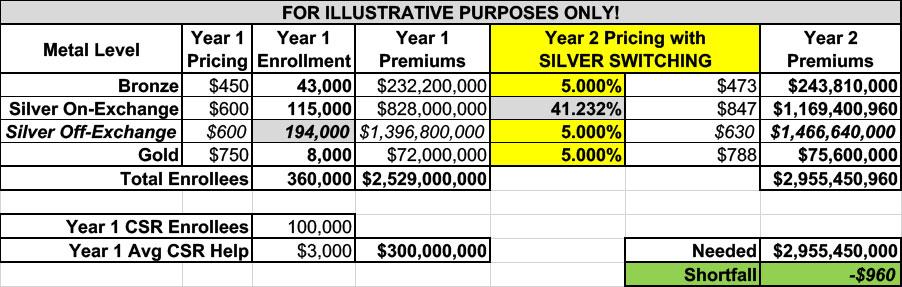

In this scenario, the carriers need to "load" an even $300 million onto their rate increases:

I'm gonna skip past "Broad Loading" and go straight to "Silver Loading," where the full $300M is loaded onto both on- and off-exchange Silver plans:

Next, let's take it one step further and go with full "Silver Switching" where the full $300M is loaded only onto on-exchange Silver plans, holding off-exchange Silver plans harmless:

Notice how while Silver Loading caused an extra 32.3-point increase in all Silver plans, silver switching only bumps it up by a few more points to 41.2%. This is because there's only a relatively tiny number of off-exchange enrollees, so concentrating the load onto on-exchange Silver only pushes those rates up a bit more.

This is what the situation looks like in most states these days, where off-exchange enrollees only make up perhaps 10% or so of the overall individual market.

But Arkansas is very different from every other state in one important way: ARHOME.

Unlike other states which expanded Medicaid to non-disabled adults age 19 - 64 who earn up to 138% of the Federal Poverty Level (FPL), Arkansas came up with an unusual arrangement which was agreed to by the Obama Administration, and which has continued through the Trump, Biden and Trump (again) administrations: Instead of enrolling eligible adults into Medicaid itself, most of them are instead enrolled in the same ACA individual market plans that traditional ACA marketplace enrollees are.

The state then takes the money provided by the federal government (which is, I believe, equivalent to 90% of what it would otherwise cost to enroll the same population into Medicaid itself) and uses it to pay for most of the premiums, with the state also covering "wraparound" costs to make the plans as comprehensive and inexpensive to the enrollees themselves as Medicaid itself would be.

As I've written before, this is an absurdly convoluted, complicated and inefficient way to provide healthcare coverage for the expansion population (it cost something like 27% more per enrollee to do it this way, last time I checked), but it was apparently the only way the powers that be were able to get the Arkansas legislature/governor to sign off on it at the time, so there it is.

This is where my conversation with Mr. Hardy comes back into play:

ARHOME...is a key part of why the state issued that bulletin earlier this spring that instructed carriers to price on-exchange and off-exchange silver plans differently.

Hardy correctly notes that ARHOME enrollees are considered to be "off-exchange" (this is why the ~190,000 or so ARHOME enrollees in ACA plans aren't counted as part of the official CMS Public Use Files).

...So really this is about pricing ARHOME plans differently than individually purchased marketplace plans. Therefore, "silver switching" has the effect of jacking up rates for on-exchange silver plans but NOT for ARHOME plans.

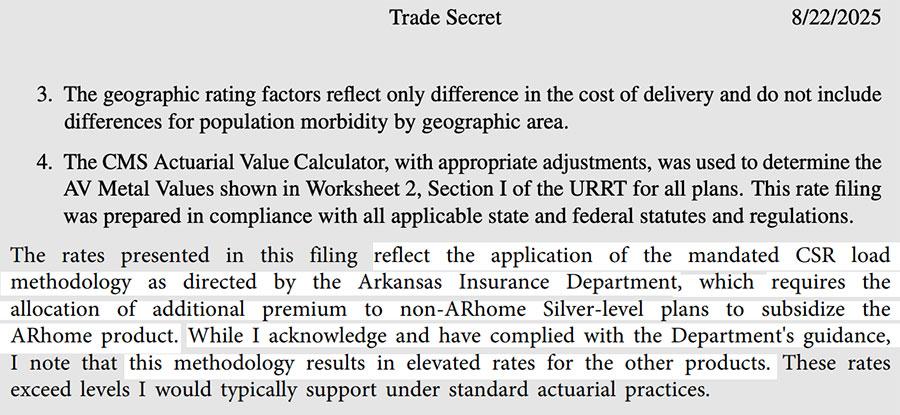

Check out this bit from the actuarial certifications in Centene's most recent rate filings (this is from page 33 of the pdf):

My understanding... is that the carriers were pushed to do this separate pricing in part to keep ARHOME premiums lower.

Since the state pays a portion of that premium...I think they hoped this strategy would both maximize the effect of silver loading while also keeping Medicaid costs down for the state. Remember also that the number of beneficiaries in ARHOME far exceeds the number of people buying individual on-exchange plans -- it's the majority of the insurers' covered population.

So if you require ARHOME population to be priced separately, you're really piling the silver load just on a relatively small number of plans.

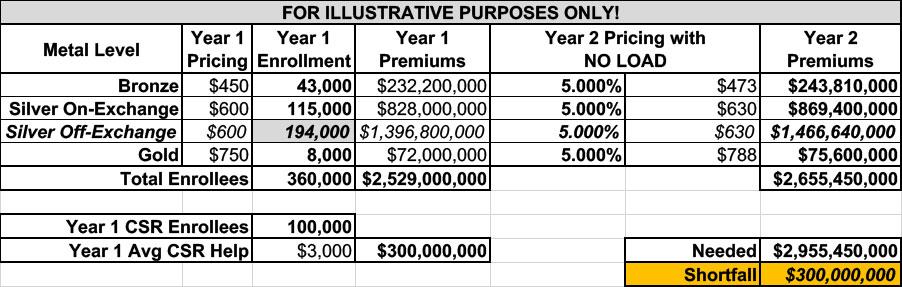

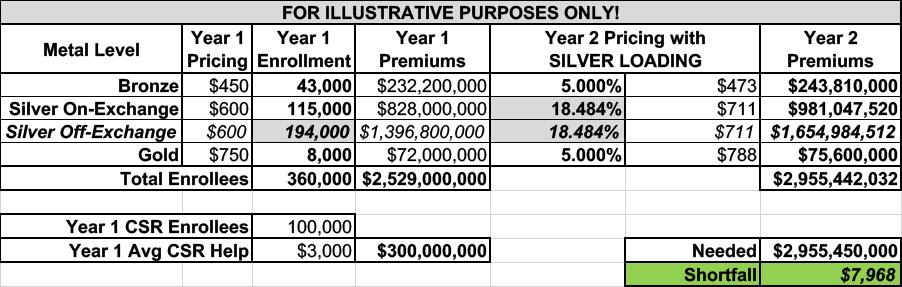

Let's take another look at the three tables above, but this time I'm going to add ~180,000 ARHOME enrollees into the mix, all of whom are off-exchange Silver plan enrollees:

If I simply add them to the off-exchange enrollment figures, the amount of CSR load needed remains identical:

If I go with normal Silver Loading, the impact is more diluted than it was before, because you're spreading the CSR load across an additional 180,000 Silver plan enrollees; Silver plans only go up 18.5% instead of 37.3%.

If I go the extra mile and do full Silver Switching, we're right back at where we were before: A 41.2% average premium hike for on-exchange Silver plans only, because the same load is being spread across the same 115,000 enrollees:

The scenario which we've come up with (and which we could very well be wrong about) is basically as follows:

- The state initially planned on doing full-bore Silver Switching with robust Premium Alignment.

- They did this to both maximize tax credits for on-exchange enrollees earning less than 400% FPL as well as to minimize how much the state has to pay for their share of ARHOME enrollment ("subsidize the ARHOME product" as the actuary put it in the Centene memo quoted above).

- Doing this, however, caused face value, gross premiums to appear to skyrocket from a 26.2% preliminary average increase to a whopping 35.7%, with one carrier listing their average as over 54%.

- Gov. Sarah Huckabee Sanders saw this an basically had a public meltdown, demanding that the carriers refile at lower rates (officially) in order to make the numbers "look less scary."

- In response, the carriers backed away from the full-bore Silver Switching/Premium Alignment and went back to either less extreme Silver Switching or possibly to simple Silver Loading (or somewhere in between)

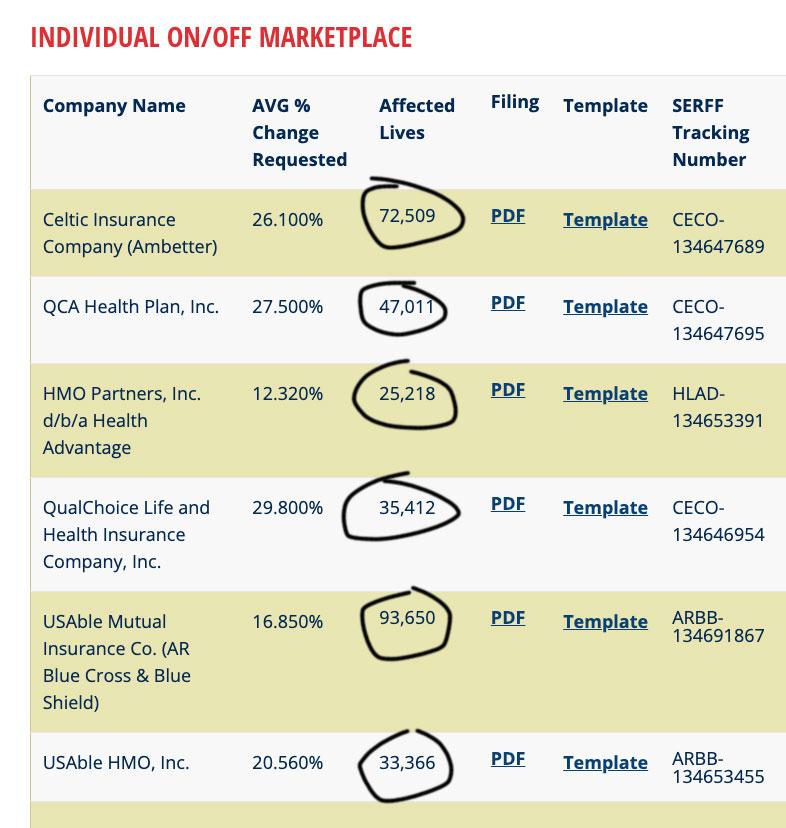

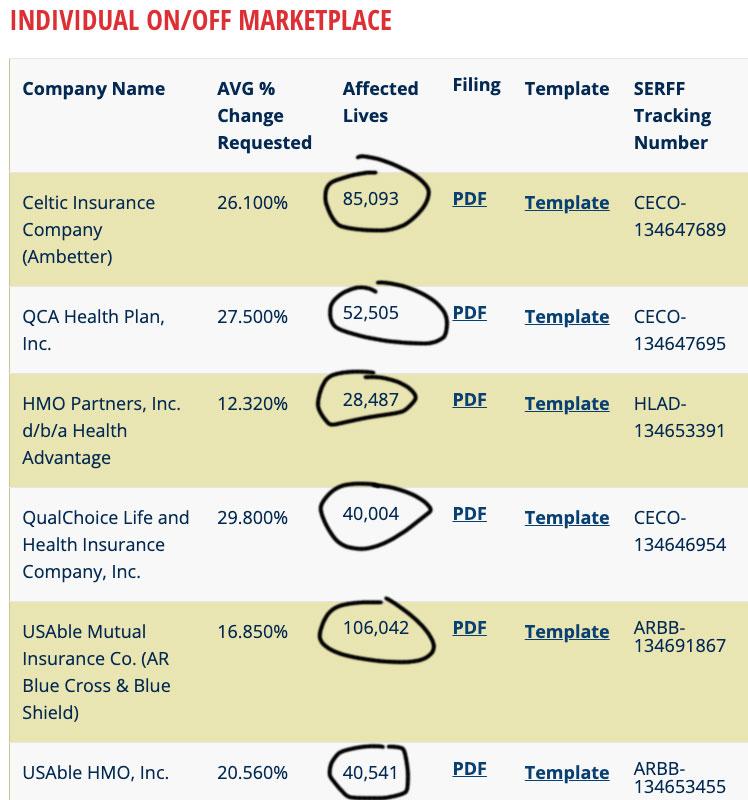

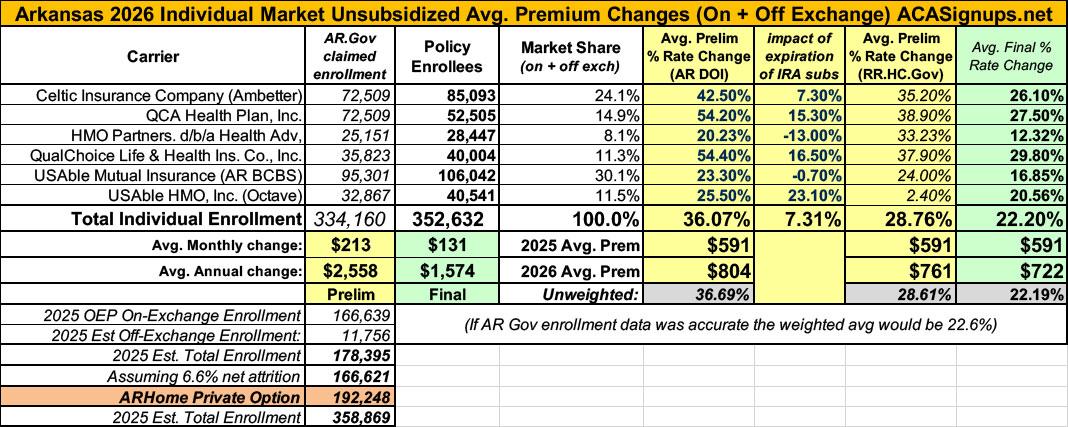

- This, in turn, results in the final official weighted rate filings which I wrote about last week, and which look like so as of this writing:

So, there you have it: 22.2% gross/unsubsidized rate hikes on average, which would be considered sky-high any other year but which is actually slightly below the national average increase (~23.7%) this year.

What does this mean for ARHOME costs? I'm not sure, actually. If we're correct, it suggests that ARHOME plans will increase for the state (as well as the federal government) substantially as well.

It would also means that Arkansas ACA exchange enrollees won't benefit nearly as much from the tax credit boost as they would under a full-bore Switching/Premium Alignment strategy which the AR DOI was originally planning on going with.

But hey, at least Gov. Sanders won't have to see that scary-looking 54% QCA rate hike on the Insurance Dept. website.

Or...we could simply be wrong: The state may still very well be going the "full switching" route in which case exchange enrollees would benefit more and the state would avoid being hit with having to pay more for their share of the ARHOME plans.

In any event, I guess we'll find out for sure three weeks from now when HealthCare.Gov itself goes live for the 2026 Open Enrollment Period.

ADDENDUM:

When I discussed this with Hardy, I also speculated about another possibility: Notice how even with the ARHOME population listed, I still only have 100,000 CSR enrollees?

Well, the ARHOME enrollees also receive robust Cost Sharing Reduction (CSR) assistance. The question is, where is that coming from?

Now, my colleague Louise Norris provided me with a link to the ARHOME Section 1115 Demonstration Project Application summary which states that Arkansas provides the carriers with CSR payments in advance:

DHS makes monthly capitated payments to the QHPs to cover the cost of premiums. It also makes advanced cost sharing reduction (ACSR) payments to the QHPs to reimburse providers to cover the cost of deductibles and copayments. The difference between the ACSR payments and actual cost sharing payments from the QHPs to providers is reconciled annually. Total payments to the QHPs on behalf of their members have an average value of approximately $7,000 per person per year.

As an aside, Hardy has also confirmed the details on how this works in practice with the AR Insurance Dept:

Silver-level plans sold on the Marketplace charge higher copays than the $4.70 or $9.40 ARHOME beneficiaries pay.

For example, a plan might normally have a $50 copay for a doctor’s visit. ARHOME beneficiaries pay just $4.70 of that $50 copay, and DHS is responsible for the rest. DHS makes a monthly payment, known as an Advanced Cost Share Reduction (ACSR) payment, to the QHPs to cover the estimated amount of the copay not paid by ARHOME beneficiaries. This is an estimated up-front payment to cover beneficiary copays. At the end of the year, the estimated amounts are compared against actual copays incurred, and reconciliation payments are made to settle any uncovered costs or overpayments.

I should note that this, ironically, is very similar to how federal ACA CSR payments used to be made to insurance carriers before Trump 1.0 cut them off in October 2017, except that those were reimbursement payments made after the fact.

For each beneficiary, DHS pays the plan’s monthly premium and an ACSR payment. The ACSR rates for 2025 were set at 38% of each premium rate.

ACA market premiums in Arkansas run $591/month on average this year, so 38% of that would be roughly $225/month or around $2,700/year.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.