Schrodinger's Open Enrollment Period Continues: 2025 OEP both down 26.5% & up 2.3% at the same time!

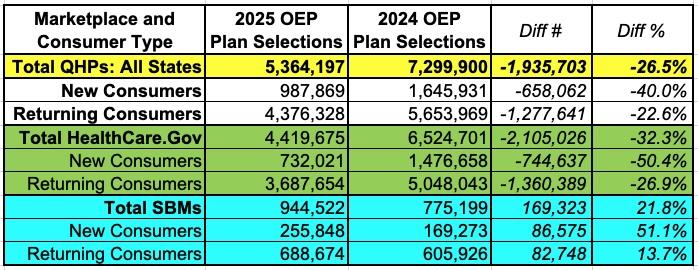

Earlier this afternoon, the Centers for Medicare & Medicaid Services (CMS) published the second 2025 Open Enrollment Period "National Snapshot" report...and as I noted two weeks ago, at first glance healthcare data junkies might panic at the seemingly low topline numbers:

The Centers for Medicare & Medicaid Services (CMS) is committed to creating a robust Marketplace Open Enrollment process for consumers so they can effortlessly purchase high-quality, affordable health care coverage. CMS reports that nearly 988,000 consumers who do not currently have health care coverage through the individual market Marketplace have signed up for plan year 2025 coverage.

OMG! Last year over 1.6 milllion new enrollees had signed up as of the first snapshot report...over 66% more!

During last year’s record-setting Open Enrollment Period, 21.4 million people signed up for coverage, driving the uninsured rate to a historic low, where it remains today. Consumers who have Marketplace coverage now will generally see their coverage renewed for 2025 if they take no action during the current Open Enrollment Period. At the same time, existing consumers are encouraged to return to the Marketplace and actively renew their coverage. Nearly 4.4 million existing consumers have already returned to the Marketplace to select a plan for 2025. Building on the historic success of last year, we are on track for a record high number of plan selections for this year’s Open Enrollment.

OMG! Last year over 5.65 million existing consumers had actively re-enrolled...over 29% more!

But wait...what's that last bit?

we are on track for a record high number of plan selections for this year’s Open Enrollment.

Huh? How could that be? From the initial numbers, it looks like the 2025 OEP is off to an ugly 26.5% drop in enrollments...

So what's going on here? A lot.

First of all, let's look at the footnotes:

[3] These metrics reflect available data through November 30, 2024, for Federally-facilitated Marketplaces (FFMs) and State-based Market places on the Federal Platform (SBM-FP) and through November 23, 2024, for State-based Marketplace (SBMs).

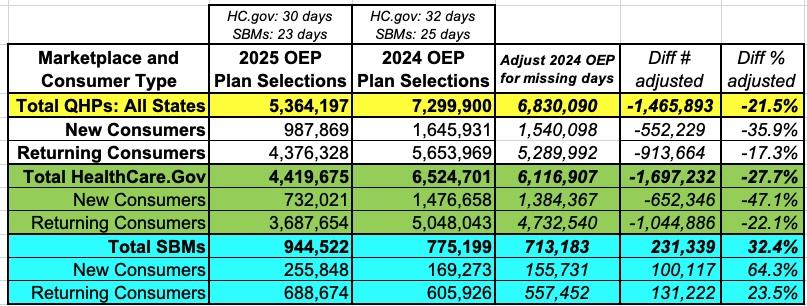

Why is this important? Because last year's second snapshot report included enrollments through Dec. 2nd for FFM states and through Nov. 25th for SBM states...two more days for each state.

Those two missing days may not sound like much, but for the first report they make a big difference: That's 6.3% less time for FFM states and 8% less for SBM states.

Here's what it looks like when I adjust for each:

When I adjust for the missing 2 days, that 26.5% enrollment drop is actually a 21.5% drop...still not great, but 1/5th fewer is better than 1/4 fewer.

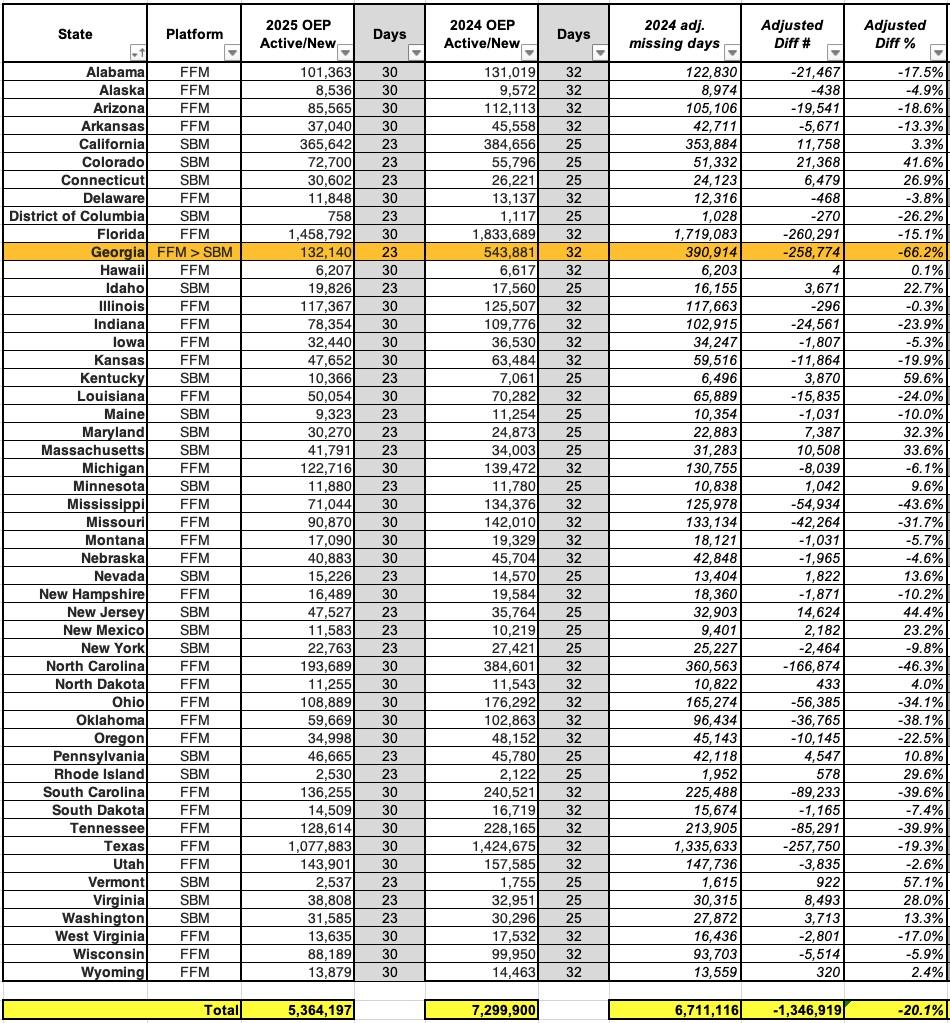

Next, we have to adjust for another major change from last year: Georgia, which transitioned from being hosted via the Federally Facilitated Marketplace (FFM, or HealthCare.Gov) over to its own full State-Based Marketplace (SBM), Georgia Access.

This is important for several reasons. The 2024 data above includes Georgia as an FFM state...but the 2025 data has it rightly listed as an SBM state. The problem is that unlike every other state which has to be adjusted from either 32 to 30 days or from 25 to 23 days...Georgia has to be adjusted from 32 days to 23 days!

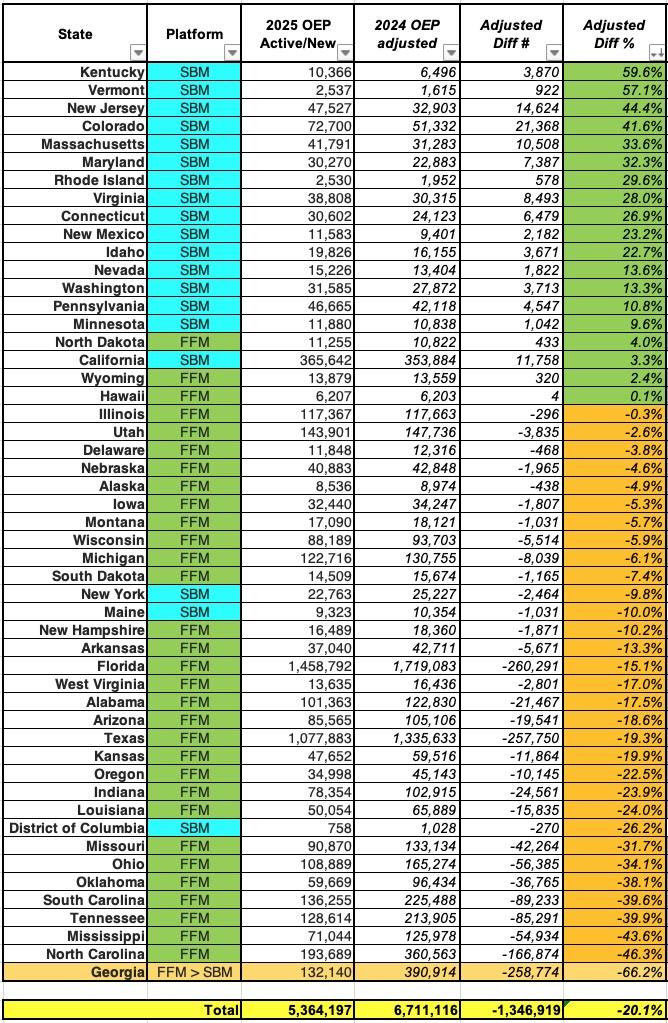

To see that, I've plugged in the actual numbers for each individual state and adjusted each for the missing days, which looks like this:

When you do this, the actual year over year drop is a bit lower still: down 20.1%.

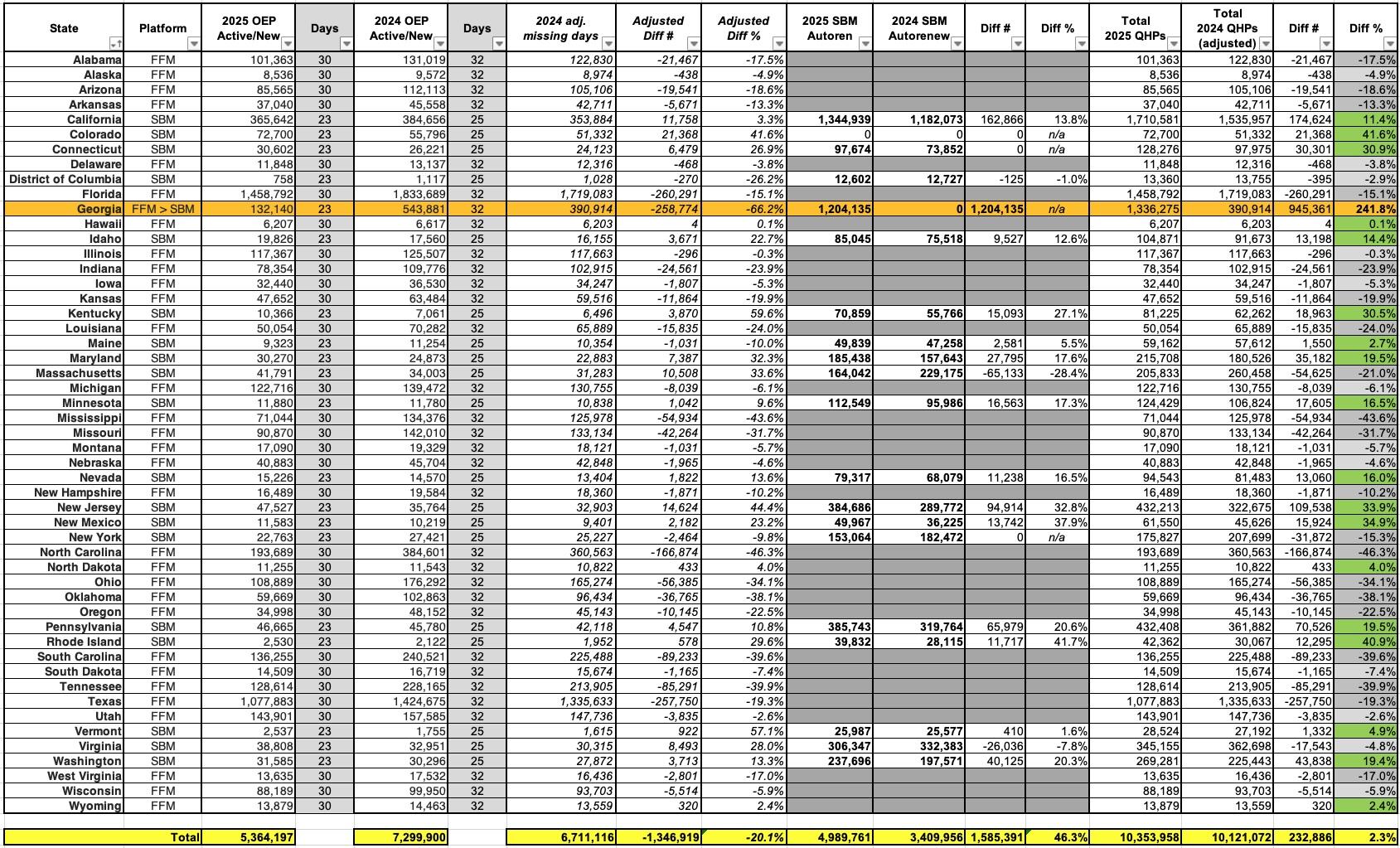

But there's also One More Thing: AUTO-RENEWALS.

If you keep reading, you'll see that nearly all of the state-based exchanges front-load their auto-renewals of existing enrollees (HC.gov waits until after the initial Dec. 15th deadline before doing so).

And when you compare 2025 SBM front-loaded auto-renewals to the same data from last year, there's a pretty big change:

Every SBM except for Colorado is now reporting their auto-renewals. If you don't include Georgia, they add up to 3.78 million...375K higher than last year. But even that is dwarfed by Georgia, which reported a whopping 1.2 million auto-renewals on their brand-new SBM platform, which means that total SBM auto-renewals are up to nearly 5 million, up nearly 1.6 million (46%) vs. the same point last year.

This also means that when you include all 2025 Qualified Health Plan (QHP) selections, whether new enrollees, active re-enrollees or auto-reenrollees, the grand total comes to around 10.35 million...or 2.3% higher than the same point last year!

Now, that does NOT mean that total 2025 OEP enrollment will end up being higher than last year. It may run even, or it may actually end up falling well short after all. Remember, the auto-renewal figures being reported by the SBMs will change over time, since some current enrollees will either actively go back into their accounts and terminate it, or they may simply do nothing at all but fail to pay their January premium...at which point they'll be terminated as well.

In addition, if you look only at 2025 FFM states (that is, not including Georgia in either year), active + new enrollments are still down 17% after adjusting for the 2 missing days.

But again, there could be a number of reasons for that--including the possibility that more people may simply have decided to passively auto-renew this year than last. If so, then the remaining auto-renewals (from the 31 FFM states and Colorado) may end up being dramatically higher than last year, thus making up some or even all of the difference.

The larger point is to look beyond the headlines and dig into the actual data before jumping to any conclusions.

It's also important to keep in mind that:

- New York expanded their Basic Health Plan (BHP) program from 200% FPL to 250% FPL this year

- Oregon launched their BHP program this year

- North Carolina may still be seeing some impact from expanding Medicaid last winter

...all of which could account for some of the drop in those states.

Update: It's also worth noting that--looking purely at the adjusted new & active renewals only--there are 19 states running ahead of the same point last year...in some cases dramatically so (Kentucky & Vermont are running more than 50% ahead; New Jersey, Colorado, Massachusetts, Maryland, Rhode Island, Virginia and Connecticut are all more than 25% ahead).

What's particularly noteworthy is that 16 of the 19 are state-based exchanges...a complete reversal of the trend over the past few years where it was the federal exchange states which saw dramatic enrollment increases while state-based exchanges held flat for the most part. Huh.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.