New Mexico: *Final* avg. unsubsidized 2025 #ACA rate changes: +10.2% (updated)

Originally posted 9/09/24

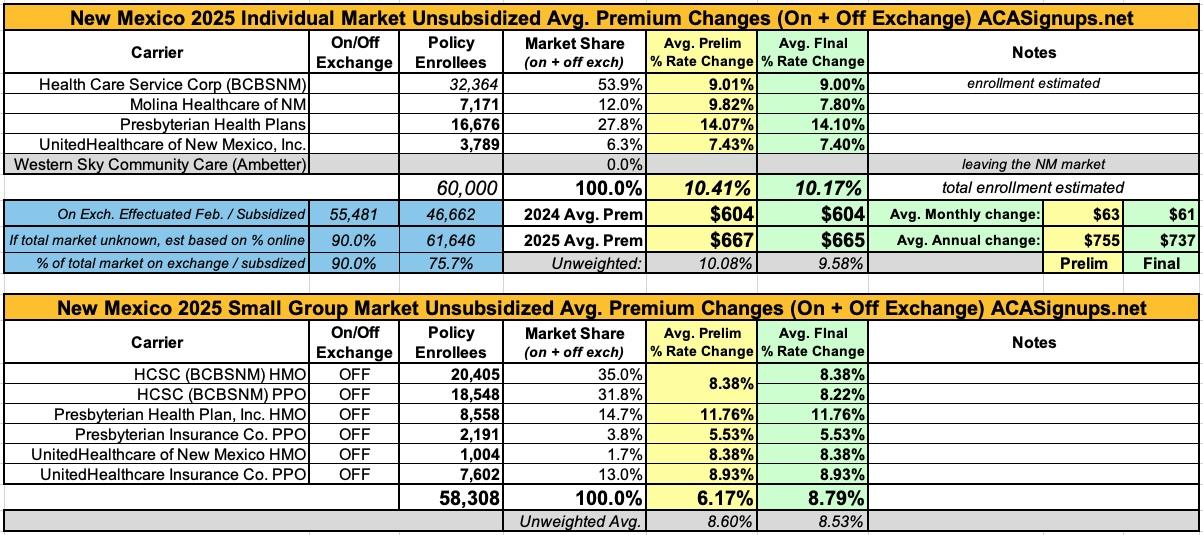

The bad news is that I was only able to acquire effectuated enrollment for 3 of New Mexico's 4 individual market carriers participating in 2025 (a fifth carrier, Western Sky, is dropping out of the market entirely).

The good news is that I'm able to roughly estimate the enrollment of the remaining carrier (BCBS NM) if I look at on-exchange effectuated enrollment as of February and assume that another 10% or so is off-exchange. That gives me an estimated weighted average increase of 10.6%.

Even if that estimate is wrong, it doesn't make much difference since the unweighted average is around 10.1% anyway.

As for the small group market, I only have an unweighted average there of 8.6%.

UPDATE 10/21/24: OK, New Mexico's final/approved 2025 rates have been posted. Not many changes, but the overall weighted rate increase has been shaved down a bit for the individual market, to +10.2%. The SERFF filings now include the actual enrollment numbers for the small group market as well, which means I was able to calculate the weighted rate hike there; it's +8.8% overall.

There's also a press release from the NM Office of Superintendent of Insurance:

SANTA FE – The Office of the Superintendent of Insurance (OSI) completed its review of 2025 Qualified Health Plan (QHP) rates for New Mexico residents.

The OSI reviewed Individual Market – Medical applications from Health Care Service Corporation (dba BCBSNM), Molina Healthcare of New Mexico, Inc, Presbyterian Health Plan, Inc. and United Healthcare of New Mexico, Inc.

Overall, in 2025, New Mexicans will see a 10.2% rate increase in the individual market and 9% in the small group market. Despite these rate increases, subsidies will continue to offer significant savings for most consumers and offset the actual cost.

“Our rigorous review resulted in New Mexico residents having many options,” Superintendent of Insurance Alice T. Kane said. “Most New Mexicans who qualify for subsidies will see no changes in their insurance premiums. The OSI review process focused on ensuring health insurance rates are fair, reasonable, and adequate to cover medical claims. We encourage New Mexicans to shop for the plan that best meets their needs and to set up an appointment with a BeWell certified Enrollment Assister in their community to help navigating their healthcare options.”

In 2025, more New Mexicans will have access to Turquoise Plans, which are health plans that offer extra savings on out-of-pocket costs, including lower deductibles and co-pays.

Based on analysis performed by OSI’s contractors:

- Individuals making under $30,000 a year or a family of four making up to $62,000 will have access to at least 8 Turquoise Plans with a premium under $10 a month.

- Individuals making up to $45,000 a year or a family of four making up to $93,000 a year can choose from 6 Turquoise Plans for under $25 a month.

- Individuals making up to $60,000 a year or a family of four making up to $124,000 per year can find Turquoise Plans for less than $125 a month per family member.

New Mexicans will also have access to Standardized Plans, which are offered by all carriers in the individual market and have standardized out-of-pocket costs. This allows for a simplified and streamlined consumer shopping experience and an “apples-to-apples” plan comparison.

OSI focused on ensuring final approved plans comply with new and existing laws related to benefit mandates, network adequacy and utilization review standards and to ensure that rates are reasonable, not excessive or inadequate and not unfairly discriminatory, as well as that they are actuarially sound.

Open Enrollment for all New Mexico residents starts Nov. 1, 2024 through Jan. 15, 2025. People who choose to enroll through BeWell, New Mexico’s Health Insurance Marketplace, at beWellnm.com, will continue to see significant savings.

Most enrollees qualify for financial assistance through BeWell, which can significantly reduce monthly premiums. The federal Affordable Care Act and programs under New Mexico’s Health Care Affordability Fund subsidy program are keeping costs low for consumers, ensuring that New Mexicans who get insurance from BeWell will have numerous affordable choices during the upcoming open enrollment period.