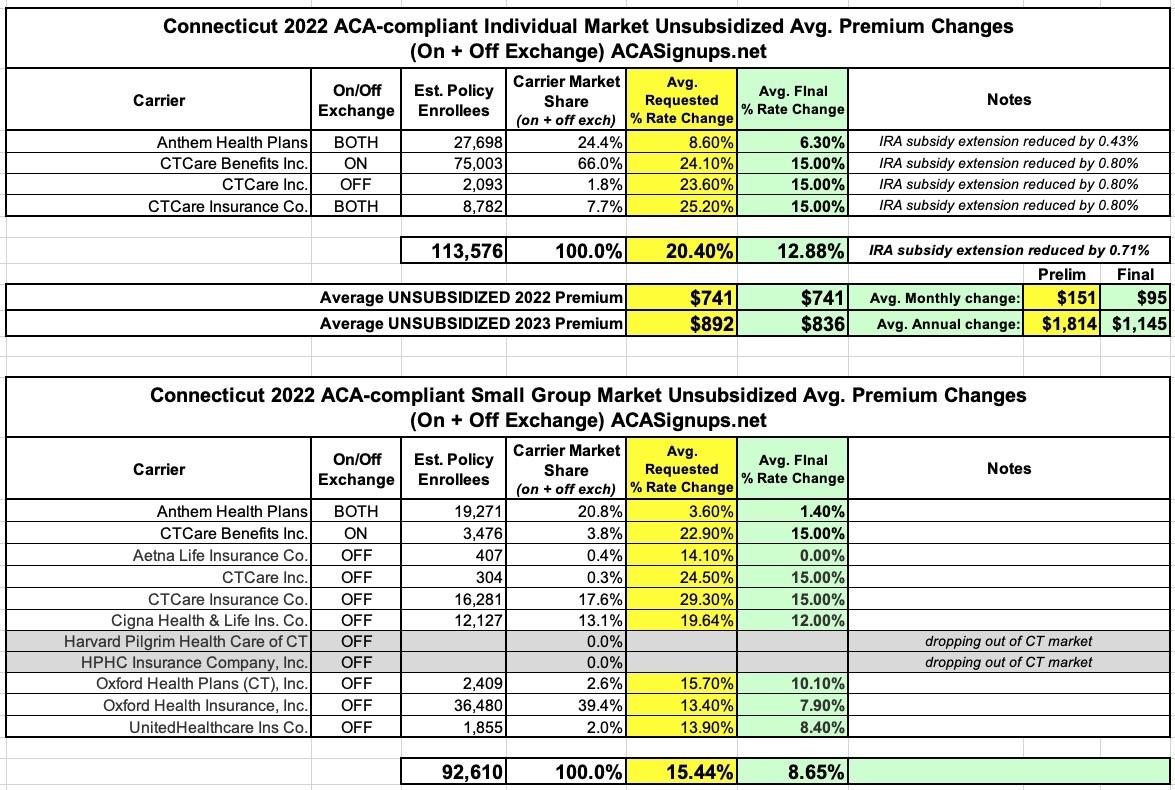

Connecticut: Final avg. unsubsidized 2023 #ACA rate changes: +12.9% (7.5 points lower than requested)

via the Connecticut Insurance Department:

CONNECTICUT INSURANCE COMMISSIONER ANNOUNCES 2023 HEALTH INSURANCE PREMIUM RATES, SAVING ACA PLAN MEMBERS $138.4 MILLION

- As Health Care Costs Continue to Rise, Insurance Department Protects Consumers Against Unjustified Rate Increases by Holding Insurers to Historically Low Profit Margins

Connecticut Insurance Department (CID) Commissioner Andrew N. Mais announced today that the Department continues to protect consumers by significantly reducing health insurers’ 2023 requested rates, despite ongoing increases in underlying health care costs.

Rate increase requests in the individual market were reduced by 37% from the requested 20.4%, resulting in an average increase of 12.9%. In the small group market, the insurers’ requested premium increases were reduced 47% from a requested average of 14.8% to an average increase of 7.9%.

Medical costs have increased about 8-10%, while prescription costs have risen about 10-12%, based on the trend experience submitted in this year’s rate filings. Increased health care use and greater severity — patients presenting at more advanced disease stages thus increasing treatment cost — have helped to drive up aggregate health care spending.

The 206,000 members enrolled in individual and small group plans are projected to save approximately $138.4 million next year due to the rate request reductions and holding insurers’ profit provisions to a historically low 0.5%. Over four years, the Insurance Department’s rate reductions have saved Connecticut consumers approximately $365 million.

“Working on behalf of consumers, the Department’s hard-working actuaries and professional staff were able to reduce the health insurance rate increase requests. But the skyrocketing cost of health care that these premiums cover must be addressed, as we will discuss and explore at an upcoming public informational session on October 3rd,” Commissioner Mais said, “The unit cost of hospital inpatient and outpatient care has risen about 9% per year. Prescription drug prices have risen even higher. The rates announced today will continue to protect consumers from inflationary pricing and unwarranted profits while ensuring Connecticut residents have access to a stable, competitive health insurance market. But we must examine other available avenues to reduce overall costs and keep care, and this insurance, affordable.”

“Consumers can rest assured that health insurance companies in Connecticut are not profiting at the expense of their policyholders. By my order, profits are capped at 0.5%,” said Mais. “Solvency is a very important factor to consider in any rate review to ensure policyholder’s claims will be paid to protect consumers. We have taken each company’s financial condition into account to ensure that consumers will always get the coverage they signed up for. While there are a limited number of carriers participating in the Connecticut individual and small group markets due to the lack of profitability in this small market compared to other states — as one company disclosed during the rate hearings, it was sustaining significant losses in this market — we will continue to work to increase consumer choice and access to health care coverage.”

Commissioner Mais also urged consumers to visit the state’s Affordable Care Act (ACA) Exchange, Access Health Connecticut: “Whether or not you now have an Access Health plan, you may be able to find significant savings on a top-notch product by shopping there.”

Enhanced federal subsidies under the American Rescue Plan Act of 2021 (ARPA) lowers the cost of coverage available through Access Health CT to the lowest it has been in recent years. The amount of these tax credits depends on your income and where you live. Many individuals on the exchange who already receive subsidies will continue to experience these increased subsidies at least through 2025 and those above 400% of the Federal Poverty Level who may not have received subsidies previously will see a reduction in premiums as the maximum premium they can pay under ARPA is 8.5% of household income.

Examples:

- ConnectiCare: A 45-year-old single in Fairfield County that has income of $67,950 (500% FPL) currently pays $456/month in 2022 and will pay approximately $481/month in 2023. Note, while the approved increase is 15%, the subsidized premium increases 5%.

- ConnectiCare: If their income is $40,770 (300% FPL) currently pays$193/month in 2022 and will pay approximately $203/month in 2023. Note, while the approved increase is 15%, the subsidized premium increases 5%.

The Connecticut Insurance Department received 13 rate filings from nine health insurers for plans that will be offered on the individual and small group market, both on and off the state-sponsored exchange, Access Health CT. Those plans cover approximately 206,000 residents.

Here's how the average rate hikes break out, including the requested changes and the approved ones:

It's worth noting that aside from changes to the other factors listed below, the CT Insurance Dept. also shaved off around 0.7% from the individual market rate hikes thanks to the Inflation Reduction Act extending the ARP subsidies for another three years. On average, that's around $5.30/month per enrollee, or roughly $63/year per person. That comes to roughly $7 million saved statewide. Around 81% of ACA exchange enrollees are subsidized in Connecticut, so this should knock the federal APTC subsidy spending down by around $5.7 million, give or take.

Pricing Factors for 2023:

Trend (8-10% for medical, 10-12% for Rx): Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs, and the increased demand for medical services.

Experience Adjustments: Adjustments made to the current premium rates to account for better or worse experience.

COVID-19: The potential impact on future claims to account for the COVID-19 pandemic. The federal government has noted it intends to transfer costs it has previously covered to commercial and other insurers and patients.

Deteriorating Morbidity: As the small group market continues to contract, the potential for deteriorating experience exists.