Connecticut: Approved avg. 2022 #ACA rate changes: +5.6% individual market, +7.0% sm. group (updated)

via the Connecticut Insurance Dept:

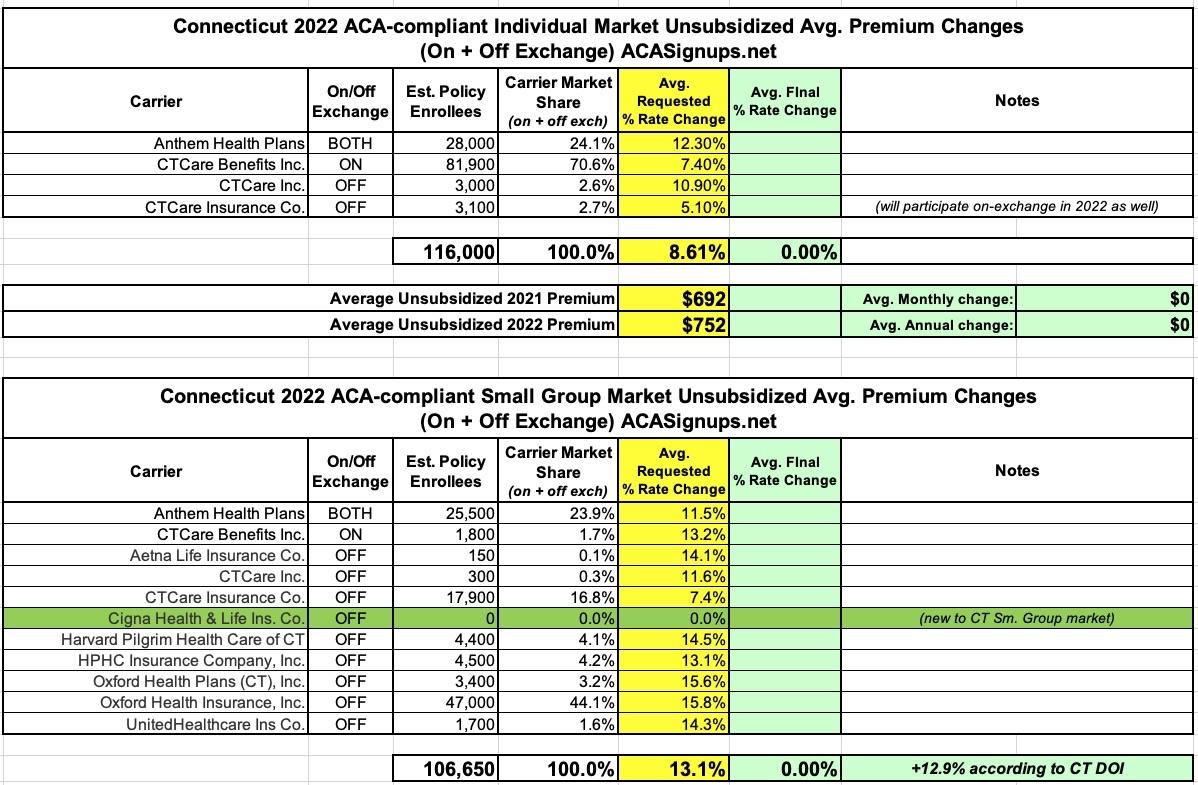

The Connecticut Insurance Department has posted the initial proposed health insurance rate filings for the 2022 individual and small group markets. There are 15 filings made by 11 health insurers for plans that currently cover approximately 222,700 people.

Anthem and ConnectiCare Benefits Inc. (CBI) have filed rates for both individual and small group plans that will be marketed through Access Health CT, the state-sponsored health insurance exchange. ConnectiCare Insurance Company, Inc. will begin participating on the exchange in the individual market effective 1/1/2022.

Cigna Health and Life Insurance Company began participating in the small group market 7/1/2021.

The 2022 rate proposals for the individual and small group market are on average higher than last year:

The proposed average individual rate request is an 8.6 percent increase, compared to 6.3 percent in 2021 and ranges from 5.1 percent to 12.3 percent.

The proposed average small group rate request is an 12.9 percent increase, compared to 11.3 percent in 2021 and ranges from 7.4 percent to 15.8 percent.

In addition, carriers have attributed the proposed increases to:

- Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs and the increased demand for medical services.

- COVID-19: An increase in morbidity and severity of projected claims due to delays in care as a result of the pandemic. In addition, there is an expectation of pent-up demand experienced throughout 2021 and an increase in behavioral health disease anticipated in 2022.

- Legislation: The impact of bills passed such as richer benefits for diabetic treatments (i.e. prescription drugs and medical supplies) and the elimination of copay accumulators are also included in the 2022 proposed rates.

The Insurance Department will conduct actuarial reviews on each filing to determine if they are justified and will either approve, reject or modify the request. The 30-day public comment period on all filings begins today (July 9) and comments can be filed online through the link that accompanies every filing or can be delivered to the Connecticut Insurance Department at P.O. 816, Hartford, CT 06142-0816.

The Department expects to make final rulings on the proposals in September. Open enrollment for the 2022 coverage year begins November 1, 2021.

Here's the breakout by market and carrier. The press release doesn't mention it, but it looks like Cigna is joining the CT small group market this year. Also note that I get a weighted average increase of 13.1% for the small group market vs. the insurance dept's 12.9%, but theirs is the official figure so that's what it is, I guess:

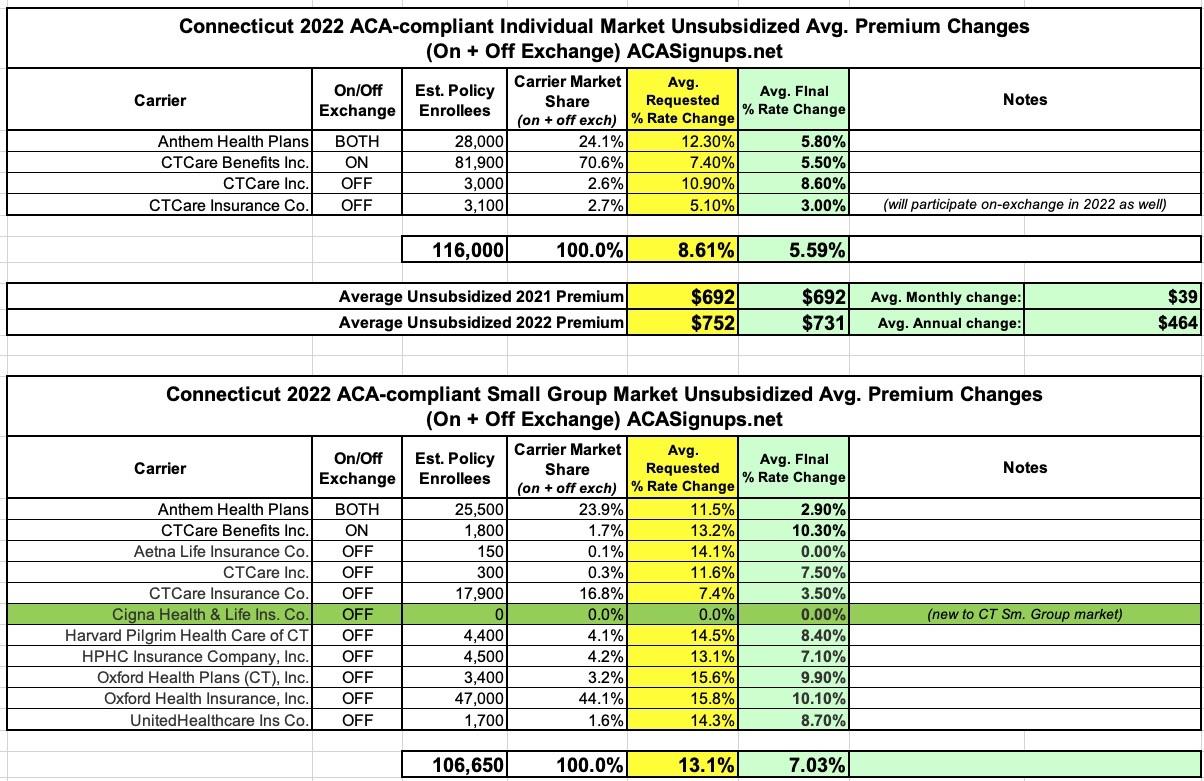

UPDATED 10/19/21: State regulators have issued their final, approved rate change rulings and have cut down on the average increases significantly in both markets: