2024 ACA Open Enrollment Period: State by State breakout; WV up 80%, FL breaks 4.2 MILLION, TX *adds* 1.1M & more!

via the Centers for Medicare & Medicaid Services:

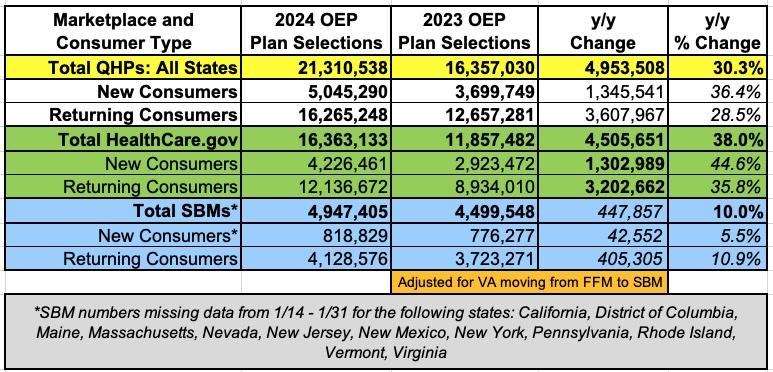

The Centers for Medicare & Medicaid Services (CMS) reports that 21.3 million consumers have signed up for 2024 individual market health insurance coverage through the Marketplaces since the start of the 2024 Marketplace Open Enrollment Period (OEP) on November 1. This includes 16.4 million Marketplace plan selections in the 32 states using the HealthCare.gov platform for the 2024 plan year through the end of the OEP on January 16, 2024 (Week 11+), and 4.9 million plan selections in the 18 states and the District of Columbia with State-based Marketplaces (SBMs) that are using their own eligibility and enrollment platforms, through January 13, 2024 (Week 11) or the end of their OEP[1]. Total nationwide plan selections include 5 million consumers (24% of total) who are new to the Marketplaces for 2024, and 16.3 million consumers (76% of total) who have active 2023 coverage and returned to their respective Marketplaces to renew or select a new plan for 2024.

As of December 31, 2023, CMS data shows that 2.4 million plan selections within states using HealthCare.gov, or approximately 15%, were made by individuals who were previously enrolled in Medicaid or CHIP coverage. By the end of the Open Enrollment Period on January 16, 2024, nearly 4.2 million more individuals with household incomes under 250% of the federal poverty level enrolled in coverage compared to last year. This further indicates that lower-income individuals and families have enrolled in quality Marketplace coverage as states continue their post-COVID redeterminations of Medicaid and CHIP eligibilities.

Here, again, is the national summary, compared to last year's Open Enrollment Period, and adjusted to account for the fact that Virginia moved from the federal exchange to a state-based exchange this year. It's also important to note that there are still some 2024 OEP enrollees missing from a dozen states where data is only included through Jan. 13th; this will likely only add perhaps 20,000 or so more to the total when the dust settles:

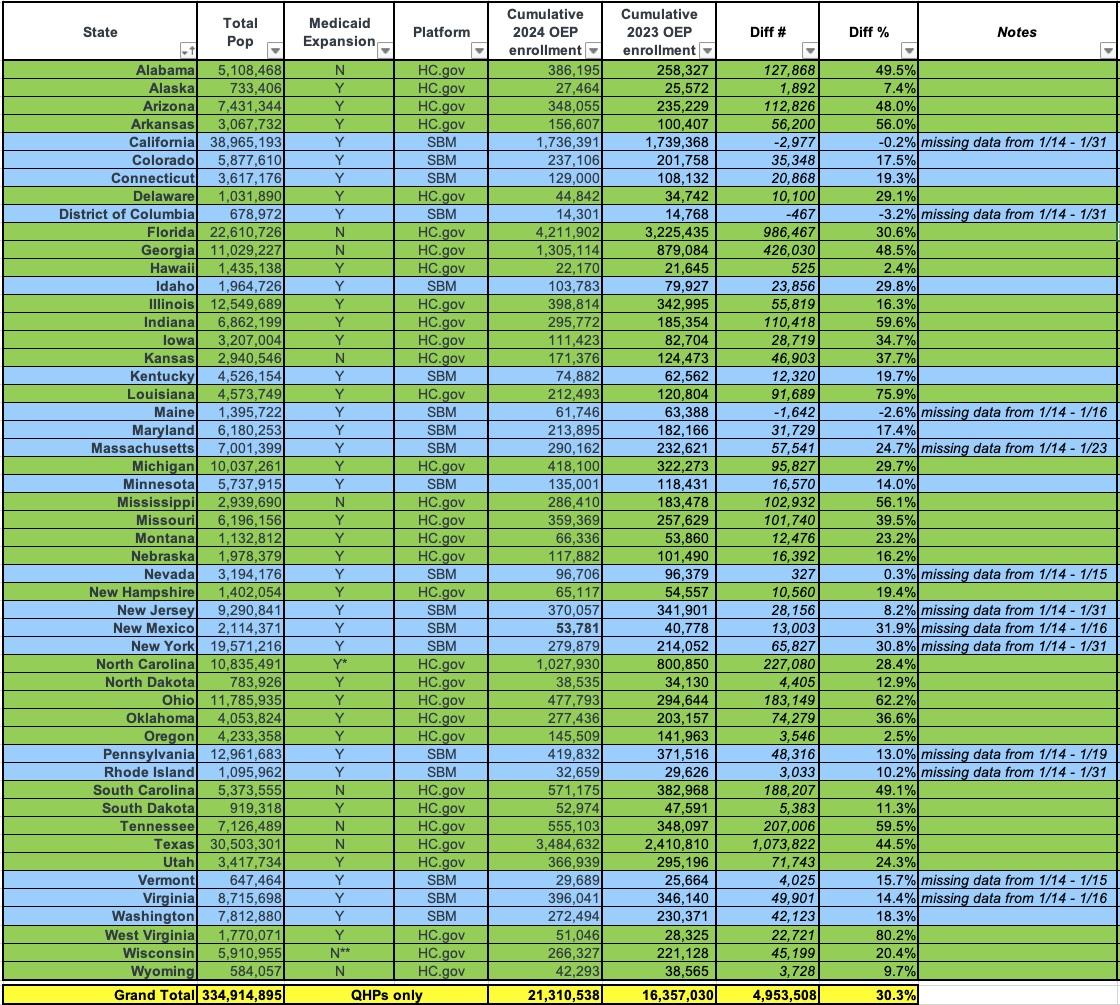

Now we get to the state-by-state breakout, where I compare total enrollment (w/the caveat about partial data missing for some states) against last year's final totals:

Some key numbers:

- WEST VIRGINIA saw an astonishing 80% year over year growth, the highest in the country percentage-wise

- In raw numbers, TEXAS continues to kick ass, with nearly 1.1 million more residents enrolling this year than last. Put another way, Texas added more ACA enrollees this year than the total who enrolled in 17 other states + DC combined.

- In raw numbers, FLORIDA continues to blow away every other state, with over 4.2 million residents enrolled in ACA exchange plans. This is nearly 20% of the total exchange enrollment nationally, and means that 18.6% of the Sunshine State's entire population is now enrolled directly in ACA exchange policies.

- Seven states saw enrollment growth of 50% or higher, and 42 states increased by at least 10%. Overall, 48 states saw year over year increases.

At the opposite end of the spectrum...

- California, Maine and the District of Columbia all saw slight enrollment decreases from last year (ranging from 0.2% - 3.2%), although these will likely increase a bit when the final numbers are included. In Maine's case there's only 3 days of data missing, but both California and DC still have open enrollment happening through Jan. 31st.

- Other states with single-digit growth include Wyoming, New Jersey, Alaska, Oregon, Hawaii and Nevada.

-

California had the highest raw enrollment drop at 2,977, but again, that will likely be made up when the 1/14 - 1/31 enrollees are added to the mix.

Next, let's look at BHPs and the FFM/SBM and Medicaid expansion factors:

As I keep noting, the Basic Health Plan (BHP) programs in Minnesota and New York really shouldn't be relegated to footnote status any longer; over 1.3 million Americans are enrolled in these programs, or over 6% as many as QHP enrollees. In fact, in New York, BHP enrollees outnumber QHP enrollees 4.3 to 1.

When you add BHPs to the exchange QHP enrollees, the combined total comes to over 22.6 million people. I've also thrwon in the 12.5K QHP enrollees in Colorado's "CO Connect" program...these are technically off-exchange QHPs, but it seems fitting to include them here since they're still the same individual market plans and they're promoted via CO's exchange.

The federal exchange states continue to dramatically outpace the state-based exchanges growth-wise, seeing increases of 38% vs. just 10% on the SBM states. However, as demonstrated in the next table, some of this is simply because all of the SBMs are in states which have expanded Medicaid while all 10 of the remaining non-expansion states are found on the federal exchange: Non-expansion states grew by nearly 40% while expansion states only grew by 21%.

This doesn't account for all of the FFM/SBM gap, however, since even the expansion states on the federal exchange increased enrollment by 3.4x as much as the SBM states.

Update 2:00pm: One other key number is noted in the press release itself: Around 14.6% of the HC.gov enrollees (~2.4 million) were previously enrolled in Medicaid or CHIP. Not all of these are members of the Medicaid Unwinding population, since a small portion of ACA exchange enrollees were always previously enrolled in Medicaid/CHIP, but the vast majority should be.

The press release doesn't give a hard number, nor does it include the 19 state-based exchange enrollees previously enrolled in Medicaid/CHIP, but through the end of September, the breakout was:

- FFM states: 812,893 QHPs out of 5,786,612 Unwound, or 14.0%

- SBM states: 231,677 QHPs out of 3,459,522 Unwound, or 6.7%

Assuming these ratios have remained relatively stable since September, and assuming perhaps 90% of that 2.4 million were actually part of the Unwinding population, this suggests that through New Year's Eve, out of perhaps ~15.5 million Unwound (accourding to KFF)...

- FFM states: ~2.16 million out of ~9.86 million = ~21.9%

- SBM states: ~620K out of 5.90 million = ~10.5%

...or upwards of 2.8 million of the unwinding population. However, this is pure speculation until CMS releases the next few monthly Unwinding reports.

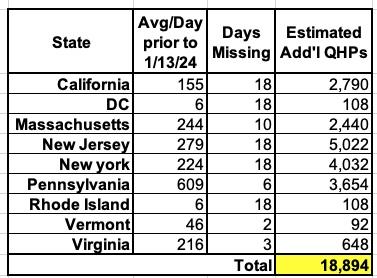

Update 3:30pm: As for how many more enrollees could potentially be tacked onto the total above, as I noted upthread, it probably won't be more than perhaps 20,000 or so. Here's a table breaking out the number of days of Open Enrollment data missing for each of the 12 states, along with the average number of enrollees they gained from 12/23/23 - 1/13/24. If you assume those rates remained the same from 1/14 - their final deadline (which ranges from 1/15 - 1/31 depending on the state), only around 19,000 more people would enroll.

There might be a last-day mini surge but it still likely won't be more than a rounding error.