How much more will YOU pay if #AmRescuePlan subsidies AREN'T extended?

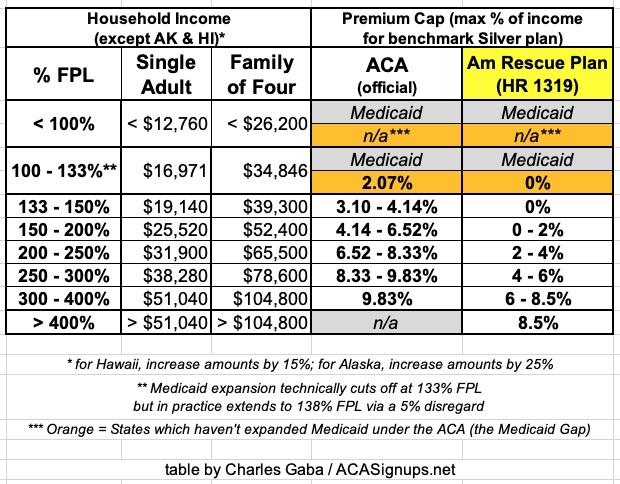

For years now, I've been a tireless advocate for dramatically expanding & improving the Affordable Care Act's Advance Premium Tax Credit (APTC) formula. This is the table which determines a) just how generous the ACA's health insurance premium tax credits are at different income levels and b) how far up the income ladder those financial subsidies extend.

Just over a year ago, the American Rescue Plan (ARP), passed by Democrats in Congress and signed into law by President Biden, did exactly what I've been clamouring for all this time: It made ACA subsidies far more generous while also removing the completely arbitrary income eligibility cut-off threshold (otherwise known as the "Subsidy Cliff."

As a refresher, the way the ACA subsidies work is as follows:

- The formula looks at the monthly full price premium rate for the benchmark plan (defined as the second least-expensive Silver plan available in your county/zip code).

- It then compares that price to a given percentage of your household income. This percentage increases on a sliding scale.

- Whatever the difference is between the two is the amount of financial help you're eligible for to help pay your premiums.

For instance, let's say you're single/no kids, and the sticker price for the benchmark Silver plan for you where you live is $400/month.

Now, suppose you earn $2,500/month, or $35,000/year . That's roughly 258% of the Federal Poverty Level (FPL).

Based on the original (pre-ARP) ACA subsidy formula, the "premium cap" percentage for a household earning 258% FPL was around 8.4% of your income, or $245/month. This means you'd be eligible for the difference between that and $400/month, or $155/month in APTC assistance.

You had the option of enrolling in the benchmark Silver plan for $245/month or you could apply that $155/mo APTC towards any other ACA exchange plan--Bronze, Silver, Gold or even Platinum (though there aren't many Platinum plans available).

If your income was lower, you'd be eligible for more generous subsidies; if it was higher, you'd be eligible for less generous subsidies. If your income was more than 400% FPL, however, you were no longer eligible for any financial help at all.

While the ACA's subsidy formula was a huge financial relief for millions of Americans, however, it wasn't nearly as generous or expansive as it was originally envisioned. Premiums were still fairly steep for millions of people even after the subsidies, and for those who earned more than 400% FPL (around $54,000/yr for a single adult or $111,000/yr for a family of four), they were often completely unaffordable, since they had to pay full price. This was especially true for older people, since the ACA still allows unsubsidized premiums to run up to 3x higher for those in their early 60's vs. those in their 20's.

Enter the American Rescue Plan: Again, this resolved both problems in one shot, by making the sliding scale subsidy formula far more generous to those earning less than 400% FPL and eliminating that 400% FPL "Subsidy Cliff" entirely, so that no one would have to pay more than a maximum of 8.5% of their household income for the benchmark Silver plan.

Here's what the two formulas look like side by side (note: The dollar amounts in the 2nd & 3rd column are based on 2021 FPL thresholds; these went up slightly for 2022):

As you can see, under the American Rescue Plan, the subsidies are far more generous across the board:

- A household earning up to 150% FPL goes from having to pay as much as 4.1% of their income in premiums down to...nothing.

- A household earning 200% FPL goes from paying 6.5% of their income to just 2%

- A household earning 300% FPL goes from paying 9.8% down to 6%

- A household earning 400% FPL goes from paying 9.8% down to 8.5%

- And, of course, a household earning more than 400% FPL goes from paying full price (which could be as much as an absurd ~30% of their income or more) down to just 8.5% of it.

So far, so good: Thanks in large part to the ARP's expanded ACA subsidy formula and the elimination of the Subsidy Cliff, 2022 ACA exchange enrollment jumped by a whopping 21% to an all-time high of over 14.5 million people (actually 15.5 million when you include those enrolled in the Basic Health Plan programs in Minnesota & New York).

There's only one problem: The ARP's expanded ACA subsidies expire at the end of 2022.

If they aren't extended beyond 12/31/22, the ACA subsidy formula will revert back to the original table...which means far stingier financial help for those earning less than 400% FPL, as well as the return of the Subsidy Cliff for those earning more than that amount.

President Biden's "Build Back Better Act," which was passed by the U.S. House of Representatives last fall, included a 3-year extension of the ARP's subsidy formula, though the end of 2025. Unfortunately, the BBB bill came to a screeching halt in the U.S. Senate in mid-December when all 50 Republican Senators as well as one Democratic Senator, Joe Manchin, refused to vote for it.

Since December, the larger BBB bill (which included a lot of other important stuff, much of which was healthcare related, as I laid out when it passed the House in October) has been pretty much declared dead...but there's been some hope of salvaging some provisions of it. I'm praying this happens, and of course I'm praying that the expanded ARP subsidies will be part of whatever makes the cut in the end.

The Congressional Budget Office recently projected that making the enhanced ARP subsidies permanent would only cost $220 billion over a decade, or $22 billion per year. On a U.S. Federal Budget level, this is a drop in the bucket--it would be less than 0.35% of total annual spending...and it would dramatically improve the lives of 15 million Americans or more.

A couple of weeks ago, Covered California sent out their own analysis of just how ugly things could get if the ARP subsidies aren't extended past the end of 2022, whether stand-alone or as part of a larger federal bill:

In California, all consumers would face premium increases, including 1 million lower-income consumers (individuals earning less than $32,200 per year), who would see their premiums more than double.

In addition, middle-income individuals and families (for individuals, those earning more than $51,520 per year), would no longer be eligible for any financial help and would face higher monthly premium costs that for many will mean annual cost increases in the thousands of dollars.

The increase in costs could force more than 150,000 people in California and more than 1.7 million nationally to drop their health insurance.

Yesterday, Access Health CT sent out their own analysis as well for how bad it would be for Connecticut residents:

...more than 65,000 Connecticut residents would be negatively impacted by reduced or eliminated financial help for health insurance if the increased financial assistance from the American Rescue Plan Act (ARPA) expires at the end of 2022.

The $178 million per year ($14.8 million per month) of assistance residents receive through ARPA will end unless the enhanced premium tax credits continue past 2022 through federal legislation.

If ARPA is not extended, 21,000 enrollees would lose financial help entirely. The average household in Connecticut enrolled through Access Health CT would pay $220 more per month or $2,650 per year in premiums. Without the premium assistance of ARPA, consumers may decide to choose plans with higher cost-sharing burdens or choose to be uninsured.

So, how much more could some current ACA enrollees end up paying starting in January 2023 if the ARP subsidy table isn't extended and ACA subsidies revert back to the pre-ARP formula?

Sadly, this is pretty easy: All I have to do is dust off the same "ski slope graphs" which I used so frequently in advocating for the ARP subsidy upgrade in the first place...and reverse them.

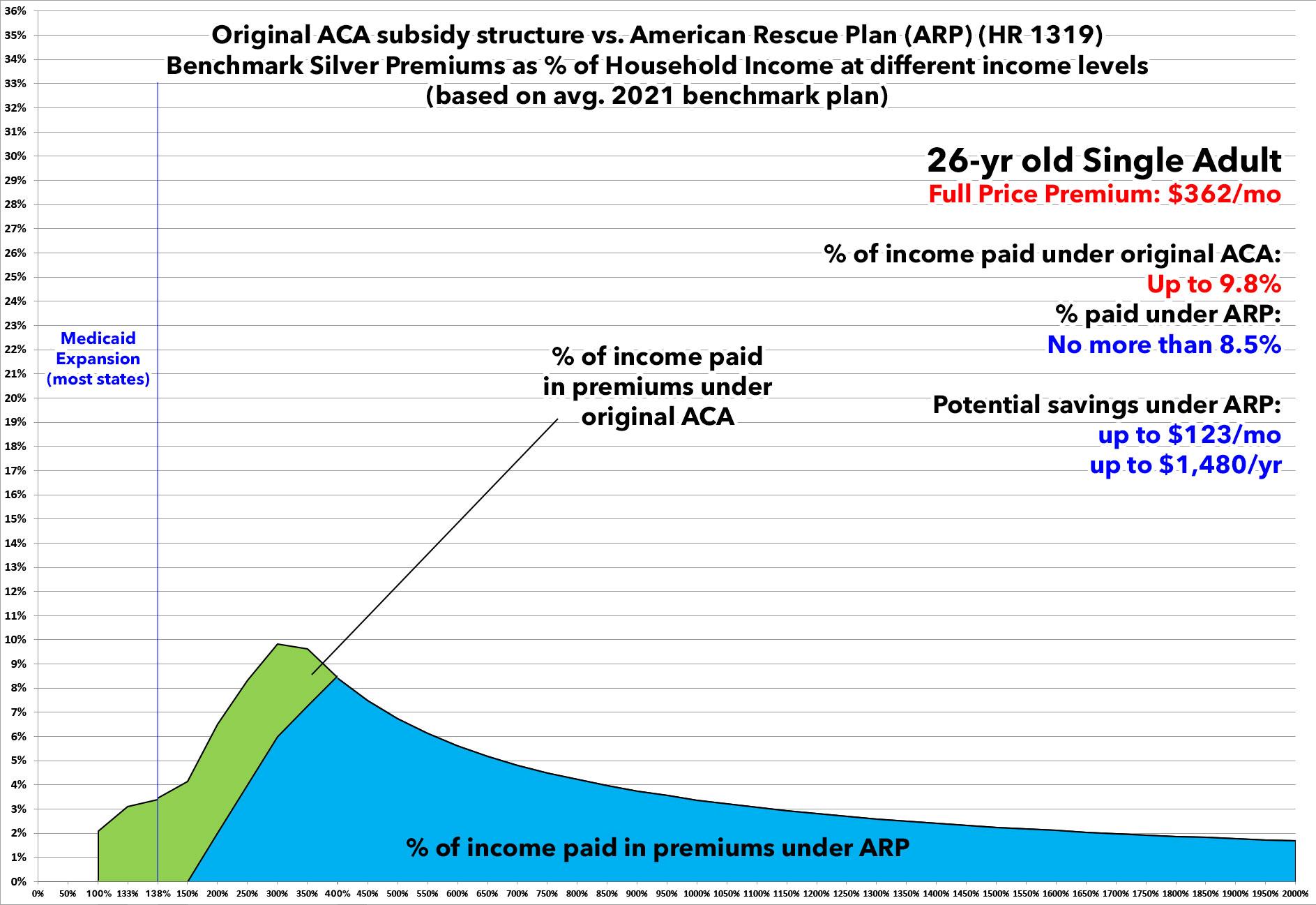

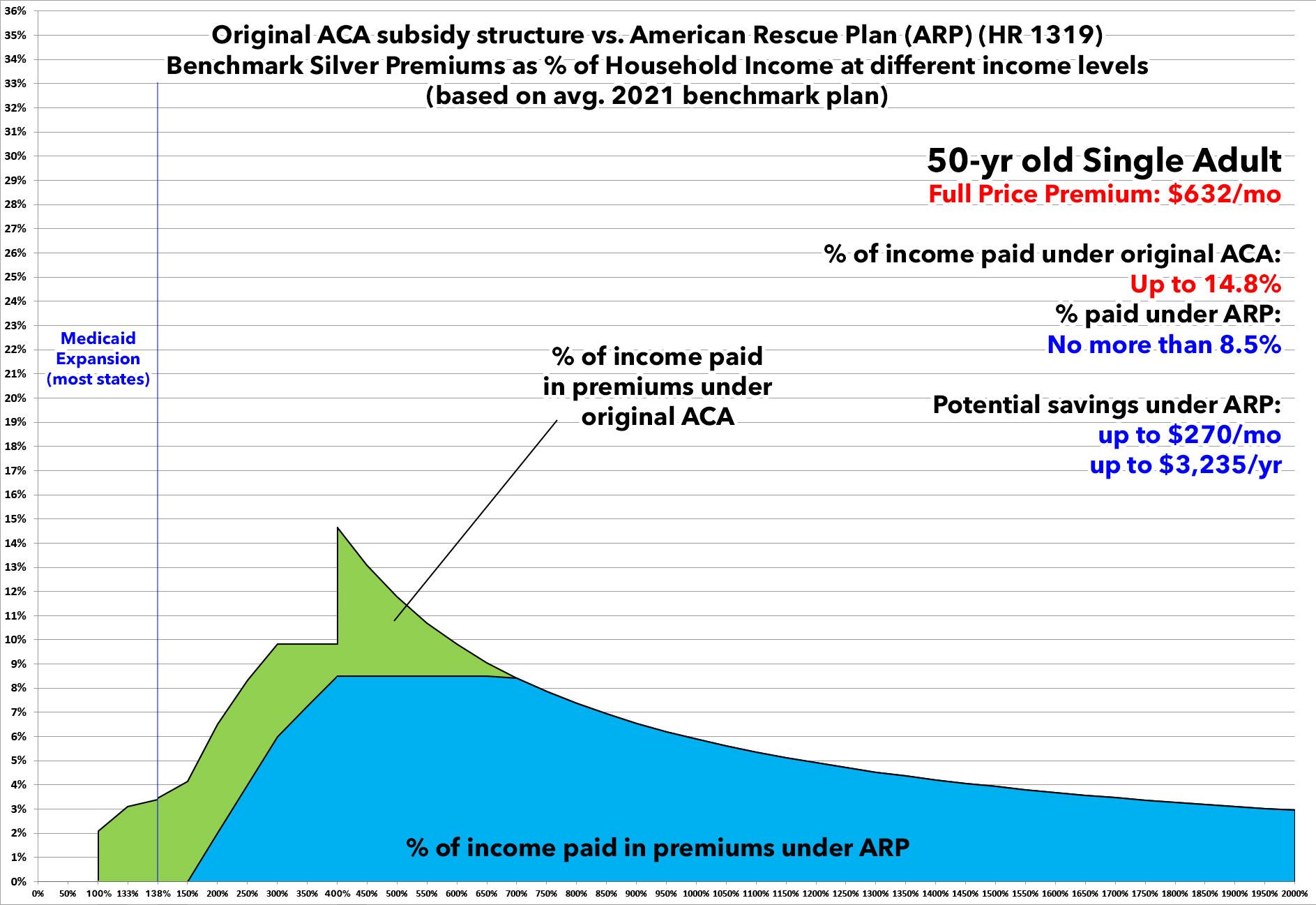

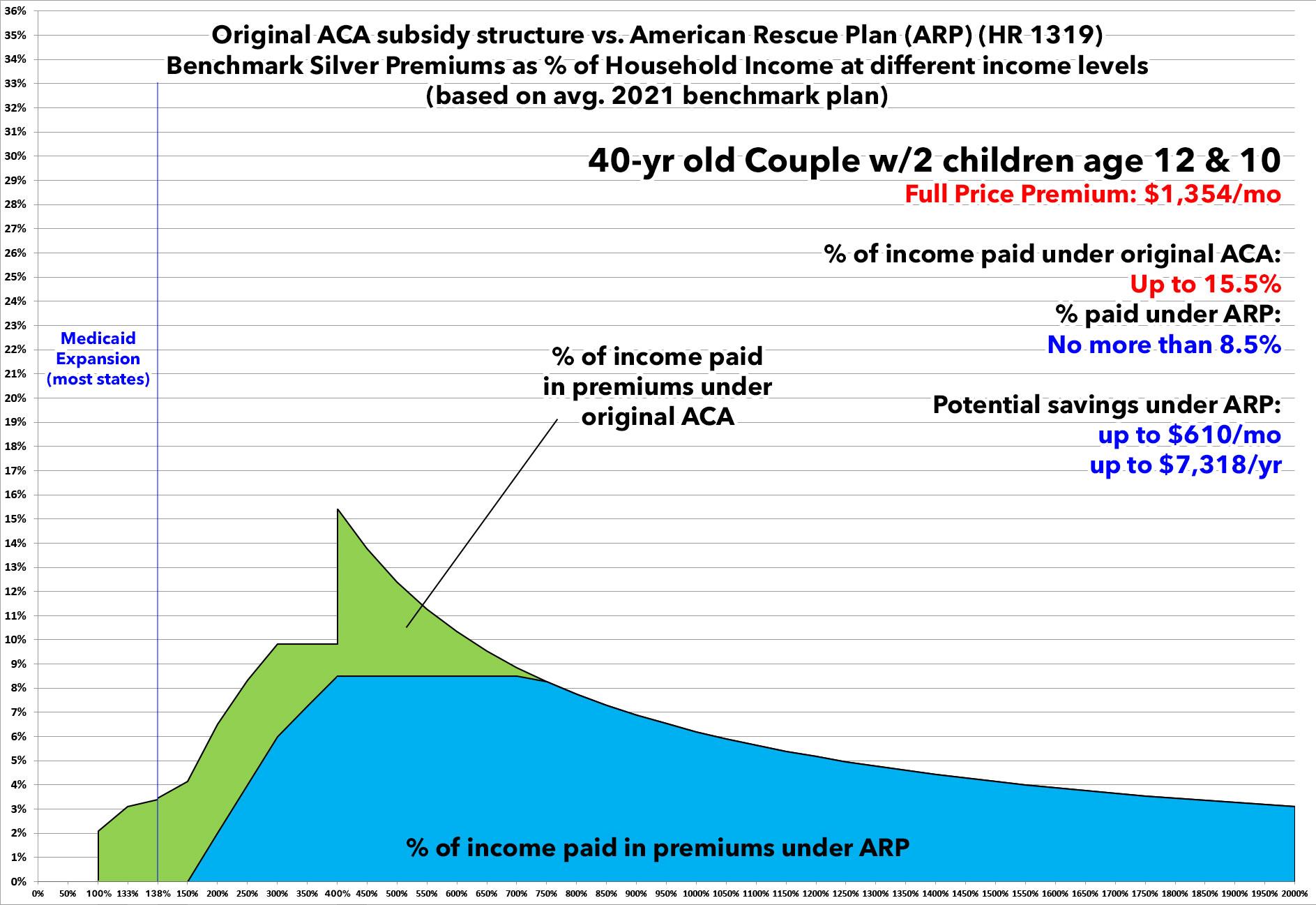

The following graphs are all based on the national average 2021 ACA benchmark Silver plan premiums for each household shown. While benchmark Silver premiums will vary in 2023, these should still be fairly representative.

Here's a 26-yr old single adult. Under the American Rescue Plan, they're currently paying no more than 8.5% of their income...and if they earn less than $20,385/year, they don't have to pay anything in premiums.

If the ARP subsidies are allowed to expire, however, starting in 2023, they'll see their monthly premiums increase by as much as $120/month or nearly $1,500/year.

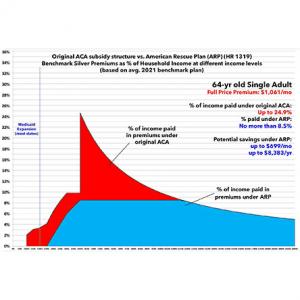

How about a 50-year old single adult with no dependents?

If the American Rescue Plan's subsidy formula is allowed to expire, they'll see their premiums jump to as much as 14.8% of their annual income...costing them as much as an additional $270/month or over $3,200 per year.

OK, that's single folks. What about a Nuclear Family? You know...two parents, two young children?

Well, including children makes things a bit tricky at lower income levels since they may be eligible for the Children's Health Insurance Program (CHIP) instead. Having said that, this family is in a similar situation to the example above: If the ARP subsidies are allowed to sunset at the end of 2022, starting in January 2023 they'll see their monthly premiums jump by as much as $600/month or more, potentially costing them as much as $7,300/year.

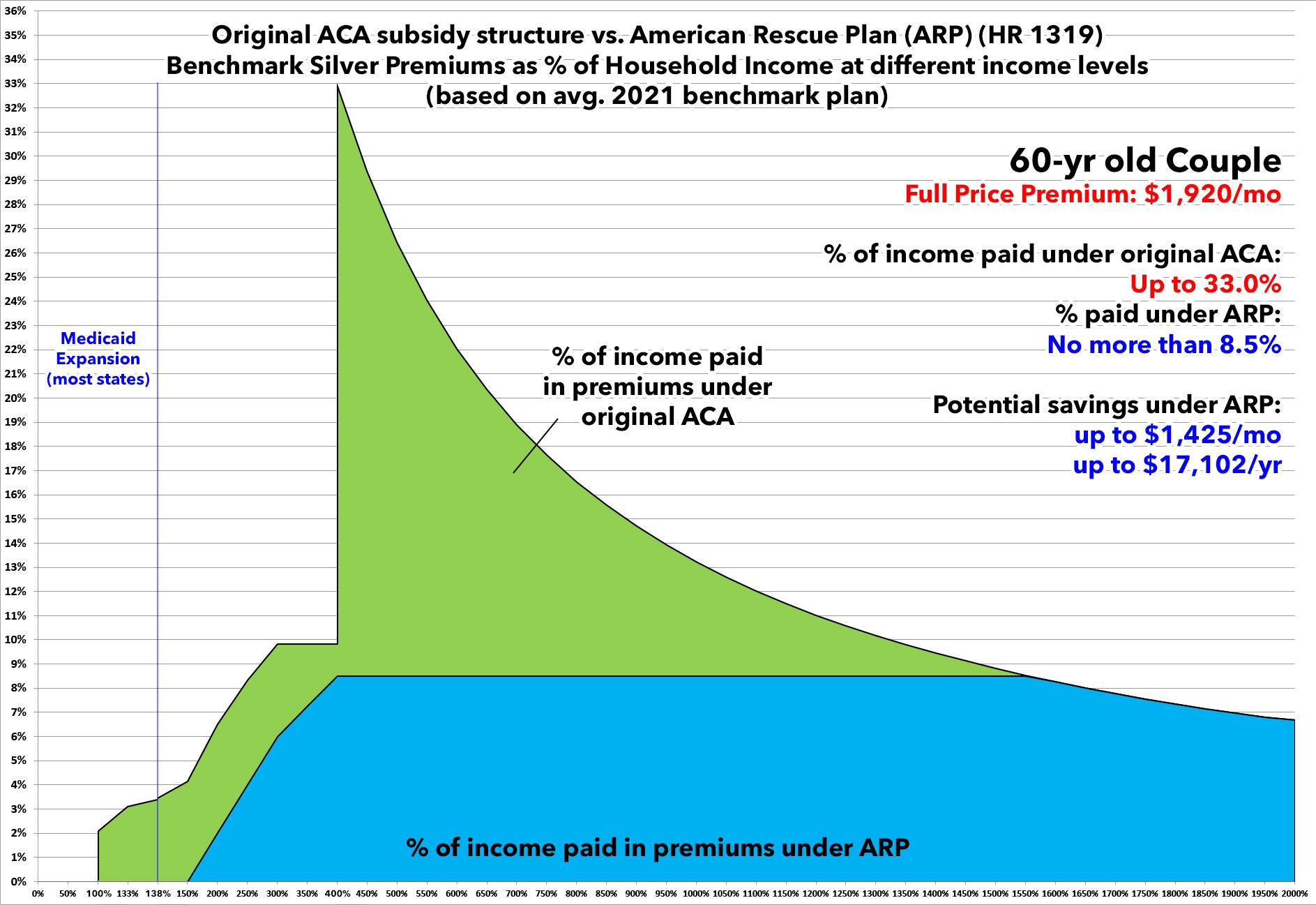

Finally, here's the real jaw-dropper: A 60-year old "empty nest" couple.

Under the expanded American Rescue Plan subsidy structure, they only have to pay a maximum of 8.5% of their income for the benchmark Silver ACA plan.

If these are allowed to expire--in particular, if the 400% FPL "Subsidy Cliff" returns--this couple would see their health insurance premiums jump to as much as a full 1/3 of their total income. They could potentially have to pay as much as $1,400 more per month, costing them up to $17,000 more per year.

Of course, that's an unlikely scenario...but only because anyone who happens to be caught in that specific situation (an older couple without employer coverage earning just a little bit over 400% FPL) would almost certainly be forced to either a) enroll in a bare-bones Bronze plan (which could still end up costing them about 75% as much as the benchmark Silver, or roughly $11,000/year more than they're paying this year for the Silver plan); b) enroll in a non-ACA compliant "junk" plan like a so-called "Short-Term, Limited Duration" plan with massive coverage holes and hidden costs; or c) roll the dice and go completely "bare" with no healthcare coverage whatsoever...a terrible gamble for anyone, and especially when you're in your 60's.

Let's make sure that none of that happens: Contact your Representative or Senator and ask them to make the ARP subsidies permanent!

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.