2022 FPL Increase: Good News for everyone...except those caught in the Medicaid Gap.

Section 673(2) of the Omnibus Budget Reconciliation Act (OBRA) of 1981 (42 U.S.C. 9902(2)) requires the Secretary of the Department of Health and Human Services to update the poverty guidelines at least annually, adjusting them on the basis of the Consumer Price Index for All Urban Consumers (CPI-U). The poverty guidelines are used as an eligibility criterion by Medicaid and a number of other Federal programs.

The poverty guidelines issued here are a simplified version of the poverty thresholds that the Census Bureau uses to prepare its estimates of the number of individuals and families in poverty.

As required by law, this update is accomplished by increasing the latest published Census Bureau poverty thresholds by the relevant percentage change in the Consumer Price Index for All Urban Consumers (CPI-U). The guidelines in this 2022 notice reflect the 4.7 percent price increase between calendar years 2020 and 2021.

After this inflation adjustment, the guidelines are rounded and adjusted to standardize the differences between family sizes. In rare circumstances, the rounding and standardizing adjustments in the formula result in small decreases in the poverty guidelines for some household sizes even when the inflation factor is not negative. In cases where the year-to-year change in inflation is not negative and the rounding and standardizing adjustments in the formula result in reductions to the guidelines from the previous year for some household sizes, the guidelines for the affected household sizes are fixed at the prior year's guidelines. As in prior years, these 2022 guidelines are roughly equal to the poverty thresholds for calendar year 2021, which the Census Bureau expects to publish in final form in September 2022.

In recent years, the CPI-U has increased by 2.4% (2019), 1.8% (2020) and 1.2% (2021). For 2022, however, it's going up considerably more to reflect the inflation spike of the past year: 4.7%.

What does this change in the Federal Poverty Level (FPL) mean for Affordable Care Act programs? Well, it's mostly good news...but with one pretty unfortunate lump of coal in the stocking.

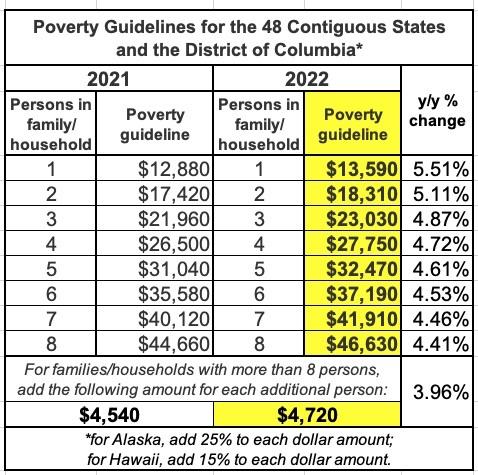

First, here's how the 2022 FPL thresholds compare to the 2021 levels. Note that these apply to 48 states + DC only; Hawaii's FPL levels are 15% higher across the board and Alaska's are 25% higher:

Interestingly, while the national CPI-U increase is 4.7% overall, that doesn't mean that each household size goes up by 4.7%...as you can see, it ranges from a high of 5.51% to as low as 3.96% as the household size goes up. I don't know what formula is used to determine that, but there you have it.

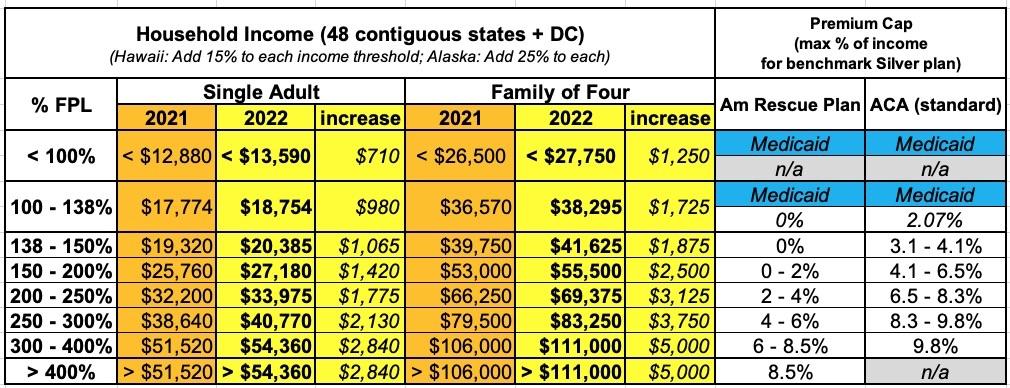

OK, so what does this mean for ACA enrollees? Well, for most people this is good news, because it means the ACA subsidy formula will be more generous for people earning ~4.7% more money next year (this will be the case to some degree whether the enhanced American Rescue Plan subsidies are extended beyond the end of 2022 or not, though of course the subsidies will be much more generous for millions more people if the ARP subsidies are extended):

Let's say the ARP subsidies are extended. Here's how the table would work for a single adult earning exactly $33,000 in 2022 and 2023:

- 2022: $33,000 would be 256% FPL, so they'd have to pay 4.24% of their income in premiums, or $1,399/yr

- 2023: $33,000 would be 243% FPL, so they'd have to pay 3.72% of their income in premiums, or $1,228/yr...saving an additional $171.

If ARP subsidies aren't extended, here's what it would look like for the same single adult earning $33,000 both years:

- 2022: $33,000 would be 256% FPL, so they'd have to pay 8.48% of their income in premiums, or $2,798/yr

- 2023: $33,000 would be 243% FPL, so they'd have to pay 8.05% of their income in premiums, or $2,657/yr...saving an additional $141.

The amount of extra savings will vary widely depending on the household; it could be several hundred dollars in some family cases.

Again, obviously it would be far better if the ARP subsidies are extended/made permanent...especially for those earning more than 400% FPL, since the Subsidy Cliff will return if they aren't.

HOWEVER, there's one population who is, ironically, harmed by the annual FPL increase, and adding insult to injury, it's the same population who's already been screwed for the past decade in a dozen states: Those caught in the Medicaid Gap.

These, again, are people who a) earn less than 100% of the Federal Poverty Level and who live in states which are still refusing to expand Medicaid under the ACA. There's around ~2.2 million documented Americans in this situation according to the most recent Kaiser Family Foundation estimate.

Because ACA subsidies don't kick in until a household earns over 100% FPL, this population, who is supposed to be eligible for Medicaid, doesn't qualify for either Medicaid or ACA subsidies, meaning they'd have to pay full price for an ACA plan...which they almost certainly can't afford (it's conceivable that a few folks close to 100% FPL in this group might be able to scrape together enough to pay for the least-expensive Bronze plan in certain counties, but I doubt it).

Unfortunately and ironically, for this particular population, the FPL threshold being bumped up by ~4.7% means that a single adult who earns exactly $18,000 in both years would fall into the Medicaid Gap in 2023 as the 100% FPL line rises past their income.

The Build Back Better Act would resolve the Medicaid Gap problem (at least for a few years), but it's been kicked to the back burner recently, so unless the Gap fix is passed this year (either temporarily or permanently), this is the scenario low-income residents of non-expansion states are facing in January.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.