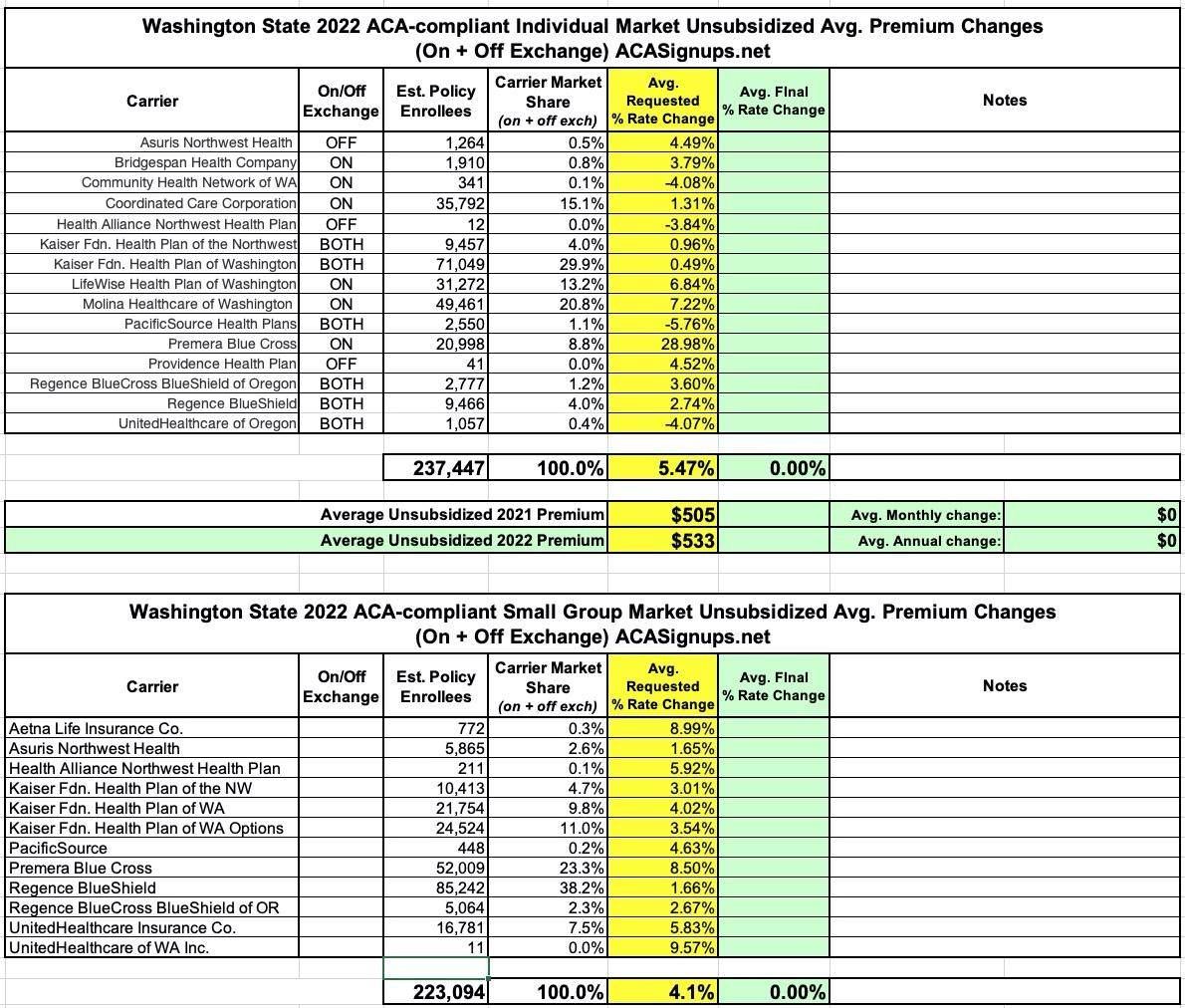

Washington State: Preliminary avg. 2022 premium rate changes: +5.5% indy market, +4.1% sm. group

Every year, I spend months tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

How many effectuated enrollees they have enrolled in ACA-compliant individual market policies;

What their average projected premium rate change is for those enrollees (assuming 100% of them renew their existing policies, of course); and

Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

Usually I begin this process in late April or early May, but this year I've been swamped with other spring/summer projects: My state-by-state Medicaid Enrollment project and my state/county-level COVID-19 vaccination rate project.

To give you an idea of just how backed up I am, this press release from the Washington State insurance commissioner came out back on June 1st, nearly 2 full months ago:

Fifteen health insurers request average rate increase of 5.47% for Washington’s individual market

OLYMPIA, Wash. – Fifteen health insurers filed an average proposed rate increase of 5.47% for Washington's individual health insurance market. The plans and proposed rates are currently under review and final decisions will come this fall.

"Access to meaningful and affordable health coverage has always been critical to our lives and our economy, but no more so than this year," said Insurance Commissioner Mike Kreidler. "I'm incredibly proud of the efforts our state made to help people find coverage, through outreach and opening special enrollment periods. We took regulatory action when needed to make sure people did not have financial barriers to COVID-19 testing, did not receive surprise bills for these tests and increased coverage for additional methods of telehealth. I'm grateful to the health insurers, too, for their commitment to their customers and our markets. For now, we'll get back to our regular work of carefully reviewing the plans and their rates to see what's justified."

People who do not get health insurance coverage from their employer shop for insurance in the individual market. Premium subsidies are available, based on income through Washington's Exchange, www.wahealthplanfinder.org. The Exchange opened a Public Health Emergency Special Enrollment that runs through Aug. 15. People can purchase plans directly from an insurer too, but subsidies are only available through the Exchange.

About 240,000 consumers in Washington are currently enrolled in health plans through the individual market.

This year, due to the federal American Rescue Act, Washington state received $250 million in tax cuts to help people afford coverage. This money is helping over half a million people find savings through the Exchange.

Sure enough, when I searched through the states own rate filing database (which is far easier to navigate than the SERFF one, I should note), I get the following results, which average out to exactly 5.47% as the press release states.

Washington enrolled around 222,000 people in on-exchange individual market policies during the official 2022 Open Enrollment Period. The ongoing COVID Special Enrollment Period likely cancelled out the normal net attrition since then, which means that WA likely only has around 15,000 off-exchange ACA enrollees, or perhaps 6% of their total indy market.

The press release doesn't mention WA's small group market at all, but it's nearly the same size (around 223,000) and average requested rate increases are around 4.1% there.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.