(updated) Why does the #AmRescuePlan include COBRA subsidies in the first place?

A couple of weeks ago I went on a bit of a rant about some terribly irresponsible reporting about how much the American Rescue Plan is spending on subsidizing private health insurance and how many people that money is expected to provide insurance premium assistance for.

The bottom line is that a whole lot of people got both the numerator and denominator wrong: Instead of being ~$53 billion to cover ~1.3 million people (which would be an insane $40,000 per person for just six months), it's actually more like ~$61 billion to help cover ~18.6 million people (roughly $3,300 per person per year on average).

The main focus of the post was about how much/how many would be covered under COBRA (the Consolidated Omnibus Budet Reconciliation Act):

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. Qualified individuals may be required to pay the entire premium for coverage up to 102% of the cost to the plan.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

While the confusion about the amount being spent per enrollee was an incredibly obvious flub, the COBRA kerfuffle does raise a legitimate question about why the ARP is covering subsidies for COBRA enrollees in the first place, instead of offering the ~7.4 million folks in question some other option. This very question was brought up by Mehdi Hasan in an interview with White House Office of Public Engagement director Cedric Richmond last night:

On the @MehdiHasanShow, senior White House official Cedric Richmond and I had a rather lively and robust exchange over why the Biden administration is spending $35bn covering Cobra costs for unemployed workers which, imho, is not a good use of cash.

Watch:pic.twitter.com/pVrF5mkWv1— Mehdi Hasan (@mehdirhasan) March 24, 2021

I've embedded the full show above; the relevant portion starts around 10 minutes in.

Hasan: "There are a lot of good things in this legislation, but also some questionable things. I want to talk about one of those. Today's the 11th anniversary of the Affordable Care Act. As you say, the Rescue Plan expands subsidies for ACA plans, making premiums much cheaper for many families; that's a good thing. But it could also spend an estimated $35 billion fully covering COBRA for around 2 million unemployed people for just six months. How is that a good use of that money? $35 billion subsidizing insurance companies for six months...wouldn't that money be better invested towards building univrersal healthcare in this country?"

OK first of all...Hasan also got both the numerator and denominator wrong, though not nearly as badly as the examples I noted two weeks ago.

$35 billion / 2.0 million people would be $17,500 apiece...for six months. Which translates into $35,000/year per enrollee. Which is absolutely bonkers, since average employer-based insurance premiums average around $7,500 per person per year ($7,188/yr for single coverage, $20,576/yr for family coverage; assume ~2.6 people per family).

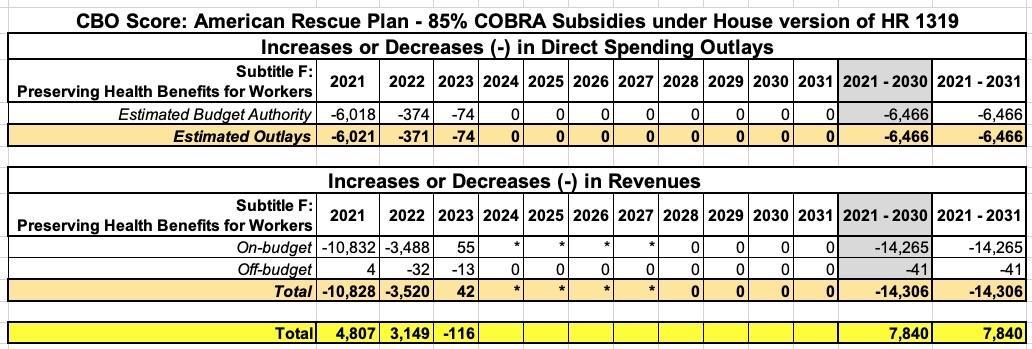

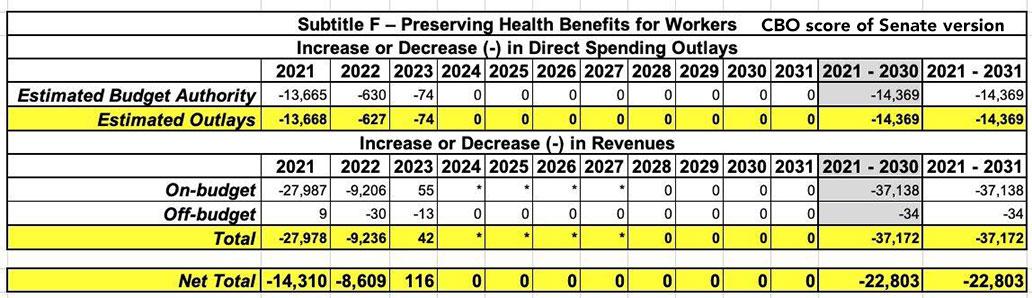

The CBO score of the final Senate version of the bill (which is the one should be used) puts the gross subsidies at $37.2 billion (which is actually $2.2 billion higher), but they put the net cost at around $22.8 billion after savings in other areas. The CBO score of the House version, meanwhile, put the gross cost at just $14.3 billion and the net cost after savings at just $7.8 billion, so it didn't come from there.

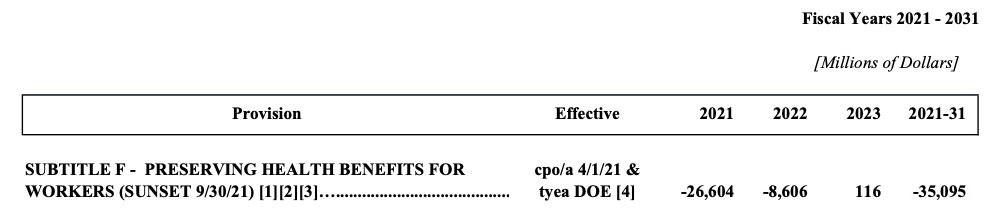

UPDATE: As for where Hasan got the $35 billion figure, here's his source: An article by NY Times reporter Sarah Kliff, which in turn quotes the Joint Committee on Taxation report, which estimates the final Senate version would result in a gross deficit increase of $35 billion (I've truncated years 2024 - 2031 since the amounts are either $0 or less than $500K per year):

However, it turns out the JCT report only includes raw spending, NOT the offsets...which means $22.8 billion net spending is the correct amount to use after all.

Kimberly Leonard of Business Insider confirms my original math: $7.8 billion for the House version, $22.8 billion for the Senate version.

In any event, as for the "around 2 million unemployed people"...that's wrong as well. The House version of the CBO score put it at an 2.2 million in addition to around 800,000 people who would otherwise have enrolled in COBRA anyway...or 3.0 million total:

In response to the availability of those subsidies, CBO and JCT estimate that an additional 2.2 million people, on a FYE basis, would enroll in COBRA coverage, resulting in a total of about 3 million FYE COBRA enrollees in 2021. In total, the agencies estimate that subsidies for COBRA—for existing and new enrollees—would increase deficits by $14.8 billion over the 2021-2030 period.

However, the House version isn't the one which was signed into law...nor is it the one which even comes close to $35 billion. That'd be the Senate version.

The Senate version doesn't mention a projected number of COBRA enrollees, but given that the price per enrollee would be roughly 18% higher (since it would cover 100% of premiums instead of 85%), it would be around $3,100 apiece. $22.8 billion / $3,100 = roughly 7.4 million people. Hell, even if you ignore the savings and just look at the gross subsidies (~$5,600 apiece), that'd still shake out to roughly 6.6 million people.

So, setting aside overstating the COBRA subsidy cost by 5.6x (or even 3.7x), let's go back to his main question: Why COBRA at all?

Congress and the Biden Administration had several options on how to tackle the millions of people who have lost their employer-provided health insurance at the same time they lost their jobs through no fault of their own:

- Do nothing...in which case they have the option of paying full price for COBRA or they can enroll in an ACA individual market policy with dramatically-expanded subsidies.

- Write the law in a way to make this population automatically (temporarily) eligible for either Medicare or Medicaid

- Subsidize COBRA for awhile (6 months, as it happens)...which is what they did

As I noted in a Twitter thread last night:

Under normal circumstances, I agree that "Losing your job automatically qualifies you for Medicaid" would make more sense as a general policy than "Losing your job means the gov't covers your COBRA premiums".

However...these are not normal circumstances.

Shifting 7.4M people from employer plans to Medicaid *en masse, all at once* would cause a huge mess...not just at the back end, but also for the enrollees, who likely would have to deal with different PCPs, specialists, hospitals, formularies, etc:

We would do COBRA. We’ve already met our deductible and are reasonably close to our out of pocket. We know all of Savannah’s 14 specialists are in network. We have already fought for the prior authorizations we need. It makes ZERO sense to start over before Jan 1.

— Lori (@lorihensler) March 24, 2021

Also, my guess is many of these folks have been on employer coverage for many years or even decades. They may not be familiar with navigating the intricacies of the Medicaid system. I'm not crying in my soup for them, I'm just saying that this would add to the confusion.

The other option would be to simply throw these folks onto the open ACA exchange market. With the ARP's beefed-up subsidies in place, it would be awesome to have ~7.4 million newly-subsidy-eligible ACA enrollees flood the market. However, this would also involve millions of people pouring into a system they have no experience with, hunting for the right networks, etc.

This is something which every ACA enrollee has to deal with, of course, but they'd be doing this at the same time that the exchanges are undergoing some major back-end upgrades to put the expanded subsidies in place. There's already a tremendous amount of confusion re. the new subsidies for *current* enrollees. HealthCare.Gov has already stated that the new subsidies won't be available to current enrollees until April 1st, and even then they'll have to log back into their accounts and update their info. They've even had to bump the enrollment deadline out all the way to mid-August, because the extra ARP-enabled subsidies for those on unemployment won't be baked into the system until July.

That would be up to 7 million or more people who've never navigated the current ACA system in addition to several million other potential new ACA enrollees via the enhanced subsidies. That's more confusion and more potential bottlenecks.

I should also note, by the way, that these people can still opt for an ACA policy instead of COBRA if they wish. My guess is most of them will go for COBRA for obvious reasons (no need to look for new doctors, no resetting of their deductible, 100% of premiums covered for 6 months)...but some might still choose the ACA route, since the COBRA subsidies cut off as of September 30th; they'd have to go back to paying full price for the last 3 months of the year, while the ACA subsidies are good for all 9 months of 2021 (April - December).

Finally, if cost savings are the issue, the average premium for an ACA individual market policy is around $6,900/year ($3,450 for 6 months)...in roughly the same ballpark as subsidizing COBRA, give or take.

Again, I'm not a COBRA fan, and I'm not sure that I would've made the same call as the Biden Administration did, but it was a reasonable decision to make given the unique circumstances of the moment...especially given the time factor involved in getting the ARP signed.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.