Updated: $80K of bullsh*t: News media overstates cost of COBRA & ACA coverage by 10x or more

NOTE: SEE SUMMARY TABLE IN UPDATE ALL THE WAY AT THE END.

I'm doing my best to stop myself from putting my head through a wall this weekend.

You may have seen this viral tweet making the rounds over the past day or so:

The Democrats just spent $52 billion to subsidize COBRA for 1.3 million people until September. That’s $40k per person for less than 6 months of health insurance. Most countries spend about $5-6k per person per year for universal healthcare.

— cabral (@axcomrade) March 12, 2021

This was posted at 12:22pm on Friday, March 12th, 2021. It's still live as of 11:00am on Sunday the 14th, has over 32,700 Likes and has been retweeted over 7,300 times as of this writing, but in case it's deleted by the time you read this, here's a screen shot:

$40,000 per person for less than 6 months of healthcare coverage, huh? Wow, that is pretty pricey! That's $80,000 per person per year!

Considering it was retweeted by former Presidential candidate Marianne Williamson to her 2.8 million followers and even sitting U.S. Congressman Mondaire Jones (who actually voted for the bill in question), this seems like a Really Big Deal!

So...what's going on here?

About a month ago, the Congressional Budget Office (CBO) issued their 10-year score of the projected net budgetary impact of the House Ways & Means Committee portion of H.R. 1319, the American Rescue Plan (ARP).

The ARP as a whole actually consists of a lot more than what was included in the Ways & Means portion of the bill, and even the W&M part includes a long list of stuff, including the much-ballyhooed $1,400 direct relief checks.

However, the sections of the ARP in question involve individual market coverage (the ACA exchanges) and COBRA coverage for those who've lost jobs which provide healthcare coverage for their employees. These can be found in Subtitle F (COBRA) and Subtitle G (ACA premium tax credits). Subtitle G also includes a bunch of other core provisions such as the $1,400 checks, expanded child tax credits and so forth.

Normally, COBRA allows laid-off employees to keep their existing employer-sponsored healthcare coverage for up to 18 months for most employees...except that they have to start paying the full amount of the monthly premiums (in fact they may have to pay up to 102% of the cost). Since employers usually pay between 70 or more of the premiums for their employees (this is techniclally considered part of their total compensation, but it's tax-exempt for both employer and employee), this means that COBRA is often a terrible deal because you have to start paying 3-4x as much in premiums at the exact moment you've just lost your income.

Under the House ARP bill, employers would be required to continue to pay 85% of those same premiums for up to six months (April - September 2021), with the government reimbursing the employer for that amount. (Note: The final Senate version of the bill increased the 6-month COBRA subsidies to a full 100%, which was reflected in a modified CBO score, but I'll get to that later).

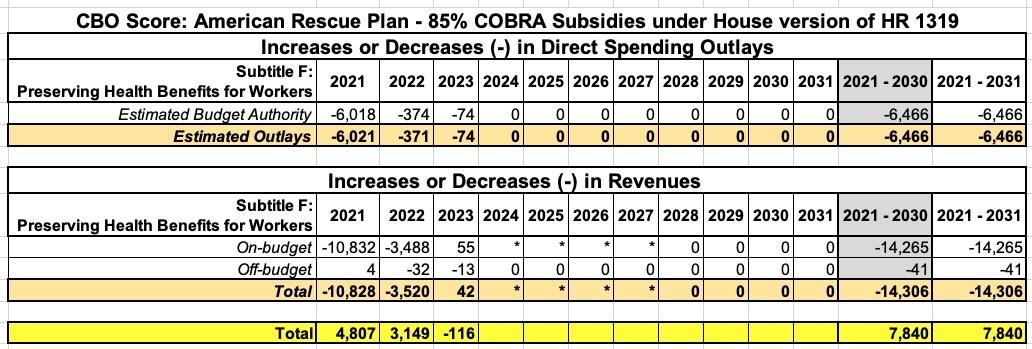

OK, so how much did the CBO think this would cost (and how many people did they say it would cover)?

Subtitle F. Preserving Health Benefits for Workers

Under current law, people who lose their job or experience another qualifying event that results in a termination of their employment-based health insurance are eligible to continue health insurance coverage through the Consolidated Omnibus Budget Reconciliation Act (COBRA). If an individual chooses to enroll in COBRA coverage, he or she may be required to pay up to 102 percent of the total premium and can maintain the coverage for 18 months. Under section 9501, qualifying COBRA enrollees would be required to pay 15 percent of the total COBRA premium from the first of the month following the date of enactment through September 30, 2021. The federal government would provide a subsidy on behalf of the individual for the remainder. People would be eligible for premiums to be paid on their behalf if they are enrolled in, or are eligible to enroll in, COBRA coverage because of an involuntary termination or reduction of hours at the time of enactment. Section 9501 would permit eligible people who did not previously elect COBRA coverage and eligible people who discontinued COBRA coverage prior to enactment to enroll within 60 days of being notified about the availability of these subsidies.

CBO and JCT estimate that enacting section 9501 would increase federal deficits by $7.8 billion over the 2021-2030 period, after accounting for interactions with sections 9661 and 9663 in subtitle G. That increase in deficits would consist of a decrease in direct spending of $6.5 billion and a decrease in revenues of $14.3 billion over the period. Those effects would primarily stem from federal subsidies for COBRA premiums, partially offset by a reduction in federal subsidies for other sources of health insurance coverage.

OK, got that? $14.3 billion in subsidies minus $6.5 billion in savings = a net deficit increase of $7.8 billion...over ten years.

Next: How many people would this cover?

Under current law, after adjusting for the effects of sections 9661 and 9663 (described below), CBO and JCT project that about 800,000 people would be enrolled in COBRA coverage on a full year equivalent basis (FYE), representing less than 10 percent of the eligible population. The estimated take-up of COBRA coverage is low because premiums are not typically subsidized by employers as they are when people are actively employed. The remaining estimated 12 million eligible people who do not enroll in COBRA coverage would enroll in another form of insurance coverage or be uninsured.

In response to the availability of those subsidies, CBO and JCT estimate that an additional 2.2 million people, on a FYE basis, would enroll in COBRA coverage, resulting in a total of about 3 million FYE COBRA enrollees in 2021. In total, the agencies estimate that subsidies for COBRA—for existing and new enrollees—would increase deficits by $14.8 billion over the 2021-2030 period.

OK, got that? 800,000 would've enrolled in COBRA this year regardless of the subsidies, plus another 2.2 million who will enroll because of the subsidies = 3.0 million total subsidized COBRA enrollees. Around 27% of the subsidies would go to 800K existing COBRA enrollees, 73% would go to additional enrollees (2.2 million).

Just to be crystal clear, CBO sums up by saying:

CBO and JCT estimate there would be offsetting effects as people who would newly enroll in COBRA coverage would no longer enroll in other sources of health insurance coverage that are subsidized by the federal government. Of the 2.2 million FYEs that CBO and JCT estimate would newly enroll in COBRA coverage, an estimated 1.1 million would have otherwise been enrolled in Medicaid or CHIP and about 600,000 would have forgone insurance coverage and been uninsured. About 300,000 FYEs would otherwise have enrolled in subsidized nongroup coverage, and the remainder, about 200,000, would have been enrolled in employment-based coverage. CBO and JCT estimate that those changes in health insurance coverage would offset the cost of the new COBRA subsidy by $7 billion over the 2021-2030 period. On net, the COBRA provisions in the legislation would increase deficits by $7.8 billion over the 2021-2030 period.

$7.8 billion / 3.0 million = $2,600 per COBRA enrollee for a six-month period.

Note: If you really want to move the goal posts, I suppose you could only include the "additional spending" part and ignore the offsets, which would give you $14.3 billion / 3.0 million = $4,767 apiece for six months apiece...but that would be pretty disingenuous.

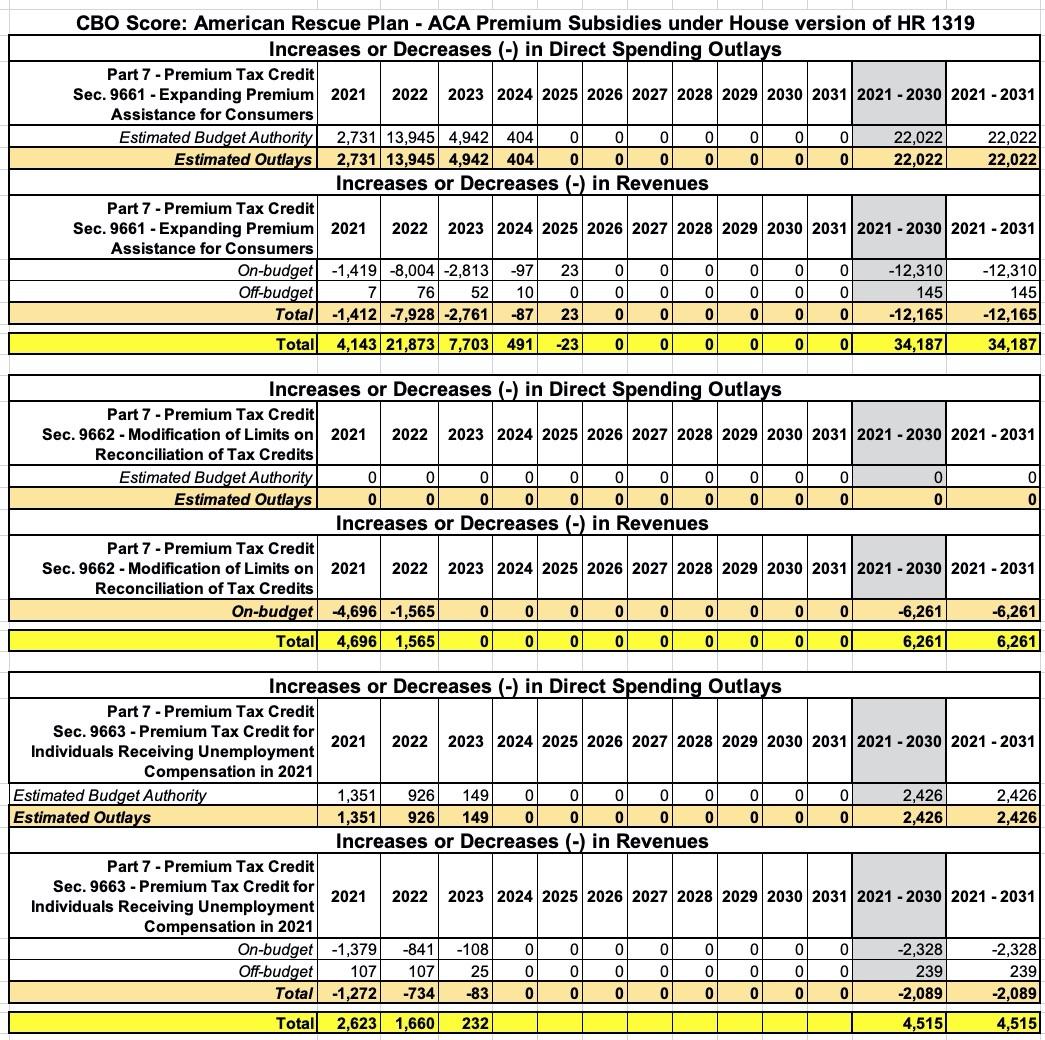

OK, next, let's look at the ACA subsidy portion of Subtitle G:

Premium tax credit.

Under current law, subsidies for health insurance through the marketplaces established under the Affordable Care Act are primarily provided through premium tax credits, which are available to people with modified adjusted gross income between 100 percent and 400 percent of the federal poverty level (FPL) who are lawfully present in the United States, are not eligible for public coverage (such as Medicaid or the Children’s Health Insurance Program (CHIP)), and do not have an affordable offer of employment-based coverage. Eligible people can use those tax credits to lower the out-ofpocket cost of their monthly premiums. The amount of a person’s premium tax credit is calculated as the difference between the benchmark premium (that is, the premium for the second-lowest-cost silver plan available in the marketplace in the area of residence) and a specified maximum contribution expressed as a percentage of income. That specified percentage of income varies according to household income.

Expanding premium assistance for consumers. Section 9661 would increase premium tax credits for most currently eligible people and expand eligibility to people with incomes greater than 400 percent of the FPL through the end of 2022. For 2021, the legislation would modify the subsidy structure under current law, as detailed in Exhibit 1.

CBO and JCT estimate that section 9661 would increase federal deficits by $34.2 billion over the 2021-2030 period: an increase in direct spending of $22.0 billion and a reduction in revenues of $12.2 billion. Those effects reflect a $35.5 billion increase in premium tax credits for health insurance purchased through the marketplaces established under the Affordable Care Act, partially offset by other small effects.

OK, got that? $35.5 billion in subsidies minus $1.3 billion in savings = a net deficit increase of $34.2 billion...over ten years.

Section 9661 would have a twofold effect on people with health insurance coverage through the marketplaces. First, most marketplace enrollees with subsidies under current law would gain access to enhanced subsidies, lowering their out-of-pocket premium costs. Second, marketplace enrollees who are currently ineligible for subsidies because their income is greater than 400 percent of the FPL could gain eligibility for subsidies under the enhanced subsidy structure. In addition to reducing the costs of marketplace coverage for those currently enrolled, CBO and JCT project that the enhanced subsidies would also attract enrollees who are new to the marketplaces, particularly people who are uninsured under current law. CBO and JCT estimate that new marketplace enrollees would account for $13.0 billion of the estimated increase in premium tax credits and existing marketplace enrollees would account for the remaining $22.5 billion.

Got that? 63% of the subsidies would go to existing ACA exchange enrollees; 37% would go to the new enrollees.

In general, the enhanced tax credits under the legislation would be larger than the premium tax credits under current law. In an illustrative example, CBO and JCT estimate that a 21- year-old with income at 150 percent of the FPL in 2021 would be eligible for a premium tax credit of about $3,500 under current law; the tax credit would increase to about $4,300 under the legislation (see Exhibit 2). CBO and JCT expect that people with incomes just over 400 percent of the FPL who are older or enrolled in family policies or in insurance rating areas with especially high premiums would experience the greatest reduction in net premiums.

In 2022, the year for which the provision would be in effect for the entire calendar year, CBO and JCT estimate that enacting the provision would increase the number of people with coverage through the marketplaces by 1.7 million. The agencies project that roughly 40 percent of the additional marketplace enrollees would be people ineligible for premium tax credits under current law because their income exceeds 400 percent of the FPL.

OK, got that? 1.7 million additional ACA exchange enrollees in 2022 specifically, in addition to the millions of current exchange enrollees. Around 12.0 million people selected ACA exchange plans during the 2021 Open Enrollment Period (OEP), but there's always some net attrition throughout the year as people drop their coverage or newly enroll via Special Enrollment Periods. We don't know how many people would "normally" be enrolled in exchange policies on average in 2021 without the ARP, but we do know that it averaged around 10.5 million per month last year.

Of course, only around 86% of those folks received subsidies under the pre-ARP subsidy formula...or roughly 9.1 million of them. Since total 2021 OEP enrollment is up around 4.8% over 2020, it's safe to assume this will be at last 9.5 million each month (remember, that doesn't even include the hundreds of thousands who've already enrolled via the re-opened COVID Special Enrollment Period before the ARP was signed into law).

My guess is that the enhanced ARP subsidies will mean that a far higher percent of existing enrollees will be subsidized in 2021 - 2022, but I'm willing to lowball this one and use the 9.5 million figure.

So, that's at least 9.5 million + 1.7 million newly-subsidized enrollees = at least 11.2 million subsidized ACA exchange enrollees.

$34.2 billion / 11.2 million = around $3,053 per subsidized ACA exchange enrollee...over a 3-year period (mostly over 2022, however).

The estimated increase in marketplace enrollment would consist of 1.3 million fewer uninsured people, 300,000 fewer people with nongroup coverage purchased outside of the marketplaces, and 100,000 fewer people with employment-based coverage. The estimated effect on the number of people with employment-based coverage is limited because CBO and JCT do not anticipate that many employers would change their decision to offer health insurance given the temporary nature of the enhanced subsidy.

CBO and JCT estimate that enacting section 9661 would affect health insurance coverage to a much more limited extent in 2021 and 2023. The effect on health insurance coverage in 2021 would be constrained because the enhanced subsidy structure would take effect midway through the plan year. For 2023, CBO and JCT anticipate that some of the estimated increase in enrollment would persist beyond 2022, when the enhanced subsidy structure prescribed by this legislation would expire, and would gradually return to current law levels by 2024.

Besides the "official" ACA subsidy enhancements, however, there's also two additional one-time, COVID-specific provisions attached to ACA subsidies:

Modification of limits on reconciliation of tax credits.

Under current law, people are entitled to advance payments of their subsidies, which are based on income estimated from tax returns for prior years. If people’s circumstances change to the extent that their advanced subsidies exceed the actual subsidies to which they are entitled, they may be required to repay some or all of the credits. Section 9662 would remove this requirement for purposes of plan year 2020.

Section 9662 also would eliminate the requirement that people must repay any overpayments of health insurance subsidies received for plan year 2020. JCT estimates that section 9662 would increase the federal deficit by $6.3 billion over the 2021-2030 period after accounting for interactions with sections 9661 and 9663 as well as section 9501 in subtitle F. This increase would come from a decrease in revenues.

Put simply, subsidized enrollees last year received around $6.3 billion in "excess subsidies"...they underestimated their income for the year and would normally be required to pay them back, but the ARP is waiving that "clawback" of overpayments for one year only in response to the pandemic.

This $6.3 billion has nothing to do with increasing healthcare coverage or affordability for 2021, 2022 or beyond...it basically amounts to a roundabout way of increasing those "$1,400 direct relief payments" for several million people.

Application of premium tax credit for people receiving unemployment compensation in 2021.

Under current law, eligible people may receive a premium tax credit for health insurance through the marketplaces that equals the difference between the benchmark premium and a maximum contribution specified as a percentage of household income. Exhibit 1 shows the maximum income contribution percentages for 2021 under section 9661. (CBO and JCT estimated the effects of section 9663 relative to section 9661, which would increase premium tax credits for all currently eligible income levels and expand eligibility to people with incomes greater than 400 percent of the FPL through the end of 2022.)

Section 9663 would increase the amount of the premium tax credit for people receiving unemployment benefits for any length of time in 2021. People with household incomes greater than 100 percent of the FPL after excluding unemployment benefits—who are otherwise eligible for premium tax credits—would receive a premium tax credit as if their income were 133 percent of the FPL in 2021.

In short, if you're on unemployment for part of 2021 but end up earning more than 133% FPL by the end of the year, you still get counted as earning 133% FPL and get bonus subsidies. I'm not honestly sure I understand why they did this, but it is what it is.

After accounting for the effects of section 9661, CBO and JCT estimate that section 9663 would increase federal deficits by $4.5 billion over the 2021-2030 period, which would consist of an increase in outlays of $2.4 billion and a decrease in revenues of $2.1 billion. Those effects would stem primarily from an increase in premium tax credits for health insurance purchased through the marketplaces.

In 2021, CBO and JCT estimate that about 900,000 people enrolled in subsidized coverage through the marketplaces under current law and after incorporating the effects of section 9661 would receive unemployment benefits and an increased subsidy under section 9663. The average incremental subsidy people would receive is estimated to be $1,040. An additional 500,000 people, who would otherwise obtain health insurance through COBRA or be uninsured, would newly enroll in coverage through the health insurance marketplaces and newly receive on average a premium tax credit of $7,040.

Overall, the agencies estimate a total of about 1.4 million people receiving unemployment benefits would be enrolled in subsidized coverage through the marketplaces and receive a premium tax credit. The mid-year enactment of the policy would limit the provision’s effect on health insurance coverage. CBO and JCT expect that most of the people newly enrolling in coverage through the marketplaces because of the increased premium tax credit are those who would begin receiving unemployment benefits following enactment of the legislation and would have otherwise enrolled in another form of coverage, such as a spouse’s employment-based insurance plan or COBRA continuation coverage. The provision would not affect the incentives of most recipients to take a new job because they would be considering job offers from employers that would not provide them with an offer of health insurance coverage that would disqualify them from receiving the subsidy in 2021. For recipients considering job offers that would disqualify them from receiving the subsidy because the job included an affordable offer of employment-based health insurance, the effect of the provision on the disincentive to take the job would depend on the extent of the subsidy for health insurance provided by the employer.

For 2022, CBO and JCT anticipate that some of the estimated increase in enrollment would persist beyond 2021, when the increase in premium tax credits in this provision would expire, and would return to current law levels by 2023.

OK, both the net spending and the enrollment numbers in this part gets a little confusing, because while the $4.5 billion net deficit amount appears to be separate from the $34.2 billion listed above, it's less clear whether the 900,000 enrollees receiving "bonus" subsidies due to their unemployment status should be added to the 1.7 million "new enrollee" figure above or whether they're supposed to be included within the 1.7 million figure. I'm going to err on the side of caution and assume that they're already included to avoid double-counting them.

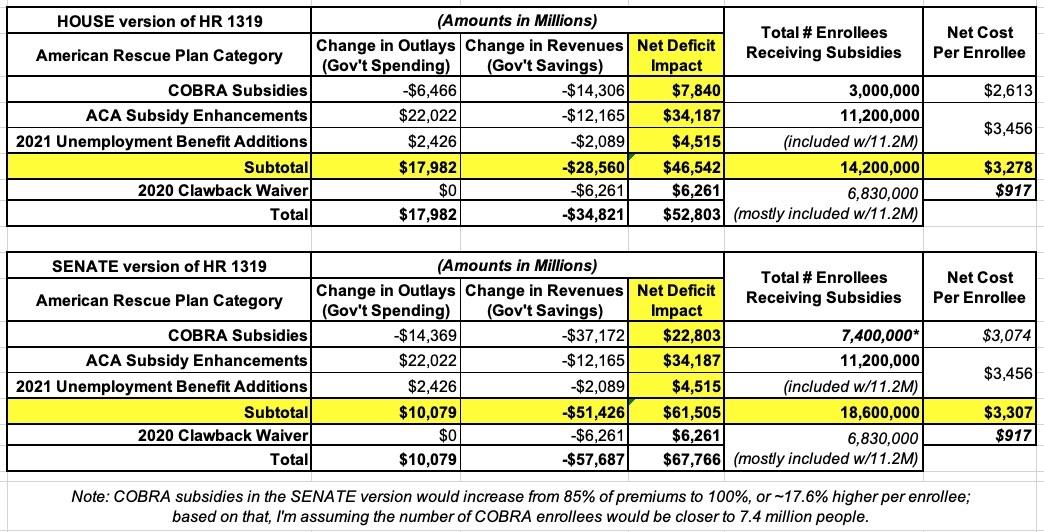

IN TOTAL, the CBO projected that the House version of the ARP would cost a total of:

- $7.8 billion / 3.0 million = $2,600 per COBRA enrollee (for 6 months)

- $34.2 billion / 11.2 million = around $3,053 per subsidized ACA exchange enrollee (over 3 years)

- $6.3 billion in waived 2020 subsidy clawbacks (1-time for a prior year)

- $4.5 billion in "bonus" subsidies for 900K uninsured enrollees (already counted above)

Total: $52.8 billion

So, how much does this actually work out to on a per-enrollee basis?

- COBRA enrollees: 3.0 million

- ACA Exchange enrollees: 11.2 million

Total: 14.2 million people

That comes to $3,718 per subsidized enrollee.

Except that it's actually less than that. Remember, the $6.3 billion in waived clawbacks has nothing to do with subsidizing 2021, 2022, 2023 or beyond. That money isn't going to the insurance carriers, and it's not going to cut premiums today, tomorrow or ever in the future; it's just bonus direct relief to a bunch of people who miscalculated how much they earned last year.

Subtract that out and it's $46.5 billion / 14.2 million = $3,274 apiece.

But wait, there's more! Remember, the CBO score covers a ten-year period (2021 - 2030). Being more honest, though, all of the numbers above are only spread out over three years (2021, 2022 & 2023).

Here's the breakout of the COBRA provisions:

In the case of COBRA, nearly all of the costs and savings are spread out over a 2-year period (2021 & 2022), but the actual time period the enrollees would be covered is clearly limited to 3.0 million people for the six-month period from April - September 2021.

Here's the breakout of the ACA Subsidy provisions...remember, there's three separate sections: The official subsidy expansion/enhancements; the 2020 clawback waiver; and the extra 2021 subsidies for 2021 unemployment beneficiaries. This gets more complicated because not all of the provisions start or end at the same time, nor do they apply equally to all enrollees:

Combined, $11.46 billion applies in 2021; $25.1 billion in 2022 and $7.94 billion in 2023...with just $468 million extending into 2024 or 2025.

However, as noted above, Section 9662, the 2020 clawback waiver, is irrelevant for purposes of "how much is the government spending to subsidize healthcare coverage for people in 2021 or later". If you take that out of the totals, you get:

- 2021: $6.77 billion

- 2022: $23.53 billion

- 2023: $7.94 billion

Let's focus on 2022, since that's the year specified by the CBO in which a) expanded ACA subsidies would apply to everyone enrolled for the full 12-month period but b) neither the 2020 clawback waiver nor the "bonus" for unemployed enrollees would be in place. In 2022 specifically, you're basically looking at: $23.53 billion / 11.2 million enrollees, or around $2,100 in subsidies per enrollee.

In other words, if you're looking at how much the ARP is projected to spend for a single calendar year to subsidize healthcare premiums, the year to look at is 2021 for COBRA and 2022 for ACA enrollees...and the averages come to:

- COBRA: 2021: $7.8 billion / 3.0 million = $2,600 apiece for six months...or $5,200 apiece for 1.5 million full-year enrollees

- ACA: 2022: $23.5 billion / 11.2 million - $2,100 apiece for the each full-year enrollee

Overall average: around $2,750 per full-year enrollee.

As for the SENATE version of the American Rescue Plan (the version which was actually signed into law), that did include one significant change in the COBRA section: Instead of subsidizing 85% of premiums for COBRA enrollees for six months, it subsidizes 100% of them. On the surface, you'd think this would only increase the cost from $7.8 billion to $9.2 billion for the 3.0 million COBRA enrollees in question, but of course not having to pay a dime in premiums has a much bigger incentive for more laid-off folks to sign up for COBRA as well.

Unfortuantely, the CBO's score of the SENATE version doesn't include an explanatory memo listing the number of people they expect to sign up for COBRA under the revised subsidies, but it does list the budgetary figures: $37.2 billion in subsidies, minus $14.4 billion in savings = around $22.8 billion.

The Senate version's raw outlay figure is 2.2x higher than the House's, while the revenue change is 2.9x higher. The net deficit impact is around 2.6x higher. Assuming the same per-person premium cost under the Senate version, that should be something like 7.8 million COBRA enrollees.

Wow, there's a whole bunch of "per enrollee" and "per year" averages listed above! Which one is the "right" one?

- $2,600 per person (6 months of coverage)

- $3,053 per person

- $3,718 per person

- $3,274 per person

- $5,200 per person (12 months of coverage)

- $2,100 per person

- $2,750 per person

- $4,767 per person

Well, it depends on how you define it I suppose...but you know what I don't see here no matter how you measure it?

$40,000 for six months, or $80,000 per year.

Basically, that's at least 8x as much and potentially up to 38x as much as the American Rescue Plan is actually spending per enrollee, per year.

There's a reason for that:

COBRA (Employer-Sponsored Insurance):

According to research published by the Kaiser Family Foundation in 2019, the average cost of employer-sponsored health insurance for annual premiums was $7,188 for single coverage and $20,576 for family coverage. The report also found that the average annual deductible amount for single coverage was $1,655 for covered workers.

According to the Pew Research Center, the average U.S. household had around 2.63 people in 2018, so family coverage works out to roughly $7,823/year per family member. If you split the difference between single and family coverage, that means employer-sponsored insurance premiums average around $7,500 per year.

ACA Individual Market Health Insurance:

- 2021 ACA individual market policies average around $576/month or $6,912 per year per enrollee

(this includes all metal tiers and all enrollees on & off-exchange; the Kaiser Family Foundation puts the average premiums for the lowest-cost plan of each metal tier at between $328 - $482/month, or $3,936 - $5,784 per year)

Thousands of Americans are running around falsely claiming that the American Rescue Plan will spend more than 10x as much on health insurance subsidies per person than it actually does.

So, what's the source for this insanity?

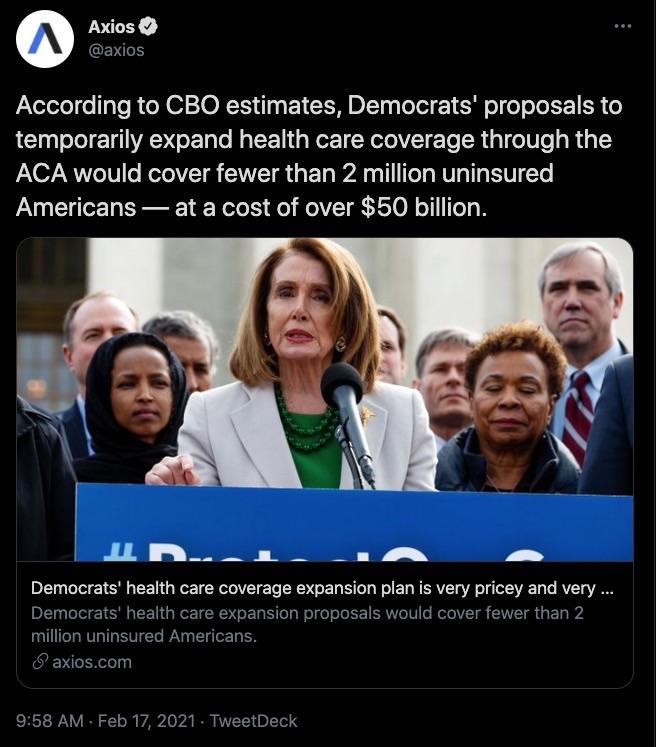

Well, the odds are pretty high that this story by Sam Baker of Axios is to blame:

According to CBO estimates, Democrats' proposals to temporarily expand health care coverage through the ACA would cover fewer than 2 million uninsured Americans — at a cost of over $50 billion. https://t.co/oAuMMOOXwf

— Axios (@axios) February 17, 2021

If you just read that tweet and didn't click on the story, you'd come away thinking the ARP will spend $25,000 apiece ($50 billion / 2 million). I guess that's "better" in that it "only" overstates the per-person spending by 3-4x.

Here's Baker's own tweet of his story:

This does not seem like a particularly efficient, or even effective, bridge for the millions of people who lost their health insurance when they or their family members lost their jobs amid the pandemic. https://t.co/syGP289LCM

— Sam Baker (@sam_baker) February 17, 2021

When you get to the story itself, it's no better:

Democrats' very pricey, very small health care coverage expansion

The Congressional Budget Office doesn't expect much from House Democrats' plan to temporarily expand health care coverage through the Affordable Care Act.

The big picture: According to CBO's estimates, Democrats' proposals would cover fewer than 2 million uninsured Americans — at a cumulative cost of over $50 billion.

Details: Democrats on the House Ways and Means Committee want to make more people eligible for the ACA's premium subsidies and increase the value of those subsidies for people who already get them. Both changes would be temporary.

- Those changes would cover about 1.3 million uninsured people next year, CBO projects, and would end up costing the federal government about $34 billion.

- Offering full subsidies to people receiving unemployment benefits would cost another $4.5 billion. And people wouldn't have to pay back excess subsidies from last year, adding another $6.3 billion.

- Separately, Democrats' plan to subsidize COBRA benefits would cover about 600,000 otherwise uninsured Americans, along with over 1.6 million more who would have otherwise had some other form of coverage, at a cost of $7.8 billion.

By the numbers: That comes out to nearly $53 billion, for a set of policies that would, per CBO's estimates, cover 800,000 uninsured Americans this year, 1.3 million in 2022 and 400,000 in 2023, before phasing out.

Our thought bubble ... This does not seem like a particularly efficient, or even effective, way to achieve Democrats' primary goal: Offering a bridge to the millions of people who lost their health insurance when they or their family members lost their jobs amid the pandemic

I know reporters don't usually write the headlines, but they sure as hell write the lede, and the entire focus of Baker's story centers around making it sound like the ARP will spend all $53 billion to reduce the number of uninsured Americans by between 400K - 1.3 million in 2021 - 2023...when most of this particular spending is intended to provide financial assistance to those already insured who are still having trouble affording the cost of coverage.

Baker and I have followed each other on Twitter for years, and while we've never interacted before, I immediately contacted him to call him out on this both privately and publicly precisely because I knew exactly what it would lead to. Three weeks later...crickets.

As for the tweet at the top of the page, after being called out by numerous people, over 8 hours later (long after the original had gone viral) the author finally kind of, sort of issued a mea culpa...without deleting the original tweet (and even the "clarification" is still wildly inaccurate):

Apparently the $52 billion includes ACA subsidies... which is still massively inefficient and a gargantuan transfer of public funds to for-profit health insurance parasites.

— cabral (@axcomrade) March 13, 2021

Both Williamson and Jones appear to have deleted their retweets, at least, but I don't think either of them has replaced it with an apology for spreading misinformation in the first place. Meanwhile the original tweet is still live as of this writing, and the damage has already long since been done.

UPDATE: Since this is such a long, wonky post, I've summarized the data in as simple a format as I could (see below). Again, I think the 2021 Unemployment beneficiaries are already baked in with the 11.2 million exchange enrollees, but could be wrong; if so, that would increase the number impacted and reduce the per-enrollee average.

Update x2: I've also now broken out how many people the $6.3 billion in waived clawback overpayments would be divided among. As far as I can tell, it's around 6.8 million people, most of whom are, again, among the 11.2 million ACA exchange enrollees noted above: