Joe Biden is rolling 2 major ACA 2.0 provisions into the #AmericanRescuePlan

As I noted a year and a half ago in my analysis of Joe Biden's healthcare policy proposal, two major chunks of his plan are taken straight out of the House Democrats ACA 2.0 bills from 2018 & 2019 and from the Elizabeth Warren's ACA 2.0 bill in the Senate (CHIP, or the Consumer Health Insurance Protection Act). In fact, these two particular proposals were even part of Hillary Clinton's 2016 health plan, and originated way back in 2015 under a proposal by the Urban Institute:

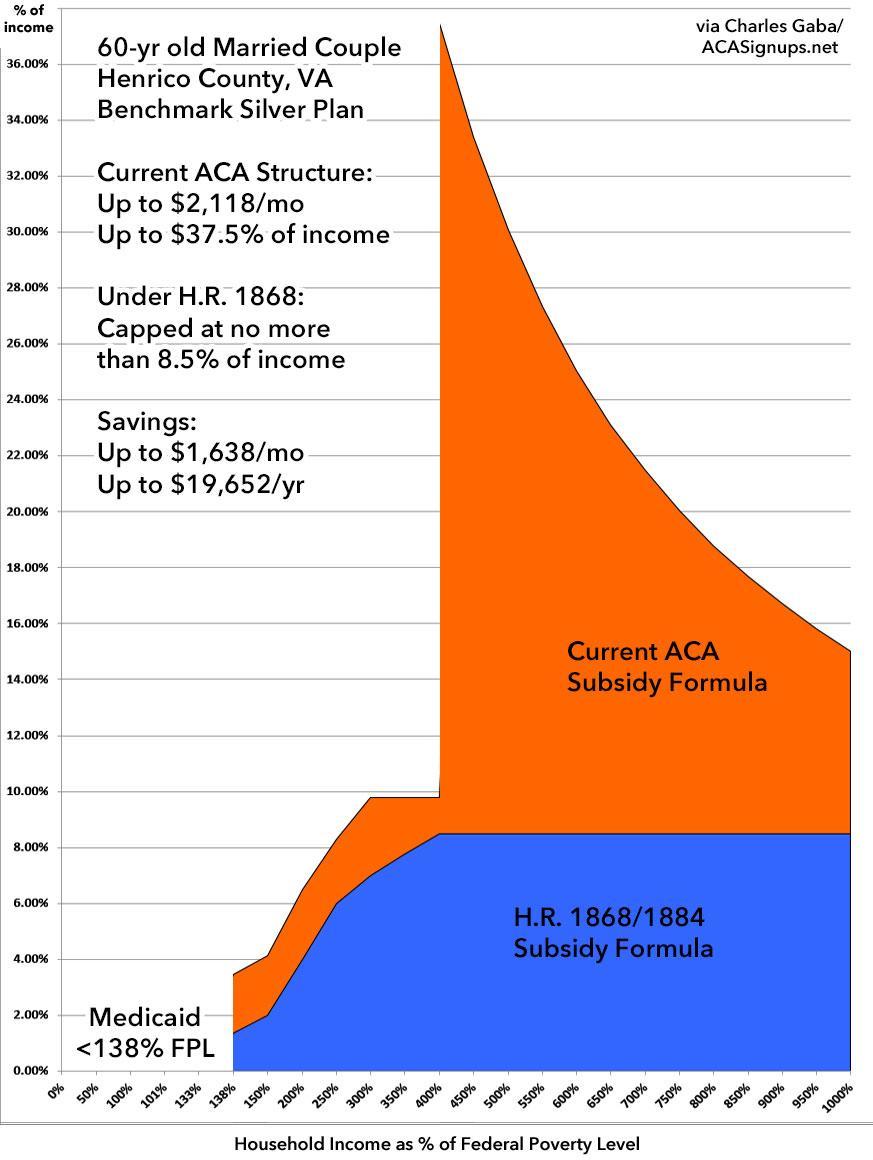

- First, eliminate the 400% FPL income eligibility ceiling for ACA subsidies

- Second, beef up the subsidy formula so that it maxes out at 8.5% of income instead of the current ~9.8%

Neither of these are terribly complicated, but combined they would make a huge improvement in the ACA and would reduce healthcare costs by thousands of dollars (or even tens of thousands in some cases) for millions of Americans.

There's a lot more in Biden's plan, of course, but these two items are the ones which I've been pushing hard for several years now, to the point that I actually met with staffers for over a dozen House Democrats almost exactly one year ago specifically to push them to cosponsor H.R. 1868, which would do exactly these two things. A similar version of each was included in H.R. 1425, which passed the House last summer...only to be DOA in the Senate, of course.

Anyway, Larry Levitt of the Kaiser Family Foundation called this to my attention earlier this evening:

Two big health coverage proposals in Biden's emergency relief package:

An increase in ACA subsidies and extension to the middle class by capping premiums at 8.5% of income.

A temporary subsidy of COBRA continuation coverage for people who have lost job-based insurance.

— Larry Levitt (@larry_levitt) January 14, 2021

President-elect Biden Announces American Rescue Plan

Emergency Legislative Package to Fund Vaccinations, Provide Immediate, Direct Relief to Families Bearing the Brunt of the COVID-19 Crisis, and Support Struggling Communities

Obviously the main focus of this ambitious $1.9 trillion proposal is things like direct cash relief payments ($1,400 apiece, to make good on the $2,000/person total being discussed over the past month or so), COVID-19 vaccination funding and a host of other vitally important stuff...but if you scroll down to page 15, there's also this:

Preserving and expanding health coverage.

Roughly two to three million people lost employer sponsored health insurance between March and September, and even families who have maintained coverage may struggle to pay premiums and afford care. Further, going into this crisis, 30 million people were without coverage, limiting their access to the health care system in the middle of a pandemic. To ensure access to health coverage, President-elect Biden is calling on Congress to subsidize continuation health coverage (COBRA) through the end of September. He is also asking Congress to expand and increase the value of the Premium Tax Credit to lower or eliminate health insurance premiums and ensure enrollees - including those who never had coverage through their jobs - will not pay more than 8.5 percent of their income for coverage.

Together, these policies would reduce premiums for more than ten million people and reduce the ranks of the uninsured by millions more.

The 9-month COBRA subsidization is important, but is clearly being pushed as a short-term thing during the COVID crisis. Killing the subsidy cliff & beefing up the formula would be permanent (I mean, I suppose they could include language stating that each would revert back to the current status after a year or whatever, but that would be stupid and would cause havoc with the insurance carrier actuarial projections, MLR rebate estimates, risk adjustment and a host of other areas of the insurance industry).

UPDATE 3/6/21: Welp, they actually did limit the subsidy upgrades/expansion to 2 years after all...at least for now. Apparently Senate reconciliation rules meant they couldn't push it out any longer than that for the moment. The hope is to make these provisions permanent before the midterms. Also important: One of the 2 years is this year...the extra subsidies are supposed to be retroactive to January 2021.

We'll see if this ends up being part of the final relief package or not, but if it is, and if it actually goes through quickly (this is, after all, supposed to be an emergency pandemic relief bill), it's conceivable that Biden could accomplish a good 1/4 or so of his healthcare plan within his first few weeks in office, which would be impressive as hell.

I'm not surprised that he's leaving a lot of stuff like the Public Option out for now, but it's interesting that Biden isn't bundling a third part of his proposed ACA exchange plan: Upgrading the benchmark plan from Silver to Gold (which would basically slash deductibles and other out of pocket expenses dramatically for most ACA enrollees). I don't know if this would be a bridge too far for this particular bill, or if doing so would cause some sort of procedural glitch connected to the filibuster, reconciliation, etc., but even without it the first two items would be huge.

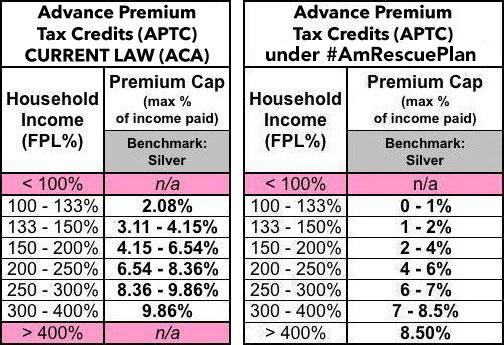

Here's how the ACA's subsidy formula would could* change:

*Update 1/19/21: I should clarify that I don't know for certain what the formula would look like below the 8.5% ceiling; I'm assuming it would be based on the H.R. 1868 / H.R. 1884 table but it's possible it would be the more generous table used in H.R. 1425 or some other variant.

UPDATE 3/6/21: It turns out the #AmRescuePlan does include the more generous table used by H.R. 1425...which is also used by H.R. 369. I've written a lengthy analysis w/better examples of that table here.

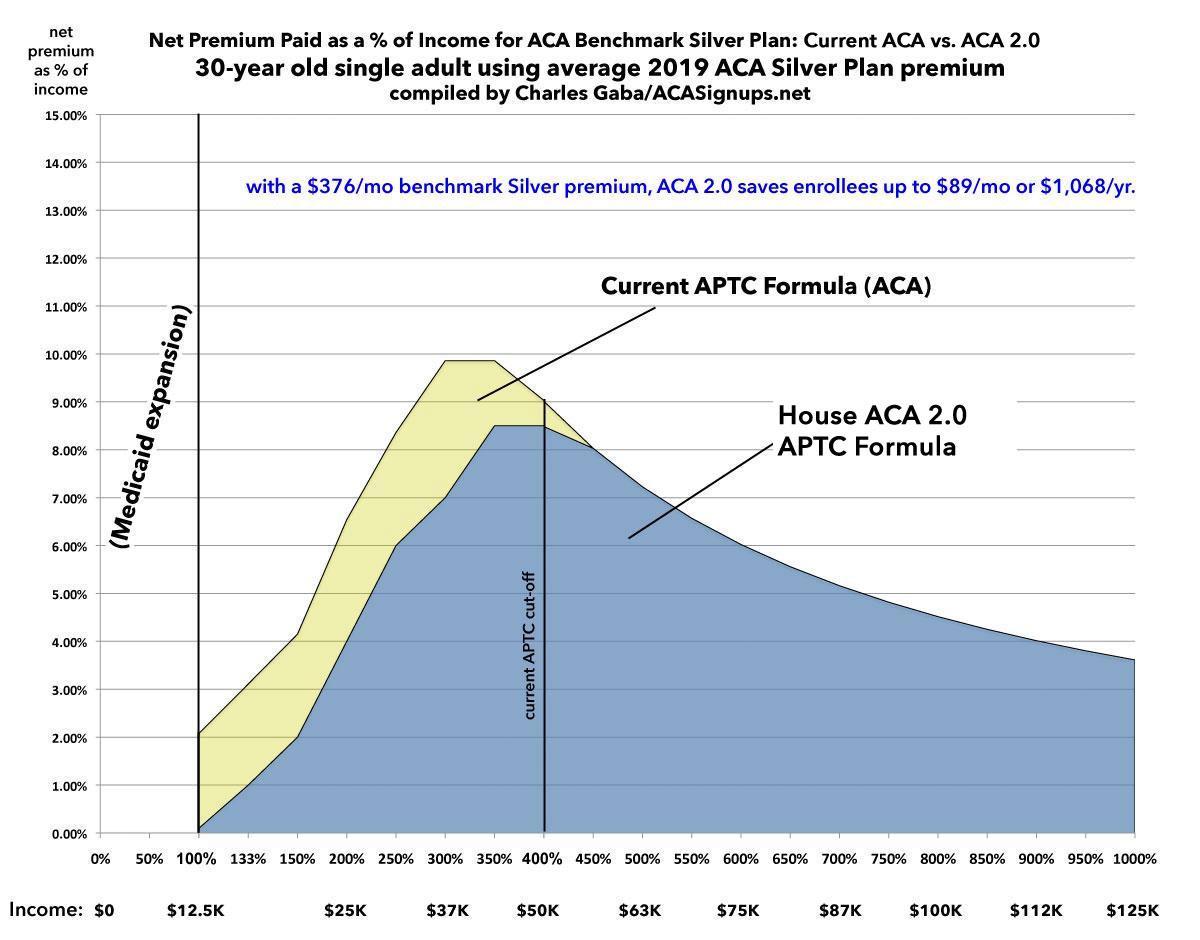

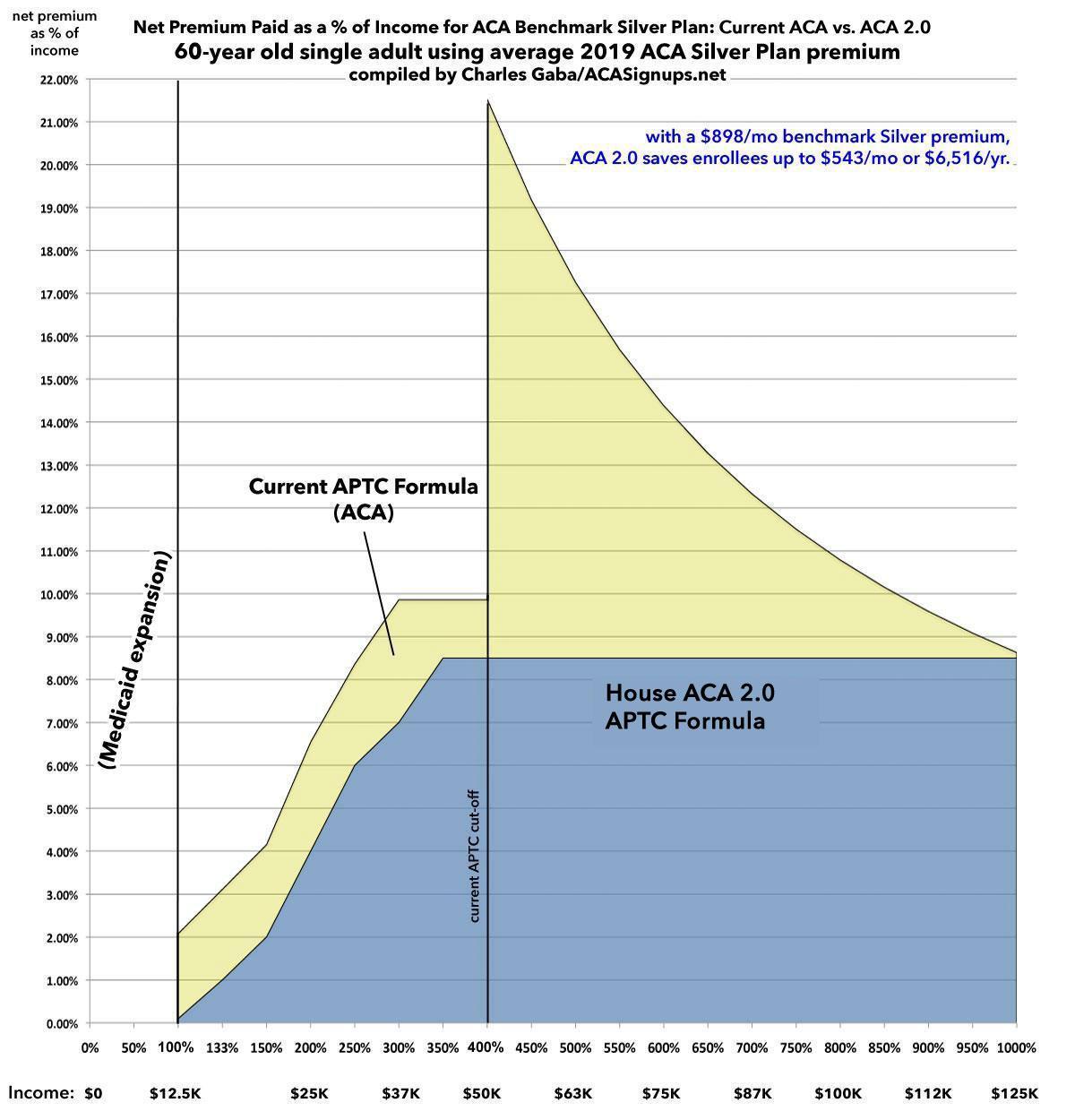

Assuming both the removing of the 400% FPL cap and the beefed-up APTC formula go through (maxing out at 8.5%), here's a couple of examples of how much enrollees would save depending on their age and household makeup. Keep in mind that these are averages (and are based on 2019 rates); the actual savings could be significantly higher or lower depending on where you live:

For a single adult, the average savings would range from up to over $1,000/year for a 30-year old to as much as $6,500/year for a 60-year old.

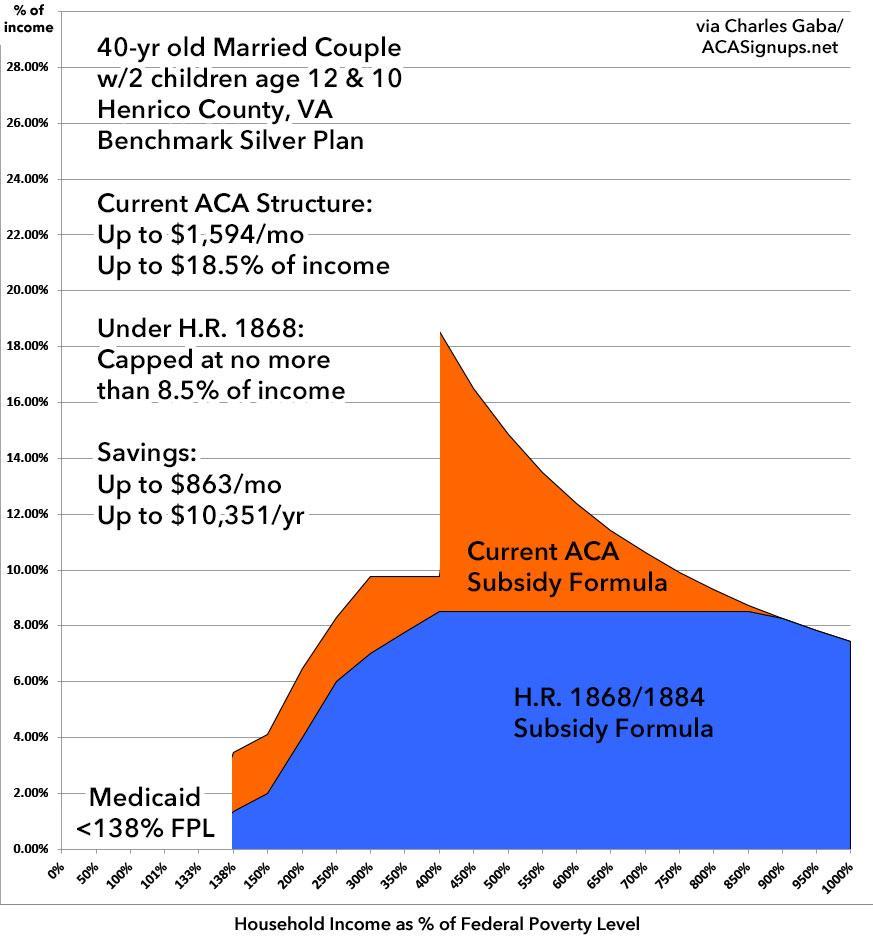

For couples or families with children, the average savings would be even more dramatic. Here's examples of a family of 4 (40-year old parents) and a 60-year old couple living in Henrico County, VA specifically:

That's up to over $10,000/yr in savings for the family of four, and up to nearly $20,000/yr in savings (you read that right) for an older couple.

The only real question I have is about something else not included in the American Rescue Plan summary: Making #MootTheSuit. There's no mention at all of the pending Supreme Court decision on the entire ACA itself. I can't believe that they're not aware of the simple (on paper) fixes available, so there's only two reasons not to include this line item:

- Biden's team is very confident that the SCOTUS will rule against the plaintiffs (or at worst, strike down the mandate only)

- Biden's team is still concerned that if the fix fails to pass the House or Senate, it could still cause SCOTUS to rule against the ACA (i.e., "since Congress tried to fix the problem that proves there's a problem which had to be fixed.")

The first reason seems foolish; while oral arguments went about as well as they could have for the ACA (even Alito was questioning the logic of the plaintiffs), there's still a chance of them striking down the entire law.

The second reason seems more likley...and in fact, that's exactly the rationale I was using for opposing a #MootTheSuit bill until I was confident that Trump had been defeated and flipping the Senate was a real possibility...but that's also exactly why it makes sense to bake it into a larger "must-pass" omnibus bill like this one, where at least 10 Republican Senators will be under great pressure to vote for the whole thing.

Anyway, stay tuned...six days to go...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.