ACA 2.0 Hunger Games & the Transitional Policy Brouhaha

Note: This is the second or third time that I'm cribbing a bit from my friend & colleague Andrew Sprung over at Xpostfactoid. If you like my healthcare policy analysis/writing style and follow me on Twitter, you should follow him at @xpostfactoid as well.

Over at Xpostfactoid, Andrew Sprung beat me to the punch by several days with an excellent two-part look at the "ACA 2.0 Hunger Games" scenario.

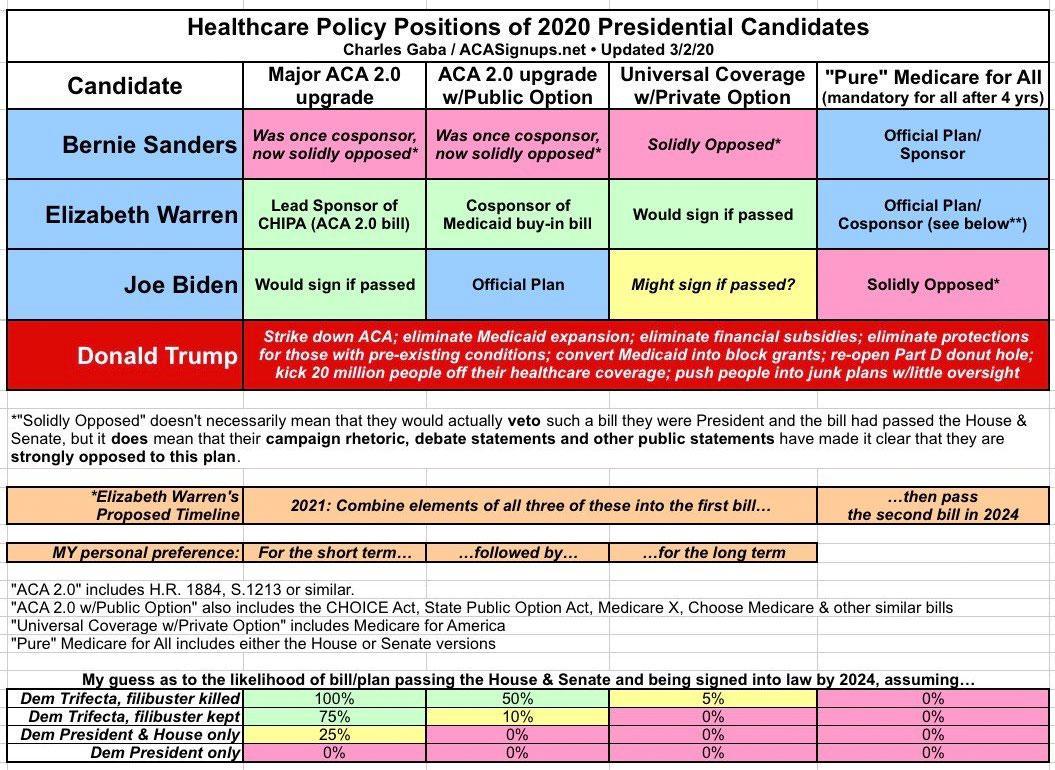

During the Democratic primary season, I posted a simple graph which boiled down the four major types of healthcare policy overhaul favored by the various Democratic Presidential candidates...which also largely cover the gamut of systems preferred by various Democratic members of the House and Senate.

The most extreme (or "bold" if you prefer) was, of course, Bernie Sanders' "100% pure" Medicare for All, in which 100% of virtually every healthcare expense would be covered for 100% of the entire U.S. population at zero out of pocket cost, with all of it being paid for via massive tax increases and the like.

The least extreme (or "most incremental" if you prefer) would be some sort of "ACA 2.0" upgrade in which the ACA has various repairs, protections & improvements to strengthen it...including beefing up the premium and/or cost sharing subsidies, expanding those so no one pays more than a given percent of their income in premiums, fixing the "family glitch" and so forth.

The other two variants were somewhere in between: "ACA 2.0 w/Public Option" (Biden's plan) and "Universal Coverage w/Private Option" (which was Kamala Harris' plan before she dropped out, and is also where my own preferred long term plan, "Medicare for America" would fall).

With Biden winning the nomination and the Presidency, we can scratch the third and fourth categories off the list...and with Democrats entering the 117th Congress with bare majorities in both the House and Senate (just 5 seats in the House and a 50/50 Senate w/Kamala Harris as the tie-breaker), even Biden's full healthcare plan is gonna be an extremely tough grind.

As you can see in the smaller table above, I even gave my rough odds of any of the plans managing to survive the sausage-making process. At the time I figured that Biden's full plan (including the PO) only had a 50/50 chance even if Democrats kill the filibuster, and perhaps a 10% chance if they don't...which seems extremely unlikely now, given that centrist Dems like Joe Manchin have already stated unequivocally that he's dead set against killing it (though he may be open to some tweaking in how it works).

-----

That brings us to the first plan: ACA 2.0. This seems like something which should be doable under the bare-trifecta situation Democrats find themselves in, and as I wrote a few days ago, Biden has announced that he's going to attempt to shoehorn two major chunks of ACA 2.0 into his big COVID-19 "American Rescue Plan": 1. #KillTheCliff and 2. #UpTheSubs.

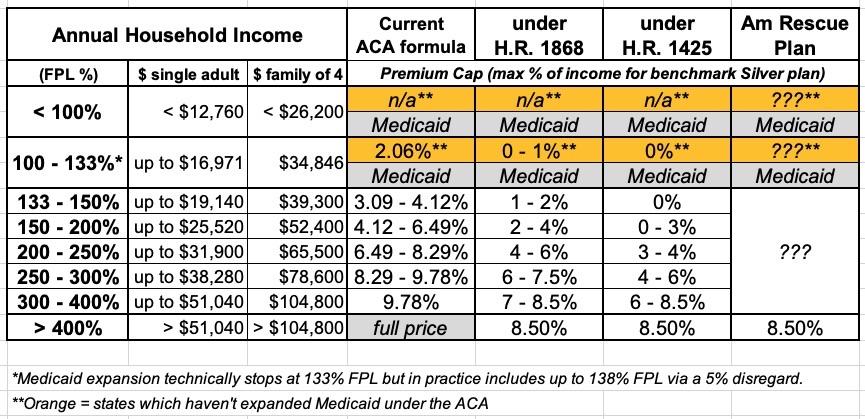

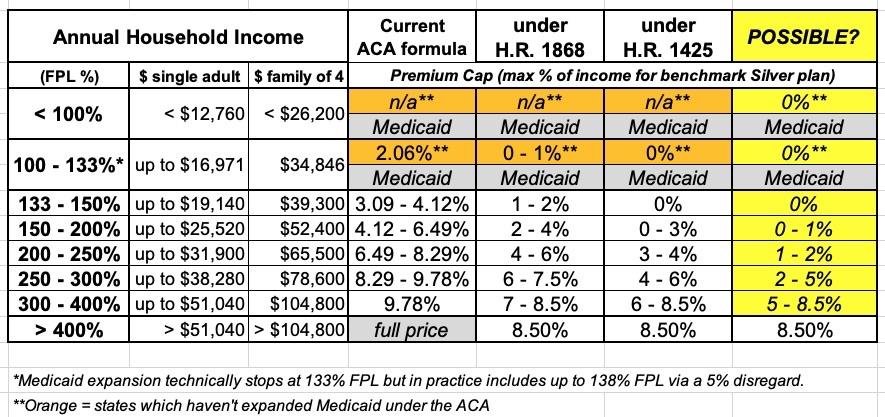

In other words, he wants to include H.R. 1868, the Health Care Affordability Act, which would remove the current 400% FPL income subsidy eligibility ceiling on the ACA exchange while also beefing up the underlying subsidy formula. The table below shows the current formula (which cuts off all subsidies at 400% FPL), the formula under H.R. 1868 and the even more generous formula under H.R. 1425, which passed the House of Representatives last summer before becoming D.O.A. in the Senate.

I have no idea what the subsidy formula would look like under the #AmRescuePlan other than that it would top out at 8.5%. My guess is that it'll follow the H.R. 1868 formula, but who knows? I also don't know whether it would do anything for those caught in the Medicaid Gap (below the 100% FPL margin), since Biden's larger healthcare vision includes moving those folks onto a new Public Option plan at no cost.

There's a whole bunch of other stuff included in Biden's plan, several of which directly impact the ACA itself such as fixing the family glitch and upgrading the benchmark ACA plan from Silver to Gold, which would dramatically reduce deductibles, co-pays and other types of out of pocket expenses...but for the moment, #KillTheCliff & #UpTheSubs are the only two provisions mentioned in the #AmRescuePlan. I assume he'll take a crack at the rest (including the Public Option) down the line, but until then these are the only ACA-specific items on the legislative table.

-----

Getting back to Andrew's "Hunger Games" theme, it boils down to this:

On Twitter yesterday, some healthcare types slipped into playing a kind of Hunger Games: if Dems go for half a loaf, should they concentrate new benefits on those already eligible for subsidies, or on those currently ineligible?

The need is pretty compelling on both sides of the 400% FPL divide. Consider:

- Among the subsidy-eligible, takeup of marketplace coverage is below 50%, according to the Kaiser Family Foundation ( or maybe a few points higher than Kaiser calculates).

- Enrollment among the unsubsidized in ACA-compliant plans dropped by 2.8 million, or 45%, from 2016 to 2019, according to CMS. That was in the wake of premium increases exceeding 20% in 2017 (a market correction after initial underpricing) and 2018 (driven by the failed Republican repeal drive and regulatory assault).

"But wait!" you may be saying...doesn't Biden's proposal address both groups? After all, it helps middle-class enrollees by removing the 400% income cap, and it helps lower-income enrollees by beefing up the subsidies!

Well....yes, it does, but there's no way of knowing which exact formula would be included in the legislation as written...or in the final version as passed and signed into law. Don't get me wrong: Either of the changed tables above would be a massive improvement over the status quo...but how much it would help different populations would vary greatly, and it could be modified in other ways instead.

Sprung goes into great detail noting the different variables at play. He notes, for instance, that at the state level, some states are also experimenting with enhanced ACA subsidies:

- Massachusetts has enhanced subsidies specifically for enrollees earning less than 300% FPL...and has had the lowest unsubsidized premiums in the country for 7 years running (I'm not sure about 2021...Utah may have finally beaten them for 1st place).

- Vermont also provides enhanced subsidies on top of the federal assistance up to the 300% FPL level, knocking 1.5% of income off of net premiums for those enrollees (i.e., at 200% FPL net premiums cost 4.8% of income instead of 6.3%)...but their average unsubsidized premiums are in the upper half of the country.

- New Jersey just started offering enhanced subsidies this year...spread out across all enrollees up to the 400% FPL threshold, ranging from $20/month at the lower end to $95/month to those at the upper income level. As Sprung notes, there's no way of knowing exactly how that'll work out since there's no data yet and NJ just moved to their own state-based exchange as well, complicating things further.

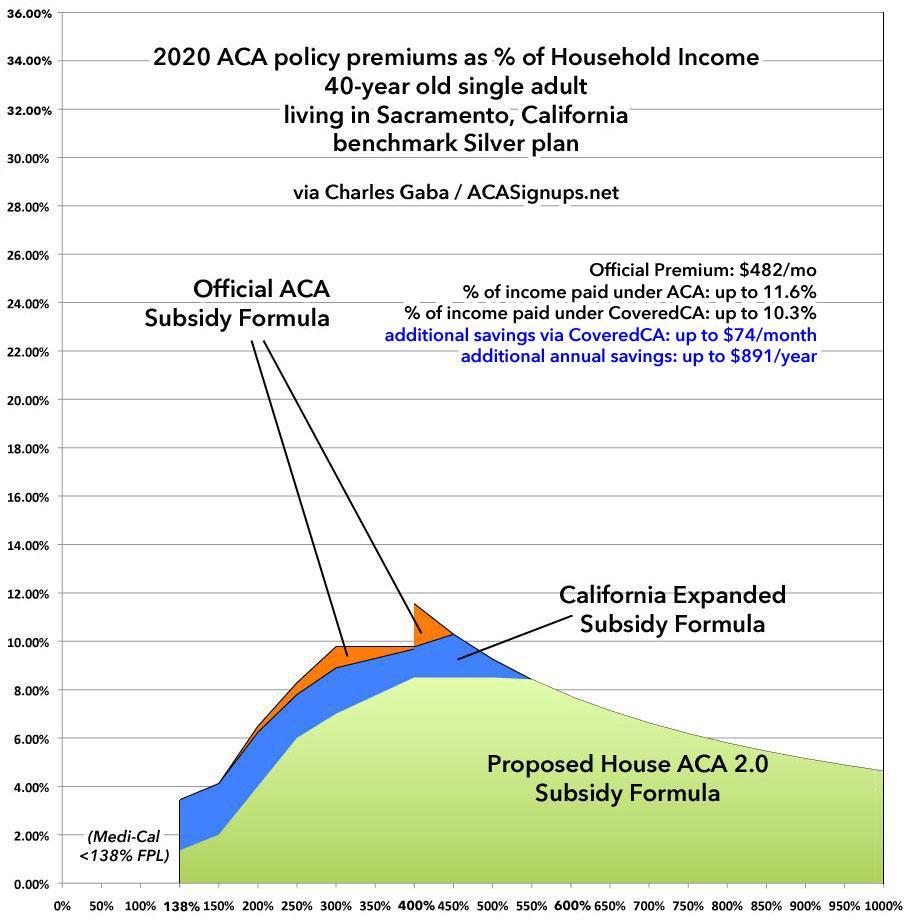

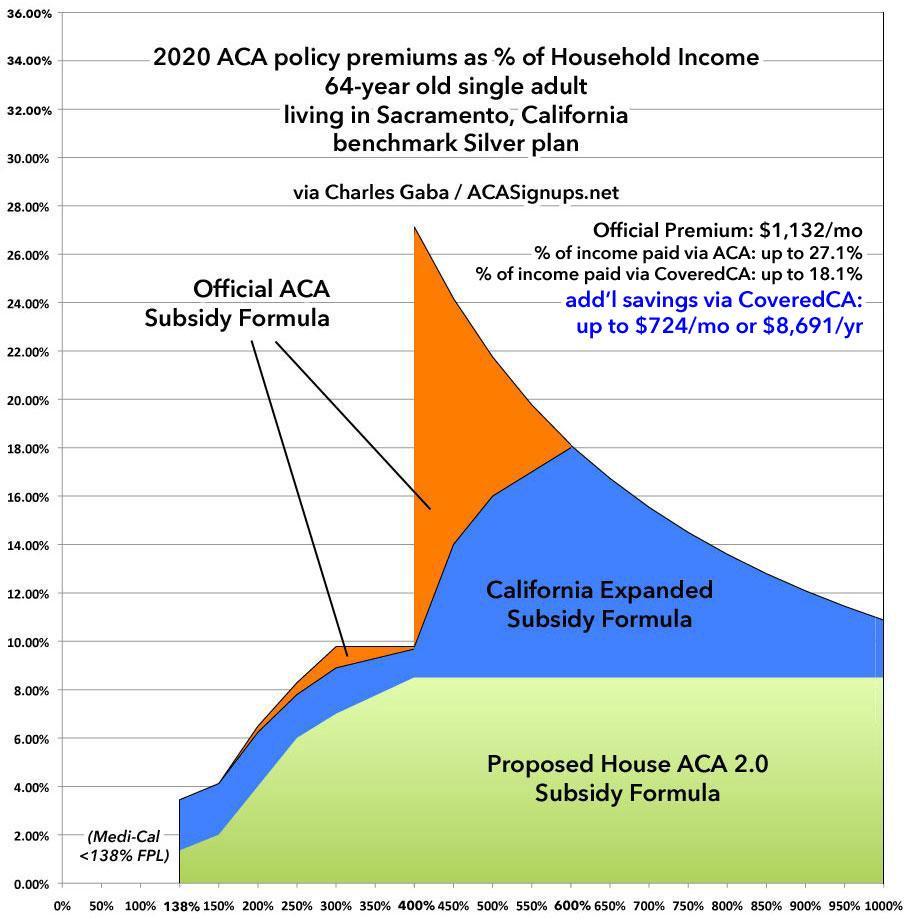

- California added their own state-based subsidy enhancements starting in 2020. In their case, they did a very watered-down version of H.R. 1868...they padded subsidies modestly for those already eligible in the 200 - 400% FPL range, and extended subsidies over the 400% FPL range...but only up to the 600% FPL mark, and even those still max premiums out at as high as 18% of income.

Here's two examples of what California's subsidies look like compared to the formula under the current ACA as well as what they would look like under under H.R. 1868, for a single 40-year old and a single 64-year old living in Sacramento:

As you can see, the California subsides help quite a bit if you earn between 400 - 600% if you're over 60, but they don't do a whole lot at any income range if you're only 40. The H.R. 1868 formula helps somewhat at any income and dramatically if you're over 50 or so.

The problem is that "helping somewhat" means something very different to someone earning, say, 150% FPL (just over the Medicaid expansion eligibility cut-off) vs. someone earning 500% FPL. At $19,000/year, even 1% of your income ($16/month) might still be a bit tough.

Over 40% of Covered CA enrollees (640,000) are receiving the enhanced/expanded subsidies at the moment...including nearly 600,000 below 400% FPL (receiving both federal & state help) and 44,500 in the 400-600% range who are only receiving state assistance. On the one hand, CoveredCA is reporting record enrollment (1.57 million as of 12/30, with a full month of Open Enrollment left to go). On the other hand, the COVID-19 pandemic is likely responsible for some of that, so it's hard to know just how much of the enrollment spike is due specifically to the extra subsidies...or at what income thresholds.

As Stan Dorn of Families USA (noted by Sprung) points out, making subsidies as generous as possible at the lower end of the income scale is not only better from a moral POV, it's also likely to increase enrollment more than focusing on the middle class will (since middle income Americans are more likely to already have insurance to begin with via their employer, there's a smaller pool remaining to be covered).

-----

In my mind, there's really three different populations here: Under 200% FPL; 200 - 400% FPL; and over 400% FPL.

As it happens, the middle group (200 - 400% FPL) is already being helped out via the long, strange saga of Silver Loading and the Silver Switcharoo, which I've discussed ad infinitum and won't go into further in this piece. The impact of silver loading on cost savings ranges dramatically depending on where you live due to some states/carriers taking greater advantage of it than others, but it's definitely doing a pretty good job of cutting costs for the 200-400% FPL crowd in spite of how absurd its path into existence was.

This mainly leaves the < 200% and > 400% populations.

The best scenario, of course, would be to provide far more generous subsidies to all three groups...but of course Congress being Congress, there's no way of knowing how that will play out....thus, the Hunger Games scenario: IF they decide that there's only a limited pool of funding available which can only be targeted towards one group or another, where should they go?

The evidence so far suggests that on paper, it's the < 200% population which should be targeted more. The problem with this gets political. As Sprung notes:

...the Affordable Care Act has failed to make coverage affordable for millions of unsubsidized prospective enrollees, and Democrats have been flayed for that since the law's passage -- with some justification. The one subset of Americans that the ACA materially harmed were healthy pre-ACA individual market enrollees who paid less for coverage they found adequately comprehensive -- often far less -- than they had to pay once the ACA marketplace launched. Unquestionably, unsubsidized ACA-compliant coverage is a heavy financial lift, and quite literally unaffordable in some markets. As mentioned above, about 3 million enrollees have been priced out since 2016, and perhaps as many between the ACA marketplace's launch in 2014 and 2016.

Long-time readers may remember this post of mine from October 2015, in which I explained how the ACA's "Transitional Policy Brouhaha" came about. In a nutshell:

- In late 2013, somewhere between 5-6 million people enrolled in pre-ACA "major medical" individual market policies received termnation notices stating that their policies weren't compliant with the new healthcare law.

- Many of these people freaked the hell out, especially since President Obama had repeatedly stated that "if you like your plan you can keep it"...and these people in particular had just been told that they couldn't keep it.

- There was an instant and massive PR backlash, so intense that President Obama issued an executive order (or an HHS directive?) allowing any non-ACA compliant policy which people were already enrolled in to remain in place for an extra year, as long as their enrollment had started between 2010 - 2013.

- Later on, that extra 1-year extension was stretched out to 2 years, then 3 years...and has in fact been bumped out by a year ever since.

- Total enrollment in these "Grandmothered" or "Transitional" policies has gradually dwindled over time to the point that only a few hundred thousand people are still enrolled in them today.

Now, not all of those 5-6 million people were angry. Most of them transitioned over to subsidized ACA plans. But a lot of them were pissed as hell, either because they earned too much to be subsidized or they thought they did (there's millions of people who are subsidy-eligible and don't know it). Regardless, an angry registered voter is still an angry registered voter. Over the next few years, the annual average premium increases (going from an average of around $256/month in 2013 to perhaps $580/month in 2021) didn't do anything to make these folks any happier about their situation regardless of the reasons for the rate hikes.

The middle class population, especially those in around the 400 - 800% FPL income range, don't really care why their premiums have increased by 125% since 2013. Whether it's for positive reasons (pre-existing condition protections, mandated essential health benefits, etc.), negative ones (Trump cutting off CSR reimbursements, zeroing out of the shared responsibility payment provision, etc) or simple inflation, none of that changed the fact that these folks are paying 2.25x more today than they were 8 years ago.

Meanwhile, as Sprung notes, 3 million of the unsubsidized individual market crowd have simply dropped out of the market altogether, with most of them either opting for junk plans or going bare altogether. Millions more who "should" be enrolled in ACA individual market plans never enrolled in the first place for this very reason.

-----

There's an additional upside to making certain that the subsidy cliff is completely eliminated (as opposed to simply raising it to, say, 600% FPL as California did): Doing so would completely eliminate the need for an off-exchange market whatsoever.

Remember, while most individual market enrollees sign up via ACA exchanges, several million people still enroll off-exchange as well, directly through an insurance carrier. This makes perfect sense if you're certain that your income is going to be higher than 400% FPL in the coming year; if you know you won't qualify for any subsidies, it doesn't matter how you enroll. In fact, in the 2020 Notice of Benefit & Payment Parameters (NBPP), CMS added a new Special Enrollment Period (SEP) category specifically letting people who do this switch to an on-exchange plan if they experience a mid-year income drop which would qualify them for APTC subsidies.

If you eliminate the subsidy cliff, there's no longer any reason to enroll off-exchange. Not only would far more people be eligible for subsidies, even those who don't would still be better off enrolling on-exchange just to save the hassle of utilizing the new SEP down the road.

For that matter, millions of people who are currently enrolled in off-exchange plans are leaving financial help on the table because they don't even realize that they'd be eligible for it if they had enrolled in the same policy on-exchange. Covered California reported last year that around 280,000 state residents fall into this category: 240,000 of them earn less than 400% FPL and another 40,000 earn 400-600% FPL.

Even if you only look at the under 400% crowd, if this is representative nationally, that suggests around 2 million off-exchange individual market enrollees nationally who would be eligible for ACA subsidies if they simply shifted on-exchange. Killing the cliff would massively simplify marketing, allowing the exchanges and private carriers to push every potential enrollee to do so on-exchange, bringing financial assistance to hundreds of thousands more enrollees who are currently losing out on the help.

-----

The #HR1425 subsidy table attempts to tackle both populations by setting the benchmark premiums for those below 150% FPL to $0, and cutting premiums for those 150 - 200% FPL to less than half from a maximum of 6.5% down to 3.0%. For those over 400% FPL, it locks them in at no more than 8.5% of income...13% lower than the current premium cap of 9.8% for those earning 300 - 400% FPL.

The #HR1868 table is just as generous over 400%, but isn't as generous at the lower end...though it's still much more generous than the current ACA formula (and still far more robust than California's...bearing in mind that states have much less freedom with their budgets than the federal government).

Here's another possible table, which would not only take the generous H.R. 1425 plan even further, but which would also tackle the Medicaid Gap issue head on: By extending $0 exchange plan premiums below the 100% FPL minimum.

The upside is that this would provide at least a reasonable option for those currently caught in the Medicaid Gap in Texas, Florida and a dozen other states. The downside is that this still wouldn't be nearly as good of a solution for these very low-income folks, and it would pretty much guarantee that no more states would ever expand Medicaid in the future since so much of the pressure would be taken off of them to do so.

Worse yet, some states which have expanded Medicaid already would likely let it expire, since they have to pay 10% of the cost of the program whereas the federal government eats 100% of ACA subsidies. I suspect this is why neither HR 1868 nor HR 1425 addressed the Medicaid Gap at all--more & more states have been quietly expanding Medicaid each year thanks to ballot initiatives anyway, so they're probably counting on that to continue to gain momentum.

Still, if Biden's Public Option solution becomes a nonstarter or if it looks like most of the remaining non-expansion states are still dead set on never expanding the program, reducing the APTC lower end might be one way to (very reluctantly) go.

Regardless of what the final legislative subsidy improvements end up looking like, as Sprung notes, Stan Dorn & Frederick Isasi of Families USA have posted a long list of other important regulatory measures the Biden Administration can take without Congress to enhance and improve healthcare coverage and affordability on top of it. The more generous for the more lower- and middle-class people the better.

Stay tuned...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.