#ACA2.0 gets a vote at last: A Deep Dive into #HR1425, the Affordable Care Enhancement Act

Back in early March (a lifetime ago given the events of the past few months), House Democrats were on the verge of finally voting on a suite of important ACA protections, repairs and improvements which I've long dubbed "ACA 2.0" (the actual title of the first version of the "upgrade suite" bill was ridiculous when it was first introduced in 2018, and the slightly modified version re-introduced in 2019 was somehow even worse, no matter how good the bill itself was).

The game plan was to hold a full floor vote in the House on H.R. 1884 (or possibly a slightly different variant) the week of March 23rd, 2020 to coincide with the 10th Anniversary of the Affordable Care Act itself. This would have made perfect sense both symbolically as well as policywise, as the ACA desperately needs a major upgrade (and it would've needed one even without years of Trump/GOP sabotage, I should note).

Unfortunately, March 2020 had other plans...namely, the United States of America being hit with the full force of a deadly global pandemic. The federal government, along with dozens of states, scrambled to effectively shut down operations across the board, and the big, splashy, high-profile House vote on ACA 2.0 was scrapped.

Since then, Speaker Pelosi and House Democratic leadership have tried to slip some portions of the package in with a couple of the COVID-19 emergency response bills. The "Take Responsibility for Workers & Families Act" included a provision to eliminate the ACA's Subsidy Cliff and beef up the underlying subsidy formula, much like H.R. 1884 (and the standalone H.R. 1868) bills would. It's my understanding there were also attempts to include a few of the H.R. 1884 provisions in the CARES Act as well as the HEROES Act (the former became law while the latter passed the House but sits idly in the Senate), to no avail.

Fortunately, as I wrote about last week, House Democrats have decided to go ahead and return to their original plan after all: An official floor vote on a standalone "ACA 2.0" bill. The new official title is H.R. 1425, the Patient Protection & Affordable Care Enhancement Act.

OK...it's not called ACA 2.0, but I can live with it; shorthand it as the #ACEA. Fair enough.

So what's actually in the bill? As I expected, much of it is identical (or very similar to) H.R. 1884...but there's also some other interesting provisions. In total, there are 30 different provisions, some of which are pretty significant They're broken into 3 sections; the first deals with the ACA exchanges themselves (my core area of interest); the second deals with Medicaid improvements; and the third deals with prescription drug pricing. Let's take a look!

TITLE I—LOWERING HEALTH CARE COSTS AND PROTECTING PEOPLE WITH PREEXISTING CONDITIONS

Sec. 101. Improving affordability by expanding premium assistance for consumers.

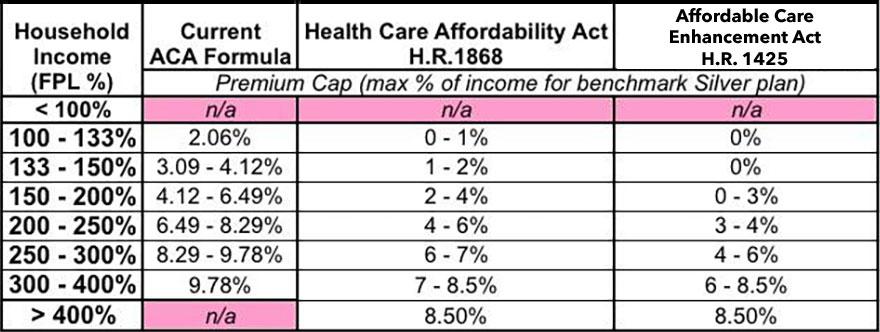

This is basically an even more enhanced version of the already beefed-up Advance Premium Tax Credit subsidy formula already found in H.R. 1868/1884 (which I've been pushing for for over a year now)...and as H.R. 1868/1884 already did, it also finally kills off the 400% FPL subsidy cliff.

Once again, under the current ACA formula, if you earn between 100 - 400% of the Federal Poverty Line (that is, between roughly $12,500 - $50,000/year if you're single, or between roughly $26,000 - $104,000/year for a family of four), you're eligible for financial subsidies on a sliding scale to reduce the cost of your ACA individual market exchange health insurance premiums. The current formula works pretty well for people earning up to 200% FPL, but between 200 - 400% the subsidies simply aren't generous enough, and if you earn more than 400% FPL (by even $1/year!), you're eligible for precisely zilch and have to pay full price...which is simply unaffordable for a lot of people.

Here's a table showing the maximum percent of household income you have to pay at different income levels under the current formula, under H.R. 1868/1884, and under H.R. 1425:

As I've shown in my ongoing #HR1868 series, both the strenghtened subsidy formula and especially the elimination of the upper-end 400% FPL income cap for subsidy eligibility would save millions of people thousands of dollars per year (potentially as much as tens of thousands of dollars, in fact, depending on the household). H.R. 1425 does pretty much the same thing (capping premiums at no more than 8.5% of household income at the upper end), but is even more generous at the lower tiers.

H.R. 1868 also elminates the smaller but still problematic lower-end subsidy cliff. Right now, people who earn just a little too much to be eligible for Medicaid expansion (138% FPL) or who earn just over 100% FPL in non-expansion states, have to pay at least 2% (in non-expansion states) or 3.2% of their income in premiums (in expansion states) for subsidized ACA exchange policies. H.R. 1868 lowers the on-ramp to the ground, so these start out at 0% or just over 1% before gradually inching up the income scale.

H.R. 1425 takes this even further, setting ACA exchange premiums at $0 across the board for anyone earning less than 150% FPL.

I want to stress how significant this first provision is. Even if HR 1425 included nothing else, this alone would be a major improvement in the Affordable Care Act.

Sec. 102. Improving affordability by reducing out-of-pocket and premium costs for consumers.

OK, this one gets really wonky, but it's actually not as bad as it sounds. In the table above, you might have noticed that the current ACA subsidy formula tiers are kind of weird--instead of being nice, round percentages, they're strange fractional numbers (2.06% instead of 2.0%; 3.09 - 4.12% instead of 3 - 4%, etc.). The original ACA language did mostly use whole numbers (2.0%, 3 - 4%, 4 - 6.3%, 6.3 - 8.05%, and 8.05 - 9.5%). However, it also included an indexing clause which basically sets up a formula for those percentages to vary slightly from year to year based on how much average employer sponsored insurance premiums changed from year to year relative to what they were the year before. As a result, some years these percentages go up a bit, some years they go down.

A year or so ago, the Trump Administration used their interpretation of this clause to change how this adjustment (known as the Premium Adjustment Percentage) was calculated. The end result of this adjustment is that ACA premium subsidies--along with the cap on maximum out of pocket expenses allowed for by the ACA--were made slightly less generous:

Reductions in federal premium tax credit spending of approximately $980 million in 2020, $1.04 billion in 2021, $1.09 billion in 2022 and $1.15 billion in 2023, which is a transfer from consumers to the federal government, due to the change in the method of calculating the premium adjustment percentage.

Assuming an average monthly enrollment of around 9.1 million people, 7.8 million of whom are subsidized, that would amount to around $125 more per subsidized enrollee, or $10/month...

Anyway, Sec. 102 of HR 1425 basically codifies the original formula used for the Premium Adjustment Percentage:

Section 1302(c)(4) of the Patient Protection and Affordable Care Act (42 U.S.C. 18022(c)(4)) is amended by striking ‘‘calendar year)’’ and inserting ‘‘calendar year, based on estimates and projections for the applicable calendar year of the percentage (if any) by which the average per enrollee premium for eligible employer-sponsored health plans (as defined in section 5000A(f)(2) of the Internal Revenue Code of 1986) exceeds such average per enrollee premium for the preceding calendar year, as published in the National Health Expenditure Accounts)’’.

In short, this would save every subsidized ACA enrollee about $10/month, and potentially up to a couple hundred bucks in co-pays or deductible spending.

Sec. 103. Expanding affordability for working families to fix the family glitch.

Ah, yes: The family glitch. I wrote about this way back in 2017, and others have been complaining about it for years before that:

Most employers provide healthcare coverage for both their employees and the families of their employees. The problem is that for several million people nationally, while the coverage provided to the employee themselves is pretty reasonably priced, adding their family to the plan can often jack up costs significantly. As Louise Norris explains here...

Unfortunately, due to a “glitch” in the ACA, they [the families of the employee] are not eligible for premium subsidies in the exchange if the amount the employee has to pay for employee-only coverage on the group plan is deemed “affordable” – defined as less than 9.66 percent of household income in 2016.

...It doesn’t matter how much the employee would have to pay to purchase family coverage. The family members are not eligible for exchange subsidies if the employee could get employer-sponsored coverage just for him or herself, for less than 9.66 percent of the household’s income.

Norris estimated at the time that 2-4 million Americans are losing out on eligibility for ACA subsidies purely due to this rather stupid oversight in the language of the ACA. Sec. 103 of HR 1425 would fix this problem, instantly making healthcare more affordable for several million more Americans.

Sec. 104. Tax credit reconciliation protections for individuals receiving social security lump-sum payments.

This is a new one--apparently there's some Social Security recipients who receive lump-sump payments which include some money they were owed from before the current year...which increases their modified adjusted gross income (MAGI), which in turn can cause them to have to pay back some or even all of their ACA subsidies when they file their taxes the following year. Sec. 104 states that the chunk of those lump-sums from before that year don't get counted as part of MAGI.

Sec. 105. Preserving State option to implement health care Marketplaces.

The ACA originally included hundreds of millions of dollars in grants to help states establish their own ACA exchange web portals & integrate them with their other systems. However, that money had a time limit, and sunsetted several years ago, meaning that any state which decides they want ot split off of HealthCare.Gov and set up their own full exchange today has to do it completely on their own dime. Sec. 105 would provide up to $200 million in new state grants for them to do so (I have to wonder how states like Nevada, which just launched their own ACA exchange completely out of their own funds last year would feel about this, but whatever).

Sec. 106. Establishing a Health Insurance Affordability Fund.

For the first three years of the ACA exchanges (2014 - 2016), there was federal funding for a national reinsurance program. I explained how reinsurance works here, but the basic idea is that it acts as a sort of "invisible high risk pool"...essentially, the government covers a portion of the cost of really expensive insurance enrollees, thus allowing the unsubsidized premiums for everyone else to be lower as a result.

Let's say that out of 100 enrollees, 90 of them only run up $5,000/year in medical claims, 9 cost $50,000/year and one really sick guy costs a whopping $500,000. Normally the insurance carrier would price everyone's premium to cover all $1.4 million. With reinsurance, the government might agree to pay for, say, 80% of any claims running between $100K - $400K. In this case, that would mean the government would pay $240K of the really sick guy's medical bills. This would bring the total cost down by 17%, which is then passed along in the form of reduced premiums to the enrollees.

Over a dozen states have already re-established their own limited ACA reinsurance programs via Section 1332 waivers, using a combination of federal and state funding...but Section 106 would relaunch full funding for any state which wanted to do so, to the tune of up to $10 billion/year.

However, some of that money wouldn't necessarily go for reinsurance--it could also be used "To provide assistance...to reduce out of-pocket costs, such as copayments, coinsurance, premiums, and deductibles, of individuals enrolled under qualified health plans offered on the individual market through an Exchange."...in other words, states would have the option of submitting a different type of plan to use some of that $10 billion to reduce costs for enrollees in a different manner. The plan would have to meet certian criteria and be approved first...but interestingly, this section is written to make approval of such a plan the default unless the HHS Secretary actively says no:

‘‘(2) AUTOMATIC APPROVAL.—An application so submitted is approved unless the Administrator notifies the State submitting the application, not later than 60 days after the date of the submission of such application, that the application has been denied for not being in compliance with any requirement of this part and of the reason for such denial.

Huh. Sounds to me like a lot of people are cranky with CMS Administrator Seema Verma for taking way too long to review some of the waiver requests sitting on her desk.

Sec. 107. Rescinding the short-term limited duration insurance regulation.

I've written about #ShortAssPlans more times than I care to, but here it is again in a nutshell:

- "Short-Term, Limited Duration" healthcare plans are non-ACA compliant, and while they serve a purpose for some people, for the most part they tend to be junk, with huge coverage gaps, tons of fine print, and the ability to discriminate against people with pre-existing conditions. In other words, the exact type of plans the ACA was supposed to discourage people from using...but which it didn't actually outlaw.

- While STLDs were't banned or restricted by the ACA, President Obama issued an executive order restricting them to last no longer than 90 days (thus making them short term) and not letting them be renewed within a calendar year (thus making them of limited duration).

- Donald Trump issued his own executive order lifting President Obama's restrictions...and actively promoting the hell out of STLD as his "solution" to ACA premiums increasing for unsubsidized enrollees.

So, Section 107 of HR 1425 simply states that Donald Trump's XO is null, void and can no longer be implemented by the HHS, Labor or Treasury Depts.

Oddly enough, it doesn't actually outlaw short-term plans, nor does it even codify the 90-day/no-renewal restrictions into law...it simply voids Trump's XO, thus reinstating Obama's. Huh. I have no idea if there's a legal reason for that or if whoever wrote that section was just trying to make a point, but the effect is the same.

Sec. 108. Revoking section 1332 guidance.

As I explained back in November 2018:

One of the great strengths and dangers of the ACA is that it includes tools for individual states to modify the law to some degree by improving how it works at the local level. The main way this can be done is something called a "Section 1332 State Innovation Waiver":

Section 1332 of the Affordable Care Act (ACA) permits a state to apply for a State Innovation Waiver to pursue innovative strategies for providing their residents with access to high quality, affordable health insurance while retaining the basic protections of the ACA.

State Innovation Waivers allow states to implement innovative ways to provide access to quality health care that is at least as comprehensive and affordable as would be provided absent the waiver, provides coverage to a comparable number of residents of the state as would be provided coverage absent a waiver, and does not increase the federal deficit.

State Innovation Waivers are available beginning January 1, 2017. State Innovation Waivers are approved for five-year periods, and can be renewed. Waivers must not increase the Federal deficit.

In other words, the ACA itself allows for individual states to experiment to some degree...but only as long as those experiments are proven to do at least as good a job of providing quality healthcare coverage, to at least as many people, without costing either the enrollees or the federal government more than the "vanilla" ACA provisions otherwise would.

When done in good faith and according to the spirit of the ACA, this can result in positive results, such as the reinsurance programs which a half-dozen states have implemented over the past year or so. In those cases, 1332 waivers allow states to leverage the power of the ACA's federal dollars to multiply the impact of state dollars.

In other cases, states like Vermont and Colorado have tried to use 1332 waivers for even bolder experiments in achieving Single Payer healthcare systems at the state level. Unfortunately, every attempt has failed so far for various reasons.

The downside of 1332 waivers, of course, is that defining what counts as being "at least as good" is highly subjective...and much of this depends on the judgment of whoever is running things at HHS and/or CMS. Which, at the moment, happens to be Trump appointees Alex Azar and Seema Verma respectively.

The short version is that Seema Verma issued her own warped interpretation of Section 1332, including a whole mess of changes which are highly questionable at best.

Section 108 of HR 1425 would, like 107, effectively just say that Verma's "guidance" is null, void and unenforceable, reverting Section 1332 Waivers back to Obama-era regulations.

Sec. 109. Requiring Marketplace outreach, educational activities, and annual enrollment targets.

Trump slashed the ACA's Navigator and related program funding by 90% and also placed absurdly unrealistic requirements for the non-profit organizations which use the remaining grant money. Section 109 would restore navigator/etc. funding to $100 million per year, and would rescind the draconian enrollment thresholds being mandated under the Trump Administration.

Sec. 110. Report on effects of website maintenance during open enrollment.

This is a new one: HealthCare.Gov is down for maintenance from time to time like any other large, complex website...but in recent years there've been a lot of accusations that the timing and types of maintenance periods have been done in such a way as to deliberately make enrollment harder. This section would require a report by the Comptroller General as to whether that's the case or not.

Sec. 111. Promoting consumer outreach and education.

In addition to slashing HealthCare.Gov's navigator program funding by 90%, Trump also slashed the federal exchange's marketing and awareness program by 90% as well. This is very similar to Section 109: It would provide $100 million/year to restore that funding while also requiring the HHS Dept. to use the money to actually market and promote ACA Open Enrollment properly (as opposed to blowing the money on, for instance, producing videos OPPOSING the Affordable Care Act.

Sec. 112. Improving transparency and accountability in the Marketplace.

This is a new one, and it relates directly to the core focus of this website: It legally requires the HHS Dept. to provide detailed biweekly demographic reports during Open Enrollment along with the post-Open Enrollment in-depth report on performance. For the most part this sounds similar to what they already do with the Weekly Snapshot and Final OEP reports every year, actually. The differences seem to be 1) This would codify those reports into law (I'm assuming they're up to the whim of the HHS Secretary at the moment?), and 2) it would add additional demographic details to what's currently included, such as a lot more info on call centers and navigator/agent/broker performance. It also looks like it adds a mandated post-Open Enrollment advertising/consumer outreach report. All of the above would have to include details on the impact on specific demographic groups (lower-income, underserved communities, etc).

In addition, Section 112 would also mandate a report which amounts to an audit of just how HealthCare.Gov's money is spent. I raised this issue over two years ago, when I pointed out that the 3.5% premium fee which was in place for HealthCare.Gov had remained exactly the same since the exchanges launched in 2014, even as unsubsidized premiums more than doubled and the number of exchange enrollees increased by up to 50%.

In other words, HC.gov's annual user fee revenue has more than tripled even though most of the startup expenses have long since been amortized at the same time they were slashing spending on things like marketing, outreach and navigator programs (see sections 109 & 111 above). Basically, this section demands accountability as to where the hell all that money is going (Seema Verma actually dropped the fee from 3.5% to 3.0% a year or so ago in response to mounting pressure on this issue, but it's still important to know how the funds are being spent).

Sec. 113. Improving awareness of health coverage options.

This is also new to me: It requires the Labor Dept. to prominently display detailed information about COBRA (the law which requires employees who lose employer-sponsored healthcare coverage to have the option of keeping that coverage after they lose their job, though they have to pay full price for it from that point on). It also requires Labor to remind employees that they're alternately eligible for a 60-day Special Enrollment Period via an ACA exchange (potentially with financial subsidies), as well as details on the circumstances under which people are or aren't eligible for subsidies.

I'm guessing this is one of those things which was a minor annoyance prior to the COVID-19 pandemic, but which has caused tremendous confusion over the past few months as over 40 million people have lost their jobs in one shot.

Sec. 114. Promoting State innovations to expand coverage.

This is basically a $200 million/year, 3-year fund to help states brainstorm and implement useful ways of boosting ACA enrollment, including streamlining their enrollment process, improving data sharing, or--and this one is an eyebrow-raiser: implementing a state-based individual mandate penalty.

Huh. THAT'S interesting--this basically means that House Democrats have (wisely, in my view) officially given up on reinstituting the federal Individual Mandate Penalty, and have decided to leave it up to individual states to do so if they wish (as a half-dozen states have already done, including California, Massachusetts, New Jersey, DC, Rhode Island and Vermont...although VT's is rather vague).

Don't get me wrong--it's still conceivable that House Dems will, if they have to, reinstate a nominal fee (say, $1/year) in order to resolve the absurd Texas Fold'em lawsuit pending at the Supreme Court this fall--but it sure sounds like they have zero intention of ramping the fee back up to the original $695/person / 2.5% of income fee which it used to be.

Sec. 115. Strengthening network adequacy.

The three biggest complaints people have about ACA exchange policies is a) premiums are too high if you earn more than 400% FPL; b) deductibles/co-pays are too high if you earn more than 200% FPL...and c) skinny networks (i.e., not enough doctors, hospitals, clinics and/or prescription medications are included in many policies). This would basiclally require exchange plans to meet certain minimum network adequacy thresholds as set by either the HHS Secretary or the state-based exchanges. I kind of thought this was already a requirement, but evidently not (or the existing language is apparently too open to loopholes).

Sec. 116. Protecting consumers from unreasonable rate hikes.

Most states already give their state insurance commissioner a large measure of rate review and veto power over what they deem to be excessive or unjustified annual premium rate hikes on the individual and small group markets, but some states don't give them any authority at all while others only give them the power to publicly shame insurance carriers over high rate increases. This section appears to override states with skimpy rate controls (I think) by granting them all additional authority to crack down on excessive rate hikes. It also seems to expand rate enforcement to grandfathered plans (i.e., non-ACA compliant plans which pre-date the ACA which still have people enrolled in them, though there aren't many of those left these days).

TITLE II—ENCOURAGING MEDICAID EXPANSION AND STRENGTHENING THE MEDICAID PROGRAM

Sec. 201. Incentivizing Medicaid expansion.

Under the ACA, states which expanded Medicaid would have 100% of the cost paid for by the federal government for the first three years (2014 - 2016). After that, the states had to gradually start chipping in a portion of the cost--starting with 5% in 2017 and increasing to a maximum of 10% starting in 2020 and beyond. HOWEVER, those years were locked in stone, which means that any state which took a pass the first few years but agreed to expand Medicaid later on has had to pay between 5 - 10% of the cost themselves right out of the gate...and if any of the 14 remaining holdout states (Alabama, Florida, Georgia, Kansas, Mississippi, Missouri, North Carolina, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Wisconsin and Wyoming) decide to expand the program now, they'll have to pay the full 10% immediately.

Section 201 changes the wording so that the 3-year, 100% federal funding match period doesn't start until the state actually expands Medicaid (along with the phased-in 5-10% state funding period), which should act as a major incentive to get some of those remaining states to stop being stubborn jackasses about doing so, as it would save them hundreds of millions (or even billions) of dollars each year for the next 6 years straight.

If all 14 states jumped on this, it would wipe out the Medicaid Gap, providing healthcare coverage to more than 2.3 million low-income adults (while also shifting up to another 2.1 million from subsidized ACA exchange plans over to Medicaid as well).

Sec. 202. Providing 12-months of continuous eligibility for Medicaid and CHIP.

Right now, some states require Medicaid enrollees to reapply for eligibility multiple times per year (up to every month in some cases). This section basically says that if they're determined to be eligible once, they're good to go for up to 12 months.

Obviously some Medicaid enrollees win the lottery, get a job (or a better-paying job) or otherwise see their fortunes improve less than a year later, but the administrative overhead, paperwork and other red tape headaches presumably are more expense and trouble than they're worth, and having to fill out a bunch of paperwork each and every month strongly discourages a lot of people from applying in the first place.

Sec. 203. Mandatory 12-months of postpartum Medicaid eligibility.

Right now, pregnant women who are eligible for Medicaid only remain eligible for 60 days after they give birth, resulting in a lot of healthcare problems among new mothers. This would extend that eligibility out to a full year.

Sec. 204. Reducing the administrative FMAP for nonexpansion States.

If Section 201 (100% 3-year FMAP match for Medicaid funding) is the carrot to get the remaining states to expand Medicaid, Section 204 is the stick: Any state which still refuses to expand Medicaid under the ACA by 2022 will see the federal government reduce the portion of the cost they pay by 0.5 percentage points starting in the last quarter of 2022, 1.0 points for Q1 2023, 1.5 points for Q2 2023 and so on, reaching a maximum of 10 points for Q3 2027.

In other words, that 100%, 3-year match is a limited time offer: Those 14 states would have a couple of years to get off their butts and expand the program, but after that the clock would be ticking, and every day that Texas, Florida and Georgia continue to be assholes about expanding Medicaid, the offer would become less generous. After another 4 years or so of nonaction (technically 13 years from 1/1/2014), it will have withered away into nothing.

Sec. 205. Enhanced reporting requirements for nonexpansion states.

Hmmmm...this seems to basically be saying that any state which still hasn't expanded Medicaid by now is clearly not likely to be acting in good faith, so there's additional reporting requirements placed on them: They'd have to start reporting a detailed demographic breakout of how many of their residents are uninsured by different age groups, what their plan is to provide coverage for residents, how much uncompensated hospital care they face each year and so forth. Interesting.

Sec. 206. Primary care pay increase.

For all the fuss about doctors being paid too much, this actually varies widely by specialty, and primary care physicians are generally underpaid in America. This section would beef up their pay under Medicare/CHIP etc (the details get pretty wonky).

Sec. 207. Permanent funding for CHIP.

Every few years, the Children's Health Insurance Program (CHIP), which provides healthcare coverage for 9 million low-income kids, has to have its federal funding renewed by Congress. The funding renewal has historically been a no-drama, bipartisan thing...until the Trump era. IN 2018, there was an ugly situation with the DACA standoff in which Trump and Congressional Republicans basically took those 9 million children hostage in an attempt to force Democrats to throw 9 million Dreamers under the bus.

The issue was eventually resolved (sort of) and the CHIP funding was renewed for another 6 years...but Section 207 would resolve it permanently by removing the 2024 renewal date and locking in funding each year after that.

Sec. 208. Permanent extension of CHIP enrollment and quality measures.

This appears to be connected to Section 207; it looks like it's some supplemental funding for administrative programs related to CHIP which also currently have to be renewed every few years.

Sec. 209. State option to increase children’s eligibility for Medicaid and CHIP.

I'm a litlte confused by this one--as far as I can tell, right now states can make children eligible for the CHIP program via either of two different income criteria, but only one of the two; this section appears to say that either criteria will make the kid eligible. Again, it's too obscurely and sparely worded for me to be sure.

Sec. 210. Medicaid coverage for citizens of Freely Associated States.

This deals with Medicaid eligibilty for residents of Micronesia, the Marshall Islands, Palau, Guam, Puerto Rico, the U.S. Virgin Islands, Northern Mariana Islands and American Samoa. I'm not an expert on how Medicaid eligibility currently works in any of those territories/regions, but it sounds like this either adds it, expands it, or both, which is a good thing.

UPDATE: OK, I had this partly correct; I've been informed that Section 210 actually only deals with Medicaid eligibility for residents of Micronesia, the Marshall Islands, and Palau who are living in the U.S. Apparently this population can live and work in the U.S. without restriction but are currently ineligible for Medicaid. This language would create Medicaid eligibility for this population.

Sec. 211. Extension of full Federal medical assistance percentage to Indian health care providers.

Huh. Apparently, until now, healthcare providers who provide services via Medicaid or the Indian Health Service to Native Americans, Native Hawaiians (and I'm guessing Alaska Natives?) have been getting shortchanged. This section appears to require payment parity.

TITLE III—LOWERING PRICES THROUGH FAIR DRUG PRICE NEGOTIATION

Sec. 301. Establishing a Fair Drug Pricing Program.

Sec. 302. Drug manufacturer excise tax for noncompliance.

Sec. 303. Fair Price Negotiation Implementation Fund.

OK, I may be completely misreading this, but it sure looks like the entire prescription drug section is basically a shortened version of...H.R. 3, the game-changing (if it had actually passed the Senate and been signed into law) prescription drug price negotiation/price-setting bill passed by the House last year. As far as I can tell, the main reason to bake this chunk of H.R. 3 into H.R. 1425 is primarily to ensure that the rest of the bill is actually paid for.

Remember, if H.R. 1425 is ever actually given a floor vote on the Senate (which, tragically, will never happen as long as Mitch McConnell is Senate Majority Leader...which means it won't happen before next January no matter what), it would almost certainly have to go through the Congressional Budget Office's 10-year scoring process first, so the House Dems made sure it included a payment mechanism to prevent the CBO score from claiming that it would increase the federal debt.

So there you have it. This is a fantastic bill which includes a ton of important and long-overdue protections, repairs and dramatic improvements to the Affordable Care Act. It kills the subsidy cliff. It makes ACA plans far more affordable for potentially 20 million or so Americans. It would likely either eliminate the Medicaid Gap or at the very least would slice it down to a small fraction of its current size, It significantly beefs up consumer protections. It enhances Medicaid quality for millions. It reduces payment discrepancy for underserved healthcare providers. It permanently funds CHIP. It fixes the Family Glitch, restores proper ACA Open Enrollment funding and outreach programs. It restores the Navigator funding. It funds a robust reinsurance program and much more as well.

It checks off about a half-dozen of my old, outdated "If I Ran the Zoo" wish list items in one shot (there were 20 in all, but several of them have become moot since then such as the Risk Corridor and CSR funding items), while adding a lot of stuff I didn't include but am glad this bill does.

So what doesn't it include? Well, there's obviously always room for improvement, but the only significant items missing that I can see are a) it doesn't include the age-based subsidy adjustment I wrote about last week, nor does it fix the "Skinny Plan" glitch (Item #4 on my Ran the Zoo list). One thing on my list was to enhance the ACA's Basic Health Plan provision (currently only 2 states, MN & NY, have implemented it), but the greatly-beefed up APTC subsidy formula serves mostly the same purpose (remember, it would set premiums for a Silver benchmark plan to $0 for anyone earning up to 150% FPL, and to just 3% of income for those earning up to 200% FPL).

The other notable exception--which was also true of the prior versions of the House ACA 2.0 bill--is that it doesn't officially touch the Cost Sharing Reduction (CSR) situation at all, nor does it upgrade the benchmark plan from Silver to Gold (which ties in with CSR). This was a conscious choice by the lawmakers--the original ACA 2.0 bill introduced back in 2018 did enhance CSR subsidies while also formally appropriating funding to make CSR payments to carriers, which would have deliberately eliminated Silver Loading...but both of the CSR provisions were stripped out of the 2019 version and are missing here as well.

As far as I can tell, House Dem leadership has decided to just leave Silver Loading as it is on a permanent basis...which is fine as long as the APTC formula itself is beefed up enough, which it absolutely is here

I may have a few other quibbles, but overall this includes nearly everything I'd want to see in an ACA 2.0 bill, and I'm ubergeeked to see it finally getting a full House floor vote.

Too bad it's Dead On Arrival in Mitch McConnell's legislative graveyard after that.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.