Introducing H.R. 6545, the perfect companion for H.R. 1868!

For several years now, I've been urging Congress to upgrade the Affordable Care Act via a series of major improvements. Most notable among these is the need to #KillTheCliff...that is, to eliminate the so-called "Subsidy Cliff" which kicks in for ACA individual market enrollees who earn more than 400% of the Federal Poverty Line (roughly $50,000 for a single adult or $103,000 for a family of four).

As I've explained many tmes, the ACA's subsidy structure works pretty well for those earning between 100 - 200% FPL, and is at least acceptable for those earning 200 - 400% FPL (in fact, thanks to #SilverLoading, it works quite well for most of that population as well). The real problem kicks in above 400% FPL (and to a lesser extent below 138% FPL for those living in the 14 states which still haven't expanded Medicaid). In addition, the subsidy formula still doesn't make policies truly affordable for many of those receiving them.

In short, both the upper- & lower-bound Subsidy Cliffs need to be eliminated, and the underlying formula needs to be strengthened as well.

All of these issues are resolved by several different bills which have been introduced by Democrats in both the House (H.R. 1868, H.R. 1884) and the Senate (S.1213). They were also addressed by Hillary Clinton as part of her 2016 campaign healthcare plan and by Joe Biden in his current plan, along with the healthcare proposals put forth by many of the other 2020 Democratic candidates who have since dropped out, including Michael Bloomberg, Tom Steyer, Pete Buttigieg, Amy Klobuchar and others...all of which have relied on the exact same formula: Instead of capping benchmark premiums between 2 - 10% of income between 100 - 400% FPL, the new formula calls on premiums to be capped between 0 - 8.5%...and then to stay at 8.5% above the 400% FPL threshold.

Back in March, I noted that House Democrats were attempting to bake a modified version of H.R. 1868, which does exactly this, into the first COVID-19 emergency response bill, the "Take Responsibility for Workers & Families Act". The provision was pretty close to the standalone H.R. 1868 formula, except that it was somewhat more generous.

Unfortunately, the #KillTheCliff provision ended up being dropped from the "Take Responsibility" bill, along with the other 2-3 COVID bills which have since passed through the House and Senate.

As I noted in March, however, while H.R. 1868 (or a bill like it) would certainly provide dramatic premium relief for millions of middle-class Americans, the vast bulk of that relief only goes towards older unsubsidized Americans. For younger people (and by "younger" I mean below 50 years old), the premium relief is decent at best but nominal at worst.

In short, any subsidy formula which is purely income-based instead of age-based is going to disproportionately help older enrollees a lot more relative to what the official, unsubsidized premiums are than it will younger enrollees.

Now, you may ask why this is a problem--after all, the younger enrollee is only paying about 1/3 as much as the older enrollee at full price and they'd still be paying less than the 64-year old under the enhanced formula...but that's not how people work. Remember, the 26-year old is likely to earn less than the 64-year old...but more importantly, there's a reason they're called "Young Invincibles"...and it's not because they are invincible; they just tend to think they are.

The solution to this is to add another formula tweak to the premium subsidy formula...one which is age-based instead of income-based.

I noted in March that Sen. Tammy Baldwin has introduced a bill intended to address this, and I generally support it...but it also presents some serious logistical problems in how it's structured.

Fortunately, a bill has now been introduced which neatly resolves the age-based adjustment issue in a far simpler, more equitable and more efficient manner, without running into any of the issues in Baldwin's bill: H.R. 6545, the Health Insurance Marketplace Affordability Act of 2020":

AGE RATING ADJUSTMENT TO APPLICABLE PERCENTAGE USED TO DETERMINE THE CREDIT FOR COVERAGE UNDER QUALIFIED HEALTH PLANS.

(a) In General.—Section 36B(b)(3)(A) of the Internal Revenue Code of 1986 is amended by adding at the end the following new clause:

“(iii) AGE RATING ADJUSTMENT.—For purposes of this subparagraph—

“(I) IN GENERAL.—The applicable percentage otherwise determined under clause (i) shall be multiplied by the age adjustment value determined under subclause (II).

“(II) AGE ADJUSTMENT VALUE.—The age adjustment value for any taxpayer is the average of the age rate adjustments for all individuals which have coverage described in paragraph (2)(A) with respect to the taxpayer, divided by the maximum age rate adjustment allowed under section 2701(a)(1)(A)(iii) of the Public Health Service Act.

“(III) AGE RATE ADJUSTMENT.—The age rate adjustment for any individual shall be determined using a single national age rating curve which shall be specified in guidance by the Secretary of Health and Human Services and shall reflect market patterns in the individual market in accordance with section 2701(a)(1)(A)(iii) of the Public Health Service Act.”.

(b) Effective Date.—The amendment made by this section shall apply to taxable years beginning after the date on which the single national age rating curve referred to in section 36B(b)(3)(A)(iii)(III) of the Internal Revenue Code of 1986 (as added by this section) is specified by the Secretary of Health and Human Services.

The language is surprisingly sparse, but here's what it does in a nutshell:

- Let's say you're a single adult, aged 40 years old, living in Oakland County, Michigan, earning 250% FPL (just under $32,000/year)

- Under the current ACA subsidy formula, you'd only hae to pay 8.29% of your income for a benchmark Silver plan, which means you'd be eligible for $89/month in APTC subsidies ($1,068/year), bringing your cost for a benchmark Silver plan down from $315/month to $226/month

- Assuming the "national age rating curve" matched the current one used by most states, the age rate adjustment for a 40-year old is 1.278. That simply means that the full-price premium is 27.8% higher for a 40-year old than a 21-year old.

- Under H.R.6545, you'd divide 1.278 by 3 (the maximum age rate adjustment allowed for under the ACA) to get 0.426. You'd then multiply that by 8.29% to get an age-adjusted premium cap of 3.53% of your income.

- In other words, instead of having to pay $226/month, you'd now only have to pay $94/month.

The adjustment is naturally more generous the younger you are and less generous the older you are (if you're 64 years old, the adjustment would be 3 / 3, or 1...in other words, there is no further adjustment at the upper threshold by design.

Also note the reference to "a single national age rating curve". This is necessary because two states (New York and Vermont) don't have an age rate adjustment at all (that is, everyone pays exactly the same amount regardless of age), while one state (Massachusetts) has a 2:1 range instead of the 3:1 range used by the other 47 states. By specifying a single national age rating curve, this avoids NY, VT or MA being penalized for their age bands.

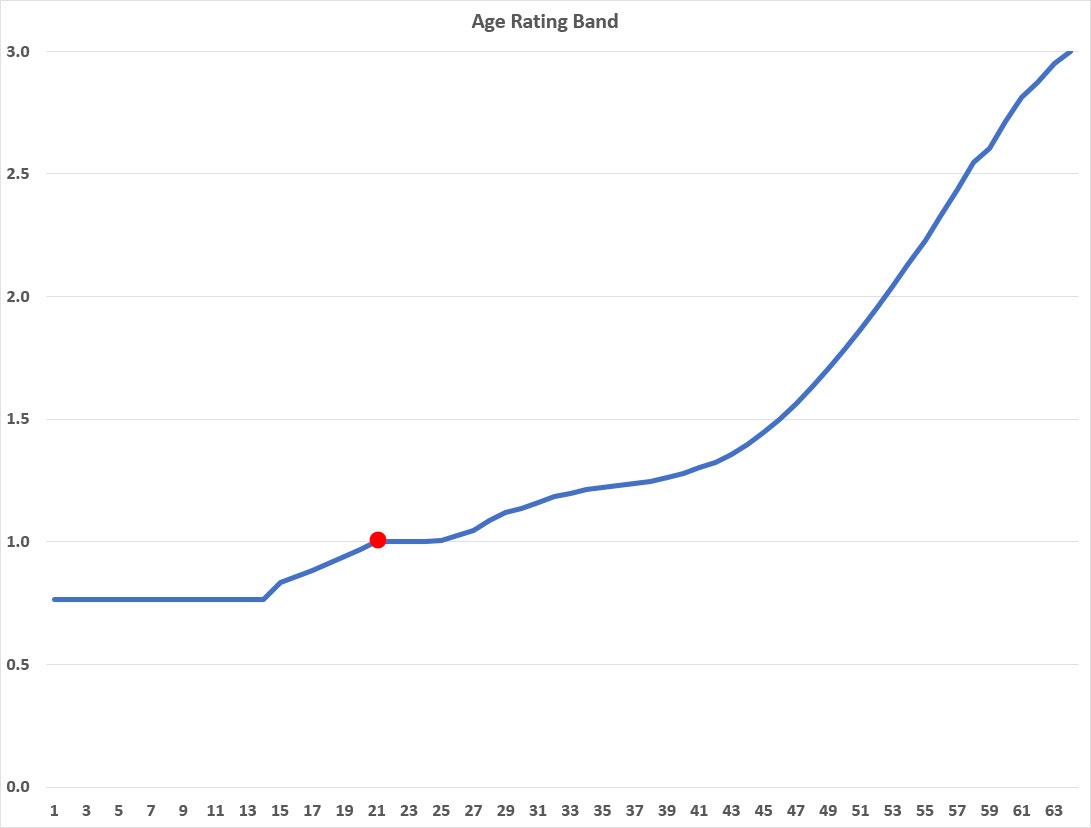

Here's what the standard 3:1 age rating band looks like. Notice that it's not a simple straight line from 1x to 3x; the ratio stays flat for children up to 14 years old, and from 15 until around 44 years old it increases at a fairly nominal rate; a 44-year old is still only paying around 40% more than a 21-year old. Once you hit around 45 years old, however, the line curves sharply upwards:

For example, let's look at a single 64-year old above earning exactly 300% FPL ($37,470/year). They're at the upper end of the age band, so for them it would be 9.78% x (3 / 3) = 9.78%. Nothing changes; they receive whatever their current subsidies are (or what they'd be under H.R. 1868 or the "Take Responsibility Act"). Under the current ACA formula, they'd still pay $305/month.

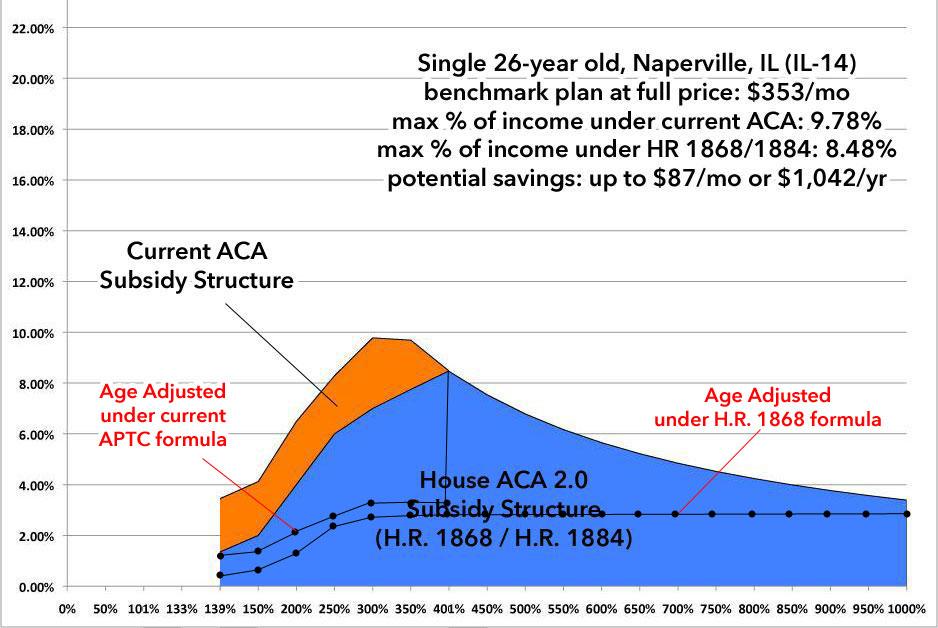

How about a single 26-year old? In their case, they have an age rating of 1.024 on the standard 3:1 Age Band, so their calculation would be: 9.78% x (1.024 / 3) = 9.78% x 0.341 = 3.34%. They'd go from paying $305/month to just $104/month under the current ACA formula. Here's what this would look like. I've overlaid two scenarios: The first includes only the age adjustment formula on top of the existing APTC table; the second shows what the age-adjusted formula would look like on top of the H.R. 1868 #KillTheCliff table:

You could obviously play around with the exact formula a bit. The point is that this is a much more elegant way of blending together income based subsidies with age-based subsidies without causing all sorts of logistical headaches and sudden jumps in net premiums being owed.

Here's a graph which shows what the impact on premiums would be if only were to be passed and signed into law--that is, without H.R. 1868 or any other "Kill the Cliff" legislation accompanying it:

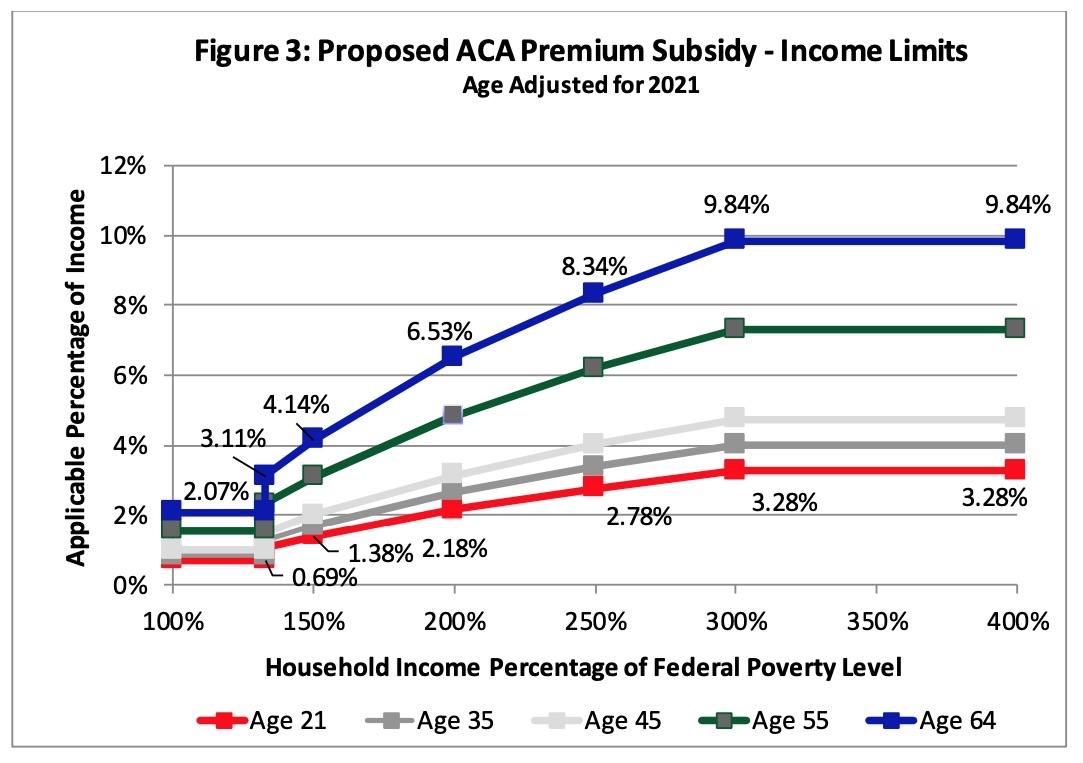

At age 64, it would follow the exact current ACA APTC subsidy formula. A 55-year old, however, would be capped at around 7.8% of income; a 45-year old at around 4.7%, a 35-year old at 4% and a 21-year old at just 3.3% of their income for a benchmark Silver plan (exactly 1/3 of the maximum cap for the 64-year old).

On the one hand, this may seem to still leave those over 400% FPL high and dry, since the subsidy cliff would still be there...but that's where the magic of risk pools comes into play: By reducing premiums so much more dramatically for younger enrollees, H.R. 6545 should lead to a dramatic increase in "Young Invincible" types...which should result in a dramatically healthier risk pool, which should result in unsubsidized premiums dropping significantly as well.

If so, that would mean that even unsubsidized enrollees (those earning more than 400% FPL) should still see significant savings from H.R. 6545 even if they don't receive any financial assistance themselves.

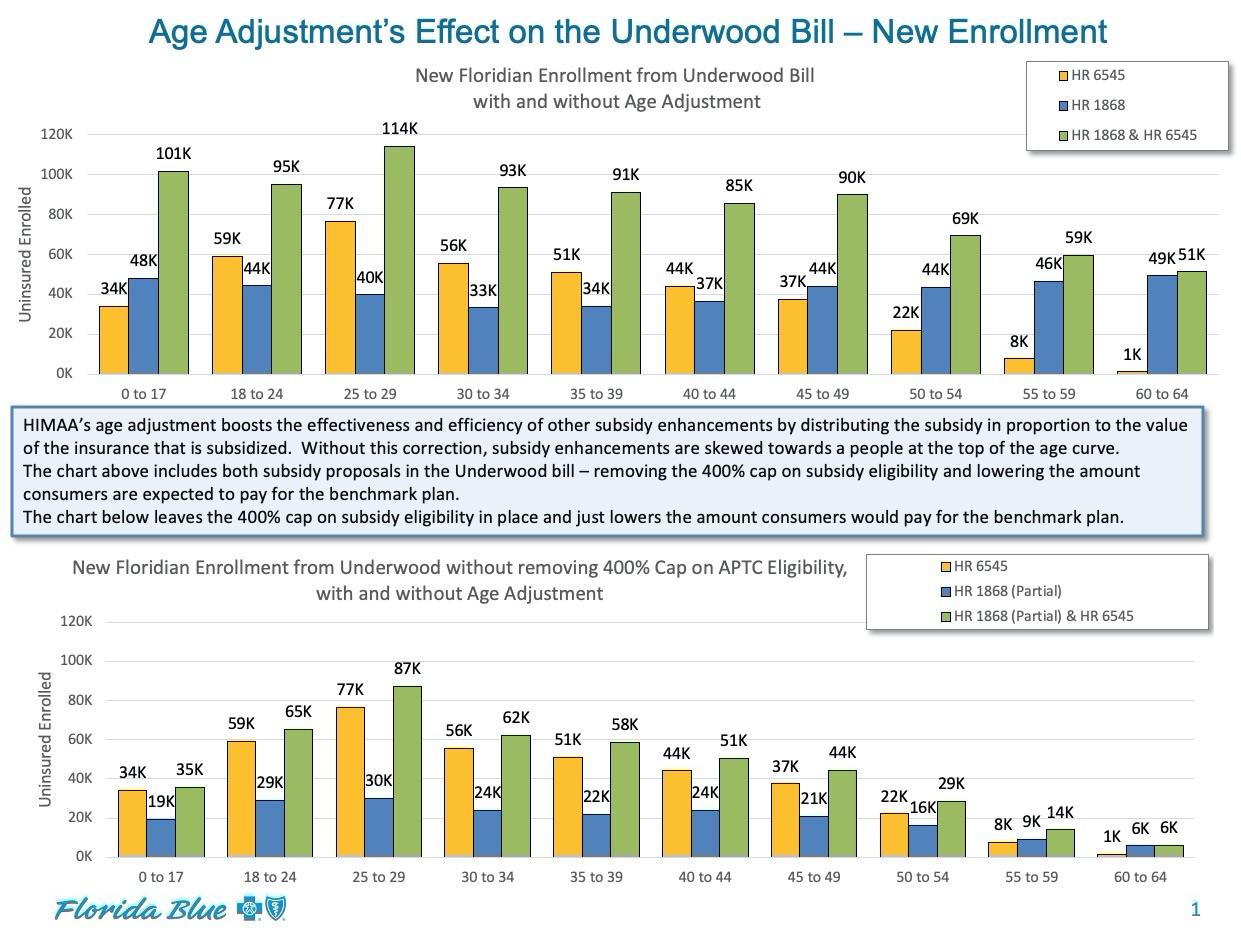

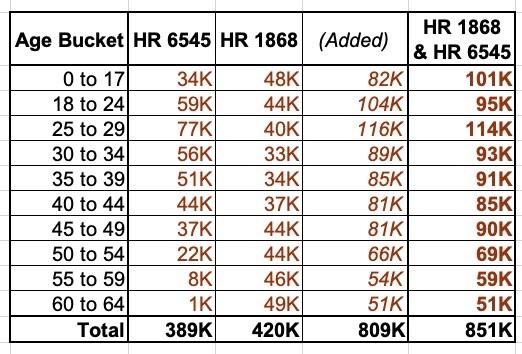

OK, so H.R. 1868 would dramatically benefit middle-class, older enrollees...and H.R. 6545 would dramatically benefit younger, lower income enrollees (while also somewhat benefitting middle-class enrollees). What happens if both bills were to pass into law? The combined impact would be even more dramatic. Here's a projection from Florida Blue for how much they expect ACA exchange enrollment would increase at different age ranges in Florida specifically if either HR 1868, HR 6545 or both bills were to become law:

The projections above would be on top of existing enrollment.

Notice that the Underwood bill (HR 1868) is projected to drive up enrollment more for children and those over 45 years old, while the Age Adjustment bill would drive enrollment more for those age 18 - 45...which makes sense when you remember how much the slope of the age band curve bends starting at right around 45. Also notice that the enrollment increase from passing both bills isn't simply a matter of adding the two numbers together...it'd actually be even higher than that:

Remember, Florida has around 1.9 million residents enrolled in on-exchange plans this year (the highest of any state in the country). That means that if this projection is accurate:

- HR 6545 would increase Florida ACA exchange enrollment by 20%

- HR 1868 would increase Florida ACA exchange enrollment by 22%

- HR 6545 & 1868 combined would increase Florida ACA exchange enrollment by nearly 45%

Of course, the impact would be higher in some states, lower in others, but you get the idea. A 45% net enrollment increase nationally would amount to over 5 million more people enrolling in an affordable ACA exchange policy.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.