My half-assed attempt to explain how reinsurance works

When the ACA exchanges first launched for the 2014 Open Enrollment Period, the law included three individual market stabilization programs. One of the programs was called reinsurance, and as far as I know it worked pretty well. Unfortunately, the federal ACA reinsurance program sunsetted after only three years, at the end of 2016, which is part of why rates spiked so much in 2017 (they shot up in most states in 2018 as well, but for very different reasons).

In response, several states (Alaska, Minnesota and Oregon) have enacted their own, state-level reinsurance programs, and several more are on the way (New Jersey, Maryland and Wisconsin). It's a fairly cut & dried way of keeping premiums down (or even lowering them in some cases) which requires no additional federal spending and much less state spending than you would think.

Here's an example of how it works:

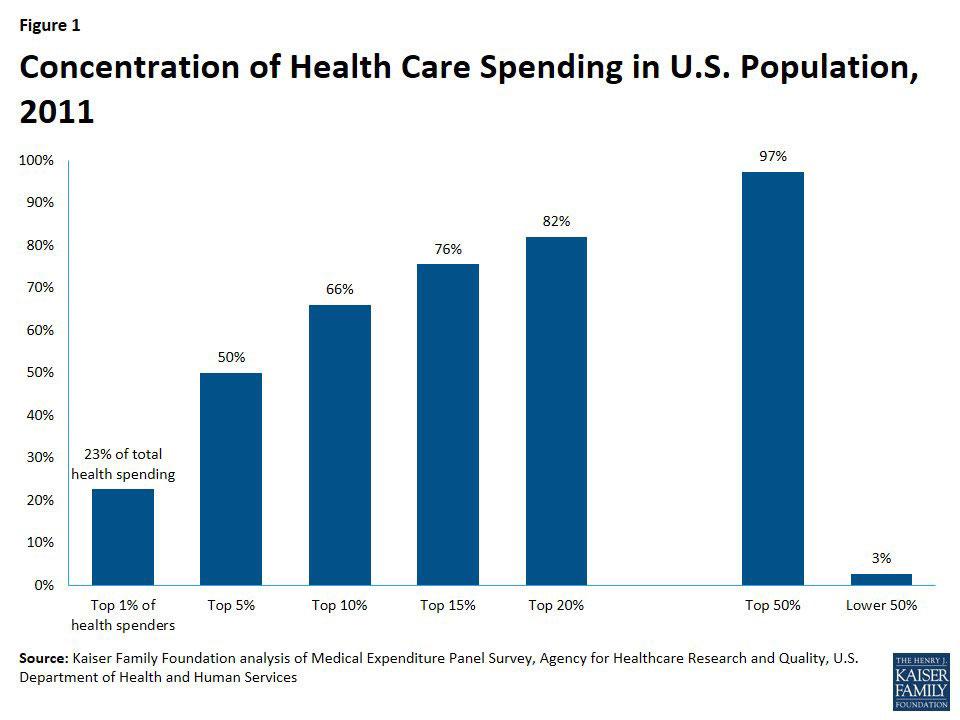

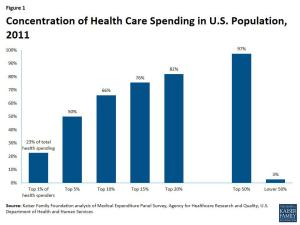

According to the Kaiser Family Foundation (KFF), around 1% of those in a given risk pool rack up 23% of total healthcare expenses, and 5% rack up about 50% of the total.

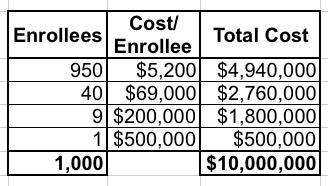

Let's say you have exactly 1,000 enrollees in a risk pool, with 950 of them only racking up average medical expenses of $5,200/year; 40 of them have expensive problems which cost $69,000/year apiece; 9 of them cost $200,000 apiece and one enrollee has really expensive problems costing $500,000/year, for a grand total of right around $10,000,000 even. Since all 1,000 are part of the same risk pool, the total healthcare cost per enrollee averages around $10,000 apiece.

Under a reinsurance program, the government agrees to pay for a percentage of the cost of the really expensive, high-risk enrollees...basically, that last 5% or so...in order to lower the premiums for everyone else. In serves a similar function to the pre-ACA "High Risk Pools", except that it's done behind the scenes, there's no individual medical underwriting needed, there's no stigma attached to the enrollees (since they aren't shunted off into a separate program), and there's no funding discrimination.

To use a real world example, the reinsurance law just passed in New Jersey will pay 60% of insurers' costs for enrollees whose medical costs exceed $40,000 in the year, up to a cap of $250,000 per enrollee.

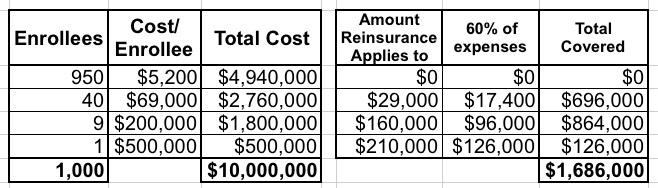

Let's suppose we applied these parameters to my example above.

- 40 of the enrollees have total expenses of $69K apiece. Subtracting the first $40K leaves $29K. 60% of that is $17,400. Multiply by 40 enrollees and that's $696,000.

- 9 of the enrollees have total expenses of $200K apiece. Subtracting the first $40K leaves $160K. 60% of that is $96,000. Multiply by 9 and that's $864,000.

- The final enrollee has total expenses of $500K. The upper bound on the reinsurance program is $250K, so subtracting $40K leaves $210K. 60% of that is $126,000.

- Add it up and the reinsurance program would cover $1,686,000 out of the $10,000,000 grand total...or around 17% of all medical expenses for the entire pool.

This should translate into premiums being 17% lower than they would be otherwise. It doesn't necessarily mean a net 17% drop, of course, because there are other factors each year (normal inflation, medical cost trend and so on), but at the very least, it should mean the difference between a 20% increase and a 3% increase.

Of course, the actual impact will vary greatly depending on the state and how robust the percentages and thresholds are set at, but you get the idea.

OK, so let's multiply the numbers above by 100 to get more real-world numbers. Instead of 1,000 people, let's call it 100,000. Instead of $10 million in total costs, you're talking about $1 billion. And instead of $1.7 million, the total cost of the reinsurance program might be $170 million per year.

But here's the thing about how state-based reinsurance waivers work within the ACA framework: If approved by CMS, the state would not have to come up with the full $170 million!

Here's why (I'm using national averages for this example; again, this will vary depending on the state):

- Of the 100,000 total enrollees, around 62% of them, or 62,000, receive federal ACA subsidies.

- Those subsidies average around $520/month apiece, or $6,200 for the year.

- That's a total of roughly $387 million in federal spending on ACA subsidies.

- By lowering the unsubsidized premium cost by 17%, that also means the amount needed for subsidies drops as well.

- The subsidies may not drop by the full 17% for various reasons, but they should come close...let's say 15%.

- That means the federal government would save $58 million on ACA subsidies for the state.

- The $58 million in federal funds instead go to cover about 35% of the total program cost, so the state only has to come up with $112 million.

Put another way, in this example it would cost the state $112 million per year to lower premiums by 15% for 38,000 residents.

In addition, there should be a residual effect: By lowering rates 15%, this should also encourage at least a few thousand more people to go ahead and enroll in a policy who otherwise wouldn't do so. If total enrollment increases by, say, 5,000 people, you now have a total risk pool of 105,000...and assuming most of those folks are lower risk (i.e., not part of that 5% high risk crowd), that should in turn improve the risk pool somewhat the following year, and so on.

Obviously the actual cost and impact on premium reductions could very widely depending on what the actual claim breakout is across the risk pool, how the program is structured and how much medical claims for high-risk enrollees are. If you make the thresholds more generous (70% instead of 60% of the cost, or starting at $30K instead of $40K, for instance), the impact would be greater. In New Jersey, they expect rates to be about 15% lower than they would be otherwise next year.

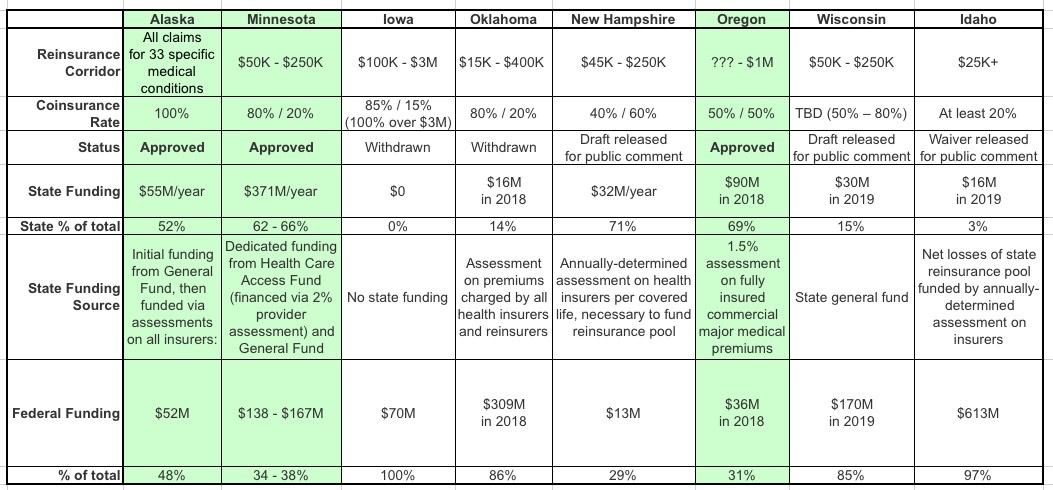

If you want some real-world examples of how effective reinsurance programs have already been, in Alaska, premiums dropped by a whopping 23.6% this year. In Minnesota, they only dropped by 6.3%, but next year are estimated to drop by another 8% or so even with the impact of mandate repeal sabotage. Oregon's reinsurance program isn't quite as robust; it only kept rates down by around 6% this year vs. what they otherwise would be, but that's still hundreds of dollars in savings per unsubsidized enrollee.

Here's a great summary from SHADAC of how eight different states have approached ACA individual market risk pools. Unfortunately, the included table doesn't include either New Jersey or Maryland (both of them submitted their proposals more recently), but it gives a good overview of the variables. I've created a simplified version below for illustrative purposes:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.