UPDATE: House Democrats formally introduce ACA 2.0!

UPDATE: Late last night I was able to dig up the actual legislative text of the bill introduced by the House Democrats yesterday; after reading over the details, I've decided that it's a strong enough package overall that, in software terms, it would be considered a full version upgrade (2.0) as opposed to "only" a service pack/point upgrade (1.5). I've therefore changed the headline to reflect this.

I've also updated some sections fo the analysis below to include the details from the text itself.

A little under a year ago, I posted a lengthy list of 20 recommendations for repairing, improving and strengthening the Affordable Care Act, entitled "If I Ran the Zoo". Here's a summary list of all 20:

- 1. Lock in CSR reimbursements

- 2. Restore Risk Corridor Funding

- 3. Fix the Family Glitch

- 4. Fix the Skinny Plan Glitch

- 5. Encourage remaining states to expand Medicaid

- 6. Encourage more states to establish BHP programs

- 7a. Raise or remove the 400% FPL subsidy cap...

- 7b. ...and beef up the formula below 400%

- 8. Raise the cap on CSR eligibility

- 9: Increase the Individual Mandate Penalty

- 10. Require all individual plans to be sold on-exchange only

- 11. Allow undocumented immigrants to enroll on-exchange (at full price)

- 12. Tie Medicare Advantage/MCO contracts to exchange participation

- 13. Reinstate a Federal Reinsurance Program

- 14. Institute an 80/20 MLR policy for pharmaceuticals

- 15: Let Medicare negotiate drug prices

- 16. Fix the Silver Spam gaming problem

- 17. Merge rating areas statewide

- 18: Merge the individual & small group risk pools

- 19. Unleash the Public Option Kraken

- 20. Repeal the Employer Mandate (yes, that's right).

Since then, things have changed a bit. Thanks to relentless sabotage/undermining efforts by the Trump Administration and Congressional Republicans, the Cost Sharing Reduction (CSR) payments are no longer just "not locked in" (#1 on the list), they've been completely discontinued. Ironically, the net effect of discontinuing CSR reimbursements--via a long, convoluted process involving a clever workaround called "Silver Loading" and the "Silver Switcharoo"--ended up resulting in one of the other bullets (7b. "beef up the APTC formula") effectively being taken care of by mistake. I should also note that the last item on the list (#20, "repeal the employer mandate") would only be recommended after some of the earlier items (#3, 4 and 7a) are already implemented. In addition, one more state (Maine) has expanded Medicaid, and another (Virginia) appears to be on the verge of doing so.

In any event, earlier today, threeHouse Democrats (Rep. Frank Pallone, Rep. Bobby Scott and Rep. Richard Neal) introduced a new bill, called the "Undo Sabotage and Expand Affordability of Health Insurance Act of 2018" (or "USEAHIA"...really guys?), which includes a half-dozen of the bullet points from my "If I Ran the Zoo" list...and a whole lot more:

Top House Dems out with bill to expand ObamaCare:

--Give subsidies to everybody regardless of income, not just up to 400 percent of porverty

--Cancel out Trump admin orders to allow skimpier, cheaper plans

--Provide $100 million in sign-up outreach fundshttps://t.co/yxxv4dg0wM— Peter Sullivan (@PeterSullivan4) March 5, 2018

Personally, I think the official title of the bill is too long and unwieldy, so I'm just gonna go ahead and refer to it as ACA 2.0...and I mean that as a compliment, because it really does both fix and substantially improve/strengthen a LOT of the ACA's weaknesses/issues.

Here's the full list of what would be included. By my count, they're basically pushing for #1, #3, #7a, 7b, #8, #13, and (sort of) #16...along with a bunch of other fixes/improvements which weren't on my own list (some of which weren't even issues until last fall, of course, due to deliberate sabotage on the part of the Trump Administration, like slashing advertising/outreach funding and the like):

TITLE I: EXPAND AFFORDABILITY

Section 101: Improve affordability and reduce premium costs for consumers.

As the 2018 open enrollment season has shown, consumers continue to want comprehensive, affordable coverage. The legislation would increase the affordability of coverage by expanding eligibility for premium tax credits beyond 400 percent of the federal poverty line (FPL), and would increase the size of the tax credit for all income brackets.

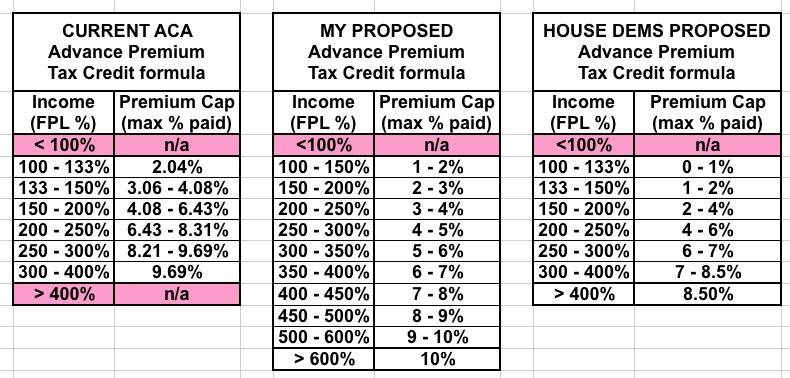

The summary sheet doesn't specify whether it proposes to raise the 400% FPL threshold (to, say, 600%?) or remove it completely, but either would be a major improvement. It also doesn't specify how much the credits would be increased, although it sounds like it would be along the lines of what I proposed last year. This would scratch both 7a and 7b off my list above.

I should note that there was a Senate bill introduced by Diane Feinstein and a half-dozen of her colleagues last June which would have simply removed the 400% FPL cap altogether (although it wouldn't have changed the underlying formula).

UPDATE: OK, here's the revised APTC formula being proposed, compared against the current ACA formula and my own proposal from last year. As you can see, the House Dems are proposing to make tax credits even more generous than I had suggested at most income levels, with a maximum cut-off point of 8.5%:

Section 102: Lower out-of-pocket costs for consumers.

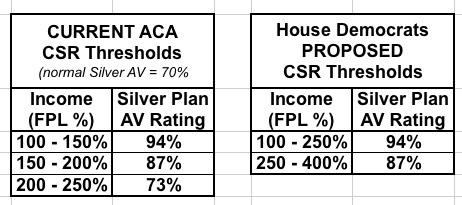

The legislation would expand eligibility for cost sharing reductions (CSRs) beyond 250 percent of the FPL, up to 400 percent, and would make CSRs more generous for those below 250 percent of the FPL.

Again, the exact formula change isn't specified here; I'd love to see the actual language to see how much more generous it would be. Again, though, anything would be an improvement, especially in the 200-250% FPL range. This scratches #8 off my list.

UPDATE: Again, I do have the formula change now; the CSR structure would be simplified from three tiers to just two, each of which would be more generous:

People earning 100 - 150% FPL wouldn't see any change here, but those earning 150% - 250% would see significantly lower out of pocket costs, and everyone earning 250 - 400% would see their deductibles/co-pay costs drop dramatically.

UPDATE: In addition, the bill would, simply and without any muss, fuss or sunset date, fund the unappropriated CSR reimbursement payments after all:

(b) FUNDING COST SHARING REDUCTIONS.—Section 1402 of the Patient Protection and Affordable Care Act (42 U.S.C. 18071) is amended by adding at the end the following new subsection:

‘‘(g) FUNDING.—Out of any funds in the Treasury not otherwise appropriated, there is hereby appropriated to the Secretary such sums as may be necessary for payments under this section.’’.

This is why it's important that the APTC formula above was changed to not only remove the 400% FPL cap, but also made more generous below that threshold--because funding CSRs would otherwise reverse the beefed-up subsidies created by Silver Loading. This scratches #1 off my list.

Section 103: Expand affordability for working families.

Currently, an individual who has an offer of coverage through his or her employer can receive subsidized coverage in the Marketplaces if the cost of self-only coverage is unaffordable (i.e., the employee’s financial contribution exceeds 9.5 percent of the employee’s household income). However, some low-to-moderate-income families are locked out of receiving financial assistance by determining affordability based on the cost of self-only coverage, rather than family coverage (which is significantly more expensive). The legislation addresses this gap by ensuring that access to subsidized coverage turns on the affordability of family coverage, rather than self-only coverage, thereby expanding access to tax credits for coverage for working families.

This would fix the ACA's "Family Glitch", #3 on my list.

IMPORTANT: Note that none of the changes above would kick in until January 1, 2020, which is understandable since there's no chance of this becoming law until early 2019 at the earliest anyway, at which point 2019 rates, deductibles, etc. would already be locked in for the year.

TITLE II: UNDO SABOTAGE

Section 201: Protect comprehensive coverage for small businesses and workers.

The legislation would rescind the Trump Administration’s proposed regulation designed to destabilize and segment the individual and small group markets. The proposed regulation threatens comprehensive and affordable health coverage for small employers and individuals through Association Health Plans (AHPs)—plans that could circumvent many of the consumer protections in the Affordable Care Act (ACA). AHPs would have a destabilizing effect by incentivizing healthier individuals to leave the ACA-compliant market, thereby negatively affecting the risk pool and increasing premiums.

This would cancel out the "Ass" part of Trump's "#ShortAssPlans" executive order.

Section 202: Prevent junk plans and continue protections for consumers with preexisting conditions.

The legislation would prevent a rule on short-term, limited-duration insurance plans from having devastating and discriminatory effects. The legislation would require short-term, limited duration health plans to play by the same rules as ACA-compliant plans (guaranteed issue, community rating, essential health benefits, protections for preexisting conditions), thereby preventing these junk plans from undermining the individual insurance market and raising premiums.

This would effectively cancel out the "Short" part of Trump's #ShortAssPlans order.

Note that both of these items would go into effect starting on January 1, 2019...a year earlier than the subsidy/CSR changes. I presume this is because these changes are much easier to implement retroactively back to the beginning of the calendar year.

Section 203: Ensure plans provide comprehensive benefits.

The legislation would prevent the Trump Administration from taking certain actions proposed in the 2019 Payment Notice that would undermine coverage of essential health benefits (EHBs). It would require plans to cover all EHBs, prohibit substitution of benefits across benefit categories, and ensure broad coverage of prescription drugs. The legislation would also require the Trump Administration to continue to make available standardized plans, so that consumers can make simpler comparisons of plans offered by different issuers.

This would help tighten up the rules which currently allow the Trump Administration to screw around with the strength of ACA-compliant policies at the edges. To be honest I wasn't even aware of this one, but it makes sense that they'd try to nibble away at it. This provision would also kind of/sort of scratch #16 off my list ("Fix the Silver Spamming problem")

Section 204: Undo Administration sabotage by requiring open enrollment outreach, education, and funding for navigators.

The Trump Administration cut marketing and outreach by 90 percent, and cut navigators by 60 percent for the most recent open enrollment season. Marketing and outreach is critically important to assuring a balanced risk pool. Covered California estimates that an aggressive marketing strategy could lower premiums by 2-8 percent. The legislation requires the Department of Health and Human Services (HHS) to implement a navigator program for the federally-facilitated Marketplace (FFM), and funds it at $100 million per year from 2019 through 2021. It further requires HHS to conduct marketing and outreach for the FFM and funds these activities at $100 million per year from 2019 through 2021.

Interesting timing for this one: Through 2021 only. Gee, why are they limiting it to 2021? What could House Democrats possibly be thinking might happen after that? Hmmm...

Section 205 Improve Marketplace stability to prevent sabotage from raising premiums.

A well-designed national reinsurance program could offset some, but not all, of the premium increases from the individual mandate repeal and the cumulative effects of the Trump Administration’s sabotage of health insurance markets. The legislation establishes a national reinsurance program with a statutorily prescribed attachment point, cap, and coinsurance rate. Funding would flow directly to insurers based on their claims, instead of based on an allocation formula that could be used to harm certain parts of the country.

Again, I'd really want to see the dollar figures and formula involved for the proposed reinsurance program, but again, it could only serve to improve affordability regardless (as long as the money isn't stolen from another deserving program like the Basic Health Plan program, which is what happened to Minnesota this year). This scratches #13 off my list.

UPDATE: OK, here's the details on the proposed Reinsurance program:

The Secretary of Health and Human Services shall use amounts available in the Fund to establish a national reinsurance program under which the Secretary makes reinsurance payments to health insurance issuers with respect to claims for individuals enrolled under qualifying reinsurance plans offered by such issuers for plan year 2019 or a subsequent plan year that exceed, subject to paragraph (2), $50,000 in an amount equal to 75 percent of the amount of such claims, but not to exceed $1,000,000.

In other words, Let's say that an insurance carrier has 100,000 enrollees with an average cost of, say, $400/month each. That's a total cost of $480 million to the carrier. However, what if just 1,000 fo those enrollees are eating up a full 25% of the claims ($120 million), at an average cost of $120,000 per year apiece? Under this reinsurance proposal, the government would reimburse the insurance carrier for about $52,500 per enrollee (75% of the $70K amount over $50K), or about $53 million. This lops about 11% off the carrier's expenses. Since the ACA requires them to spend at least 80% of premiums on actual healthcare costs, that means they'd have to drop their premium rates by about 11% the following year.

On the surface this makes it sound like the government has to shell out $53 million...but remember that if the unsubsidized premiums drop 11%, that also means the subsidies which the government has to pay would drop somewhat as well, at least partly cancelling out that $53 million. This is basically how it works in Alaska, Oregon and Minnesota already, though the details vary a bit in each state.

TITLE III: STATE INNOVATION AND TRANSPARENCY

Section 301 Fund state health insurance education programs for consumers.

The legislation provides $100 million in Consumer Assistance Program grants for states, which supports educational activities regarding health insurance, such as helping individuals file complaints and appeals, educating consumers on their rights, and assisting consumers with enrollment, as well as obtaining premium tax credits.

This reverses the "60% navigator funding cut" portion of the funding referenced above.

Section 302 Fund state innovations to expand coverage.

Recognizing states are innovators in leading the charge to get America covered, the legislation provides $200 million a year from 2019 through 2021 in funding for states to conduct feasibility studies, pilot programs, technology upgrades, and other efforts to encourage enrollment in the individual and small group markets (including implementing a state version of an individual mandate).

Again, note the 2021 cut-off date. Hmmm...

Section 303 Preserve state option to implement health care Marketplaces.

Under current law, federal funds are no longer available for states to set up state-based Marketplaces after January 1, 2015. The legislation would lift that prohibition so that states that have had a change in leadership and want to establish a state-based Marketplace can do so, and receive federal funding for planning and implementation.

This one surprised me--under the ACA, states had a limited amount of time to request funding to set up their own exchanges. Once the deadline passed, they could still do so if they wanted to, but they'd have to do so on their own. To date, only one state has actually moved off of the federal exchange onto their own (Idaho). Two others were supposed to but never got around to actually following through (Arkansas and New Mexico), and several others started out with their own but then scrapped it and moved home to the "mothership" at HealthCare.Gov (Nevada, Oregon, Hawaii and Kentucky). Ironically, Nevada recently announced that they're moving back off the federal exchange onto their own new full-blown exchange platform...on their own dime.

Section 304 Promote transparency and accountability in the Administration’s expenditures of exchange user fees.

It is unclear how the Trump Administration is spending the funds raised from a user fee levied on issuers that is intended to be spent on exchange operations and outreach and enrollment, and whether all of those uses are appropriate. For example, during 2017, the Trump Administration appears to have spent agency money filming anti-ACA propaganda videos. The legislation requires HHS to submit an annual report to Congress that includes a detailed breakdown of the Department’s spending on outreach and enrollment, navigators, maintenance of Healthcare.gov, and operation of the Healthcare.gov call centers.

THIS one relates directly to a question I posed just a couple of weeks ago, in which I pointed out that HealthCare.Gov's revenue has gone up dramatically over the past few years as premiums have increased...at the same time that their operating budget should actually have been dropping substantially, especially this past year when they lopped off ad/marketing/navigator funding by over $100 million.

Now, you'll notice what isn't included above: A full Public Option, or Medicare for All, or BernieCare, or Single Payer, or Medicare X, or Medicare Extra, etc etc. That's perfectly OK with me FOR THE MOMENT, because there's no way in hell that any of those has any chance of being signed into law any earlier than January 2021.

This is, in effect, a short-term service pack. It's meant to stabilize, improve and strengthen the ACA for the next few years, presumably until we have a Democratic President in the White House.

"But there's no chance of this passing before 2019 either!" you say. Probably not. However, it does give the Dems a solid, reasonable package of improvements to campaign on with the understanding that this is for the short term only. This is to get the healthcare system through 2021...more realistically, 2022 or even 2023, since any major Medicare For All-style overhaul signed into law in 2021 likely wouldn't start ramping up until 2022 at the earliest. That means we're very likely "stuck" (for good or for bad) with the current general healthcare framework (Medicare, Medicaid, the ACA, etc) for the next 3-5 years no matter how lofty anyone's "pure Single Payer" dreams may be.

"But Donald Trump would veto this bill as well!" Well, probably...but given how erratic and clueless he is, there's at least a small chance he'd sign a bill like this. Keep in mind that he did sign the 10-year CHIP extension bill in the end. Again, I'm not saying he wouldn't veto it...but he'd likely have bigger problems on his mind starting in January 2019 anyway.

Of course, if the Dems don't retake at least one house of Congress this November, this is all moot anyway.

Again, look at the end date on several of these provisions: 2021. I think it's pretty clear that the House Dems are introducing this primarily as a package designed to guide the ACA through the rough waters of the next 4 years. After that, the reins would presumably be handed off to whatever major Universal Healthcare System they have in mind as being the Next Big Thing, whether it's Bernie Sanders' "Medicare for All", CAP's "Medicare Extra" or whatever.

On the one hand, "only" 7 of my 20 proposals are included in this package. On the other hand, it also includes another half-dozen or so provisions which I didn't have on my list at all...each of which is a positive thing. Overall, I love this package of improvements (again, as a stop-gap to tide things over for the next few years, at least).

Chances of it passing this year? Zilch. Chances of it becoming law if it passes next year? Close to zilch. But this is far more than "crumbs". These are solid improvements with real teeth to them.

UPDATE 3/13/18: I don't know that this is that big of a deal, but Rep. Carol Shea-Porter just jumped on board USEAHI:

Shea-Porter Backs New Legislation to Reverse Trump Administration’s Health Care Sabotage

Bill would lower health care premiums and ensure consumers’ rights are protectedWASHINGTON, DC – Congresswoman Carol Shea-Porter (NH-01) today announced her support for the Undo Sabotage and Expand Affordability of Health Insurance Act of 2018, new legislation that would lower health care premiums and out-of-pocket costs for consumers. It would reverse the Trump administration’s continued sabotage of US health care markets.

The Trump administration’s sabotage of the Affordable Care Act (ACA) is projected to cause 6.4 million more Americans to go uninsured. Furthermore, the administration has moved forward to undermine the ACA’s essential health benefits, which prohibit lifetime and annual caps on health insurance, require health insurance plans to cover people with preexisting conditions, offer free preventive health care, and cover mental health, which is essential to turning the tide in the deadly heroin, prescription opioid, and fentanyl crisis that is devastating New Hampshire communities.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.