California: @CoveredCA confirms over 175K have enrolled via #COVID19 SEP since 3/20; extends deadline thru 7/31

On April 14th, Covered California reported that 58,000 residents had enrolled in ACA exchange coverage during their COVID-19 Special Enrollment Period, of which roughly 20,000 did so via standard SEPs (losing coverage, moving, getting married/divorced, etc), while an additional 38,000 took advantage of the COVID-specific SEP.

On April 28th, they announced that the number was up to 84,000 new ACA exchange enrollees, averaging around 2.5x as many as enrolled via standard Special Enrollment Periods during the same period a year ago.

On May 20th, they announced the total was up to 123,000 new ACA exchange enrollees via the COVID SEP, "nearly" 2.5x the rate of a year before.

On June 12th, they announced the total was up to 155,000 new ACA exchange enrollees along with some additional data breakouts, including county-level enrollment.

Today, they just issued another update, bringing total COVID-19 SEP exchange enrollment up to over 175,000 people...and say they're also extending the SEP deadline again through the end of July. (I'll also note that this is happening against the backdrop of a second wave of COVID-19 wave hitting California over the past week or so):

California Extends Special-Enrollment Deadline to Give Consumers More Time to Sign Up for Health Care Coverage During COVID-19 Pandemic

- Consumers who are uninsured and eligible to enroll in health care coverage through Covered California will now be able to sign up through the end of July.

- The moves come amid continued uncertainty in the lives and livelihoods of Californians as public health officials fight against the spread of COVID-19.

- The extension will also apply to consumers who enroll in off-exchange plans, outside of Covered California, to ensure that people enrolling in the entire individual market in California will have access to coverage during the pandemic.

- All screening and testing for COVID-19 are free of charge, and all health plans available through Medi-Cal and Covered California offer telehealth options.

- More than 175,000 people have signed up for coverage through Covered California since the exchange announced a special-enrollment period in response to the COVID-19 pandemic.

SACRAMENTO, Calif. — Covered California announced on Tuesday that it would be giving consumers more time to sign up for health care coverage during the COVID-19 pandemic by extending the current special-enrollment deadline through the end of July.

“Covered California is committed to helping people get access to the health care they need, and while California is reopening parts of the state, there is still a lot of uncertainty out there due to the pandemic,” said Peter V. Lee, executive director of Covered California. “We want to make sure that people have a path to coverage, whether it is through Covered California or Medi-Cal, and giving people more time to sign up is the right thing to do.”

Covered California initially opened the health insurance exchange to any eligible uninsured individuals, who needed health care coverage amid the COVID-19 nation emergency, from March 20 to June 30. The new deadline means that anyone who meets Covered California’s eligibility requirements, which are similar to those in place during the annual open-enrollment period, can apply for coverage through July 31.

The most recent data shows that 175,030 people have signed up for health care coverage between March 20 and June 20, which is more than twice the number who signed up during the same time last year.

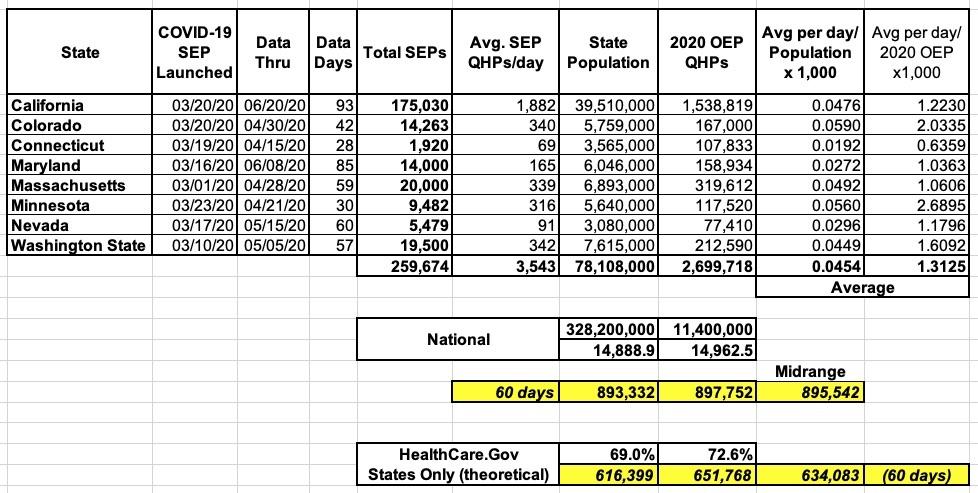

Combined with the limited data I have from some of the other state-based exchanges offering COVID-19 SEPs, this brings the total who've enrolled utilizing them up to at least 260,000 people nationwide (actually higher, since New York, DC, Rhode Island and Vermont haven't released any of their COVID-19 SEP data...and New York's is probably pretty significant, though the other three are likely pretty nominal given the small size of all three exchanges:

Every year, Covered California provides eligible consumers the opportunity to sign up for health care coverage outside of the traditional open-enrollment period if they experience a qualifying life event. These can include events like losing your health insurance, moving, getting married or having a baby.

Overall, 242,600 people have signed up for coverage since Jan. 31, when Covered California ended its open-enrollment period, through June 20, which is nearly twice as many as seen during the same time period last year.

Remember, the official COVID-19 SEP didn't start until 3/20, which means another 67,570 Californians had already enrolled via other SEPs before then (and in fact, CoveredCA had already announced an "open" SEP for those who didn't know about the reinstated individual mandate penalty or enhanced financial subsidies in the first place).

People who sign up through Covered California will have access to private health insurance plans with monthly premiums that may be lowered due to federal and new state financial help that became effective in 2020. After selecting a plan, their coverage would begin on the first day of the following month — meaning individuals losing job-based coverage would not face a gap in coverage.

The latest data from California’s Employment Development Department shows that 6.3 million unemployment claims have been processed in the state since the pandemic started.

“We know that when people lose their jobs, they often lose the health care coverage that was protecting them and their families,” Lee said. “While Californians who lose coverage can always sign up outside of open enrollment, we want to make sure even those who have lost work and did not have insurance have access to the health care in the middle of a pandemic.”

If you assume that, 6.3 million unemployed = perhaps 5 million losing their heatlhcare coverage, that's a LOT of Californians who are suddenly eligible for an ACA exchange plan...and most of them likely qualify for subsidies.

Medi-Cal and Off-Exchange Coverage

In addition, consumers who sign up through CoveredCA.com may find out that they are eligible for no-cost or low-cost coverage through Medi-Cal, which they can enroll in online. Those eligible for Medi-Cal can have coverage that is immediately effective.

California has suspended Medi-Cal renewal reviews through the end of the public health emergency, ensuring that those already enrolled can continue their coverage and freeing up resources to quickly process new enrollments. The Department of Health Care Services (DHCS) also received expanded authority to expedite enrollment for seniors and other vulnerable populations, expand the use of telehealth and take other steps to make it easier to access care.

“The ongoing challenges of COVID-19 make it vital that we help Californians get into and stay in Medi-Cal and Covered California health coverage. The goal is to make it easier to access needed care and services during these difficult times,” said Will Lightbourne, recently named as the new director of the Department of Health Care Services.

DHCS oversees Medi-Cal, California’s version of Medicaid, which provides coverage for about 13 million Californians.

The California Department of Managed Health Care (DMHC) and the California Department of Insurance have also extended the special-enrollment period through July 31, 2020, which applies to all health plans on the individual market, including off-exchange health plans. This will ensure consumers enrolling in the entire individual market in California will have access to coverage during the pandemic.

IMPORTANT: You have to enroll in an on-exchange plan in order to be eligible for ACA subsidies, but if you earn too much to qualify, you also have the option of enrolling in a similar/identical off-exchange plan instead.

“We want to make sure that Californians can access comprehensive and affordable health care coverage options when they need it,” said DMHC Director Shelley Rouillard. “The DMHC continues to work closely with our state partners and the health plans we regulate to protect the health and safety of the people of this state. Taking this important action to extend the special-enrollment period will help those impacted by the COVID-19 emergency.”

“With Californians continuing to experience job loss and, with it, the loss of employer-based insurance, the ability to access individual health insurance coverage is even more critical,” said Insurance Commissioner Ricardo Lara. “Substantial federal and state premium subsidies are available through Covered California to continue to keep quality, essential coverage within reach, especially during these extremely challenging times.”

All Covered California and Medi-Cal Plans Offer Telehealth Options

All health plans available through Covered California and Medi-Cal provide telehealth options for enrollees, giving individuals the ability to connect with a health care professional by phone or video without having to personally visit a doctor’s office or hospital.

All screening and testing for COVID-19 is free of charge. This includes telehealth or doctor’s office visits, as well as network emergency room or urgent care visits for the purpose of screening and testing for COVID-19. In addition, Medi-Cal covers costs associated with COVID-19 in both its managed care plans and with fee-for-service providers. Covered California health plans will help cover costs that arise from any required treatment or hospitalization.

New State Subsidies Help Californians Lower Their Health Care Costs

Californians who sign up for coverage may be able to benefit from a new state subsidy program that expanded the amount of financial help available to many people. The subsidies are already benefiting about 625,000 Covered California consumers. Roughly 576,000 lower-income consumers, who earn between 200 and 400 percent of the federal poverty level (FPL), are receiving an average of $608 per month, per household in federal tax credits and new state subsidies (which averages $23 per household). The financial help lowers the average household monthly premium from $881 to $272, a decrease of 70 percent.

In addition, nearly 32,000 middle-income consumers have qualified for new state subsidies, with an average state subsidy to eligible households of $504 per month, lowering their monthly premium by nearly half.

Remember, the $23 and $504 figures are per household, not per enrollee. I was informed by a contact of mine at CoveredCA that their "households" are historically around 1.4 people on average, so that's something like 22,800 households x $504/mo, plus ~411,000 households x $23/mo, or $138 million + $113 million or roughly $251 million/year in additional state subsidies for 2020.

Many of those eligible for the new middle-income state subsidies are an estimated 280,000 Californians who are likely eligible for new state or existing federal subsidies but kept their “off-exchange” coverage. They are also eligible to switch to Covered California and benefit from the financial help. During this special-enrollment period, Covered California, its health insurance companies and Certified Insurance Agents will be reaching out to these Californians to let them know how they can save money on their premiums, which will help them keep their coverage in challenging financial times.

In other words, only a small fraction of California's off-exchange individual market population has realized that they're missing out on potentially thousands of dollars per year in savings which they could take advantage of if they just shifted onto an on-exchange plan instead.

Staying Safe While Getting Help Enrolling

Covered California is working with the more than 10,000 Certified Insurance Agents that help Californians sign up and understand their coverage options through phone-based service models.

“We continue to be in a different world right now, but social distancing does not mean you cannot get personal help,” Lee said. “Health insurance is just a phone call away, and our agents and staff stand ready to help people get the coverage they need.”

Consumers can easily find out if they are eligible Medi-Cal or other forms of financial help and see which plans are available in their area by using the CoveredCA.Com Shop and Compare Tool and entering their ZIP code, household income and the ages of those who need coverage.

Those interested in learning more about their coverage options can also:

- Visit www.CoveredCA.com.

- Get free and confidential assistance over the phone, in a variety of languages, from a certified enroller.

- Have a certified enroller call them and help them for free.

- Call Covered California at (800) 300-1506.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.