I've been right a lot lately, in ways which I'm not happy about.

I've received a ton of praise over the past few months from right-wing pundits and media outlets (as well as GOP politicians and their staffers) for accurately projecting the estimated 25% average rate increase for unsubsidized individual market policies. I'm even getting kind words from Avik Roy, and the Republican Presidential nominee is now citing my data (even if he's then bastardizing and denying it at the same time). While there are numerous important caveats and disclaimers attached to this estimate, as a supporter of the ACA in general, I obviously wish I had been overstating that number.

Now it looks like another projection of mine is gonna be proven (unfortunately) accurate.

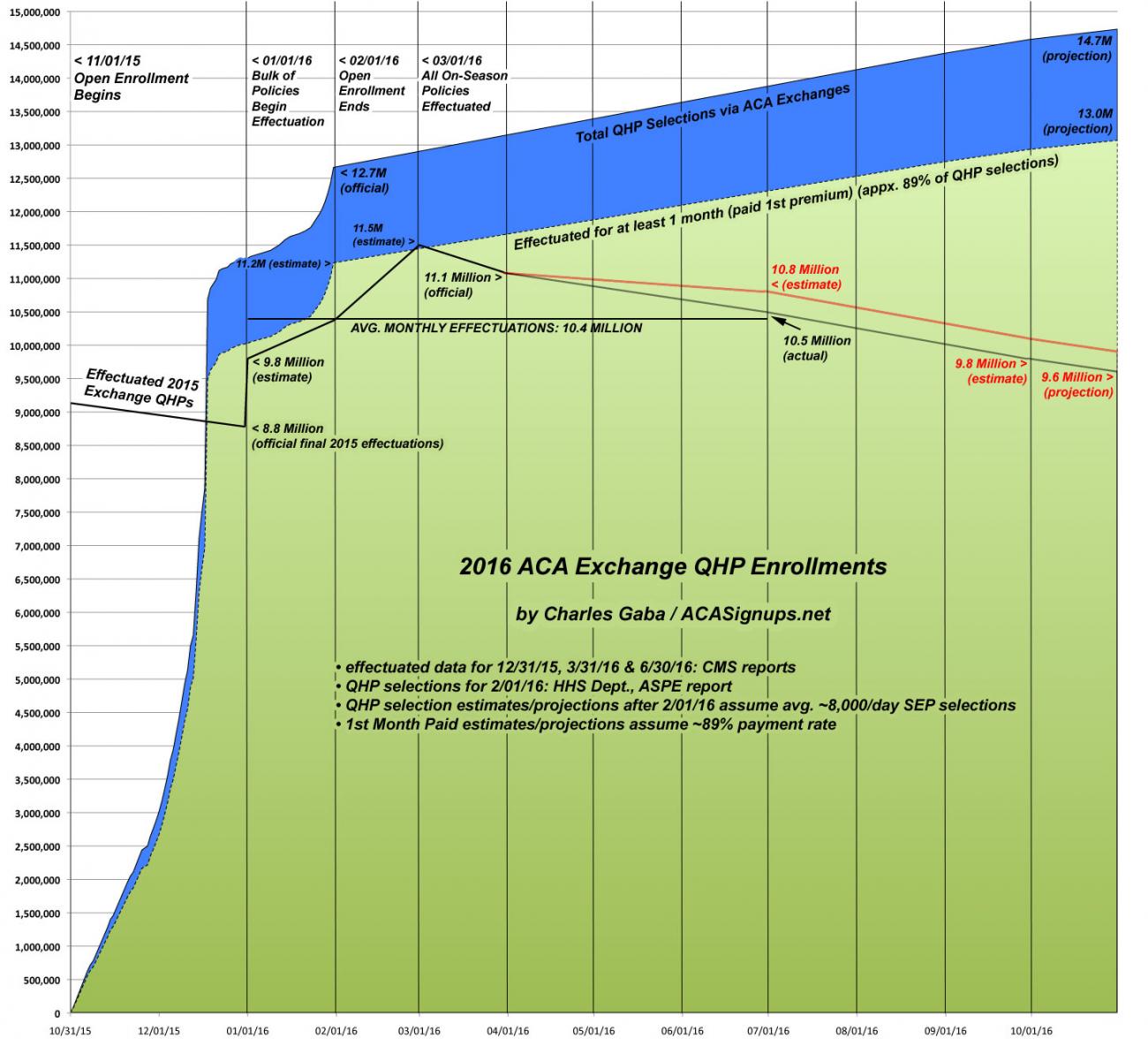

A week and a half ago, the HHS Dept. confirmed that as of the end of the 2nd quarter (June 30), there were about 10.5 million people still enrolled in effectuated QHPs via the ACA exchanges. As I noted at the time, this was about 300,000 fewer people than I had assumed would be enrolled at that point, so I revised my projections for the second half of the year:

I assumed a similar pattern to last year, with roughly 15% net attrition as of the end of June, which would have resulted in roughly 10.8 million people having effectuated exchange policies as of 6/30/16. Instead, they say it was around 10.5 million. Based on this new data, I'm revising my net attrition estimates for the rest of the year to perhaps 9.8 million as of the end of September. If so, this would result in ending 2016 with around 9.2 million people enrolled in effectuated exchange policies, for a 2nd-half monthly average of around 9.9 million and a full-year monthly average of around 10.1 million.

I charted this revised projection like so (click below for high-res version):

Well, today, Jed Graham of Investor's Business Daily has reached a similar conclusion, with a more grim take:

Third-quarter earnings reports from Aetna (AET) and UnitedHealth (UNH) showed that their combined exchange enrollment totals fell by 113,000 to 1.6 million from the end of June through September, a decline of 6.6%.

These two big insurers account for nearly one in six exchange enrollees, and UnitedHealth has tended to see less net enrollment attrition than others, possibly because midyear enrollees tend to be sicker and prefer its broader networks.

Bottom line: These enrollment declines provide a strong indication that national enrollment has fallen from an official 10.5 million total as of June 30 to less than 10 million — likely around 9.8 million — at the end of September.

On top of that, the fourth quarter appears headed toward big enrollment declines as it has in the past, as people take advantage of the law's 90-day grace period that leaves insurers on the hook even after customers stop paying their premiums.

In last year's fourth quarter, enrollment fell by about 530,000, or 5.7%, to 8.8 million.

Taken together, it now looks like the Obama administration's worst-case scenario of 9.4 million enrollees at year's end has become the best outcome possible. But the trend from UnitedHealth and Aetna, along with last year's fourth-quarter slide, point to a year-end level of 9.25 million enrollees.

Of course, some perspective is needed here; as I went on to note at the time, this would still represent an increase over 2015; the problem is that it would be pretty nominal increase at a time when significant growth is what's needed.

For comparison, 2015 ended with about 8.8 million effectuated enrollees and should have had an annual monthly average of around 9.4 million. Assuming my 2016 numbers hold, that should reflect roughly a 7.5% increase in average monthly effectuations.

In the end, though, it all goes back to what I said on Tuesday: It's just as bad to ignore a problem as it is to exaggerate it.

The ACA is mostly working, and the problems it faces are absolutely fixable...but the first step in solving any problem is recognizing there is one.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.