2026 FINAL Rate Changes - New Mexico: +35.7%, but some good news as well

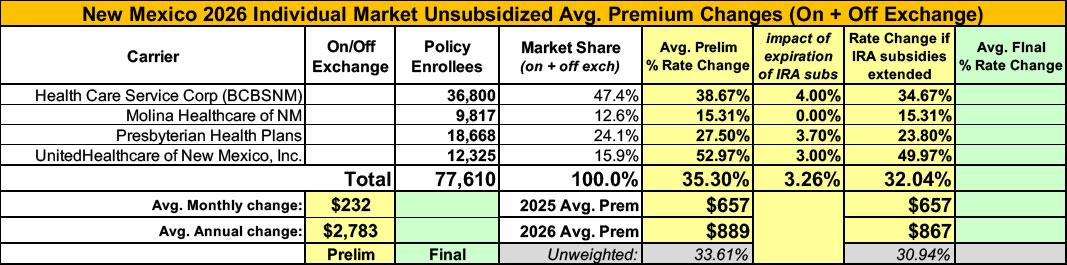

Overall preliminary rate changes via the SERFF database, New Mexico Insurance Dept. and/or the federal Rate Review database.

Blue Cross Blue Shield NM

Blue Cross and Blue Shield of New Mexico (BCBSNM) is filing new rates to be effective January 1, 2026, for its Individual ACA metallic coverage. As measured in the Unified Rate Review Template (URRT), the range of rate changes for these plans is an increase of 18.4% to an increase of 49.6%.

The cost relativities among plans are different from the experience period to the prospective rating period due to anticipated non-uniform changes in network reimbursement levels. Additionally, the rates vary by plan due to the leveraging and utilization differences driven by variations in member cost sharing. Therefore, the proposed rates and rate changes may vary by plan.

Changes in allowable rating factors, such as age and geographical area, may also impact the premium amount for the coverage.

There are currently 36,800 members on Individual Affordable Care Act (ACA) plans that may be affected by these proposed rates.

...Product Selection Impact from Regulatory Changes:

This reflects the expected reduction in premiums relative to claims from consumers switching to leaner benefit designs to offset premium increases resulting from the end of APTC Expansion and the updated CSR Loading guidance in New Mexico. The expected impact is 4.0%.

Molina Healthcare of NM

1. Scope and range of the rate increase: Molina’s proposed rates represent an average rate increase of 15.3% for the 9,817 Molina members enrolled in continuing plans effective March 2025. The proposed rate changes vary by metal tier. Members would receive premium increases of approximately 15.3% depending on their geographic location, metal tier, and age.

2. Financial experience of the product: The proposed premium rates yield a medical loss ratio of 87.5%. The medical loss ratio represents the percentage of every premium dollar that Molina expects to spend on medical expenses and improving health care quality for our members. The projected medical loss ratio of 87.5% exceeds the Affordable Care Act minimum required loss ratio of 80.0%.

3. Changes in Medical Service Costs: Medical inflation related to the utilization and cost of covered services increased claims by 9.0%. Trend is one of the primary contributors to an increase in rates. Changes in provider contracting rates also contributes to the regional rate changes.

4. Changes in Benefits: Molina is renewing 2 gold and 1 silver plan offering from 2025 , and terminating one silver plan offering. There are no benefit changes on either gold plan design, and a minimal number of changes on some variations of the Clear Cost silver plan design. For example, the Turquoise 2 variant’s individual deductible is increasing from $90 to $200 and the individual out of pocket maximum is increasing from $900 to $1200. The impact on rates of the benefit designs changes for all renewal plans is minimal.

5. Administrative Costs and Anticipated Profits: Total administrative expenses are expected to decrease compared to 2025, contributing to a decrease in rates of approximately -2.6%, dampening the impact of the overall rate increase from other rate filing components. Targeted profit margin remains the same as the prior year’s rate filing.

...eAPTC Expiration: Under current law, the enhanced federal Premium Tax Credit (PTC) provided under the Inflation Reduction Act (IRA) of 2022 is set to expire at the end of 2025. If the IRA is not extended, the HCA will use HCAF funds to backfill lost federal revenue for eligible consumers up to 400% of the Federal Poverty Level (FPL).

For states where eAPTC payments are expiring and are not being backfilled, Molina has retained Milliman to analyze the impact of expiring premium subsidies on statewide morbidity. However, no additional adjustments were made in New Mexico for the impact of eAPTC expiring at the end of 2025 due to the subsequent funding of subsidies up to 400% FPL by the NM HCAF. Due to the state of NM funding eAPTCs as they are up to 400% FPL, we don’t expect a change in member behavior at these levels. Above 400% FPL, Molina does not expect material change in member premium to alter member behavior significantly enough to have an impact on rates.

As of May 2025, only 7,626 out of 65,566 (11.6%) statewide members with an identified income as of a percent of federal poverty level are over 400% FPL.

Presbyterian Health Plans

We have calculated an overall rate change of 27.5% from the rates effective 1/1/2025 to the rates effective 1/1/2026. In pricing Individual products for 2026, we have updated underlying experience for the latest experience of the single risk pool (CY2024), updated projected rebates received for prescription drugs, updated administrative expense projections, updated assumptions for federal risk adjustment, updated network savings, and provider reimbursement information. All of these factors contribute to the premium rate change. The proposed rate change of 27.5% applies to approximately 18,668 individuals as of the first quarter of 2025. Actual increases for any particular contract holder will vary based on plan and network.

...Presbyterian is terminating Bronze plans in 2026 and is not expected to retain these members. In addition, members are expected to terminate due to the expiration of premium subsidies for members over 400% FPL and the high proposed rate increase. Relative to the retained members, the leaving members have lower loss ratios, and this results in an increase in premium of 3.7%.

UnitedHealthcare of NM

UHCNM is filing 2026 rates for individual products. The proposed rate change is 52.97% and will affect 12,325 individuals. The rate changes vary between 31.07% and 72.68%. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

The premium collected in plan year 2024 was $33,727,802. Incurred claims during this period were $41,875,570 and UHC expects payments of $1,372,419 for risk adjustment. The loss ratio, or portion of premium required to pay medical claims, for plan year 2024 is 124.60%.

Changes in Medical Service Costs

There are many different healthcare cost trends that contribute to increases in the overall U.S. healthcare spending each year. These trend factors affect health insurance premiums, which can mean a premium rate increase to cover costs. Some of the key healthcare cost trends that have affected this year’s rate actions include:

- Increasing cost of medical services [+4%]: Annual increases in reimbursement rates to healthcare providers, such as hospitals, doctors, and pharmaceutical companies.

- Increased utilization [+2.5%]: The number of office visits and other services continues to grow. In addition, total healthcare spending will vary by the intensity of care and use of different types of health services. The price of care can be affected using expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher costs from deductible leveraging: Healthcare costs continue to rise every year. If deductibles and copayments remain the same, a higher percentage of healthcare costs need to be covered by health insurance premiums each year.

- Impact of new technology [+1.5%]: Improvements to medical technology and clinical practice often result in the use of more expensive services, leading to increased healthcare spending and utilization.

- Expiration of enhanced premium tax credits: Expanded and enhanced federal premium tax credits for consumers will expire at the end of 2025. As a result, post-tax credit premiums will increase for calendar year 2026.

- Changes in market morbidity [+3%]: Premiums reflect the expected increase in the average cost per member due to healthier members leaving the market if enhanced ATPCs are allowed to expire.

Overall, the weighted average 2026 rate increases being requested for the individual market is ~35.3%

It's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

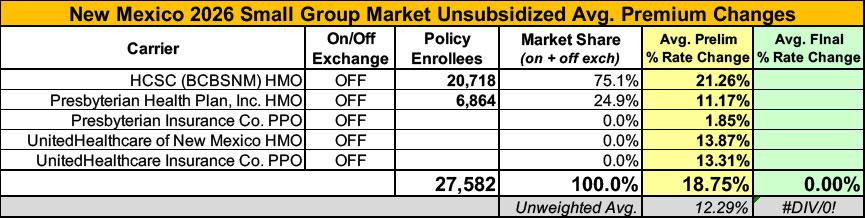

Meanwhile, I have no enrollment data at all for most of the small group carriers; the unweighted average 2026 rate hike there is around 12.3%.

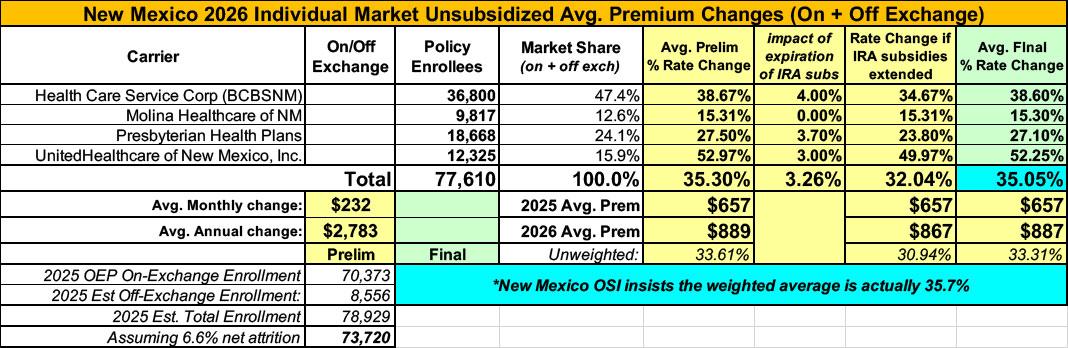

UPDATE 8/29/25: The New Mexico Office of Superintendent of Insurance (OSI) has issued a press release stating that they've approved the rate filings for all 4 individual market carriers with a weighted average increase of 35.7% (slightly higher than the preliminary 35.3%). From what I can tell the actual weighted average of the approved filings is slightly lower at 35.1%, but I'll have to go with NM OSI as the final word:

Santa Fe, NM – The New Mexico Office of the Superintendent of Insurance (OSI) has approved 2026 rates for individual market Affordable Care Act (ACA) plans sold on and off BeWell, the New Mexico Health Insurance Marketplace, with an average increase of 35.7%. Today, 75,000 New Mexicans buy health insurance through BeWell and 88% of enrollees qualify for federal and state premium assistance.

However, there's an important caveat which I'll also post about separately:

While it appears that Congress will allow enhanced federal Premium Tax Credits to expire, New Mexico’s Health Care Affordability Fund (HCAF) will cover the loss of the enhanced premium tax credits for households with income under 400% of the Federal Poverty Level (or $128,600 for a family of four), providing up to $68 million in premium relief for working families who enroll in coverage through BeWell in 2026. Federal and state premium assistance will continue to reduce the impact of the rate increases.

This is HUGE: 85% of NM ACA exchange enrollees earn less than 400% FPL, which means, if I'm reading this correctly, that 85% of NM ACA enrollees will have the federal subsidy losses cancelled out. By comparison, California and New Jersey (other states with their own supplemental subsidy programs) are only able to mitigate 9% and 40% of the lost IRA subsidies respectively.

Of course the downside is that the funding to replace the IRA losses will presumably be at the expense of the additional savings New Mexico has been providing via their "Turquoise Plan" program, but it's still much better than what enrollees in most states are facing. And of course this is small comfort to the remaining several thousand enrollees who earn more than 400% FPL, currently subsidized or not, who will still face massive rate hikes.

There are currently 75,000 New Mexicans enrolled in health and/or dental insurance through BeWell. Today, more than 50% of those customers are paying less than $10 a month for coverage thanks to federal and state subsidies only available through the marketplace.

“State insurance regulators across the country are grappling with rising health insurance costs,” said Superintendent of Insurance Alice Kane. “The OSI team rigorously reviewed rate requests to ensure they were fair and actuarially justified. These rate increases are consistent with the national trends of increased medical and prescription drug costs as well as high use of health care services. Fortunately, New Mexico had the foresight to prepare for the loss of federal premium support by providing state funds to shield most consumers.”