2026 Final Gross Rate Changes - Minnesota: +22.1% avg (up from 16.9% preliminary filings)

Originally posted 6/19/25

via the Minnesota Commerce Dept:

Federal policy shifts drive higher 2026 rates for individual and small group health plans

State actions blunt increases tied to the reconciliation bills and policy direction of the federal government

St. Paul, MN: Health insurers have submitted their proposed increased rates to the Minnesota Department of Commerce for 2026 plans available to Minnesotans who buy individual or small group health insurance through MNsure or directly through insurers. These proposed rates apply to coverage starting Jan. 1, 2026, with open enrollment beginning Nov. 1, 2025.

Federal policy shifts are driving uncertainty in the market, which is contributing to higher proposed rates. Provisions in the House-passed and Senate-proposed reconciliation bills eliminate the ability of thousands of Minnesotans to automatically renew their insurance, raise out-of-pocket costs for consumers, and lower the overall value of the insurance plans sold on the market. Consumers will also experience higher prices if, as currently laid out in the reconciliation bills, the programs offering additional financial help to reduce monthly premium costs are allowed to expire.

"It's a perfect storm that will make health insurance more expensive for Minnesotans: higher rates coming just as enhanced federal tax credits that have helped keep premiums more affordable will expire,” said Libby Caulum, MNsure CEO. “Without congressional action to extend those tax credits, almost 90,000 hardworking farmers, small business owners, working parents and their children will pay an average of almost $200 more every month for coverage."

Fighting to combat federal uncertainty and further rate increases

Last week, Governor Tim Walz signed a bill to extend the Minnesota Premium Security Plan (MPSP), which aims to blunt the impact of these increases through 2027. The MPSP is a reinsurance program established to stabilize premiums in the individual market. Without the extension, individual market premiums would have been 25% higher on average.

“Commerce is committed to protecting Minnesotans from unpredictable spikes in health insurance costs,” said Grace Arnold, commissioner of the Department of Commerce. “Reinsurance is critical for ensuring that consumers in the individual market have access to affordable, high-quality coverage.”

Proposed 2026 health insurance rates

- Individual market: Insurers have proposed average increases ranging from 7%-26% for the 187,000 Minnesotans who buy insurance in the individual market.

- Small group market: Average proposed increases range from 7%-17% for the 202,000 Minnesotans covered by small group plans.

Full details of the proposed insurance rates for the 2026 individual and small group market are available on the Minnesota Department of Commerce website.

Final approved rates, which will be released by October 1, may differ from the proposed rates. Actual premiums paid by consumers will vary due to factors like plan selection, geographic rating area, age, renewal date, and eligibility for subsidies. The Minnesota Department of Commerce reviews all rate filings to ensure rates are actuarially sound and in compliance with state and federal law.

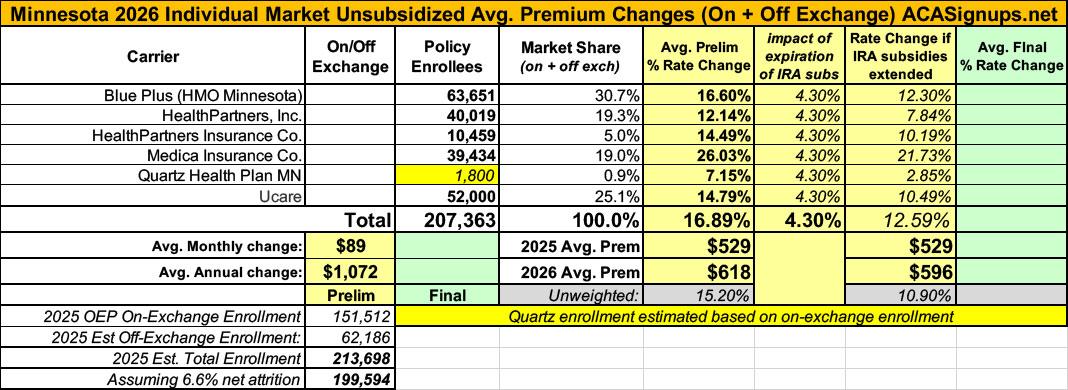

As usual, Minnesota's SERFF rate filing database doesn't seem to include any actual enrollment information, so I can't run a proper weighted average rate change for the small group market at all (the unweighted average increase is +15.2%). However, on-exchange enrollment is broken out, and it makes up 78% of the total individual market; I'm assuming the remaining off-exchange enrollment is roughly proportional. If so, that makes the weighted average requested rate increases 17.0% statewide.

Unfortuantely, the SERFF database also doesn't have the Actuarial Memos available (at least not yet), which means I don't know how much of the rate hike for each carrier is due specifically to the IRA subsidies expiring (beyond the ominous warnings in the press release above), nor do I have any details on the impact of Trump's tariffs or how much CSR reimbursement funding would change things.

It's also worth noting that there's a new carrier (sort of) entering the Minnesota market--HealthPartners Insurance Co, which I'm assuming is simply a new division of HealthPartners Inc:

* HealthPartners Insurance Company is new to the exchange for Plan Year 2026. Many individuals will be moved from a HealthPartners Inc. plan to a HealthPartners Insurance Company plan. Determining which rate increase applies would depend on an individual’s service area.

UPDATE 8/14/25: I've been able to acquire the actual current enrollment for both on+off exchange enrollees. in 5 of the 6 carriers, which doesn't really change anything in terms of overall weighted rate hikes; it nudges it down a smidge to 16.9%.

As for the small group market, I have no idea what the market share breakout is there, so I have to use the unweighted average of 11.6%.

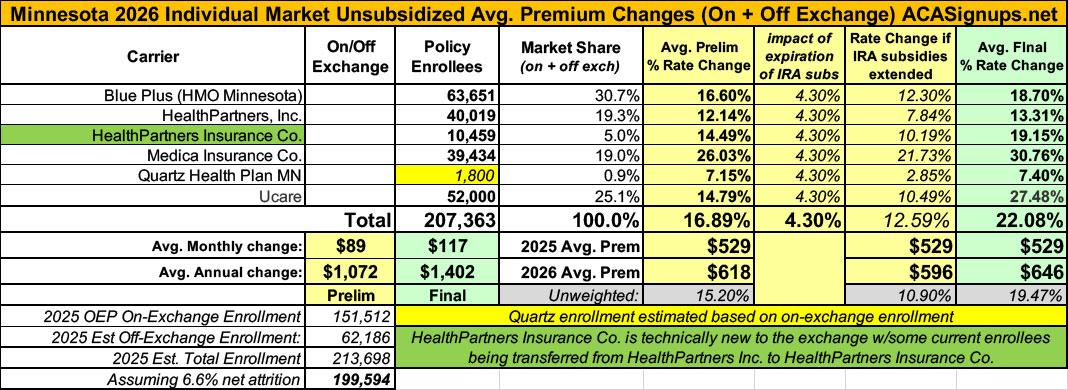

UPDATE 10/01/25: The Minnesota Commerce Dept. has published the final/approved rate changes for 2026, and I'm afraid the weighted average increase is several points higher than the preliminary filings indicated.

The weighted average increase has gone up from 16.9% to 22.1% overall.

Small Group plan rates are also going up slightly more than requested, but only by a nominal amount.