2026 FINAL Rate Changes - Delaware: +27.7%; still ugly but down from +32.5%.

Hoo boy. Via the Delaware Insurance Dept:

Plan year 2026 health and dental insurance rate filings, as proposed, are available for the companies listed below. These filings are subject to actuarial review. Additional companies will be listed as their filings are received. Any insurance filings already approved are available to the public through the NAIC’s System for Electronic Rate and Form Filing (SERFF) interface. There is no fee for using SERFF. Rate info can also be accessed at the Rate Review page at Healthcare.gov

AmeriHealth Caritas VIP Next, Inc:

- Company Legal Name AmeriHealth Caritas VIP Next, Inc.

- Market for which proposed rates apply (Individual or Small Group) Individual

- Total proposed rate change (increase/decrease) 46.20% increase

- Effective date of proposed rate change January 1, 2026

Summary

...The overall rate increase of 46.20% will impact 5,782 individual members in Delaware. The enrollment of 5,782 members is as of February 2025. The rate change varies by plan, ranging from a 36.92% increase to a 50.82% increase.

Provide a summary of the historical revenue, claims, expenses and profit on the product(s), and how the rate change should impact these in the future.

AmeriHealth Caritas VIP Next, Inc. (AHC) entered the Delaware Individual and Family Plans exchange on January 1, 2023, and therefore only has two years of historical revenue, claims, expenses and profit to report.

...The table below demonstrates the rate increase broken out by key categories limited to the proposed 2026 rate change. Note that the basis for developing the rates changed from a 100% manual rate used for the 2025 rates to one that is 100% experience rated for PY 2026. The table below represents our estimated break down of the overall rate change into the key categories listed.

- Trend - 2025 to 2026 5.5%

- Expiration of Enhanced PTCs 5.7%

- Demographic 0.0%

- Risk Adjustment 26.5%

- Reinsurance 9.2%

- Other -5.2%

- Total 46.20%

...Expiration of Enhanced PTCs: The expiration of enhanced PTCs is expected to decrease the DE market enrollment and as a result increase morbidity in the single risk pool

Celtic Insurance Company:

- Company Legal Name Celtic Insurance Company

- Market for which proposed rates apply (Individual or Small Group) Individual Market

- Total proposed rate change (increase/decrease) 31.8%

- Effective date of proposed rate change January 1, 2026

Summary

...The overall rate increase of 31.8% will affect 10,619 individual members. The rate change will vary by product and plan, ranging from a 29.3% increase to a 41.9% increase.

...The proposed rate change is due to the factors discussed in the proposed rate change section above. Due to changes in the projected provider reimbursement level and utilization, the assumed trend is a necessary component of the rate change. Legally required benefit changes had minimal impacts on rates.

Administrative costs and anticipated profits increased rates by 1.9%.

eAPTC expiration will shift statewide average morbidity, and expected to increase the index rate by 21.8% between the base and projection periods.

Reinsurance parameters were updated to an attachment point of $55,000, reinsurance cap of $340,000 and coinsurance rate of 35%, as released by DHSS on 7/15/25.

Highmark BCBSD Inc:

- Company Legal Name Highmark BCBSD Inc.

- Market for which proposed rates apply (Individual or Small Group) Individual Market

- Total proposed rate change (increase/decrease) 34.9%*

- Effective date of proposed rate change January 1, 2026

...The overall rate increase of 34.9% will affect 32,425 members. The rate change will vary by product ranging from a minimum of 32.3% to a maximum of 43.7%.

- Base Experience claims relative to projected 2024 claims in 2025 filing 3.3%

- Trend - 2024 to 2025 change from prior year’s filing 2.6%

- Trend - 2025 to 2026 10.4% Reinsurance 12.0%

- Morbidity (due to expiring enhanced premium subsidies) 3.0%

- Morbidity (other) 1.3% Retention -0.6%

- Risk Adjustment -0.8%

- Plan Design/Miscellaneous 0.1%

- Average Rate Change 34.9%

*It's worth noting that the DE DOI website lists the avg. requested rate hike for Highmark as "only" 30.3%, but it lists it as 34.9% in multiple locations throughout the filing form itself.

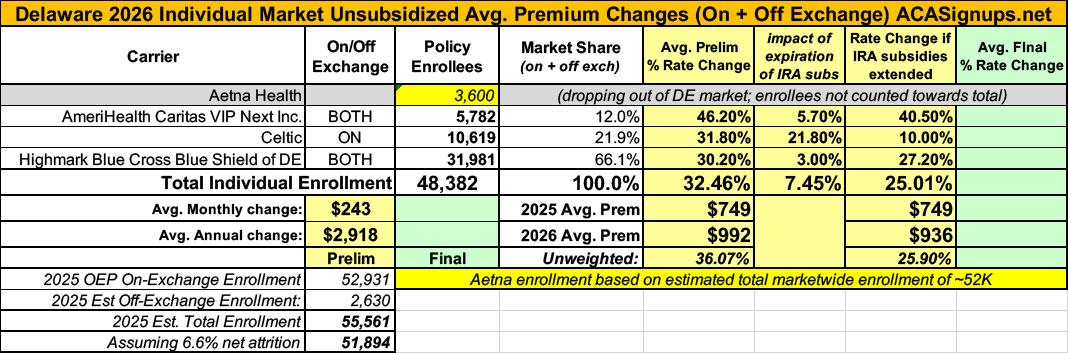

Overall, that's a weighted requested average rate hike of 35.6% marketwide, with 7.4 points being due specifically to the IRA subsidies expiring.

UPDATE 8/14/25: OK, strike that...a more recent filing on the federal rate review site does have Highmark's request down as 30.2% after all (see attachment below).

This knocks the weighted average down to 32.5%...still absurdly high, of course.

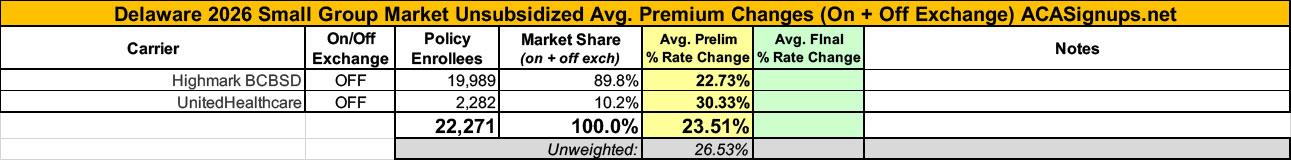

Meanwhile, things aren't looking much better for the ~22,000 Delaware residents enrolled in small group plans. The small group market usually only sees relatively modest single-digit rate hikes every year, but 2026 is looking pretty ugly in the Diamond State:

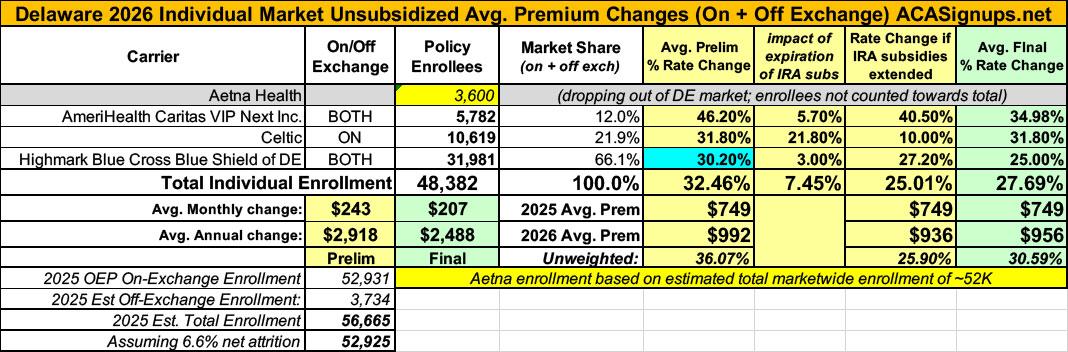

UPDATE 8/28/25: The Delaware Insurance Dept. has posted their approved rate changes for the individual market; they knocked AmeriHealth Caritas down by over 11 points and shaved 5 points off of Highmark, bringing the final weighted average increase down from 32.5% to 27.7%.