2026 Final Gross Rate Changes - California: +10.1% (updated)

Originally posted 8/12/25

Overall preliminary rate changes via the SERFF database, California Insurance Dept. and/or the federal Rate Review database.

Aetna/CVS

(Aetna/CVS is pulling out of the entire individual market nationally)

Anthem Blue Cross of CA (DMHC)

This is a rate filing for the Individual market ACA‐compliant plans offered by Anthem Blue Cross (Anthem). The proposed rates in this filing will be effective for the 2026 plan year beginning January 1, 2026, and apply to plans both On‐Exchange and Off‐Exchange.

Anthem will continue to participate in its 2025 marketplace footprint consisting of rating areas 1-10 and 12-14 with EPO plans and rating areas 11 and 15‐19 with HMO plans.

The proposed rates have been developed from 2024 ACA experience. The proposed average rate change is 14.7%. The proposed annual rate changes by product in this filing range from 14.6% to 17.8%, with rate changes by plan from 11.9% to 17.8%. The rate changes will impact 247,197 current members as of May 1, 2025.

CA Physician Service (Blue Shield of CA)

This filing covers the proposed rate changes on the non-grandfathered individual plans. The average rate change is 9.3% and varies from -22.2% to 25.3% depending on benefit plan and geographic rating region. Please see below for the major components of the average rate change.

Benefit Category Impact

- Restatement of 2025 Rates 0.9%

- 2026 Trend / Mix 6.8%

- QTI Payment / Exchange Fee 0.4%

- Federal Subsidy Expiration 1.5%

- California Premium Subsidy / eCSR -0.5%

- Filed Rate Change 9.3%

The 2026 premium rate increases are driven by a variety of factors outside of traditional core trend:

1. Restatement of 2025 rates, as 2025 utilization and contracting came in higher than expected at the time of 2025 pricing. This results in a 0.9% impact to 2026 premiums.

2. A quality payment for Covered CA’s Quality Transformation Initiative and an increase to the Exchange user fee. These impacts result in an incremental 0.4% impact on the 2026 premium rates.

3. The expiration of American Rescue Plan enhanced subsidies. We expect this to drive a morbidity increase of 2.25% for both BSC and the market, offset by a 0.75% favorable mix impact resulting from reduced enrollment in Silver 94/87 plans. Combining the above considerations results in a 1.5% increase to our 2026 premiums.

4. The addition of California premium subsidies and the expiration of enhanced CSR benefits. We expect the California premium subsidies to partially offset the impact of expiring American Rescue Plan subsidies, while the expiration of California enhanced CSR plans will result in less induced utilization on silver CSR plans. These changes result in a 0.5% reduction to 2026 premiums.

I need to take a moment to explain this: For several years now, California (along with several other states) has had their own state-based supplemental financial subsidy program for ACA exchange enrollees. The first year or so it was designed to reduce premiums beyond the federal tax credit assistance, but when the improved ARPA/IRA subsidies were put into place, they retooled the program to eliminate deductibles for hundreds of thousands of enrollees instead.

With the ARPA/IRA subsidies set to expire, CA is apparently planning on re-retooling the program to its original setup, to help mitigate the premium damage being caused by the federal subsidy expiration. This is also largely why the impact of the IRA subsidy expiration is expected to be lower in California (see table below) than in most other states.

Chinese Community Health Plan

Balance by CCHP is proposing an average rate increase of 9.5%. Rate increases range from 5.8% to 11.3% depending on the plan. Rate increases vary by plan due to shifts in the estimated relationship between benefits and cost sharing levels by plan and claims costs. The rate increase does not vary by geographic area. Area factors are unchanged between 2025 and 2026.

Appendix 1 of the Part III Actuarial Memorandum contains a detailed build-up of the proposed rate increase. This appendix illustrates the development of our proposed index rate, starting from 2024 experience data. This index rate supports our proposed rate change. Below is a high-level discussion of adjustments to the 2024 experience period.

Each of the drivers is explained in more detail below:

- 1. Change in starting allowed costs

- 2. Change in utilization and unit cost trends

- 3. Change in projected benefits

- 4. Change in projected morbidity

- 5. Change in projected area mix

- 6. Change in projected age mix

- 7. Change in non-benefit expenses (e.g., HIPF, admin, commissions)

- 8. Change in projected risk adjustment transfer

County of Santa Clara (Valley Health Plan)

In this Actuarial Addendum we assume that federal ARP premiums will expire, federal CSRs will not be funded at the federal level, California enhanced CSRs will expire, and California premium subsidies will commence (Scenario 1). Based on these changes as well as rate negotiation meeting feedback, updated base period claims run-out, and other program revisions, we have updated the following assumptions:

Updated Base Period Claims Cost

- We updated the base-period claims cost with two more months run out. The current base-period incurred claims are paid through 5/30/2025. The overall incurred claims for PY2024 including estimation of IBNP are similar with the initial April 2025 submission.

- Increased Covered CA Exchange Fee: We updated the Covered CA exchange fee from 2.25% to 2.50%.

- Revised Platinum and Bronze Metal Sloping: Based on the guidance from Covered CA, we revised the premium relativities for Platinum and Bronze plans. This change increased Platinum and decreased Bronze rates.

- VHP Estimated Member Risk Score and Risk Adjustment Transfer Payment: We updated the base period risk score estimation using the 2024 Final TPIR report from CMS as of June 30, 2025. We assumed that the 2024 new enrollees’ risk scores were 10% lower than continuing enrollees. We projected 2026 projected member risk scores based only on 2024 continuing enrollees’ assumed risk scores, that is, assuming there will not be any new enrollees in 2026 for VHP. These changes resulted in a decrease in the projected risk adjustment transfer payment in 2026.

- Remove Induced Utilization due to CA Enhanced CSRs: Under Scenario 1, CA state will no longer offer enhanced CSRs to Silver var

Health Net of CA

Health Net of California (HNCA) currently provides health care coverage for over 157,000 members enrolled in either our Ambetter HMO or PPO plans. Individual Family Plans (IFP) are available to purchase through Covered California or directly from Health Net of California. Premium rates are expected to increase on average by 14.8% for members on renewing plans, effective January 1, 2026. Annual rate changes may range between 7.6% and 22.9%, depending on what type of plan a member is enrolled in (HMO or PPO), what county a member currently resides in, and what plan design a member is enrolled in (e.g. Platinum 90 Ambetter HMO). Variations are primarily driven by underlying cost differences between different plan designs and regional cost trends. Note that these rate changes do not reflect any additional increases in a member’s calculated premium due to aging an additional year at the point of renewal.

...Changes in Medical Service Costs

Medical service costs are projected to increase at an annualized rate of 7.3% driven by several factors including medical inflation, changes in contracted reimbursement rates to providers, and higher utilization of health care services. Additional upward pressure on medical costs is expected due to demographic shifts within HNCA’s enrollee population and the broader insured 1population. These trends are expected to worsen through 2026, particularly as the expiration of federal enhanced premium subsidies (eAPTCs) at the end of 2025 lead to coverage lapses among healthier individuals, resulting in a sicker risk pool and increased average medical costs.

Inland Empire Health Plan

The purpose of this memorandum is to request a rate increase effective January 1, 2026 for Inland Empire Health Plan’s (IEHP) individual market plans. This justification is intended to comply with the requirements of CMS, the State of California Department of Managed Health Care (DMHC) and Covered California. This justification may not be appropriate for purposes or scopes beyond those described above and, therefore, should not be used for other purposes.

The rate increase requested for IEHP’s individual market plans impacts a projected 477,656 member months. The composite requested rate increase from 2025 to 2026 is 17.9% across all members assuming that the ARP subsidy will not continue in 2026.

Kaiser Foundation Health Plan

We estimate that implementation of the proposed 2026 rates will result in a 7.1% increase in member dues paid by the average member enrolled in a KFHP individual plan. The actual rate changes will vary from 0.2% to 10.7% depending on benefit plan and rating region (Northern vs Southern CA). These changes are prior to the impact of members moving to the next age band at renewal.

The rate changes are affected by the following:

- (a) medical and administrative cost trends;

- (b) benefit adjustments affecting pricing actuarial values;

- (c) projection of risk adjustment amounts;

- (d) adjustment of the rating area factors;

- (e) target margin.

These factors are discussed in detail in specific sections of this memorandum.

LA Care Health Plan

Table 2.1 summarizes proposed rate changes by product effective January 1, 2026. In aggregate, we project a change of 10.9%.

Single Risk Pool

LACHP rates are developed using a single risk pool, established according to the requirements in 45 CFR section 156.80(d) and reflects all covered lives for every non-grandfathered product/plan combination in the State of California individual health insurance market

Molina Healthcare of CA

1. Scope and range of the rate increase: Molina’s proposed rates represent an average rate increase of 14.6% for the 67,586 Molina members enrolled effective May 1, 2025. The proposed rate changes vary by metal tier. Members would receive premium increases ranging from 4.8% to 20.9% depending on their geographic location, metal tier, and age.

2. Financial experience of the product: Premium of $570.03 per member per month was received for 2024 compared to paid claims of $414.27 per member per month and risk transfer payments of $115.44 per member per month. The proposed premium rates yield a medical loss ratio of 83.4 percent. The medical loss ratio represents the percentage of every premium dollar that Molina expects to spend on medical expenses and improving health care quality for our members. The projected medical loss ratio of 83.0 percent exceeds the Affordable Care Act minimum required loss ratio of 80 percent.

3. Changes in Medical Service Costs: Medical inflation related to the utilization and cost of covered services increased claims by 10.0 percent. In addition, changes in acuity increased expected claim costs.

4. Changes in benefits: Molina is renewing all its plan offerings from 2025, with the standard benefits chosen by Covered California.

5. Administrative costs and anticipated profits: The administrative expenses for 2026 are expected to be similar on a percentage basis compared to the previous year. Targeted profit margin remained constant at 3 percent.

Sharp Health Plan

Proposed Rate Change(s)

Attachment 2 summarizes proposed rate changes by plan effective January 1, 2026. Rate changes generally vary by plan due to a combination of factors including changes in benefit relativities, network adjustments, non-benefit expenses including ACA taxes/fees, margin, and risk adjustment projections. The following are significant factors driving the proposed rate changes.

Sutter Health Plan

The purpose of this justification is to explain the rate increases for the following Sutter Health Plan (SHP) individual comprehensive medical plans in California with effective dates of January 1, 2026 through December 31, 2026. SHP is proposing an average rate increase of 18.3%. Rate increases range from 17.0% to 19.3% depending on the benefit plan. Rate increases vary by plan due to shifts in the estimated relationship between benefits and cost sharing levels by plan and claims costs. The rate increase varies by geographic area.

This justification is intended to comply with the requirements of Section 2794 of the Public Health Service Act as added by Section 1003 of the Patient Protection and Affordable Care Act (ACA). This justification may not be appropriate for purposes or scopes beyond those described above and, therefore, should not be used for other purposes.

Western Health Advantage

The purpose of this justification is to explain the rate increases for the following Western Health Advantage (WHA) individual market comprehensive medical plans in California with effective dates beginning January 1, 2026.

...The rate increases requested impact about 1,970 members (as of May 2025) in WHA's individual products. The changes vary among these plans mainly due to changes in cost sharing parameters (e.g., deductible, coinsurance, and copays) and provider reimbursement levels. The rate increases vary from 15.4% to 18.2% for the plans listed above and are relative to January 1, 2025 rating levels. This justification is intended to comply with the requirements of Section 2794 of the Public Health Service Act as added by Section 1003 of the Patient Protection and Affordable Care Act (ACA). This justification may not be appropriate for purposes or scopes beyond those described above and, therefore, should not be used for other purposes.

...The claim projection from WHA's experience to 2026 includes an expected increase in the cost of all medical and pharmacy services. We developed these trend assumptions using a combination of WHA experience, expected provider contracting changes, general industry knowledge regarding recent trends in medical inflation, industry research, and judgment. WHA also assumes higher required reimbursements to its network providers relative to 2025.

Lastly, the expiration of the state’s enhanced cost sharing subsidies will put some downward pressure on 2026 rate levels.

...WHA will make several cost sharing modifications by plan, mainly to comply with the final 2026 Actuarial Value Calculator. To the extent the plan changes lead to a higher or lower level of coverage, the 2026 premium rates increase or decrease, respectively.

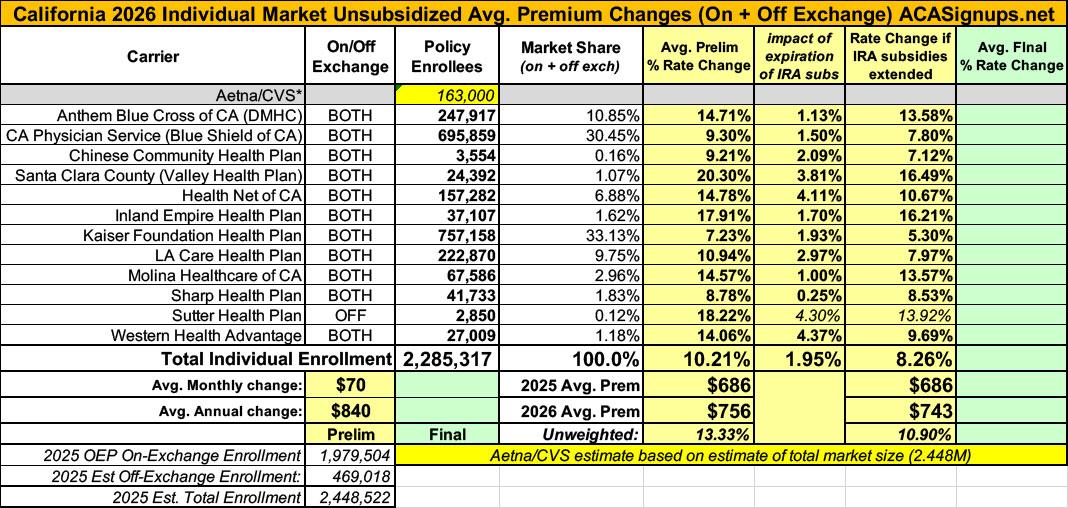

It's important to note that while some of the carriers haven't included their current enrollment in their Actuarial Memos, I was able to find all of them via the URRT forms found at California's excellent Dept. of Healthcare Rate Filing Database, which is a much simpler to use system than SERFF.

As a bonus, the CA DHS database also includes the alternate URRT forms for every carrier, which means I was able to plug in the carriers actual estimate of how much the subsidy expiration is causing their 2026 gross premiums to increase instead of guessing.

The exception to this is Aetna, which is dropping out and therefore doesn't have a 2026 URRT form or actuarial memo at all. My best guess as to Aetna's enrollment is based on the 2.45M total individual market, which I'm estimating using the 2024 CMS liability risk score report. Since 2.28 million enrollees have been accounted for across the other 12 carriers, that leaves around 163,000 or so Aetna enrollees who will have to shop around for another carrier.

Overall, California carriers are asking for a weighted average rate increase of 10.2% on the individual market.

HOEWVER, it's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

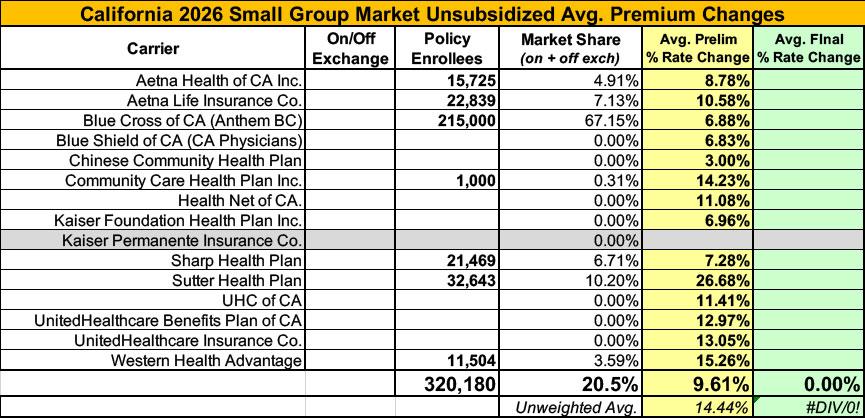

Meanwhile, I have no enrollment data at all for the small group carriers; the unweighted average 2026 rate hike there is around 14.4%

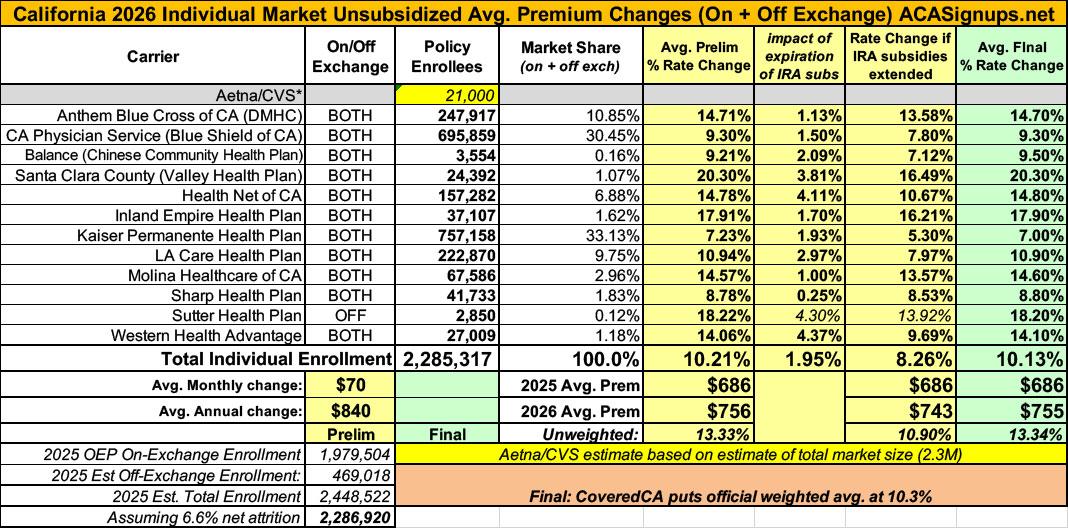

UPDATE 10/5/25: According to the California Insurance Dept. rate review filings site, all of the 2026 individual market filings have been finalized with only nominal tweaks to any of the average rate increases. The overall weighted average drops slightly from 10.2% to 10.1%, although Covered California seems to be sticking with 10.3%, so who knows...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.