2026 Final Gross Rate Changes - Connecticut: +16.8%; ~156,000 enrollees are in for a major shock this fall (updated)

originally posted 6/7/25

via the Connecticut Insurance Dept:

The Connecticut Insurance Department has posted the initial proposed health insurance rate filings for the 2026 individual and small group markets. There are 8 filings made by 7 health insurers for plans that currently cover approximately 224,000 people (158,000 individual and 66,000 small group).

Anthem has filed rates for both individual and small group plans that will be marketed through Access Health CT, the state-sponsored health insurance exchange. ConnectiCare Benefits Inc. (CBI) and ConnectiCare Insurance Company, Inc. have filed rates for the individual market on the exchange.

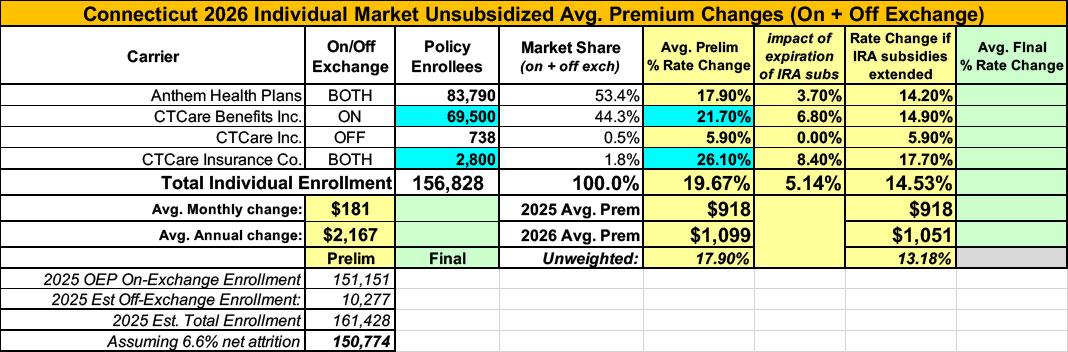

Before I continue, note that yes, I'm aware the 17.8% average shown below doesn't match the 22.9% average in the headline above. There's a reason for this which should be obvious if you read on:

The 2026 rate proposals for the individual and small group market are on average higher than last year:

The proposed average individual rate request is a 17.8 percent increase, compared to 8.3 percent in 2025, and ranges from –0.9 percent to 28.6 percent.

The proposed average small group rate request is a 13.1 percent increase, compared to 11.9 percent in 2025, and ranges from 7.0 percent to 20.4 percent.

In general, carriers have attributed the proposed increases to:

- Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs and the increased demand for medical services.

- Experience: Experience adjustment necessary to reflect deteriorating experience from the prior rating period to the current rating period.

- Cost Sharing (Individual only): Adjustment needed to reflect the increase in cost sharing reductions (CSRs) among the Silver Plan membership.

Please note these rate requests do NOT include the impact of the enhanced federal subsidies (enacted as part of American Rescue Plan Act of 2021) not being extended, which are set to expire at the end of 2025. The estimated impact on rates (only Individual ON Exchange), if the enhanced subsidies are not extended, ranges from additional increases of 3.5% to 6.8% of premium varying by carrier.

Did you catch it? For whatever reason, unlike every other state I've analyzed so far, the Connecticut Insurance Department seems to be fairly confident that--against all current evidence--the improved IRA subsidies will be extended by at least one more year. They're so confident about this happening that they've actually instructed the insurance carriers to assume that they will be extended in their rate filing--to the point of making that the "default" assumption even in the summary posted on the DOI website.

Don't get me wrong, I'm praying that they'll be proven correct in the end...but it does make for a bit of awkwardness on my 2026 rate filing spreadsheets, which are set up with the IRA subsidies expiring being the default assumption.

Since Connecticut is the only state going the other way on this so far, and since I'd rather err on the side of caution, I'm using the "IRA expiring" as the above-the-fold assumption.

With that in mind, here's the details from the individual market carriers:

ConnectiCare Insurance Company, Inc.

This submission is for rate revisions to CICI’s existing individual medical ACA-compliant products marketed through the Access Health CT Exchange. The new rates are effective for individuals with an effective date or renewal date of January 1, 2026, through December 31, 2026. The average proposed rate change across all existing plans and regions, compared to the most recently approved rates effective January 1, 2025, is 26.1%. This increase represents a weighted average of the rate changes for all existing plans that will be offered in 2026, ranging from 5.9% to 28.6%. Appendix 1 provides a comparison of the revised base rates to the current base rates for a 21-year-old.

There are several 2025 to 2026 plan-specific changes that cause the rate change to vary by plan including changes in plan benefits and revised retention assumptions. These changes are applied at the benefit plan level resulting in different rate increases by plan. Additionally, there are changes to the base premium rate.

REASONS FOR RATE CHANGE

Primary factors driving the rate change include the following items.

- Emerging claims experience

- Expected future medical inflation and utilization changes

- Changes in cost sharing levels to ensure that plans comply with the Health and Human Services (HHS) Actuarial Value (AV) metallic requirements

- Change in cost-sharing-reduction (CSR) load

- Change in the mix of business

- Demographic and geographic changes

- Anticipated risk adjustment transfers

- Changes in retention

...At the time of this rate filing submission, we acknowledge there is uncertainty regarding whether the enhanced premium tax credit subsidies introduced through the American Rescue Plan Act (ARPA) will or will not be extended beyond 2025. As instructed by the CID, we have prepared this set of rate filing materials assuming that these enhanced premium tax credits will be extended into 2026. The expiration versus extension of these subsidies could have a material impact on morbidity, enrollment, and other factors related to the Individual market. The premium rates developed and supported by this Actuarial Memorandum also assume that Cost Share Reductions (CSRs) will not be funded as is described in current regulations and guidance. If subsequent information becomes available that would materially affect this rate filing submission, we would likely pursue opportunities to revise our pricing assumptions, add or remove plans, and resubmit this rate filing.

...Per Bulletin HC-81-25, the assumptions, projections, and premium rates contained within this rate filing assume that federal enhanced Advanced Premium Tax Credit (APTC) subsidies will be extended into 2026. Due to the uncertainty of the enhancements extension, we also estimate the impact to underlying claims and premium rates if the enhanced APTCs expire at the end of 2025.

Assuming the enhanced APTCs expire, we anticipate a reduction in the overall market size in 2026. We project this will lead to increased average statewide morbidity in 2026 as consumers either lose access to subsidies (for those at or above 400% of the Federal Poverty Level (FPL)) or face higher net premiums due to less generous subsidies. We anticipate the remaining risk pool in 2026 to have higher healthcare needs, on average, as healthier consumers are more likely to lapse coverage. Given these considerations, we would apply a 7.4% adjustment to underlying claims to reflect anticipated changes in statewide average morbidity in 2026 relative to the experience rate. This adjustment to underlying claims results in an overall impact to premium rates of approximately a 8.4% increase.

In other words, the "default" 26.1% average assumes IRA subsidies do continue, while if they don't (which is actually the more likely case), tack on another 8.4 points for a total of a whopping 34.5%. Ouch.

ConnectiCare Benefits, Inc.

This submission is for rate revisions to CBI’s existing individual medical ACA-compliant products marketed through the Access Health CT Exchange. The new rates are effective for individuals with an effective date or renewal date of January 1, 2026, through December 31, 2026. The average proposed rate change across all existing plans and regions, compared to the most recently approved rates effective January 1, 2025, is 21.7%. This increase represents a weighted average of the rate changes for all existing plans that will be offered in 2026, ranging from 4.7% to 26.7%. Appendix 1 provides a comparison of the revised base rates to the current base rates for a 21-year-old.

There are several 2025 to 2026 plan-specific changes that cause the rate change to vary by plan including changes in plan benefits and revised retention assumptions. These changes are applied at the benefit plan level resulting in different rate increases by plan. Additionally, there are changes to the base premium rate.

REASONS FOR RATE CHANGE

Primary factors driving the rate change include the following items.

- Emerging claims experience

- Expected future medical inflation and utilization changes

- Changes in cost sharing levels to ensure that plans comply with the Health and Human Services (HHS) Actuarial Value (AV) metallic requirements

- Change in cost-sharing-reduction (CSR) load

- Change in the mix of business

- Demographic and geographic changes

- Anticipated risk adjustment transfers

- Changes in retention

...Per Bulletin HC-81-25, the assumptions, projections, and premium rates contained within this rate filing assume that federal enhanced Advanced Premium Tax Credit (APTC) subsidies will be extended into 2026. Due to the uncertainty of the enhancements extension, we also estimate the impact to underlying claims and premium rates if the enhanced APTCs expire at the end of 2025.

Assuming the enhanced APTCs expire, we anticipate a reduction in the overall market size in 2026. We project this will lead to increased average statewide morbidity in 2026 as consumers either lose access to subsidies (for those at or above 400% of the Federal Poverty Level (FPL)) or face higher net premiums due to less generous subsidies. We anticipate the remaining risk pool in 2026 to have higher healthcare needs, on average, as healthier consumers are more likely to lapse coverage. Given these considerations, we would apply a 7.4% adjustment to underlying claims to reflect anticipated changes in statewide average morbidity in 2026 relative to the experience rate. This adjustment to underlying claims results in an overall impact to premium rates of approximately a 6.8% increase

ConnectiCare, Inc:

This submission is for rate revisions to CCI’s existing individual medical ACA-compliant products marketed off the Exchange. The new rates are effective for individuals with an effective date or renewal date of January 1, 2026, through December 31, 2026. The average proposed rate change across all existing plans and regions, compared to the most recently approved rates effective January 1, 2025, is 5.9%. This increase represents a weighted average of the rate changes for all existing plans that will be offered in 2026, ranging from -0.9% to 6.7%. Appendix 1 provides a comparison of the revised base rates to the current base rates for a 21-year-old.

There are several 2025 to 2026 plan-specific changes that cause the rate change to vary by plan including changes in plan benefits and revised retention assumptions. These changes are applied at the benefit plan level resulting in different rate increases by plan. Additionally, there are changes to the base premium rate.

REASONS FOR RATE CHANGE

Primary factors driving the rate change include the following items.

- Emerging claims experience

- Expected future medical inflation and utilization changes

- Changes in cost sharing levels to ensure that plans comply with the Health and Human Services (HHS) Actuarial Value (AV) metallic requirements

- Change in cost-sharing-reduction (CSR) load

- Change in the mix of business

- Demographic and geographic changes

- Anticipated risk adjustment transfers

- Changes in retention

...CCI only markets plans off the Exchange. As such, the extension or expiration of enhanced Advanced Premium Tax Credit (APTC) subsidies is not applicable.

Anthem Health Plans Inc:

The proposed rates have been developed from 2024 ACA experience. The proposed annual rate changes by product in this filing range from 10.04% to 21.89%, with rate changes by plan from 6.40% to 22.77%. These ranges are based on the renewing plans and are consistent with what is reported in the Unified Rate Review Template. Exhibit A shows the rate change for each plan. The overall average annual rate increase for this filing is 14.2% as shown in Appendix A.

Factors that affect the rate changes for all plans include:

- Trend: This includes the impact of inflation, provider contracting changes, and changes in utilization of services.

- Morbidity: If the enhanced subsidies expire, there are anticipated changes in the market-wide morbidity of the covered population in the projection period. This morbidity impact is not currently reflected in the rate development but will be included within the final rate filing submitted to the Connecticut Insurance Department in August or September unless there is final guidance from the federal government of extension of the enhanced subsidies through 2026.

- Benefit modifications, including changes made to comply with updated AV requirements.

- Changes in taxes, fees, and some non-benefit expenses.

...Under the American Rescue Plan Act, Advanced Premium Tax Credits (also referred to as APTCs or premium subsidies) provided by the federal government were increased, and these enhancements to the subsidies are set to expire at the end of 2025. Per the filing requirements from Connecticut Bulletin HC-81-25, "carriers must submit their filings for 2026 Rates with the assumption that the subsidies will be extended through 2026." The rates submitted in this filing are in accordance with that guidance rather than the current regulated expiration. If these enhanced subsidies do expire, then the rates included in this rate filing will need to be revised and resubmitted. Anthem has included a 3.7% morbidity impact that will need to be applied to the rates in the event of enhanced subsidy expiration in Section 6 of this actuarial memorandum.

In the event that no decision is made on the extension of the enhanced subsidies prior to the Connecticut Insurance Department's final decision on this rate filing, Anthem assumes that the inactivity indicates that the enhanced subsidies will expire and that the morbidity impact outlined in Section 6 will be included within the final rate development submitted to the Connecticut Insurance Department in August or September. Only in the event that the federal government gives final guidance that the enhanced subsidies will be extended will this rate filing hold and the rates not need to be revised to reflect the morbidity impact provided.

Put that all together and this is what it looks like...an painful 22.9% average rate hike if the IRA subsidies aren't extended, vs. a somewhat less painful 17.8% hike if they are.

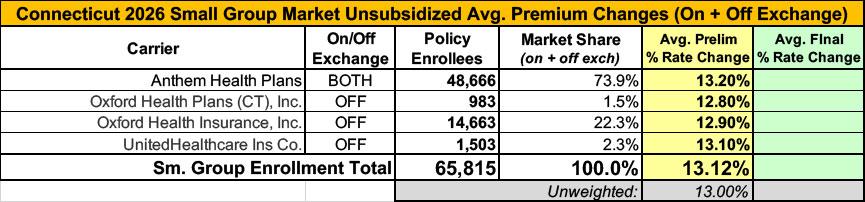

Small group carriers, meanwhile, are asking for an average rate increase of 13.1%.

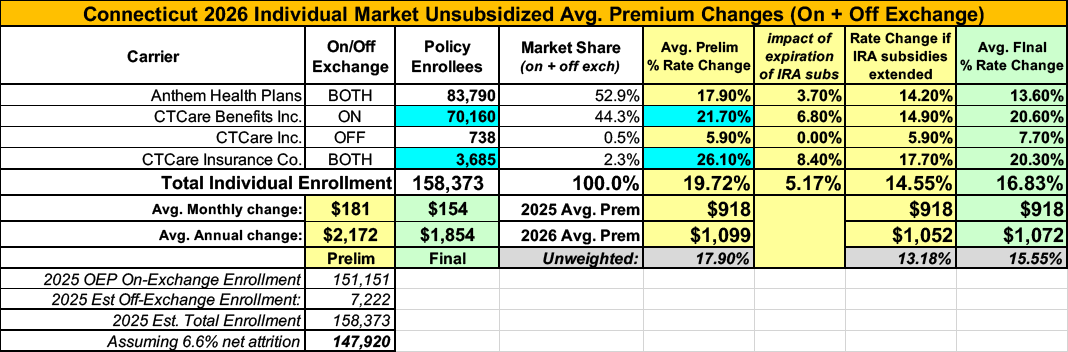

UPDATE 8/14/25: ConnectiCare Benefits and ConnectiCare Insurance Co. have refiled with reduced rate hikes (still high, just not as high). The new filings also modify the number of current enrollees.

As a result of these changes, Connecticut is looking at weighted average rate hikes of 19.7%.

UPDATE 9/11/25: the Connecticut Insurance Dept. has issued the final/approved 2026 rate filings for both the individual and small group markets along with the following press release:

DEPARTMENT REJECTS AND MODIFIES EVERY HEALTH INSURANCE RATE INCREASE REQUEST FOR 2026

- Cuts Will Save $125 Million for Consumers; Open Enrollment Begins November, 1

Connecticut Insurance Commissioner Andrew N. Mais today announced that the Department has issued its rate decisions for 2026 fully insured individual and small group health insurance plans and has rejected every initial request from insurers.

“All of us – regulators, consumers and industry – have faced unprecedented uncertainty this year due to the federal government’s pending changes to health care coverage. But our commitment to protect consumers never wavers,” Commissioner Mais said.

The Department reduced and modified the requests from seven insurers, saving consumers about $125 million next year on fully insured Affordable Care Act (ACA) compliant plans marketed on and off the state’s health insurance exchange, Access Health CT. In the past three years, the Department has saved consumers $267 million. Additionally, the Department has limited insurer profits to 0.95% of premium dollars.

The ACA plans are regulated by the Department and cover about 240,000 people in Connecticut. Self-funded employer health plans, where the majority of people are enrolled, are regulated by the U.S. Department of Labor under the Employee Retirement Income Security Act (ERISA).

Insurance Department Rate Review

The Department’s thorough and transparent actuarial review process of eight plans filed by seven carriers began in early June and included an informational public forum in August. The Department:

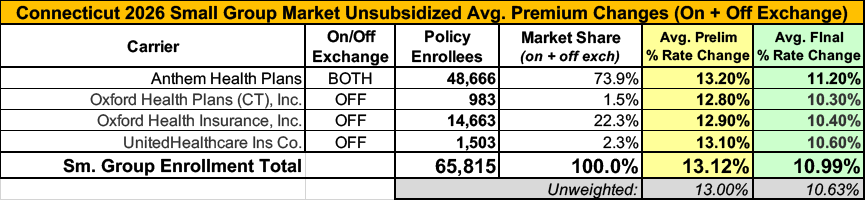

- Reduced the individual market rate increase request by 28% - from a requested average 23.3% to an average increase of 16.8%.

- Reduced the small group market rate increase request by 16% - from a requested average of 13.1% to an average increase of 11%.

In addition to the impact of potential federal enhanced subsidy changes to individual plans, insurers cited increases of 6-10% in medical costs, 9-15% increase in pharmacy costs, and an increased demand for medical services as part of their justification for requesting increases.

Federal Uncertainty Around Rate Requests

Commissioner Mais noted that nationwide, health insurance rate requests were the highest since 2018, as insurers adjusted for the potential impact of the loss of enhanced federal subsidies in the individual market. Citing a report from KFF and the Peterson Center on Health Care, the Commissioner said the median proposed increase of 18% for 2026 is nearly triple the median proposed increases in prior years. Without the enhanced subsidies, consumers with ACA coverage could see average premium increases of 75%.

In Connecticut, approximately 90% of Access Health CT enrollees received financial assistance through the enhanced subsidies for the cost of their coverage.

“If Congress does not reauthorize these subsidies, more than 139,000 Connecticut residents could face significant premium cost increases, and could lose access to coverage,” Commissioner Mais said.

Citing a Georgetown University Center for Health Insurance Research study, Commissioner Mais said 24 million people enrolled in ACA Marketplaces in 2025, more than double the number that enrolled in 2020. Should Congress fail to extend the enhanced premium tax credits, the Congressional Budget Office has estimated that 4.2 million people will become uninsured, according to the study.

Open enrollment for the 2026 coverage year begins November 1, 2025.

Complete details and public comments are available on the Department’s ACA Rate Filings page.

Here's the final breakout of the numbers for both markets: