California: Preliminary avg. unsubsidized 2025 #ACA rate changes: +7.9%; 40K DACA recipients to be eligible for #ACA coverage this fall

via Covered California: (this is actually from nearly a month ago; somehow I missed it at the time):

SACRAMENTO, Calif. — Covered California announced its health plans and rates for the 2025 coverage year with a preliminary weighted average rate increase of 7.9 percent.

The rate change can be attributed to many factors, including a continued rise in health care use, increases in pharmacy expenditures, the rising cost of care, labor shortages and other issues affecting the health care industry.

Because of the robust financial help available to Covered California enrollees, many will see a small impact, if any, to their monthly cost. Covered California, with the support of Gov. Newsom and the California Legislature, has worked to reduce the impact of increased consumer costs in 2025 by providing more support for its state-enhanced cost-sharing reduction (CSR) program, which will eliminate deductibles and lower the cost of care for over a million Californians.

“The stability of Covered California’s marketplace helped us deliver a lower rate change than last year, and the expansion of the state’s innovative cost-sharing reduction program will bring even greater affordability to our consumers in 2025,” said Covered California Executive Director Jessica Altman. “Combined with the continued enhanced federal subsidies through the Inflation Reduction Act, Californians will have more assistance paying for their health insurance than ever before. And with Affordable Care Act coverage now being made available for Deferred Action for Childhood Arrivals (DACA) recipients beginning Nov. 1, a record number of Californians will have access to coverage.”

California’s Individual Market Rate Change for 2025

While increases in the cost of health care continue to drive premium increases, the rates are more than a one-year story.

Over the past five years, these trends — combined with a big jump in enrollment due to the COVID-19 pandemic, increased federal and state subsidies, and implementation of the state penalty for going without coverage — have affected premium levels for Covered California in different ways.

With steady enrollment, a strong marketplace and active negotiations with health insurance carriers to ensure consumers are receiving the best value, Covered California has held the compounded average annual rate increase over the past half decade to just 5 percent.

Table 1: California’s Individual Market Rate Changes

- 2021: 0.5%

- 2022: 1.8%

- 2023: 5.6%

- 2024: 9.6%

- 2025: 7.9%

5-year compounded average: 5.0%

The 7.9 percent increase reflects an average of proposed rates across all health insurers that offer individual plans. Rates can differ greatly by plan and region (see Table 2: Covered California Individual Market Rate Changes by Rating Region and Table 3: California Individual Market Rate Changes by Carrier).

The preliminary rates have been filed with California’s Department of Managed Health Care and are subject to final review and public comment. The final rates will go into effect on Jan. 1, 2025.

New State Funding Leads to Highest Levels Ever of Financial Help in 2025

In 2024, California implemented its first-ever state-funded enhanced cost-sharing reduction (CSR) program. For Californians at or below 250 percent of the federal poverty level, the program improved health care affordability and access to care by eliminating deductibles in all three Silver CSR plans. It also lowered generic drug costs and copays for medical visits and reduced other out-of-pocket costs. To date, over 800,000 Californians have benefited from the program.

This year, Gov. Newsom and the California Legislature increased the amount of state funds available for the enhanced cost-sharing reduction program, appropriating $165 million to expand eligibility for it. As a result, in 2025 Californians with incomes above 200 percent of the federal poverty level (FPL) will be eligible to enroll in an Enhanced Silver 73 plan with no deductibles and reduced out-of-pocket costs, while those under 200 percent FPL will continue to have access to higher levels of benefits. This change will further reduce financial barriers to accessing health care and simplify the process of shopping for health insurance.

For example, a 21-year-old in Los Angeles County at 150 percent of the federal poverty level, or an annual income of $22,590, with an Enhanced Silver 87 plan ** ** will continue to have a $0 premium after subsidies, in addition to prescription drugs as low as $5 per month and no deductibles.

A family of four in Kern County at 325 percent of the federal poverty level, or an annual income of $101,400, with a Silver plan could expect a premium change of about $20 per month, but they would now qualify for Covered California’s expanded cost-sharing reduction Silver 73 plan in 2025. They would have no deductibles, and a visit to their primary care physician would drop from $50 to $35 per visit, among other benefits.

In fact, with the state-enhanced cost-sharing reduction subsidies in place, anyone who chooses a Silver cost-sharing reduction plan with Covered California will have no deductibles.

“With record enrollment in our 11th year, the Affordable Care Act is thriving in California,” Altman said. “Nearly 90 percent of Covered California’s enrollees are receiving financial help, and many are paying $10 or less per month for their health insurance. In 2025, many people who receive financial help will see no change to their monthly premiums, and many more will have their deductibles eliminated entirely.”

Nearly 25 percent of current enrollees are estimated to have a $0 premium in 2025, a jump from 20 percent in 2024. And if their enrollment and income level remain steady, nearly 60 percent of current enrollees will see no change, or they will see a reduction in their monthly premium with the financial help they receive.

Increased Competition, More Consumer Choice

Covered California’s strong enrollment, combined with one of the healthiest consumer pools in the nation, continues to attract health carriers, which has resulted in increased competition and choices that benefit Californians.

In 2025, with 12 health carriers providing insurance across the state, all Californians will have two or more choices, 92 percent will be able to choose three carriers or more and 85 percent will have four or more carriers to choose from.

Some changes for 2025 include Kaiser Permanente’s partial entrance into Monterey County, as Valley Health Plan exits the region. Kaiser will cover 55 percent of the enrollees in Monterey County, which includes 15 ZIP codes[1].

Opportunities for Californians to Enroll in Coverage for 2025

Covered California’s open-enrollment period, when consumers can sign up for coverage for all of 2025, begins on Nov. 1 and runs through Jan. 31, 2025.

While the rate changes and increased choices will not go into effect until coverage begins on Jan. 1, Californians who experience major life events, such as losing health coverage, getting married, having a baby or permanently moving to California, can enroll now during the ongoing special-enrollment period. A full list of qualifying life events can be found here.

Also beginning on Nov. 1, DACA recipients will be able to enroll in Covered California marketplace plans. Estimates indicate there are about 40,000 DACA recipients in Californian who will be newly eligible for coverage. Covered California will also have a special-enrollment period that begins on Nov. 1 that will allow DACA recipients to sign up for a plan throughout the remainder of the year. Those who apply in November can have their plan start as early as Dec. 1.

The Medi-Cal to Covered California Enrollment Program will continue to automatically enroll individuals in one of its low-cost health plans when they lose Medi-Cal coverage and gain eligibility for financial help through Covered California. Through early June of 2024, the program has helped 160,000 ** ** Californians remain insured over the past year.

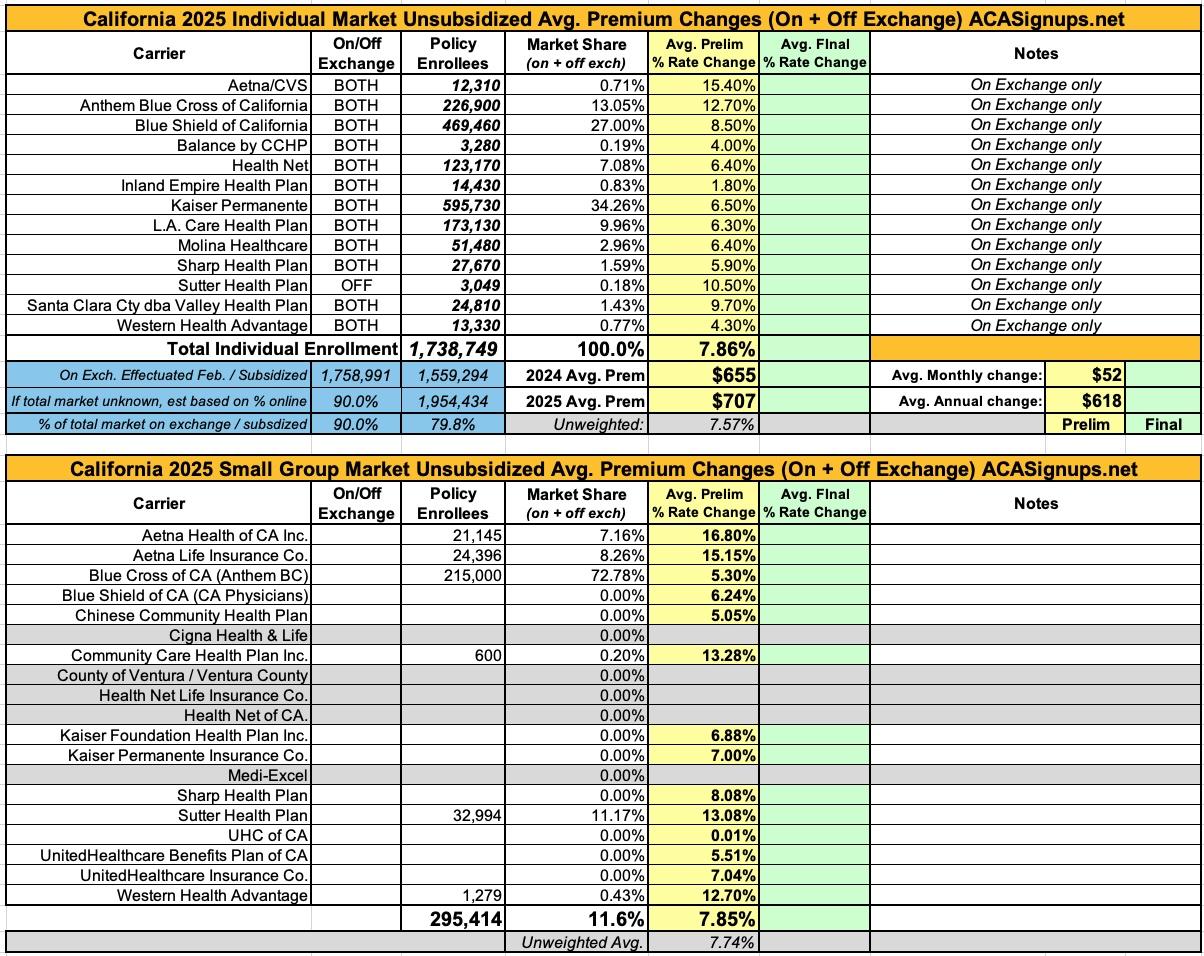

Here's how this looks when plugged into my annual rate filing spreadsheet format. It's important to keep in mind that the enrollment numbers listed for California carriers only include on-exchange enrollment (with one exception: Sutter Health, which only offers plans off-exchange and which is one of only 3 carriers for whom i was able to find off-exchange data for).

However, judging by the other two carriers I was able to find off-exchange data for, it looks like upwards of 90% of California's total ACA-compliant individual market is now on exchange, which makes sense especially given the generous subsidies being provided if you enroll via CoveredCA.

California's small group market is a different story. Unfortunately, I only have enrollment data for about 1/3 of the carriers (the others are all redacted), so I can't compile a weighted average rate hike although the unweighted increase is 7.7%. More interesting to me is that according to the federal Rate Review site, Cigna, Ventury County, Health Net and Medi-Excel are all apparently dropping out of the California small group market entirely? That seems like a lot of carriers to bail at once, so this might just be a matter of their filings not being posted publicly yet?

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.