Connecticut: @AccessHealthCT enrolls 105K QHPs during Open Enrollment; down 2.7% y/y

Access Health CT, Connecticut's state-based ACA exchange, has updated their enrollment summary and now reports 104,946 residents have selected policies for 2021, including 19,056 new enrollees.

Last year they had a total of 107,833 QHP selections during Open Enrollment, so they end the 2021 Open Enrollment Period down 2.7% year over year.

There's no formal press release, so this total might not be official but it should be pretty close.

UPDATE: I've been sent the full powerpoint slideshow from Access Health CT's monthly board meeting, which is chock full of the details; I've pulled the most important ones:

Customer Interactions:

- 313k unique AccessHealthCT.com visitors (Up 37%)

- 258k calls handled through call center (Down 2%)

- 32.6k customer web chat sessions (Up 14%)

- Started OE 8 with 98,874 enrollees (Up 4.6%)

- 104,946 enrolled into a qualified health plan (Down 2.7%)

- 28% eligible for APTC (Up 1.7%), 42% eligible for APTC/CSR (Down 1.5%)

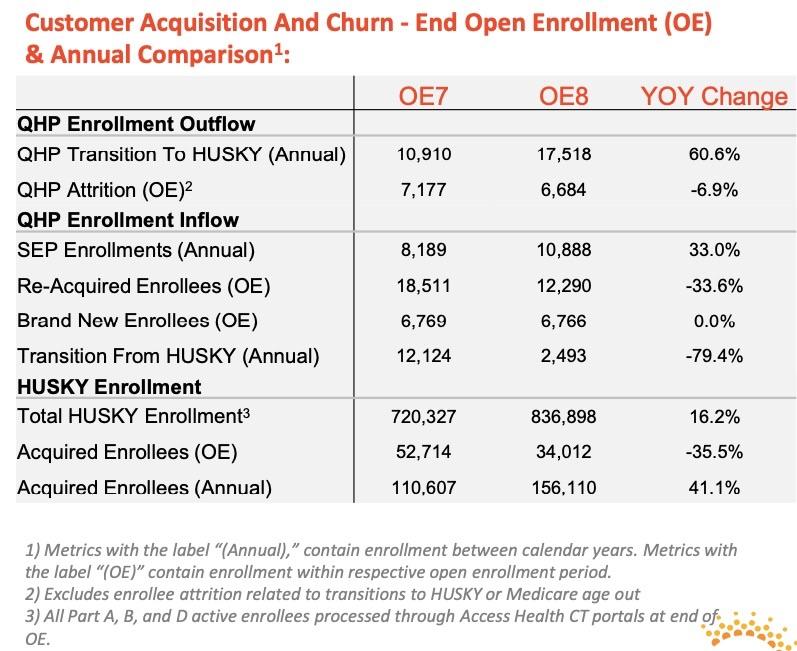

- 34,012 determined eligible and completed application for Medicaid (Down 35%)

Public Health Emergency Efforts and Impact:

- PHE extended by HHS until April 30, 2021.

- No further extension announced by U.S. Department of Health & Human Services yet.

- Over 123k with HUSKY coverage extended since start of PHE.

- Verification requirements extensions continue for enrollees for the duration of the PHE.

- Updated guidance for COVID-Related Tax Relief Act of 2020 underway.

- Planning and strategy needed for eventual PHE end.

I appreciate that they go so far as to break out "new" enrollees between brand new (never had an account) and re-acquired enrollees (which means they were enrolled via an ACA exchange plan at some point in the past, left for awhile and then came back for 2021).

Also worth noting: As expected due to the COVID-19 pandemic, Connecticut saw a 61% increase in exchange enrollees "downshifting" to Medicaid ("HUSKY") this year...6,608 more enrollees saw their incomes drop below the 138% FPL threshold. At the same time, net annual attrition dropped by 7% (as the footnote states, this doesn't include those moving to Medicaid or Medicare).

Demographics:

- Average age of enrollees is 44.4 years old (Up .5 Years)

- 53.5% of enrollees are female (Down .6%)

- Average number of covered enrollees per household is 1.9 (Unchanged)

This is a pretty minor thing but still worth noting: Nationally, the average household size is around 2.5 people...but the average number of enrollees per ACA exchange household is much smaller (in California it's typically averaged just 1.4 people). Plenty of reasons for this, since some members of the household may be covered via other means (Medicaid, CHIP, employer coverage, Medicare, whatever).

Plan Selections and Premiums:

- 44.2% of enrollees associated with a broker (Down 1.8%)

- 46.8% 2021 enrollees selected a silver plan (Up .5%)

- Median monthly gross premium $631 (+$17) / Median monthly net premium $142 (-$9)

- 92.7% retention rate into 2020 policies (Up .7%)

- 56% reduction in high probability detrimental plan selections by new enrollees (87% and 94% CSR enrollment in non-silver plans)

The higher retention rate is consistent with what I've reported in other states so far, and makes sense given the ongoing pandemic.

The last bullet may sound wonky but it's actually not...and it's a very good thing! Basically, as my colleague David Anderson keeps pointing out over at Balloon Juice, most people are terrible at making the wisest choice when it comes to health insurance. The ACA simplified the choices for comprehensive coverage to some degree, but there's still a bewildering array of choices and confusing lingo. As a result, most people don't make optimal selections for their situation.

Furthermore, as my other colleague Andrew Sprung has repeatedly noted, some of the ACA exchange websites are better than others at helping guide enrollees towards the best option. Some of this is deliberate: The whole point of the exchange sites is to provide an unbiased, apples to apples comparison between all of the ACA-compliant options available without promoting any particular carrier over the others.

On the other hand, most people don't understand the implications of many of the choices they're being asked to make (gross vs. net premiums; metal level Actuarial Value; deductibles; co-pays; coinsurance; network width; PPO vs HMO; etc.), so some hand-holding is extremely helpful. This is even more true now that most states have implemented Silver Loading, which can bring the net premium cost of a Gold plan down well below that of a Silver plan... depending on your location and household income level.

This year, Access Health CT apparently overhauled/beefed up their "decision support tool", which is basically the pop-up guide which asks a few nosy questions of the enrollee before they click "Enroll" at the end. This is particularly important for those who earn less than 200% of the Federal Poverty Level, who are almost always better off enrolling in a Silver plan with high Cost Sharing Reduction (CSR) assistance.

CSR cuts down on deductibles and other out of pocket expenses, but only if you earn less than 250% FPL and only if you choose a Silver plan. Unfortunately, many lower-income folks look at the net premiums only and tend to enroll in Bronze plans even though they'd be much better off with a Silver plan w/high CSR (94% or even 87% AV are the equivalent of a Platinum plan).

The improvements made by the CT exchange appear to have cut the number of new enrollees making poor choices by more than half, which is fantastic news.

Post Enrollment Verifications Deadlines

- Due to Public Health Emergency, verification period extended for all enrollees.

- Outstanding verification activity remaining for 15k households

- Easier documentation submission experience for mobile users

- Dedicated website to guide customers available

Outstanding Premium Payments Due

- January policy invoices delivered to enrollees

- 14.9% of 2021 policies currently pending effectuation

- 1095A Preparation

- 86k 1095As to be mailed out by Jan 27th

- Electronic 1095 download available through Access Health CT website

- Dedicated outreach and resolution staff available

It looks like around 85% of 2021 OEP enrollees have been fully effectuated as of this writing; the odds are another 5% will pay their first premium and be effectuated for at least the first month based on past experience.

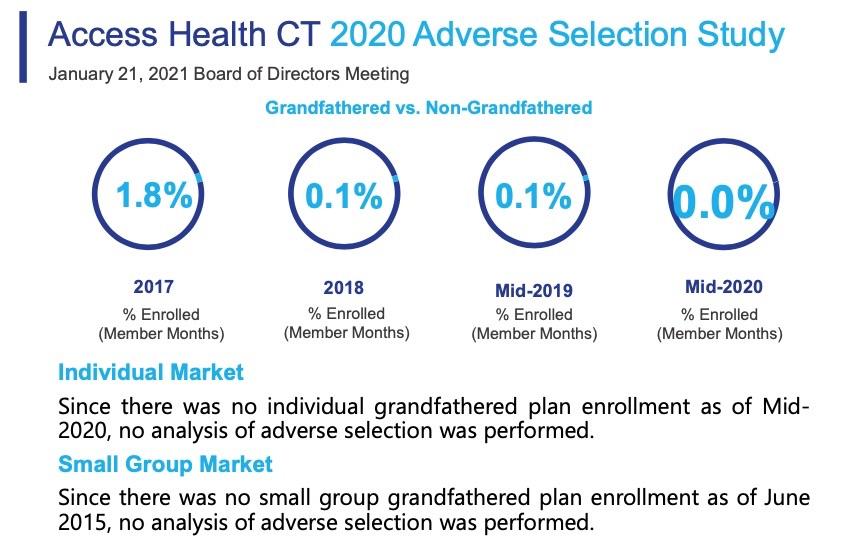

Ahhh, yes: Grandfathered plans. The ACA prohibited anyone from newly enrolling in a non-ACA compliant individual or small group market policy, but anyone already enrolled in one prior to the ACA being signed into law in March 2010 was allowed to remain enrolled in that policy as long as they wanted to if their carrier chose to keep that plan available.

Nationally, this number totalled several million people in 2014, but has dwindled over time as those enrolled in Grandfathered plans moved onto other types of coverage (aging into Medicare; seeing an income drop and moving to Medicaid; getting a job with employer coverage; moving to a subsidized ACA plan; or...dying). As of 2017, the Kaiser Family Foundation pegged the total number of Grandfathered and Grandmothered plans (those enrolled between 2010 - 2013) at around 2.1 million. In 2018 I estimated this had dropped to perhaps 1.7 million.

Well, it's January 2021 now, and in Connecticut at least, it looks like the Grandfathered market is finally completely dead (it was down to just 2,100 or so as of 2018). Connecticut never allowed Grandmothered plans in the first place, so that's that.

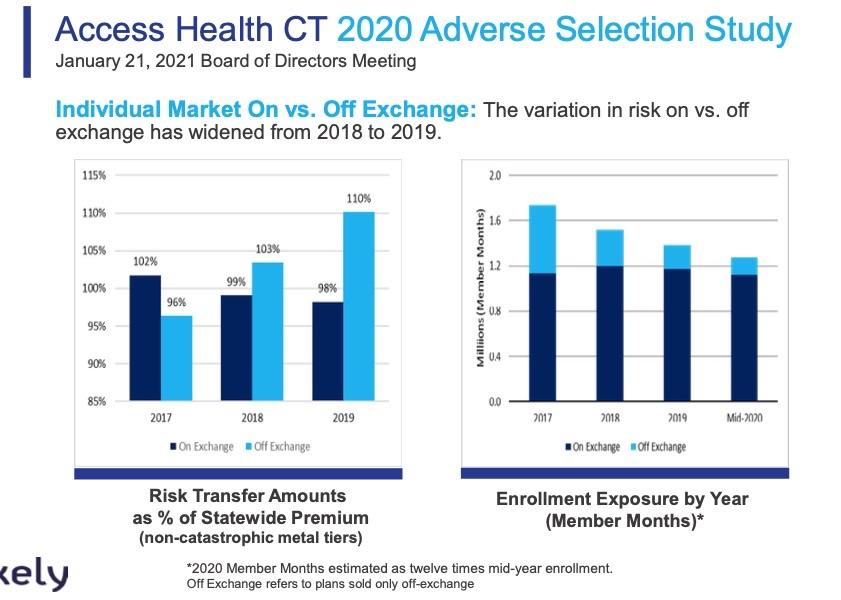

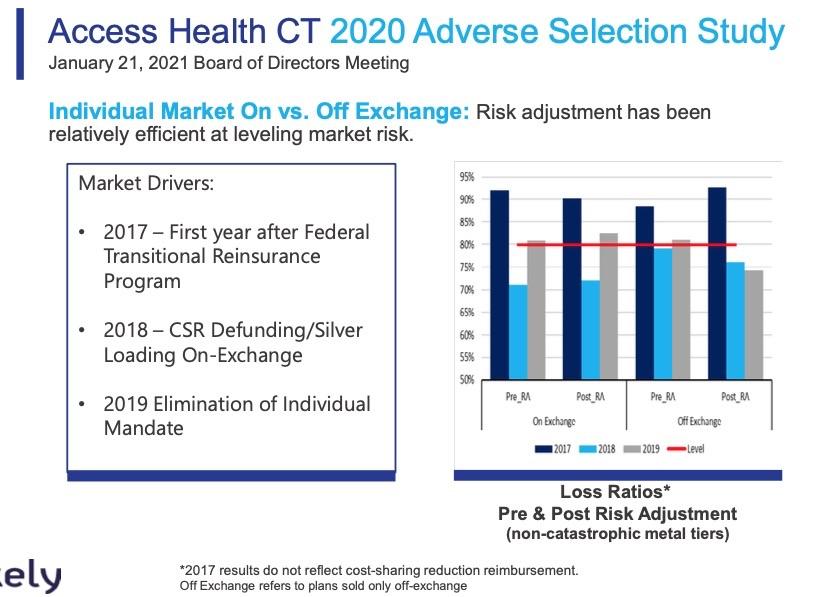

WOW. Both of the bar graphs above are striking, and the first one is new to me. These show how the off-exchange individual market has almost completely collapsed since 2016 as unsubsidized premiums have increased dramatically even as the on-exchange market (mostly subsidized) has hoevered at around the same level over the years. The first chart shows how risk adjustment payments have completely flipped around: In 2017 RA funding was mostly favoring the on-exchange market, but as of 2019 the tables had completely turned.

Conclusions: Individual Market On vs. Off Exchange:

- Higher off exchange risk scores continue to deteriorate as compared to 2018

- On exchange enrollees are of higher average age than off exchange plan enrollees in individual market

- Loss Ratios after consideration of risk adjustment transfers indicates that on exchange enrollees are currently not financially disadvantaged.

Conclusions: Small Group Market On vs. Off Exchange

- Similar to last year, small group on exchange enrollment is low and not fully credible by metal tier

- Can not make any conclusions regarding adverse selection

- Low enrollment should be monitored outside context of adverse selection to ensure sustainability of market

Recommendations: On vs. Off Exchange Adverse Selection

- Monitor overall market enrollment, as the off-exchange market continuing to shrink

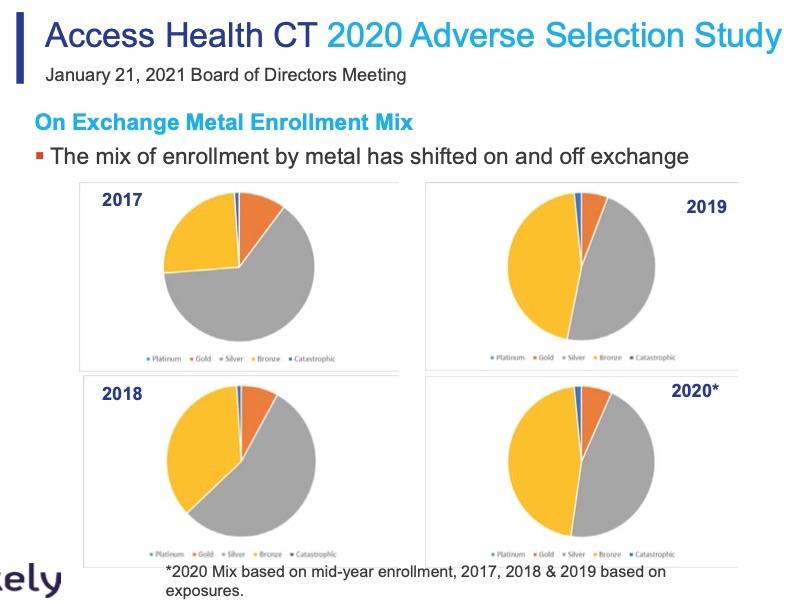

- Review impact of shifting metal option enrollment

- Explore mechanisms for stabilizing the individual and small group markets (1332 Waivers)

There's a few more slides/graphs about the small group market, but I don't really focus much on that and this post is getting pretty long already so I'll skip it for now.

I'll conclude by noting that the Access Health CT board is very much onboard with #MootTheSuit:

Potential Congressional Action to Cure Mandate Issue

Constitutionality of Mandate Issue at Center of California v. Texas

- Save the Mandate by Increasing Penalty Above $0

- Sever the Mandate from other Portions of the ACA

- Strike the Mandate from the ACA

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.