Kaiser Family Foundation supports my 2014 Off-Exchange estimate (not a repeat)

A week or so ago I noted that the new Kaiser Family Foundation monthly tracking poll strongly (if indirectly) supports my estimate of roughly 8.5 million OFF-exchange QHP policy enrollees for 2015 (actually likely closer to 8.6 - 8.7 million by now).

Today, they follow up with another new report which gives more direct off-exchange enrollment numbers for 2014:

As of the end of open enrollment in 2014, 8 million people had signed up for coverage through the Marketplaces. Accounting for the fact that some of those people did not pay their premiums or subsequently dropped coverage – and for signups through special enrollment periods throughout the year – 6.7 million people were insured through marketplace plans as of October 15, 2014. However, it has been unclear precisely how many of these Marketplace enrollees were previously uninsured or how many would have purchased individual coverage directly from an insurer in the absence of the ACA.

Kaiser Family Foundation analysis of recently-submitted 2014 filings by insurers to state insurance departments (using data compiled by Mark Farrah Associates) shows that 15.5 million people had major medical coverage in the individual insurance market – both inside and outside of the Marketplaces – as of December 31, 2014. Enrollment was up 4.8 million over the end of 2013, a 46% increase.

OK, so 6.7 million as of 10/15/14. As I've noted on both the 2014 and 2015 Graphs, that likely dipped down slightly more by December to around 6.6 million.

If 15.5 million total had private individual market coverage in December, that means around 8.9 million of those were off-exchange enrollees.

But wait--isn't this much higher than the 8.0 million off-exchange number I was estimating as of last April (2.3 million documented + another 5.7 million estimated)?

Yes...and in fact, the odds are very high that those 8.0 million QHPs likely dropped down to perhaps 6 million as well by the end of the year, just as the exchange-based policy enrollments dropped. That leaves around 3 million additional policy enrollees unaccounted for, right?

HOWEVER, the key point here is "QHPs". Remember, the entire private individual market also includes several million non-ACA compliant policies off of the exchanges: Grandfathered policies (ie, those which were already in place prior to the ACA being signed into law in 2010) as well as the "Transitional" or "Grandmothered" policies which were unexpectedly created as a response to the "If you like your plan you can keep it" brouhaha back in November 2013.

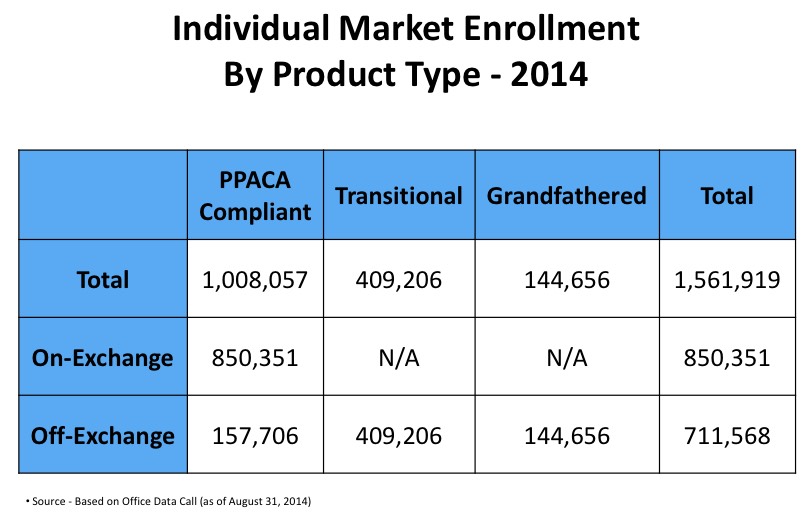

I don't know the exact number of non-compliant policies still enrolled in nationally as of the end of 2014, but in Florida, at least, as of August 31, 2014 here's how it broke out:

That's a total of 553,862 non-compliant policy enrollees out of 1,561,919 total (on+off exchange combined), or about 35% of the total. Nationally, that would be 5.4 million out of 15.5 million. However, just as the exchange enrollments dropped from 7.1 million in August down to 6.6 million by December, this 5.4 million likely dropped to around 5.0 million even by then as well.

This is still much higher than my 3 million estimate above...except that 16 states didn't allow transitional plans at all, though they do allow Grandfathered policies. This includes some large states such as California, New York, Virginia, Washington State and (surprisingly) even Texas. In fact, states making up 41% (3.3 million) of the total 2014 exchange-based enrollments didn't allow for transitional policies.

Now, I have no idea whether the transitional/grandfathered policy ratios in other states are similar to Florida's, but assuming they are, that would mean that:

- 74% of non-compliant polices would be Transitional (vs. Grandfathered)

- 74% x 41% = about 30% of all off-exchange policies would have to be subtracted from the 2014 total

...which would bring the total number of off-exchange, non-ACA compliant policies down from 5.4 million to 3.5 million. This is still higher than the 3 million number I'm estimating above, but it's at least in the rough range. And again, this is all making a lot of assumptions about Florida being representative, etc.

Anyway, at the end of 2014, it looks like the individual insurance market broke out something like:

- 6.6 million ACA exchange QHPs

- 6.0 million off-exchange QHPs/ACA compliant

- 1.8 million off-exchange "transitional"

- 1.1 million off-exchange "grandfathered"

...give or take.

There's a bunch of other interesting data-nerd stuff in the Kaiser report, including a bunch of state-level data, so check it out!

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.