KFF: Employer Coverage Premiums break ~$9.3K/yr per enrollee. How's that compare to the ACA?

In the middle of the ongoing 2026 ACA Tax Credit Expiration Crisis, healthcare think tank KFF (formerly the Kaiser Family Foundation) published the annual update to their Employer Health Benefits Survey analysis, finding that...

Annual Family Premiums for Employer Coverage Rise 6% in 2025, Nearing $27,000, with Workers Paying $6,850 Toward Premiums Out of Their Paychecks

- More of the Largest Firms Cover GLP-1s for Weight Loss, and Use Is Higher Than Expected; Some May Be Limiting Coverage

Family premiums for employer-sponsored health insurance reached an average of $26,993 this year, KFF’s annual benchmark health benefits survey of large and smaller employers finds. On average, workers contribute $6,850 annually to the cost of family coverage, with employers paying the rest.

Family premiums are up 6%, or $1,408, from last year, similar to the 7% increase recorded in each of the previous two years. This year’s increase compares to general inflation of 2.7% and wage growth of 4% over the same period.

Over the past five years, the cumulative increase in family premiums (26%) and in what workers pay toward family premiums (23%) is similar to inflation (23.5%) and wage growth (28.6%).

Many employers may be bracing for higher costs next year, with insurers requesting double-digit increases in the small-group and individual markets on average, possibly foreshadowing big increases in the large-group markets as well. Employers continue to single out drug prices as a factor contributing to higher premiums in recent years.

There's a lot more in both the press release as well as in the actual survey results, but I want to take a moment to compare the Employer-Sponsored Insurance market (ESI), which provides healthcare coverage for 154 million Americans, with the ACA Individual market (ACA), which currently provides healthcare coverage for around 22.7 million people (not including the ~1.8 million enrolled in Basic Health Plan coverage in MN/NY/OR).

I know the KFF headline and lede are all about family coverage, but for my purposes I'm going to limit myself to single worker/single enrollee coverage because comparing family coverage can get a bit messier.

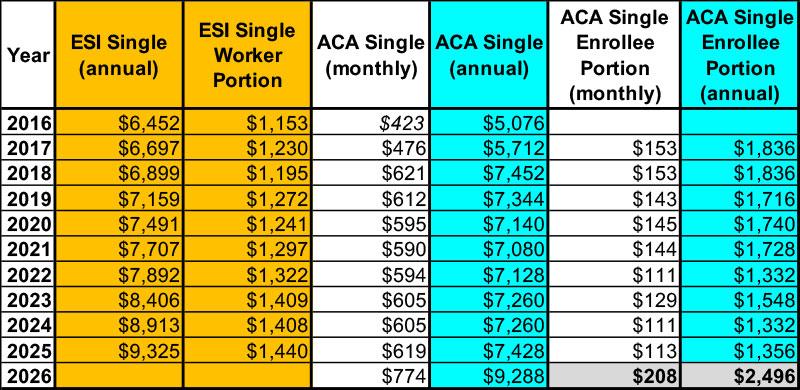

For Worker Only ESI coverage, I'm using KFF data from their annual EHB Survey. This goes back to 1999 but the ACA didn't overhaul the Individual market until 2014...and unfortunately I don't have reliable data on the average premiums for ACA enrollees prior to 2016, so that's where I'm starting.

ACA data also comes from KFF for 2017 - 2025, although they got it from the Centers for Medicare & Medicaid Services (CMS). For 2016 I reverse-engineered the 12.5% average rate hike I had estimated myself for 2017, and for 2026 I've estimated the weighted average to be a whopping 25.1% increase to $774/month (the actual average could be different).

To calculate what I estimate will end up being the average enrollee NET premiums for actual enrollees in 2026 ("enrollee portion"), I'm once again relying on KFF:

- KFF estimates that net premiums will more than double to $1,904/year for the ~92% of enrollees currently receiving federal APTC assistance

- For the remaining 8% who are already paying full price, they'd see their average premium increase ~25% to $9,288/year

- The combined average comes in at around $2,496/year...84% higher than the 2025 average overall.

Unfortunately I have no idea what average ESI premiums will be in 2026 and won't until a year from now.

Here's what all of this looks like...

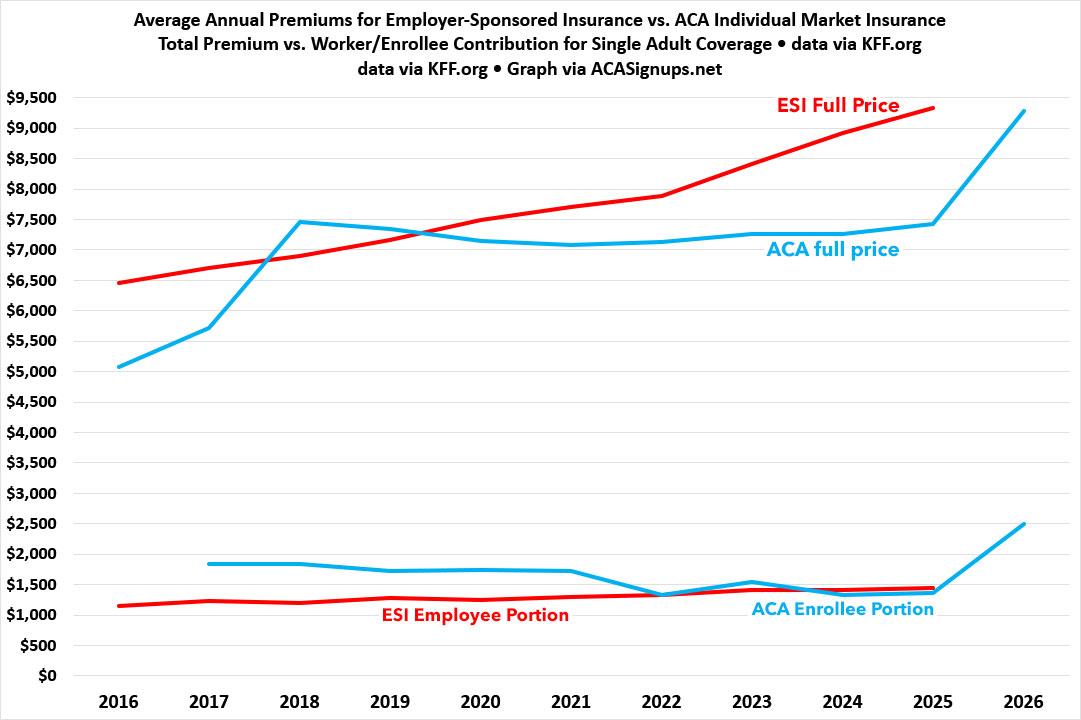

...and here's what it looks like visually:

As you can see, when looking strictly at premiums only, full-price (gross) ACA policies have actually cost considerably less than average ESI policies since 2019.

Meanwhile, the net premiums paid by ACA exchange enrollees used to be considerably higher than the portion paid by ESI enrollees until after the enhanced ACA tax credits went into effect 5 years ago; since then they've run virtually neck & neck...

...until 2026, of course, when ACA policy costs are expected to explode, with gross premiums jumping 25% and net premiums jumping 84%* on average.

*Again, KFF says it's 114% but that only applies to the 92% of current enrollees receiving tax credits; it drops to 84% overall when unsubsidized enrollees are included as well.

Interestingly, even that 25% average gross increase will still leave full-price ACA premiums slightly lower ($9,288/yr) than avg. full-price ESI premiums ($9,235)...and that's before whatever the 2026 ESI increases bring.

Of course, there's a vitally important caveat to this: Deductibles and other out-of-pocket expenses.

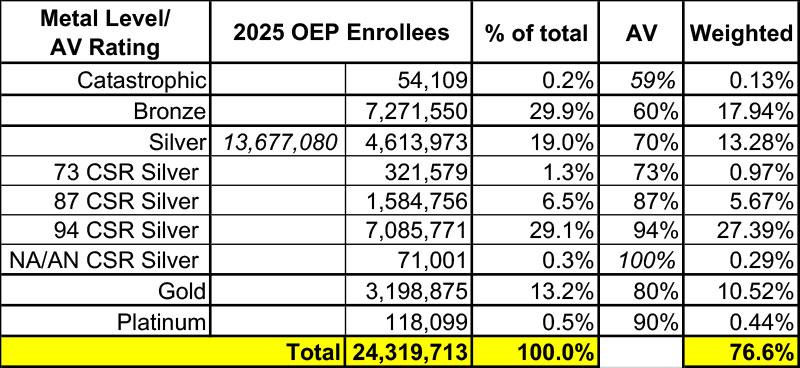

The Actuarial Value (AV) of a healthcare policy is, generally speaking, what percentage (in aggregate) of total healthcare claims that the plan provides coverage for.

Officially, ACA exchange plans have AVs of 60%, 70%, 80% or 90% (Bronze, Silver, Gold, Platinum), although more realistically they can run up to 94% AV in practice (a High-CSR Silver plan).

Using the 2025 OEP Public Use File, (and with an assist from Dave Anderson), the weighted average AV for current ACA exchange enrollees looks to be around 76.6% overall:

Meanwhile, according to this Dept. of Labor study from September 2024, ESI coverage averaged around 84.2% AV in 2021:

The following tables (Tables 6-14) show the average actuarial values by various plan characteristics for innetwork coverage. The overall average in-network actuarial value for 2021 was 0.842, meaning that on average, employer sponsored plans paid 84.2% of covered charges.

I'm assuming that this has probably dropped slightly since then, but is presumably still somewhere in the low-80% range.

In other words, average ESI premiums are higher than average ACA premiums, but ESI plans also cover perhaps 6 - 7% more of typical medical claims than ACA plans on average.

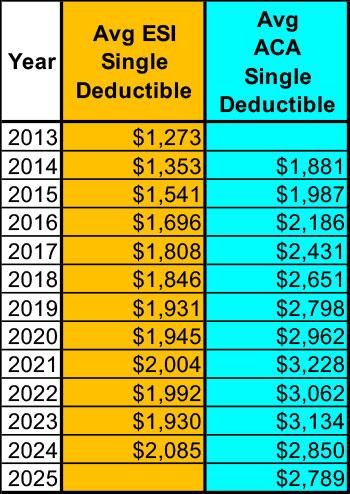

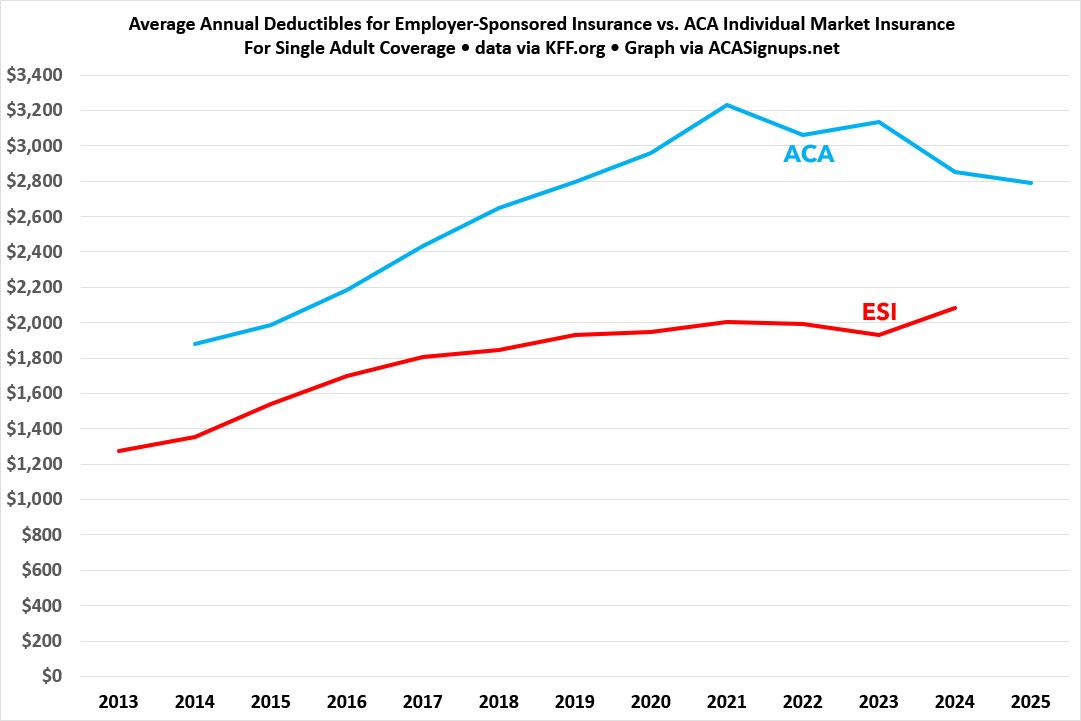

With that in mind, here (again, via KFF) is the average single enrollee deductible for ESI vs. ACA plans over the years:

Again, there's a number of additional caveats & disclaimers which I haven't included, but the larger point is that at least as of today, ACA exchange coverage is neither dramatically more expensive or significantly less expensive than comparable employer-sponsored coverage.

Premiums are about 27% lower at the moment while deductibles & other out-of-pocket costs were around 36% higher last year...but overall it seems to be pretty much a wash.

We'll see what happens starting in January, of course...