Minnesota: As Federal Law Pushes Health Premiums Up, MN Acts to Protect Consumers

via the Minnesota Commerce Dept:

State Highlights Rising 2026 Health Insurance Rate Proposals

SAINT PAUL, MN: Minnesotans are facing unnecessarily higher health insurance rate hikes, and the blame lies with new Republican-led federal policy changes passed in Washington, says Minnesota Commerce Commissioner Grace Arnold.

“While HR1 has been dubbed the “One Big Beautiful Bill” by Republicans, many in our state will find nothing beautiful in health insurance premium increases they’ll experience for 2026,” Arnold said. “These will be the highest rate hikes since 2017 for individual and group markets.”

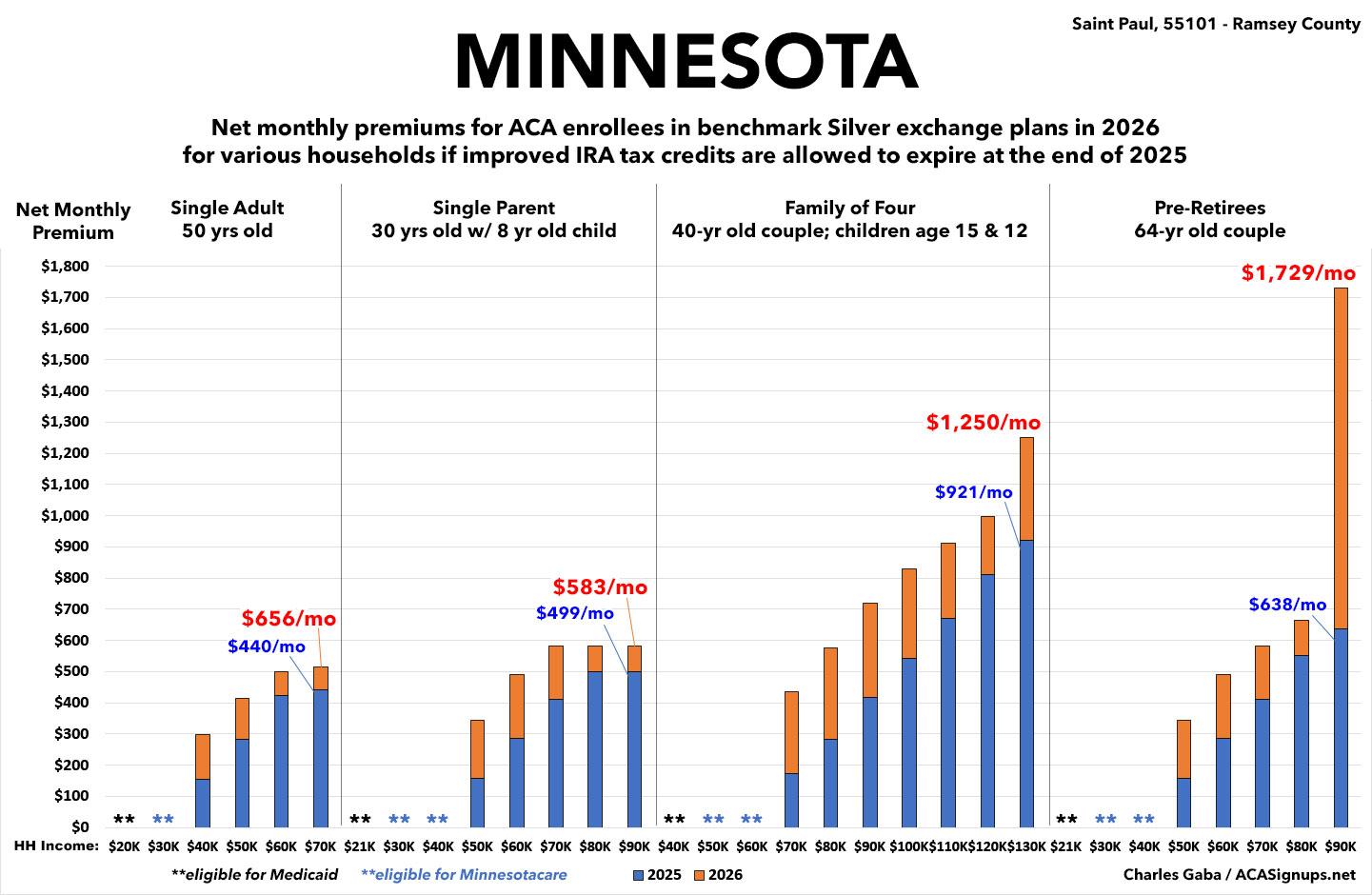

Proposed health insurance rates range from 7% to 26% in the individual market, and 7% to 17% in the small group market. Arnold said that what people pay may be felt even more deeply when purchasing a policy for 2026 due to the enhanced Advanced Premium Tax credits expiring—a direct consequence of the new federal law. The federal legislation raises out-of-pocket costs, diminishes the value of insurance plans, and removes the ability of thousands of Minnesotans to automatically renew their insurance.

The rising rates are a reaction to the instability and uncertainty in our healthcare system and are exacerbated by the federal policy. Insurance companies are already pricing in the expected consequences of the new law and the loss of enhanced federal subsidies.

Arnold said in contrast to the actions in Washington, Minnesota has acted quickly to protect families and small businesses by extending a reinsurance program that offsets high-cost claims and stabilizes premiums in the individual market. Without the Minnesota Premium Security Plan, premiums would be 25% higher, on average.

“This program has strong bipartisan support here, and it shows what can be done when we put people before politics,” Arnold said.

Minnesotans are urged to remain informed as the rate review process continues. While these are proposed rates, final approved rates will be released by October 1. Commerce reviews all rate filings to ensure compliance with state and federal law.

In the coming months, Commerce will talk with Minnesotans around the state about what these increases will mean for them.

As an aside, I should note that Minnesota's reinsurance program is helpful for unsubsidized enrollees but doesn't do anything to help subsidized enrollees (in this case, primarily those who earn between 200 - 400% FPL). In fact, most state-based reinsurance programs as currently structured actually increases the net premiums paid by enrollees in that income bracket to some degree due to them reducing federal subsidies overall.

However, this gets pretty wonky and messy, so I'm not gonna criticize too much. Besides, aside from New Mexico (which is backfilling 100% of the lost subsidies for 85% of their enrollees), Minnesota is actually the state which should see the least-dramatic net premium hikes due to the federal subsidies expiring.

It's still gonna be painful, mind you, just not nearly as bad as other states.