Where do things stand re. IRA subsidies being extended anyway?

According to Inside Health Policy's Amy Lotven & Sigi Ris, it's not looking great at the moment:

GOP Reportedly Rejects APTC Offer; Wyden Signals He’s Open To Compromise

Senate Finance Chair Ron Wyden (D-OR) Tuesday suggested he may be open to changes to the enhanced Affordable Care Act premium tax credits in order to get Republicans on board an extension of the policy that has been in effect since 2021 and will expire at the end of 2025 without congressional action.

Democrats had proposed one way of giving a hand to families that have fallen through the cracks when it comes to health care, Wyden said of the APTC extension. “If Republicans don’t care for that approach, they oughtta come back and say, ‘here’s what we’d like to do instead,” or else we'll just make the assumption they’re not interested,” he said.

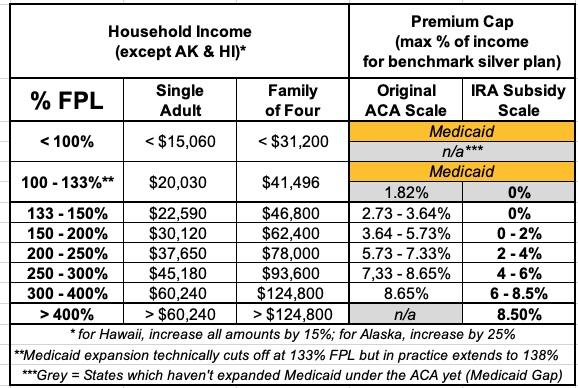

Wyden spoke to reporters following reports that the GOP had rejected Democrats’ offer to work on a one-year extension of the credits, which make $0 premium plans available to people earning up to 150% of poverty and limit the premium contribution for other Americans to no more than 8.5% of monthly income. The subsidies are seen as a key reason ACA enrollment hit record levels last year and is on track to do so again. Democratic lawmakers and numerous stakeholders are rallying to maintain the credits, and stakeholders have said action is needed as soon as possible to provide certainty to insurers, who need to know the status of the credits when they develop rates, and to consumers. While the GOP has opposed the credits, some consultants have suggested the parties could come to agreement if the credits are revamped or if Democrats offer other policy concessions.

Update 12/14/24: On the other hand, according to VIctoria Knight at Axios...

...Republican negotiators this week rejected an offer by Democrats to wrap a one-year extension of the ACA subsidies into a year-end health package.

But GOP senators over the past week acknowledged the issue could resurface next year.

...What they're saying: Incoming Senate Finance Committee Chairman Mike Crapo (R-Idaho) said the subsidies could be included in the expedited budget reconciliation process planned for early next year.

"What I can tell you is that everything is on the table," he said. "I don't know that that's been singled out yet, at least not in my deliberations."

Soon-to-be Senate health committee Chairman Bill Cassidy (R-La.) said it was "kind of premature" for him to discuss prospects but said, "It might be on the table."

...Ways and Means Committee Chairman Jason Smith (R-Mo.) refused to answer when asked twice whether there's been talk of ACA subsidy extensions in reconciliation.

House Budget Committee Chairman Jodey Arrington (R-Texas) responded, "Hell no" when asked if he could envision subsidy extensions.

Still, even House Freedom Caucus members like Rep. Chip Roy (R-Texas) see the need for health care, if not necessarily ACA subsidies, to be a part of the reconciliation discussion.

...The bottom line: That could mean a return of some of the health care plans conservatives have touted that don't provide coverage as comprehensive as ACA plans.

One bit from the Axios piece which truly made my jaw drop was this snippet, however:

Some Republicans characterize them as taxpayer-funded handouts to health insurance companies.

Wow. Just...wow. The same people who adamantly oppose expanding traditional (ie, publicly administered) Medicare or Medicaid while pushing to expand privately administered Medicare & Medicaid (Med Advantage & MCOs...aka "taxpayer-funded handouts to health insurance companies") oppose "taxpayer-funded handouts to health insurance companies." Amazing.

As for that last line ("a return of plans that don't provide coverage as comprehensive as ACA plans"), you know what that means...

In any event, it's important to keep in mind that the subsidies could be extended at anytime over the next year since they aren't scheduled to expire until 12/31/25. In fact, the subsidy upgrade itself, which was originally included for 2 years as part fo the American Rescue Plan Act, was actually made retroactive to the beginning of 2021 (the ARPA was passed & signed into law in March 2021).

However, since insurance carriers generally start the actuarial process to figure out their pricing & product offerings for the following year in March or April, that means if an extension of the improved subsidies isn't passed & signed into law by then, they'll have to operate on the assumption that they won't be extended beyond 2025, and will price their 2026 offerings accordingly...which would likely include an additional 4.3% average rate hike purely due to the subsidies not being extended, according to the CBO.

As for any changes to the tax credit upgrade, there's a lot of elbow room to discuss (assuming GOP lawmakers are interested in discussing it at all). Again, here's a side-by-side comparison of the original ACA subsidy formula vs. the IRA's upgraded version:

One possibility would be to revert back to the old formula without reinstating the 400% FPL Subsidy Cliff. This would mean that 8.65% would be the maximum that any household would pay for the benchmark Silver plan. This would be a huge relief for middle-class enrollees, but would still be pretty devastating for everyone earning less than 4x the Federal Poverty Level.

Another possibility would be to keep the subsidies where they're at under the IRA, but to reinstate the Cliff at a higher level--say, 800% FPL or whatever.

They could also split the difference between the original subsidy brackets and the current ones. For instance, for enrollees earning 150-200% FPL, the original premium cap ranged from 3.64 - 5.73% of income, while the IRA cap ranges from 0 - 2%. I could see them compromising on a range from, say, 2 - 4% in that income range or whatever.

Stay tuned...