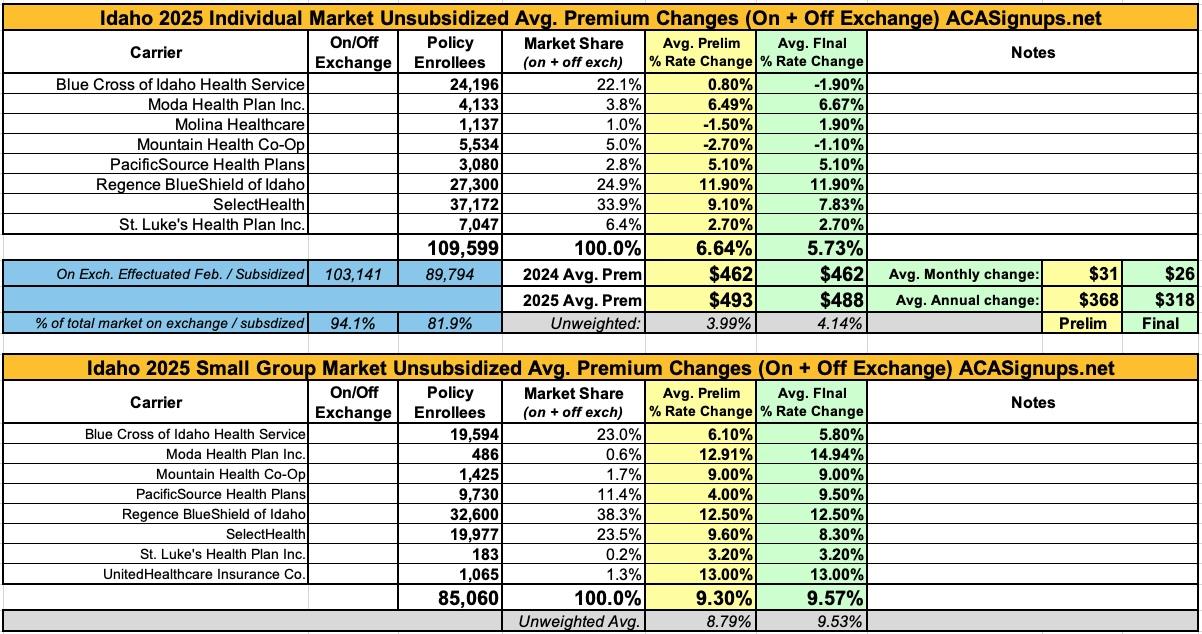

Idaho: *Final* avg. unsubsidized 2025 #ACA rate changes: +5.7%

Originally posted 8/14/24

via the Idaho Dept. of Insurance:

Each year, the Idaho Department of Insurance posts rate changes of individual and small group health insurance products so consumers can review and provide comments on the proposed increases. Insurance companies submit proposed rates for the upcoming calendar year to the Department, along with descriptions and justifications for why the rates are reasonable and not excessive. The Department of Insurance is seeking public input for rate changes of individual and small group health insurance products to improve insurer accountability and transparency. By following the links below, the public can access a summary of the increase amounts and the carrier justifications for the rates. Please submit any comments to the Department for consideration.

Preliminary Rates - 2025

Please choose one of the categories to proceed:

Idaho Rate Review Individual

This is the summary page for 2025.

The Department of Insurance receives preliminary health plan information for the following year from insurance carriers by June 1 and reviews the proposed plan documents and rates for compliance with Idaho and federal regulations.The Department of Insurance does not have the authority to set or establish insurance rates, but it does have the authority to deem rate increases submitted by insurance companies as reasonable or unreasonable. After the review and negotiation process, the carriers submit their final rate increase information.The public is invited to provide comments on the rate changes. Please send any comments to Idaho Department of Insurance.

A key driver of increases is generally the level of health claims paid compared to the premium collected. The table below shows the level of claims paid and premium collected by each insurance company for ACA-compliant health benefit plans during 2023. In addition to claims paid, the premium needs to cover the company’s administrative costs, insurance fees, and taxes. Those costs generally consume around 20 percent of the premium. Larger rate increases may be needed when the prior year’s premium is not sufficient to pay for health claims and administrative costs and fees.With its rate increase submission, each insurance company submits a consumer-oriented explanation of the increase, which is available by clicking on the name of the insurance company in the table below.

Each health benefit plan has an associated “metal level” of Bronze, Silver, Gold, or Catastrophic and offers, at a minimum, Idaho's Essential Health Benefits package.The metal level is assigned based on the policyholder's "cost-sharing," which includes any deductibles, coinsurances, copays, and out-of-pocket maximums. A Silver plan usually will have lower cost-sharing than a Bronze plan, and a Gold plan will usually have lower cost -sharing than a Silver plan.However a Gold plan usually has a higher monthly premium than a Silver plan, and a Silver plan usually has a higher monthly premium than a Bronze plan. Policyholders are able to choose which metal level and which plan within that metal level best works for them.

It's important to note that Idaho's rate filing summary tables don't actually quite match up with the actual rate filings themselves. For instance, the state DOI not only rounds off all rate changes to the nearest percent (instead of tenths or hundredths of a percent as the filings state), in some cases they're actually off by nearly a full point.

UPDATE 10/02/24: The Idaho DOI has posted the final/approved rates for 2025 for the individual and small group markets. In the end, individual market rates are going up slightly less than requested (5.7% vs. 6.6%), while small group plans are increasingly just a tad more than carriers asked for (9.6% vs. 9.3%):

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.