Michigan: Gov. Whitmer signs #ACA "Blue Leg" protections into law, scratches off half my healthcare wish list!

Back in February, I posted an updated & overhauled version of my Michigan healthcare legislative wish list for the newly-elected Democratic majorities in my home states House and Senate.

The list includes 9 major items (some of which actually include a lot more than one provision within them). It really should include ten, since I forgot about implementing a Basic Health Plan program like New York and Minnesota have (and as Oregon is ramping up to do soon as well), but it's still a pretty full plate.

The second and third items on the list included:

- Locking in the ACA's $0-cost sharing preventative services requirement (in light of the ongoing Braidwood vs. Becerra federal lawsuit), and...

- Locking in the ACA's other "blue leg" patient protections such as guaranteed issue, community rating, gender equality, essential health benefits and so forth.

Neither of these require any funding from the state, nor do they require establishing any new administrative structures; they simply codify existing ACA protections at the state level just in case any of them are ever struck down federally. These are basically among the lowest-hanging fruit on my list.

In June, David Eggert of Crain's Detroit Business reported that Michigan Democrats were indeed working to scratch several items off my list: House Bills 4619 - 4623 and Senate Bills 356, 357 & 358.

I'm happy to say that this week, Michigan Governor Gretchen Whitmer signed all eight of them into law!

Here's the descriptions of each of them again:

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 2027. Unfair methods of competition and unfair or deceptive acts or practices in the business of insurance include:

(a) Refusing to insure, refusing to continue to insure, or limiting the amount of coverage available to an individual or risk because of any of the following:

(i) Race, color, creed, marital status, sex, national origin, gender, gender identity or expression, or sexual orientation, except that marital status may be used to classify individuals or risks for the purpose of insuring family units.

(ii) The residence, age, disability, or lawful occupation of the individual or the location of the risk, unless there is a reasonable relationship between the residence, age, disability, or lawful occupation of the individual or the location of the risk and the extent of the risk or the coverage issued or to be issued, but subject to subparagraph (iii). This section does not prohibit an insurer from specializing in or limiting its transactions of insurance to certain occupational groups, types, or risks as approved by the director. The director shall approve the specialization for an insurer licensed to do business in this state and whose articles of incorporation contained a provision on July 1, 1976, requiring that specialization.

(iii) For property insurance, the location of the risk, unless there is a statistically significant relationship between the location of the risk and a risk of loss due to fire within the area in which the insured property is located. As used in this subparagraph, "area" means a single zip code number under the zoning improvement plan of the United States Postal Service.

(b) Refusing to insure or refusing to continue to insure an individual or risk solely because the insured or applicant was previously denied insurance coverage by an insurer.

(c) Charging a different rate for the same coverage based on race, color, creed, marital status, sex, national origin, gender, gender identity or expression, sexual orientation, age, residence, location of risk, disability, or lawful occupation of the risk unless the rate differential is based on sound actuarial principles and a reasonable classification system, and is related to the actual and credible loss statistics or, for new coverages, reasonably anticipated experience. This subdivision does not apply if the rate has previously been approved by the director.

The main point here is the addition of gender identity/expression and/or sexual orientation to the list of discrimination prohibited, but it also tacks on race, color & creed, which I find noteworthy because I assumed those were already covered by existing racial discrimination laws at the state and/or federal level. Still a good idea to throw them in there, though.

The prohibition on age discrimination (subject to "sound actuarial principles") is interesting since the ACA's age band limits premium variances to no more than a 3:1 ratio nationally. It's also interesting that they kept the "reasonably anticipated experience" wording while limiting that to newly covered enrollees only.

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 3406z. (1) An insurer that delivers, issues for delivery, or renews in this state a health insurance policy shall not limit or exclude coverage for an individual by imposing a preexisting condition exclusion on the individual.

(2) This section does not apply to any of the following:

- (a) A grandfathered health plan that provides individual health insurance coverage.

- (b) Insurance coverage that provides benefits for any of the following:

- (i) Hospital confinement indemnity.

- (ii) Disability income.

- (iii) Accident only.

- (iv) Long-term care.

- (v) Medicare supplemental.

- (vi) Limited benefit health.

- (vii) Specified disease indemnity.

- (viii) Sickness or bodily injury, or death by accident, or both.

- (ix) Other limited benefit policies.

(3) As used in this section, "preexisting condition exclusion" means a limitation or exclusion of benefits or a denial of coverage based on a physical or mental condition being present before the effective date of coverage or before the date coverage is denied, whether or not any medical advice, diagnosis, care, or treatment was recommended or received for the condition before the date of coverage or denial of coverage.

Pretty cut & dried. Pre-ACA grandfathered major medical policies as well as indemnity and other limited-benefit policies are excluded, but otherwise this scratches off "Guaranteed Issue."

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 3403. (1) An insurer that delivers, issues for delivery, or renews in this state a health insurance policy that makes dependent coverage available under the health insurance policy shall do all of the following:

- (a) Offer the dependent coverage, at the option of the policyholder, until the dependent is 26 years of age.

- (b) Provide the same health insurance benefits to a dependent child that are available to any other covered dependent.

- (c) Provide health insurance benefits to a dependent child at the same rate or premium applicable to any other covered dependent.

- (d) Include both of the following provisions in the health insurance policy:

- (i) That the health insurance benefits applicable for children are payable with respect to a newly born child of the insured from the moment of birth.

- (ii) (b) That the coverage for newly born children consists of coverage of injury or sickness including the necessary care and treatment of medically diagnosed congenital defects and birth abnormalities.

(2) Subject to subsection (4), a health insurance policy that offers dependent coverage for a dependent child shall offer the coverage, at the option of the policyholder, for a dependent child with a disability, regardless of the age of the child.

(3) A health insurance policy that offers dependent coverage shall not deny enrollment to an insured's child on any of the following grounds:

- (a) The child was born out of wedlock.

- (b) The child is not claimed as a dependent on the insured's federal income tax return.

- (c) The child does not reside with the insured or in the insurer's service area.

- (4) A parent shall furnish proof of a dependent child's disability to the insurer within 30 days after the dependent child attains 26 years of age and, subject to this subsection, subsequently as may be required by the insurer. After the dependent child attains 28 years of age, the insurer shall not require proof of the disability more than once a year.

This covers the "young adults can stay on their parents plan until age 26" clause of the ACA, with the addition of the "dependent child w/a disability regardless of age" section, which makes sense (I don't think this is included in the ACA at the federal level but could be wrong).

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 3406z. An insurer that delivers, issues for delivery, or renews in this state a health insurance policy shall not institute either of the following:

- (a) Lifetime limits on the dollar value of benefits for an insured.

- (b) Annual limits on the dollar value of benefits for an insured.

Boom. That covers annual/lifetime benefit limits (prior to the ACA, there were cases of premature infants maxing out their lifetime coverage limits before they even left the hospital).

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 3406z. (1) An insurer that delivers, issues for delivery, or renews in this state a health insurance policy shall provide coverage for all of the following:

- (a) Ambulatory patient services.

- (b) Emergency services.

- (c) Hospitalization.

- (d) Pregnancy, maternity, and newborn care.

- (e) Mental health and substance use disorder services, including behavioral health treatment.

- (f) Prescription drugs.

- (g) Rehabilitative and habilitative services and devices.

- (h) Laboratory services.

- (i) Preventive and wellness services and chronic disease management, as specified by an annual order of the director. The coverage required under this subdivision, as specified by the director's order, includes, but is not limited to, all of the following:

- (i) Evidence-based items or services that are highly recommended for preventive care and wellness purposes. As used in this subparagraph, "highly recommended" means that the director has determined there is a high certainty the net benefit of the item or service is substantial or moderate or there is a moderate certainty the net benefit is moderate to substantial after consideration of the recommendations issued by the United States Preventive Services Task Force, or a similar organization recognized by the director.

- (ii) Immunizations that the director determines are recommended with respect to the individual involved after consideration of recommendations from the Advisory Committee on Immunization Practices of the Centers for Disease Control, or a similar organization recognized by the director.

- (iii) With respect to infants, children, and adolescents, evidence-informed preventive care and screenings that the director determines are supported by the Health Resources and Services Administration, or a similar organization recognized by the director.

- (iv) With respect to women, additional preventive care and screenings not described in subparagraph (i) that the director determines are supported by the Health Resources and Services Administration, or a similar organization recognized by the director.

- (j) Pediatric services, including oral and vision care.

(2) An insurer that delivers, issues for delivery, or renews in this state a health insurance policy shall not impose any cost-sharing requirements for benefits provided under subsection (1)(i).

(3) Benefits provided under subsection (1) are subject to all requirements applicable to those benefits under this chapter.

(4) This section does not limit the requirements to provide additional benefits under this chapter.

Sec. 3501. As used in this chapter:

- (a) "Affiliated provider" means a health professional, licensed hospital, licensed pharmacy, or any other institution, organization, or person that has entered into a participating provider contract, directly or indirectly, with a health maintenance organization to render 1 or more health services to an enrollee. Affiliated provider includes a person described in this subdivision that has entered into a written arrangement with another person, including, but not limited to, a physician hospital organization or physician organization, that contracts directly with a health maintenance organization.

- (b) "Basic health services" means medically necessary health services that health maintenance organizations must offer to large employers in at least 1 health maintenance contract. Basic health services include all of the following:

- (i) Physician services including primary care and specialty care.

- (ii) Ambulatory patient services.

- (iii) Hospitalization services.

- (iv) Emergency health services.

- (v) Mental health and substance use disorder services, including behavioral health treatment.

- (vi) Diagnostic laboratory and diagnostic and therapeutic radiological Laboratory services.

- (vii) Home health services.

- (viii) Preventive, wellness, and chronic disease management health services.

- (ix) Pregnancy, maternity, and newborn care.

- (x) Prescription drugs.

- (xi) Rehabilitative and habilitative services and devices.

- (c) "Credentialing verification" means the process of obtaining and verifying information about a health professional and evaluating the health professional when the health professional applies to become a participating provider with a health maintenance organization.

- 8

- (d) "Health maintenance contract" means a contract between a health maintenance organization and a subscriber or group of subscribers to provide or arrange for the provision of health services within the health maintenance organization's service area. Health maintenance contract includes a prudent purchaser agreement under section 3405.

- (e) "Health maintenance organization" means a person that, among other things, does the following:

- (i) Delivers health services that are medically necessary to enrollees under the terms of its health maintenance contract, directly or through contracts with affiliated providers, in exchange for a fixed prepaid sum or per capita prepayment, without regard to the frequency, extent, or kind of health services.

- (ii) Is responsible for the availability, accessibility, and quality of the health services provided.

- (f) "Health professional" means an individual licensed, certified, or authorized in accordance with state law to practice a health profession in the individual's respective state.

- (g) "Health services" means services provided to enrollees of a health maintenance organization under their health maintenance contract.

- (h) "Service area" means a defined geographical area in which covered health services are generally available and readily accessible to enrollees and where health maintenance organizations may market their contracts.

This covers the ACA's Essential Health Benefits coverage requirements, as well as nipping any negative Braidwood v. Becerra fallout in the bud. I do find it noteworthy that the language specifies preventative services recommended by the United States Preventive Services Task Force (the USPSTF is the one which is the subject of the federal lawsuit), but doesn't mention the other two medical/scientific bodies listed by the ACA (the ACIP and HRSA/WPSI). Instead it simply refers to "similar organizations recognized by the director." Huh.

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 2212a.

(1) An insurer that delivers, issues for delivery, or renews in this state a policy of health insurance shall provide a

writtenformin plain Englishprescribed by the director to insuredsupon enrollmentthat describes the terms and conditions of theinsurer's policies. The form must provide a clear, complete, and accurate description of all of the following, as applicable:

(a) The service area.(b) Covered benefits, including prescription drug coverage, with specifications regarding requirements for the use of generic drugs.(c) Emergency health coverages and benefits.(d) Out-of-area coverages and benefits.(e) An explanation of the insured's financial responsibility for copayments, deductibles, and any other out-of-pocket expenses.(f) Provision for continuity of treatment if a provider's participation terminates during the course of an insured person's treatment by the provider.(g) The telephone number to call to receive information concerning grievance procedures.(h) How the covered benefits apply in the evaluation and treatment of pain.(i) A summary listing of the information available under subsection (2).policy. An insurer shall provide the form as follows:

- (a) To the applicant at the time of the application.

- (b) To the insured at the time the insurer issues the policy.

- (c) To the insured not later than 30 days after the effective date of a renewal of the policy.

- (d) On request of the insured, not later than 7 days after the request.

(2) An insurer shall provide

uponon request to insureds covered under a policy issued under section 3405 a clear, complete, and accurate description of any of the following information that has been requested:

- (a) The current provider network in the service area, including names and locations of affiliated or participating providers by specialty or type of practice, a statement of limitations of accessibility and referrals to specialists, and a disclosure of which providers will not accept new subscribers.

- (b) The professional credentials of affiliated or participating providers, including, but not limited to, affiliated or participating providers who are board certified in the specialty of pain medicine and the evaluation and treatment of pain and have reported that certification to the insurer, including all of the following:

- (i) Relevant professional degrees.

- (ii) Date of certification by the applicable nationally recognized boards and other professional bodies.

- (iii) The names of licensed facilities on the provider panel where the provider currently has privileges for the treatment, illness, or procedure that is the subject of the request.

- (c) The licensing verification telephone number for the department of licensing and regulatory affairs that can be accessed for information as to whether any disciplinary actions or open formal complaints have been taken or filed against a health care provider in the

immediatelypreceding 3 years.- (d) Any prior authorization requirements and any limitations, restrictions, or exclusions, including, but not limited to, drug formulary limitations and restrictions by category of service, benefit, and provider, and, if applicable, by specific service, benefit, or type of drug.

- (e) The financial relationships between the insurer and any closed provider panel, including all of the following as applicable:

- (i) Whether a fee-for-service arrangement exists, under which the provider is paid a specified amount for each covered service rendered to the participant.

- (ii) Whether a capitation arrangement exists, under which a fixed amount is paid to the provider for all covered services that are or may be rendered to each covered individual or family.

- (iii) Whether payments to providers are made based on standards relating to cost, quality, or patient satisfaction.

- (f) A telephone number and address to obtain from the insurer additional information concerning the items described in subdivisions (a) to (e).

(3)

UponOn request, any of the information provided under subsection (2) must be provided in writing. An insurer may require that a request under subsection (2) be submitted in writing.(4) A health insurer shall not deliver or issue for delivery a policy of insurance to any person in this state unless all of the following requirements are met:

- (a) The style, arrangement, and overall appearance of the policy do not give undue prominence to any portion of the text. Every printed portion of the text of the policy and of any endorsements or attached papers must be plainly printed in light-faced type of a style in general use, the size of which must be uniform and not less than 10-point with a lowercase unspaced alphabet length, not less than 120-point in length of line. As used in this subdivision, "text" includes all printed matter except the name and address of the insurer, name or title of the policy, the brief description, if any, and captions and subcaptions.

- (b) Except as otherwise provided in this subdivision or except as provided in sections 3406 to 3452, exceptions and reductions of indemnity are set forth in the policy and are printed, at the insurer's option, with the benefit provision to which they apply or under an appropriate caption such as "EXCEPTIONS" or "EXCEPTIONS AND REDUCTIONS". If an exception or reduction of indemnity specifically applies only to a particular benefit of the policy, a statement of the exception or reduction must be included with the benefit provision to which it applies.

- (c) Each form, including riders and endorsements,

areis identified by a form number in the lower left-hand corner of the first page of the form.- (d) The policy contains no provision that purports to make any portion of the charter, rules, constitution, or bylaws of the insurer a part of the policy unless the portion is set forth in full in the policy. This subdivision does not apply to the incorporation of or reference to a statement of rates, classification of risks, or short-rate table filed with the director.

(5) As used in this section, "board certified" means certified to practice in a particular medical or other health professional specialty by the American Board of Medical Specialties, the American Osteopathic Association Bureau of Osteopathic Specialists, or another appropriate national health professional organization.

This one is kind of interesting--it basically takes the provisions which have to be included in the description of benefits out of the legislative text and places it into the hands of the state health director. I'm not entirely sure this is a good idea, although it's possible that there are other laws which require the specific details to be included already, making this bullet list redundant. I'll have to inquire further.

(I'm only including the relevant additional text since virtually nothing changes in the first 4/5 of the legislative text):

Sec. 2213e.

(1) An insurer that delivers, issues for delivery, or renews in this state a health insurance policy with respect to an individual, including a group to which the individual belongs or family coverage in which the individual is included, shall not rescind coverage under the policy unless both of the following apply:

- (a) Either of the following applies:

- (i) The individual or a person seeking coverage on behalf of the individual performs an act, practice, or omission that constitutes fraud. For purposes of this subparagraph, a person seeking coverage on behalf of an individual does not include an employee or authorized representative of the insurer or a producer.

- (ii) The individual makes an intentional misrepresentation of material fact.

- (b) The insurer provides written notice to the individual at least 30 days before the recission.

(2) This section applies to a health insurance policy delivered, issued for delivery, or renewed in this state before, on, or after the date of the effective date of the amendatory act that added this section.

This addresses one of the ugliest pre-ACA practices among health insurance carriers: Rescission, in which an insurer would go over all your paperwork with a fine-toothed comb again, and if they found even the slightest error or omission (forgetting to mention that you had acne a decade ago, for instance), they would not only deny the claim, they would also retroactively cancel your entire policy. This often meant that you'd be denied insurance coverage at the exact moment that you needed it the most.

The ACA banned this practice federally; this bill would do so at the state level as well as a backup.

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 3406z.

(1) An insurer that delivers, issues for delivery, or renews in this state a health insurance policy shall offer health insurance policies that provide at least 1 of the following levels of coverage:

- (a) Coverage designed to provide benefits actuarially equivalent to 60% of the full actuarial value of the benefits provided under the policy.

- (b) Coverage designed to provide benefits actuarially equivalent to 70% of the full actuarial value of the benefits provided under the policy.

- (c) Coverage designed to provide benefits actuarially equivalent to 80% of the full actuarial value of the benefits provided under the policy.

- (d) Coverage designed to provide benefits actuarially equivalent to 90% of the full actuarial value of the benefits provided under the policy.

(2) An insurer described in subsection (1) that offers a health insurance policy in any level of coverage described in subsection (1) shall also offer coverage in that level as child-only coverage.

Hmmm...this is intended to lock in the ACA's "metal level" plan requirements (Bronze, Silver, Gold and Platinum, which have to cover 60%, 70%, 80% and 90% of aggregate benefits respectively), but I don't know whether the language is clear enough as to what "full actuarial value" means, and of course if you strip away the ACA itself, an insurance carrier would only be legally required to provide Bronze-level coverage in major medical policies, since they only have to provide "at least 1 of the following levels."

Again, there may be other laws on the books in Michigan which provide additional detail on this, but on its own it reads a bit weak to me.

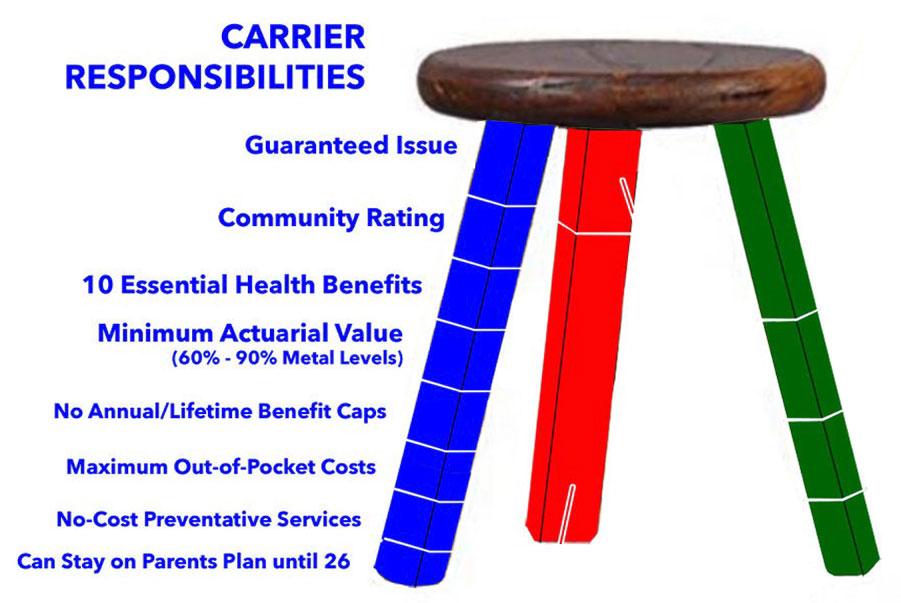

In summary, Michigan has just codified into state law:

- Guaranteed Issue

- Community Rating

- Essential Health Benefits

- No Annual/Lifetime Benefit Caps

- No-Cost Preventative Services

- Young Adults on Parents Plans

- Gender Equality/LGBTQ+ discrimination

- Rescission

- Clarity/transparency re. descriptions of benefits

- Minimum Actuarial Value (sort of)

- Restricting the Age Band (I think)

Unfortunately, these bills do not appear to address other ACA provisions such as Medical Loss Ratios (80% for the individual & small group markets & 85% for the large group market under the ACA), capping the maximum out of pocket costs (MOOP) an enrollee may be subject to, or rate review requirements.

There's also a few items like the Actuarial Value bill which could probably use some enhancements/ clarification. Overall it's a pretty good package, however.

To put this package of bills (now laws!) into my "3-Legged Stool" terms, it covers all of the below except Max Out of Pocket costs (MOOP). Not bad!