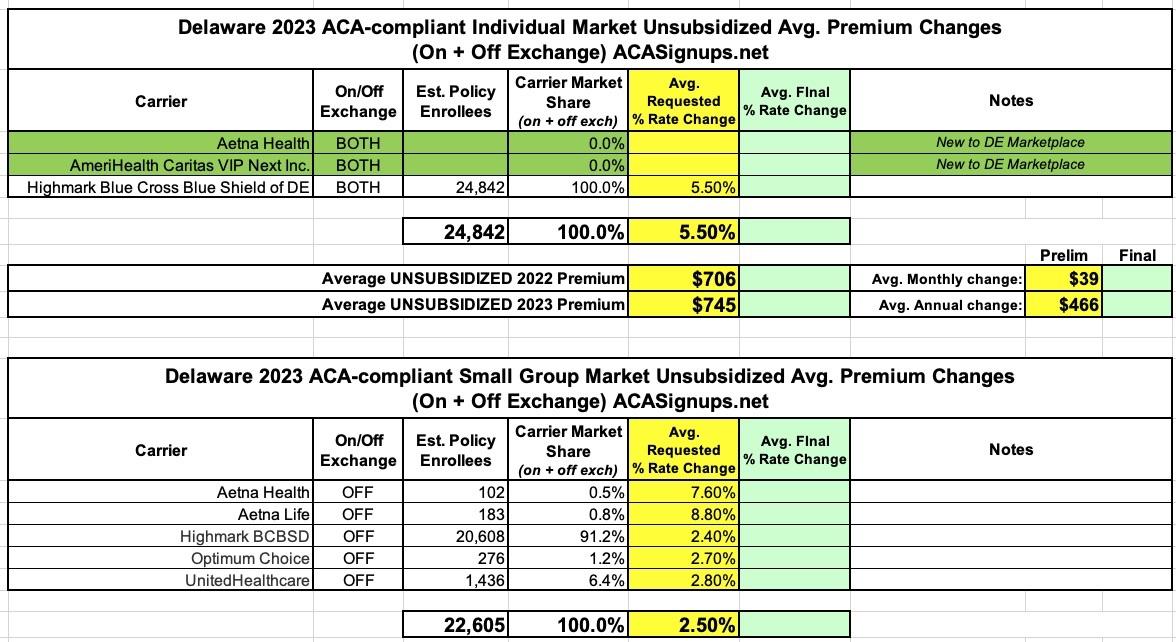

Updated: Delaware: Final avg. unsubsidized 2023 #ACA rate change: +5.5%; Aetna & AmeriHealth jumping in

David Anderson, ten days ago:

Is anyone other than @Highmark ever going to offer ON-Exchange products in #Delaware?

And if not, will HIGHMARK ever price to maximize on-exchange affordability as a sole issuer?

— David Anderson (@bjdickmayhew) July 1, 2022

Today:

Company Legal Name: Aetna Health, Inc.

State: DE HIOS

Issuer ID: 67190

Market: Individual

Effective Date: 01/01/2023The development of the rates reflects the impact of the market forces and rating requirements associated with the Patient Protection and Affordable Care Act (PPACA) and subsequent regulation. These rates are for plans issued in Delaware beginning January 1, 2023. The rates comply with all rating guidelines under federal and state regulations. The filing covers plans that will be offered on and off the public Marketplace in Delaware.

I, Kara Clark, am a Senior Principal with Oliver Wyman Actuarial Consulting, Inc. (Oliver Wyman), and have been retained by AmeriHealth Caritas VIP Next, Inc. (AHC) to assist in the review and development of their single risk pool plans to be offered for calendar year 2023 in the individual market. The plans associated with this filing will be offered both on and off the Federally Facilitated Marketplace (FFM) in Delaware. The effective date of the proposed rates is January 1, 2023.

This actuarial memorandum supports a rate filing for AHC’s individual market business. The scope of this memorandum is limited to supporting the development of the individual market rates. The rates were developed in compliance with the applicable laws and regulations of the State of Delaware as well as the Affordable Care Act and its implementing regulations. This memorandum should not be used for any purpose other than those expressly stated. Below is a summary of the company identifying information and company contact information.

As for Highmark itself...

General Information

- Company Legal Name Highmark BCBSD Inc.

- Market for which proposed rates apply (Individual or Small Group) Individual Market

- Total proposed rate change (increase/decrease) 5.5%

- Effective date of proposed rate change January 1, 2023

Summary

Provide a brief narrative summary of the scope and range of the rate change (i.e., increase or decrease) as well as the number of people impacted. Include how the rate change varies across products/plans.

The overall rate increase of 5.5% will affect 24,842 members. The rate change will vary by product ranging from a minimum of 2.7% to a maximum of 12.5%.

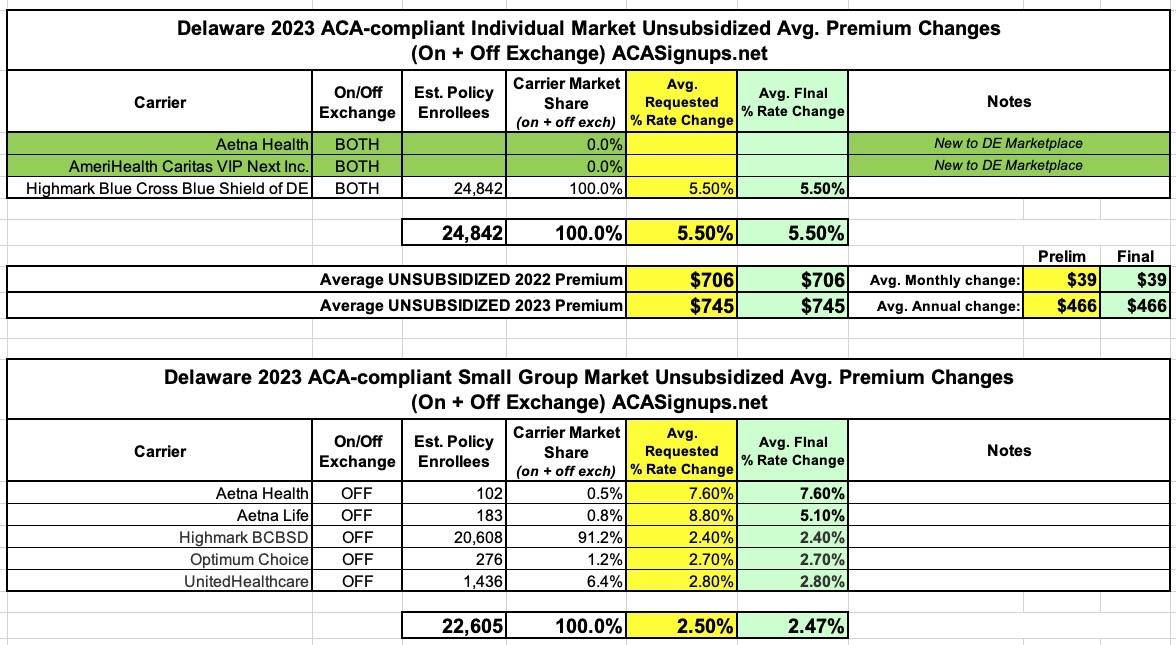

UPDATE 10/11/22: The Delaware Insurance Dept. has posted the final/approved rate changes...and there's been almost no changes. The sole individual market carrier remains at 5.5%, while four of the five small group carriers are the same as their requested rate changes. The only one with any reduction is Aetna Life, which was reduced from an 8.8% hike to 5.1%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.