UPDATE: IRONY: An anti-#ACA lawsuit filed by John Boehner in 2014 could potentially fund most of ACA 2.0. Seriously.

I honestly thought that I had written the final chapter in this absurd saga, which started two administrations, two House Speakers, three HHS Secretaries and three U.S. Attorney Generals ago when the Federal Circuit Court issued their final ruling last August, but apparently not.

Since this insanity has been grinding away for nearly seven years now, I'm pretty much just reposting my entire August entry, with an important update tacked on at the end.

Here's a quick recap:

- The ACA includes two types of financial subsidies for individual market enrollees through the ACA exchanges (HealthCare.Gov, CoveredCA.com, etc). One program is called Advance Premium Tax Credits (APTC), which reduces monthly premiums for low- and moderate-income. APTCs are the subsidies which have been substantially beefed up by the American Rescue Plan (the additional subsidies will be available starting in April in most states, soon thereafter in most other states).

- The other type of subsidies are called Cost Sharing Reductions (CSR), which reduce deductibles, co-pays and other out-of-pocket expenses for low-income enrollees.

- In 2014, then-Speaker of the House John Boehner filed a lawsuit on behalf of Congressional Republicans against the Obama Administration. They had several beefs with the ACA (shocker!), including a claim that the CSR payments were unconstitutional because they weren't explicitly appropriated by Congress in the text of the Affordable Care Act (even though the program itself was described in detail, including the payment mechanism/etc.)

- A long legal process ensued, the end of which resulted in a federal judge ruling in the GOP's favor and ordering that CSR payments stop being made...but also staying that same order pending appeal of her decision by the Justice Department (then still run by the Obama Administration).

- After Donald Trump took office and placed Jeff Sessions into power as Attorney General, he started publicly threatening to "blow up"/destroy the ACA exchanges by "cutting off" CSR payments. He did this month after month from around March 2017 through October 2017, when he finally made good on his threat...by having the Justice Dept. drop the appeal of the court decision on the CSR lawsuit.

It's important to note that Trump wasn't citing the "Rule of Law" or the "importance of respecting the Constitution" or any other Noble Cause; he simply hated "Obamacare" and felt the GOP-controlled Congress wasn't repealing the ACA quickly enough for his tastes, so he decided to damage it as much as he could himself by cutting off CSR payments. That's not remotely up for debate; he stated so explicitly in multiple tweets and public statements.

- This led to September 2017 being the last month that CSR payments were made.

All of this was Act I. Here's Act II:

- The way the CSR program works is a bit unusual. Unlike premiums, which are a set, known dollar amount for every enrollee each month, the CSR program involves deductibles & co-pays, which can vary greatly from month to month. Therefore, instead of subsidizing the enrollees directly, the insurance carriers are contractually required to cover the given portion of the enrollee's deductibles, co-pays etc. up front, and then submit their CSR expenses to the federal government on a monthly basis to be reimbursed.

- Donald Trump cut off contractually-required CSR reimbursement payments to insurance carriers in October 2017...and hasn't made any payments since.

- That means insurance carriers were effectively stiffed for October, November and December CSR payments in 2017...totalling upwards of $1.6 billion collectively.

In other words, instead of hurting low-income enrollees as he intended to do, Donald Trump ended up stiffing federal contractors out of legally-owed payments, which is pretty much par for the course.

- They were also stiffed out of 2018 CSR reimbursements (and 2019...and 2020...and...) as well. The cut-off is now permanent unless and until either the entire ACA is struck down or Congress adds a simple one-paragraph clause to the ACA explicitly appropriating the CSR reimbursement payments.

- Donald Trump assumed that this would lead to every insurance carrier refusing to renew their ACA exchange contracts for 2018 and beyond, since doing so would mean agreeing to shell out billions of dollars per year in CSR payments knowing that they'd never get paid back. This is what Trump meant by "blowing up the exchanges" (though it's also likely that he thought cutting off the payments would mean CSR enrollees would have their financial assistance cut off immediately).

- If no carriers participated in the exchanges, he would have effectively destroyed the individual market without ever needing the ACA itself to be formally repealed.

HOWEVER, something happened which Trump never anticipated: The insurance carriers, state-based ACA exchanges and state insurance commissioners put their heads together and implemented a very smart workaround to make up for their CSR losses which had been originally described by analysts at the Urban Institute: Silver Loading.

The carriers basically calculated how much they expected to have to shell out in CSR payments the following year...and then added that amount to their premiums for the following year instead.

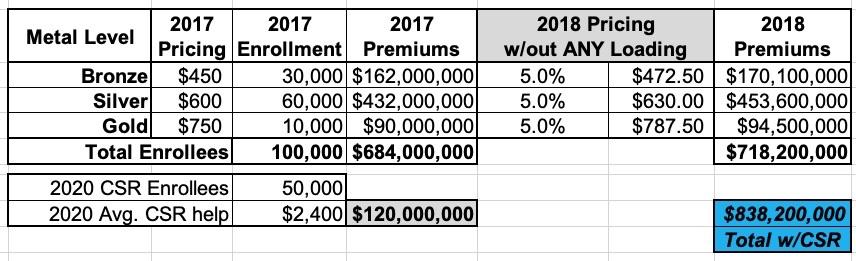

So, let's say in 2017 a carrier projected that overall claim expenses in 2018 would increase around 5%. To keep things simple, let's say they offered just 3 plans: One Bronze, one Silver (which happends to also be the "benchmark Silver" used to determine subsidies) and one Gold, priced at an average of $450, $600 and $750/month.

This carrier had 100,000 enrollees in 2017 and had to pay out $120 million in CSR assistance. They assumed that total enrollment and their CSR costs would be around the same (and the same ratios) in 2018 Since they knew they wouldn't get reimbursed from the federal government for their CSR costs in 2018, simply raising their premiums by 5% would mean a $120 million loss. Ouch:

So, what did they start doing instead? They loaded their projected CSR losses onto the premiums instead.

Basically, they took the total amount ($120 million), divided that by 12 months ($10 million/month) and then divided that across their projected enrollment to figure out how much to tack onto each enrollee's monthly premium to make up the difference.

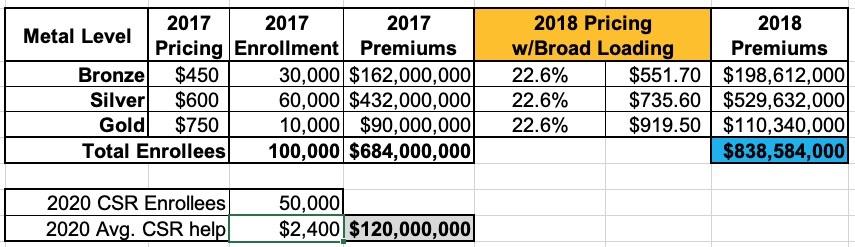

Now, if they simply divided that $10 million/month across all of their enrollees, regardless of the plan, they'd hae to raise their premiums for every plan by around 22.6% to make up that difference, like so. This is called Broad Loading:

In 2018, a few states did it this way, but most states did something very clever instead: They Silver Loaded.

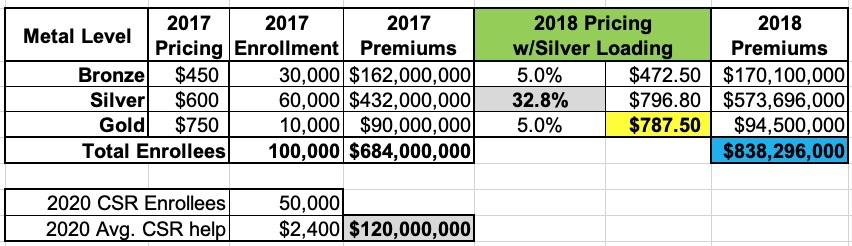

Silver loading involves concentrating the CSR costs so that they're only added to the Silver plans on the ACA market (as opposed to Bronze, Gold or Platinum). This means that instead of every plan going up by 22.6%, the Silver plans went up 32.8% while the other metal tiers only went up 5%:

The benefit of Silver Loading is that the premium subsidy program (APTC) is based on the cost of the benchmark Silver plan...but the subsidies can be applied to any plan.

Notice how the Gold plan is now priced lower than the Silver plan? Well, let's say an enrollee qualified for $400/month in APTC in 2017 (because the maximum they have to pay for the benchmark Silver is $200/month). In 2018, their APTC would increase from $400/mo to $597/month...but they can use that $597/mo for any plan. The Silver still costs them $200/mo, but suddenly the Gold plan, which would have cost $350/mo in 2017, only costs $190/mo! (Alternately, the Bronze plan, which would have cost them $50/mo in 2017, will cost nothing in 2018 since the APTC amount is actually more than the full-priced Bronze premium).

By 2019, nearly every carrier in every state was Silver Loading, and as of 2021 there's only two states still using Broad Loading (West Virginia and Mississippi, I believe). In 2022, West Virginia will finally start Silver Loading as well.

Silver Loading has resulted in millions of subsidized ACA exchange enrollees receiving more financial help than they would have otherwise, since a Bronze or Gold plan would now cost either about the same, less, or even nothing in premiums depending on where the enrollee lives.

This meant that the carriers got to be made whole on their CSR losses while millions of enrollees received more financial help and thus had lower net premiums for their policies....which meant that for the most part, the insurance carriers have since agreed to stick around for 2018, 2019 and beyond after all. This is exactly the opposite of what Donald Trump was hoping would happen. He basically botched his own attempt at sabotaging the ACA.

HOWEVER...none of this did anything to make up for their losses for the last quarter of 2017 (again, roughly $1.6 billion)...so the carriers filed a bunch of federal lawsuits to force the government to pay them back (it also didn't do anything for several million unsubsidized ACA enrollees who ended up having to either eat the full cost of the CSR load or who were forced to upgrade/downgrade their policies from Silver to Gold or Bronze to avoid getting hit with the cost, but that's another story).

...Several health insurers have sued the U.S. government over its failure to make cost-sharing reduction payments that help lower healthcare costs for certain consumers. One just scored the first victory. The U.S. Court of Federal Claims ruled in favor of Montana Health Co-op, which sued the federal government for $5.3 million in unpaid cost-sharing reduction payments, finding that the government violated its obligation under the Affordable Care Act when it stopped paying the CSRs in October 2017."

...With many of these cases now resolved, this post focuses on the status of lawsuits brought by insurers for unpaid CSRs. These lawsuits began as early as November 2017 when Common Ground Healthcare Cooperative, an insurer based in Wisconsin, amended its class action lawsuit on risk corridor payments to additionally contest the government’s failure to make CSR payments. This was followed by separate challenges from several other insurers.

To date, two insurers—Maine Community Health Options and Sanford Health Plan—have succeeded in their challenges. ...The federal government intends to appeal both cases to the Federal Circuit, and the cases will likely be consolidated on appeal.

The lawsuits regarding the last 3 months of 2017 were about as open & shut as you could make them. The federal government legally owed the carriers that money, and the fact that there was a different lawsuit regarding who was authorized to make the payments didn't change that fact, any more than Comcast is gonna let you off the hook for your cable bill just because you get fired from your job. The carriers winning their lawsuits was hardly unexpected.

THIS, however, was very unexpected:

Fed court says CHC can get CSRs reimbursed for 2017 AND for 2018 despite silver-loading.. https://t.co/v1YwtDk1DL

— Amy Lotven (@amylotven) February 16, 2019

Court: Feds Must Pay Community Health Options CSRs For 2017, 2018

The insurance industry notched a win Friday with a federal judge ruling that the Trump administration violated the Affordable Care Act and breached an implied contract when it cut off cost-sharing reduction payments and is responsible for reimbursing Texas non-profit plan Community Health Choices, Inc. (CHC) for not only the fourth quarter of 2017, but also for 2018, despite the silver-loading workaround that resulted in higher premium tax credits. The ruling followed a Thursday hearing, and the parties are asked...

Yes, that's right: Multiple federal judges ruled that not only did the federal government owe the carriers the $1.6 billion from 2017, they still owed them billions of dollars for 2018 as well even though the carriers had already baked that money into their 2018 premium pricing (and 2019...and 2020...and 2021, so far).

As the ruling stated:

...Defendant does not identify any statutory provision permitting the government to use premium tax credit payments to offset its cost- sharing reduction payment obligation (even if insurers intentionally increased premiums to obtain larger premium tax credit payments to make up for lost cost-sharing reduction payments). Nor does defendant identify any evidence in the Affordable Care Act’s legislative history suggesting that Congress intended to limit its liability to make cost-sharing reduction payments by increasing its premium tax credit payments. That insurers and states discovered a way to mitigate the insurers’ losses from the government’s failure to make cost-sharing reduction payments does not mean that Congress intended this result.

Moreover, defendant’s concern that Congress could not have intended to allow a double recovery of cost-sharing reduction payments is not well taken. The increased amount of premium tax credit payments that insurers receive from increasing silver-level plan premiums are still premium tax credit payments, not cost- sharing reduction payments. Indeed, under the statutory scheme as it exists, even if the government were making the required cost-sharing reduction payments, insurers could (to the extent permitted by their state insurance regulators) increase their silver-level plan premiums; in such circumstances, it could not credibly be argued that the insurers were obtaining a double recovery of cost-sharing reduction payments. While the premium tax credit and cost-sharing reduction provisions were enacted to reduce an individual’s health-care-related costs (to obtain insurance and to obtain health care, respectively), they are not substitutes for each other.

As I explained at the time:

Let's say you agreed to sell your car to me for $20,000, and separately agreed to sell me 4 motorcycles for $5,000 apiece, for a grand total of $40,000. Let's further suppose that for whatever reason, I decided that I wasn't able to cut you the check for the $20,000, but told you I'd pay you twice as much ($10,000) for each of the motorcycles instead.

On paper, you're still receiving a total of $40,000...but legally, this judge is saying, I'd still owe you the $20,000 for the car as well, since that's what the contract we signed for the car sale stated.

On the surface, this appeared to set the stage for insurance carriers to massively double-dip...racking up a good $10 billion/year in CSR payments on top of another $10 billion/year in jacked-up premium payments. As U of M Law Professor Nicholas Bagley put it at the time...

If this holds up on appeal, insurers could buy us the damn border wall. And they could do the same next year, and the year after, and the year after... https://t.co/6yWRJTGBsY

— Nicholas Bagley (@nicholas_bagley) February 16, 2019

HOWEVER...that brings me to the ACA's Medical Loss Ratio rule, which states that insurance carriers on the individual market can only make a 20% gross margin. That is, they have to spend at least 80% of their annual revenue on actual medical claims, leaving only 20% at most for administrative overhead, marketing, net profits and so on. If they fall below that ratio (on a 3-year rolling average basis), they have to pay out the difference to the policyholders in the form of rebate checks.

In other words, if an insurance carrier was right around the 80% threshold and suddenly had $100 million in extra revenue drop in their laps, they'd have to pay most of that back to their enrollees (the exact formula gets a bit complicated, so it might not be all of it, but a large chunk).

I speculated about this exact possibility:

Assuming every carrier was at or below the 80% MLR threshold in 2018 and every one of them successfully arranged to effectively "double dip" and got the federal government to pay them their full 2018 CSR reimbursements on top of their jacked-up Silver premiums, it's conceivable that the carriers would then be forced to turn around and rebate the full $10 billion to their policyholders.

That would be 2.5x as much rebate money in a single year as the MLR rule has paid back to enrollees in the previous seven years.

I'm not sure of the details on how those MLR rebates are allocated, but I know in 2018, nearly 6 million people received an average rebate of $119 apiece. Most of that came from the large and small group markets, but around 1 million people on the ACA individual market received $137 apiece (around $133 million total). That's right: It's theoretically possible that the carriers could have to dole out up to 75 times as much in MLR rebates for 2018 as they did last year.

That was back in February 2019...two years and a lifetime ago.

The next development, which seemed to be the Final Chapter, was pretty anticlimactic, though. Christen Linke Young was with the Brookings Institution at the time...but is now deputy director of the Domestic Policy Council for Health and Veterans Affairs in the Biden Administration:

The Federal Circuit released a decision today on cost-sharing reductions (CSRs) under the ACA. I've seen it described as a win for issuers, but it strikes me as an extremely qualified win.

— Christen Linke Young (@clinkeyoung) August 14, 2020

The court held that issuers can recover the CSRs they were not paid in the last few months of 2017, when the Trump Administration abruptly cut off payment. For 2018 and later, they can recover, but their damages must be reduced to reflect the benefits they got from silverloading.

— Christen Linke Young (@clinkeyoung) August 14, 2020

The cases are remanded to lower courts for these damages calculations. That process is likely to be extremely messy and uncertain (not to mention time-consuming and expensive). Seems clear the winning strategy for issuers and states is to continue silverloading.

— Christen Linke Young (@clinkeyoung) August 14, 2020

Basically, the issuers are going to be compensated for losses caused by the sudden nature of the Trump Administration's decision, but going forward, I don't expect changes for 2021 premiums. Opinion here: https://t.co/Uvt7Cv3FvD

— Christen Linke Young (@clinkeyoung) August 14, 2020

As my friend & colleague Dave Anderson put it...

#thread #silverload CSR litigation continues with 2017 Q4 paid to insurers & lots of lawyers and actuaries billing more hours to get a net damages estimate for 2018 https://t.co/y8nZpX6Rl0

— David Anderson (@bjdickmayhew) August 14, 2020

This was the situation when we last left this story. With a handful of exceptions, after collecting their 2017 winnings, the odds seemed slim that the vast majority of insurance carriers would go through all the additional hassle & expense of bothering to figure out whether they'd be better off going after the 2018/beyond CSR payments or just leaving well enough alone, since they could shell out a bunch of billable time to their lawyers/actuaries/accountants only to conclude that the actual CSR payments are exactly the same (or even less) than the amount they brought in from #SilverLoading instead.

I concluded my prior version of this post by saying:

Then again, this saga has gone through so many twists and turns over the past six years, who knows? There could be some new factor which pops up after all.

WELL, GUESS WHAT? Cut to last week, via Amy Lotven of Inside Health Policy:

DOJ To Weigh In Next Month On Whether SCOTUS Should Take Up CSRs

The Biden administration has until April 26 to weigh in on whether it thinks the Supreme Court should take up insurers’ suit challenging the Trump-era decision not to pay the full amount of cost-sharing reduction payments owed insurers since 2017, despite the “silver loading” workaround.

Common Ground Healthcare Cooperative, which is representing 101 insurers in a class action, asked the high court to review their case in a Feb. 24 petition. Five days earlier, Maine Community Health Center (MHCO) and Community Health Choice, Inc. also asked the high court to take up the issue after the full U.S. Court of Appeals for the Federal Circuit refused their request to review the decision from a three-judge panel.

...The government must pay all CSRS owed for the last three months of 2017, the court panel said in the ruling. But, in a move strongly opposed by the insurers, the court said the government can deduct the additional tax credits insurers got through the silver-loading workaround in 2018.

Maine Community Health Center (MCHO), Community Health Choice (CHC) and Common Ground now ask the Supreme Court to take on the case to answer the key question of whether the government can use a mitigations strategy to avoid the law’s unambiguous requirement to pay the cost-sharing reductions.

Yes, that's right: The insurance carriers have decided not to leave well enough alone. Instead of simply taking their completely reasonable Q4 2017 winnings and calling it a day, they've decided that they're entitled to double dip for 2018 as well (which also presumably opens up the floodgates for 2019, 2020, 2021 and beyond) by demanding that the federal government stick to the official terms of the contract even though they jacked up their premiums for 2018 & beyond to make up the losses in question.

On the surface this would appear to be a pure greed-based move, and I'm sure to some extent it is...except for two things:

- First: As I noted above, the ACA's MLR rule means that many carriers would have to pay out as much as 100% of any "double-dipped" winnings they receive from this lawsuit to their enrollees from 2018 anyway (and from 2019? And from 2020? And from 2021?...)

- Second: There is a separate and broader legal/contractual issue here, which is basically what I described in my car/motorcycle example above: Whether the United States Federal Government gets to ignore their contractual obligations simply because a "workaround" was developed which achieved the same outcome. And the great irony here is that the insurance carriers are using the Supreme Court's own logic in a different ACA lawsuit (the Risk Corridor Massacre case) as part of their case here:

The Supreme Court made clear in the risk corridors case that for the government to properly function, it must be held to its financial obligations, Common Ground argues.

“These holdings reflect a principle as old as the Nation itself: The Government should honor its obligations,” Justice Sonia Sotomayor had said in the risk corridors ruling.

“The Federal Circuit’s ruling undermines that fundamental principle and thus warrants this Court’s review,” Common Ground said.

So now the Biden Administration has to decide whether to challenge the case or not, which I'm pretty certain they will. Law professor and ACA expert Nicholas Bagley thinks it's extremely likely that the SCOTUS will deny the case...but again, as with everything related to the ACA, anything is possible.

BUT WAIT, THERE'S MORE!

If you read my simple Silver Loading explainer above, you might have noticed something: CSR subsidies only apply to people enrolled in CSR plans (which are all Silver)...but the APTC subsidies, which are greatly enhanced by Silver Loading, apply to people enrolled in every plan. This means that, ironically, Trump's attempt to "save" ~$10 billion per year in CSR payments actually resulted in APTC payments increasing substantially MORE than that. How much more?

...The insurers further say that allowing the government to ignore obligations can create greater problems. The government itself admitted that the decision to end CSRs will cost taxpayers $194 billion more over 10 years, Common Ground says, referring to a Congressional Budget Office score on silver-loading that the Department of Justice mentioned in a February brief in the MCHO/CHC case at the Federal Circuit.

That's an average of $19.4 billion per year from 2017 - 2026...but once Silver Loading was fully accepted as the "new normal", the CBO projected that it would be more like $25 - $26 billion per year. In other words, if you assume the 10-year period from 2022 - 2031, you're talking about the federal government spending more like $250 billion more due to Donald Trump cutting off CSR payments.

IF, however, this latest CSR challenge to the Supreme Court were to actually be successful, that would mean the federal government could ALSO have to pay out the CSR reimbursements as well! That's another $14 billion or so per year on average, according to the CBO report (though this also assumes those payments would be owed for every year ad infinitum as opposed to 2018 only). At the very least, it would tack another $8 billion or so (from 2018) onto the tab.

So what happens if you REVERSE that process? That is, what happens if a bill like, say Senator Jeanne Shaheen's S.499 were to pass and become law? Her bill would make the American Rescue Plan's expanded ACA subsidies permanent while also similarly upgrading the CSR subsidy structure...but it would also at long last formally appropriate CSR reimbursement payments...which is exactly what the original lawsuit was about in 2014.

Formally appropriating CSR payments would eliminate Silver Loading (as well as Broad Loading, for that matter) going forward...but if the original CSR formula was to be beefed up as laid out in S.499, pretty much every ACA enrollee would still see similar if not even more generous subsidies anyway. A lot of this amounts to the same subsidy money being distributed in a more logical, efficient and equitable manner.

It would also mean something else, however. Take another look at Lotven's article about S.499:

...Federal spending would increase by about $350 billion over a decade, [Urban Institute economist Linda] Blumberg estimates.

In other words, simply appropriating CSR payments and killing off Silver Loading would pay for more than 40% of the cost of massively upgrading the ACA (perhaps $250 billion of the $600 billion or so total 10-yr cost).

If the SCOTUS were to accept Common Ground, Maine Community Health Options & Community Health Choice's appeal and rule in their favor, however, that could potentially mean the feds would owe up to another $8 billion for 2018 alone, and hypothetically as much as an additional ~$140 billion from 2022 - 2031 under current law, which is what the CBO has to use as their baseline. I agree that this is extremely unlikely to happen, but again...who the hell knows?

IF that were to happen, the 10-yr cost of ACA 2.0 relative to the baseline could conceivably drop even further, to just $210 billion...without having to find the money anywhere outside of the ACA framework itself. That would potentially amount to as much as 65% of the total cost.

I'm not saying this is likely. I'm just saying that in the crazy world of federal budgets, CBO scoring and GOP lawsuits, absolutely anything is possible.

UPDATE 4/13/21: An earlier version of this post assumed that the $250 billion in CSR savings hadn't been accounted for in Ms. Blumberg's analysis of S.499 when in fact it had been. I've updated the wording of the last few paragraphs accordingly.

Also, as expected, the Biden Administration has asked the Supreme Court not to take up the lawsuit, and will presumably be defending against it to the best of their ability. I can hardly blame them for this; that's their job, after all, and the DoJ isn't supposed to be playing partisan games just because doing so might inadvertently happen to benefit the goals of one political party or the other. Good for them.

Stay tuned...