Pennsylvania: Pennie releases their very first enrollment report: 285K QHPs thru 11/15

As I've noted several times before, two more states have split off from the federal ACA health insurance exchange (HealthCare.Gov) this year. New Jersey and Pennsylvania have joined twelve other states (and DC) in operating their own full ACA enrollment platform.

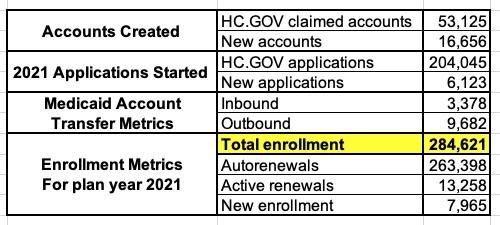

In the case of Pennsylvania, they decided to call theirs "Pennie" (Pennsylvania Insurance Exchange), and judging by their first enrollment report, it looks like it's off to a great start:

Open Enrollment Early Highlights

- ● Migration of existing 2020 customers from Healthcare.Gov

- 98% of the 208,500 enrolled households were eligible to be renewed into 2021 plans

- Of those, ~95% were automatically renewed prior to the start of OEP

- Active renewal activity has been fairly low, but steady since Open Enrollment began

- Eligibility and Enrollment Platform

- Launched as planned on November 1

- No major system, eligibility or enrollment blocking issues identified to date

- Issues have been identified and resolved in a timely fashion and GI and KPMG have worked collaboratively to test and deploy three minor patch releases since 11/1

- Call Center

- Launched as planned in early October, ramping up to start of OEP capacity and hours on 11/1

- Staffing and capacity has been adequate to handle call volumes

- GI has been responsive to feedback, demonstrating an ability to make changes, process improvements and to address CSR knowledge gaps quickly

- Telephony/IVR issues were identified on November 2, but were resolved prior to start of business on the following day

- Department of Human Services Coordination

- Starting on 11/1, over 13,000 Account Transfers have been successfully sent to and received from DHS

- Weekly calls to talk through and troubleshoot questions and issues are ongoing

- Assisters

- Nearly 170 assisters and assister entities have claimed their accounts

- Several outreach and enrollment assistance sessions have been held since the start of OEP, although some have been cancelled due to COVID-19

- Some assisters have experienced issues claiming their accounts, which we are addressing through improved user manuals, FAQs and enhanced technical training at the call center

- Insurers

- Starting on 11/1, enrollments and payments were successfully transmitted to insurers

- Minor PayNow and provider directory issues were identified and resolved quickly

- Weekly 1:1 calls with insurers to talk through and troubleshoot issues are ongoing and have been well received

- A small subset of renewals had their subscriber changed during the migration, resulting in varying operational complications for insurers.

There's an important item above which speaks to the advances and streamlining of the ACA exchange technology since the disastrous launch of HC.gov and some of the state exchanges seven years ago:

In the past, other states which transitioned from HC.gov to their own exchange (Idaho and Nevada) or which transitioned from their own onto HC.gov (such as Oregon and Kentucky), current enrollees were required to manually create a brand-new user account and re-enter all of their personal information, which can be a royal pain in the ass and which likely means losing some enrollees along the way. Pennie (as well as New Jersey's new exchange, GetCovered NJ) were able to port existing enrollee information over to the new platform, making for a much smoother transition process.

- Brokers

- Over 2,100 brokers have claimed their accounts

- The process for transitioning Healthcare.Gov books of business to the Pennie platform for brokers who pre-registered was executed as planned

- Some brokers have had issues accessing their accounts, which we are addressing through improved user manuals, FAQs and enhanced technical training at the call center

- Online engagement and paid media

- Strong presence of customers on website (nearly 500,000 page views at Pennie.com)

- Over 91 million impressions, exceeding the 63 million projected by our media buyer

- Over 14 million completed video views resulting in a cost of $0.02 per view, well below industry average

Pennie had 331,825 Qualified Health Plan (QHP) selections during the 2020 Open Enrollment Period, but this was down to 307,000 who had actually paid their first monthly premium as of February. 276,656 of those enrolled so far are currently-effectuated enrollees being renewed, so that's a 16.6% net attrition rate since the end of the last OEP.

For comparison (as I've done for Connecticut and Washington State):

- In December 2017, PA had 317,191 enrollees vs. 426,029 QHP selections, or 25.5% net attrition

- In December 2018, PA had 316,779 enrollees vs. 389,081 QHP selections, or 18.6% net attrition

- In December 2019, PA had 277,420 enrollees vs. 365,888 QHP selections, or 24.2% net attrition

Once again, the dramatic improvement this year is mostly due to a spike in Special Enrollment Period (SEP) enrollments due to the COVID pandemic. While HealthCare.Gov didn't allow an "open" COVID SEP, the normal SEP rules applied, so any Pennsylvania resident who lost their employer-sponsored healthcare coverage was still eligible for a 60-day SEP, which cancelled out some of the normal attrition throughout the year.

The Pennie report also breaks out enrollees by financial assistance, metal tiers and other metrics:

Financial Assistance:

- APTC & CSR: 175,399 enrollees (62%)

- APTC only: 72,430 enrollees (25%) (87% total for APTC)

- CSR only 108 enrollees (less than 1%)

- Unsubsidized QHPs: 36,684 enrollees (13%)

It's always interesting to me that there are a small number of people who are eligible for CSR assistance but not for APTC assistance. I'm not quite sure how that works, since you have to earn between 100 - 250% FPL for CSR and between 100 - 400% FPL for APTC...but I suppose it's possible depending on very special circumstances.

Metal Tiers:

- Bronze: 75,653 (27%)

- Silver: 146,241 (51%)

- Gold: 61,673 (22%)

- Platinum: n/a

- Catastrophic: 1,054 (<1%)

Net Premiums (unsubsidized/subsidized):

- Subsidized enrollees are paying an average of $136/mo + $524 in subsidies = $659/mo total

- Unsubsidized enrollees are paying an avg. of $511/month

- Overall, the average is $187/mo + $452/mo = $639/mo total

There's some other info in the presentation as well, but it has to do with stuff like call center response time, etc which isn't terribly relevant here.