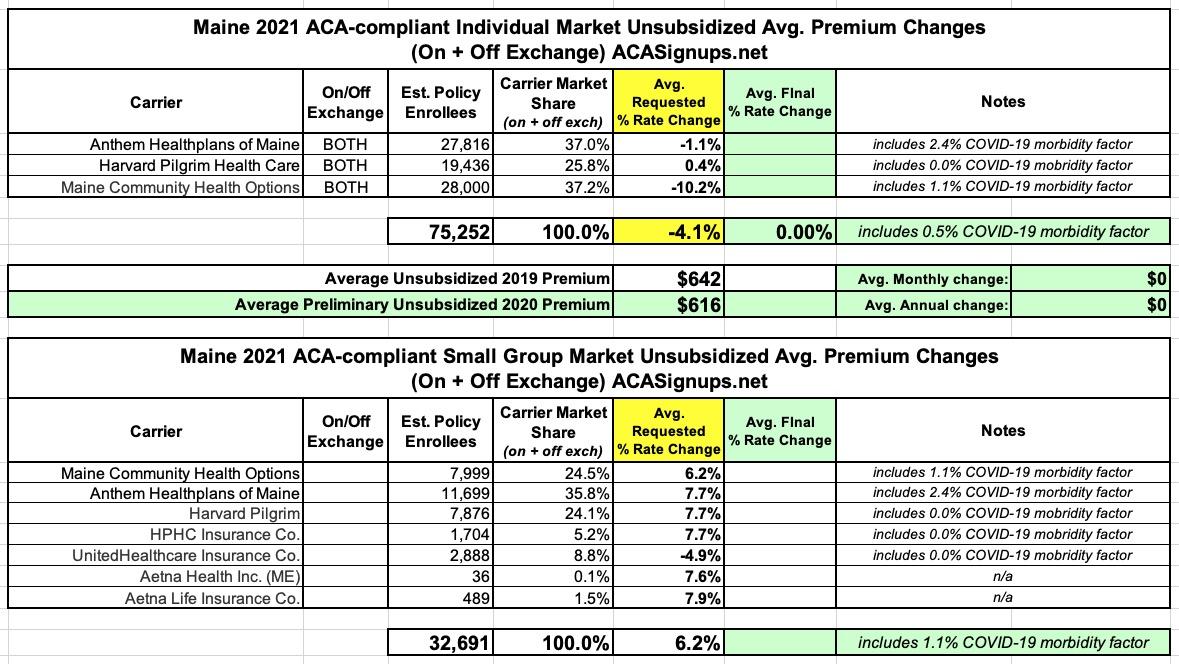

Maine: Preliminary 2021 #ACA premiums: 4.1% lower for indy market, 6.2% higher for small group plans

Over at healthinsurance.org, Louise Norris has already done the work for me in tracking down the preliminary 2021 individual and small group market rate changes for the state of Maine:

Average premiums expected to decrease Maine’s exchange in 2021

Maine’s three individual market insurers filed proposed rates for 2021 in June 2020 (average proposed rate changes are summarized here by the Maine Bureau of Insurance). For the second year in a row, average rates are expected to decrease for 2021:

- Anthem: Average proposed decrease of 1.1 percent. This does include an adjustment based on Anthem’s expectation that they will have to pay for more elective procedures in 2021 that were postponed in 2020 due to COVID-19 (Anthem projects this will result in a 2.5 percent increase in morbidity, driving costs higher in 2021). Anthem has 27,816 members as of 2020. Anthem offers POS (point of service) plans.

- Harvard Pilgrim: Average proposed increase of 0.4 percent. This does not include an adjustment based on COVID-19. Harvard Pilgrim has 19,436 enrollees as of 2020.

- Maine Community Health Options: Average proposed decrease of 10.2 percent. This includes a decrease of 1.2 percent related to COVID-19, as CHO believes that members are likely to continue to defer elective treatment in 2021 due to a second wave of COVID-19, and they project that this will more than offset the higher costs associated with treating COVID-19. Maine Community Health Options has roughly 28,000 members, and offers PPO plans.

All three insurers cite Maine’s reinsurance program (described in more detail below) as a significant factor in keeping premiums in check for 2021, which was also the case in 2019 and 2020. Without the reinsurance program, the insurers note that premiums would be 5 to 15 percent higher in 2021 (the Maine Bureau of Insurance is continuing to have insurers file rates to illustrate how much premiums would need to be without the reinsurance program in place). But as noted above, the three insurers have taken three different approaches to address COVID-19 in their projections, reflecting the widespread uncertainty about how the virus will affect the US healthcare system in the months ahead.

I've gone through the filings for the Maine small group market as well, and have found similar COVID-19 morbidity factors: MCO adds 1.1 percentage points, Anthem adds 2.4 points, Harvard Pilgrim (HPHC) isn't adding anything at this time...and Aetna doesn't even mention COVID-19 at all in their filing memorandum.

Statewide, Maine's individual market premiums are dropping by about 4.1% (they would be dropping by 4.6% without the COVID-19 factor), while small group premiums are increasing by 6.2% on average (vs. 5.1% without COVID-19):

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.