California: Reminder: 2020 ACA Open Enrollment TODAY (10/15) for you!

While the 2020 Open Enrollment Period doesn't officially start until November 1st across the rest of the country, in California it begins two weeks earlier, for whatever reason:

In most states, open enrollment for 2020 coverage will run from November 1, 2019 to December 15, 2019. But California enacted legislation (A.B.156) in late 2017 that codifies a three-month open enrollment period going forward — California will not be switching to the November 1 – December 15 open enrollment window that other states are using.

Instead, California’s open enrollment period (both on- and off-exchange) will begin each year on October 15, and will continue until January 15. Under the terms of the legislation, coverage purchased between October 15 and December 15 will be effective January 1 of the coming year, while coverage purchased between December 16 and January 15 will be effective February 1.

UPDATE: It turns out that another new bill was just signed by California Governor Gavin Newsom which bumps out the end date of open enrollment as well, to January 31st.

In any event, California residents can start shopping for 2020 coverage NOW at CoveredCA.com!

Again, there's two other important things for California residents to remember this fall:

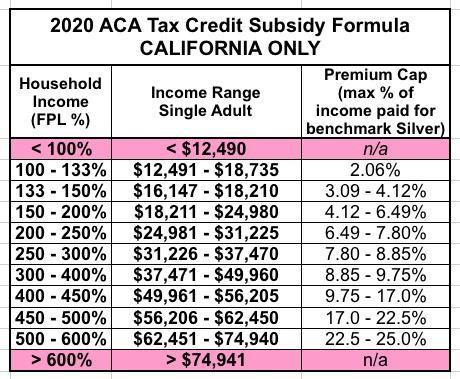

1. Until now, only CoveredCA enrollees earning 138-400% of the Federal Poverty Line were eligible for ACA financial assistance. Starting in 2020, however, enrollees earning 400-600% FPL may be eligible as well (around $50K - $75K/year if you're single, or $100K - $150K for a family of four). In addition, those earning 200-400% FPL will see their ACA subsidies enhanced a bit.

Here's what the formula looks like:

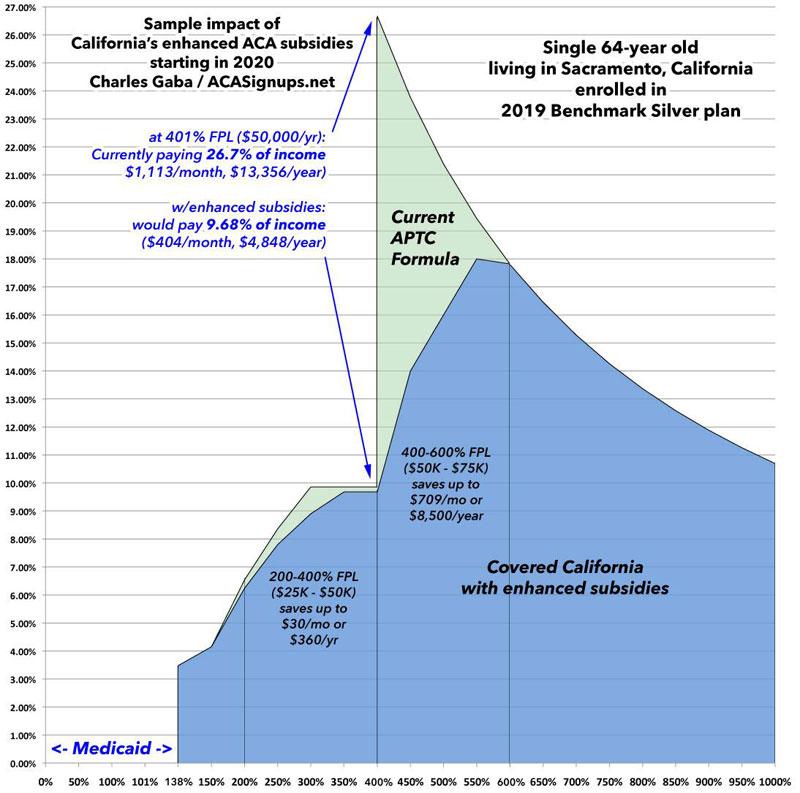

While it doesn't look that impressive, here's a chart showing what the savings look like for people earning 400-600% FPL. I'm using a single 64-year old living in Sacramento to give an idea of how dramatic the impact will be:

The actual savings compared to the current formula will vary greatly by region, age, plan chosen and household, of course.

2. California has joined several other states in reinstating the ACA individual mandate penalty. If you don't have ACA-compliant healthcare coverage or qualify for an exemption from it, you'll have to pay either 2.5% of your household income or $695/adult ($348/child) on your 2021 California state tax form.

As an aside, thanks to Louise Norris, here's a handy summary table of the start & end dates for the all 50 states + DC. Note that there's always the possibility that some of the states may bump out their end dates beyond what's listed if it looks like there's a spike in late enrollment, technical issues, a natural disaster or whatever:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.