UPDATE: Washington State & California: How much will their supplemental subsidies reduce premiums?

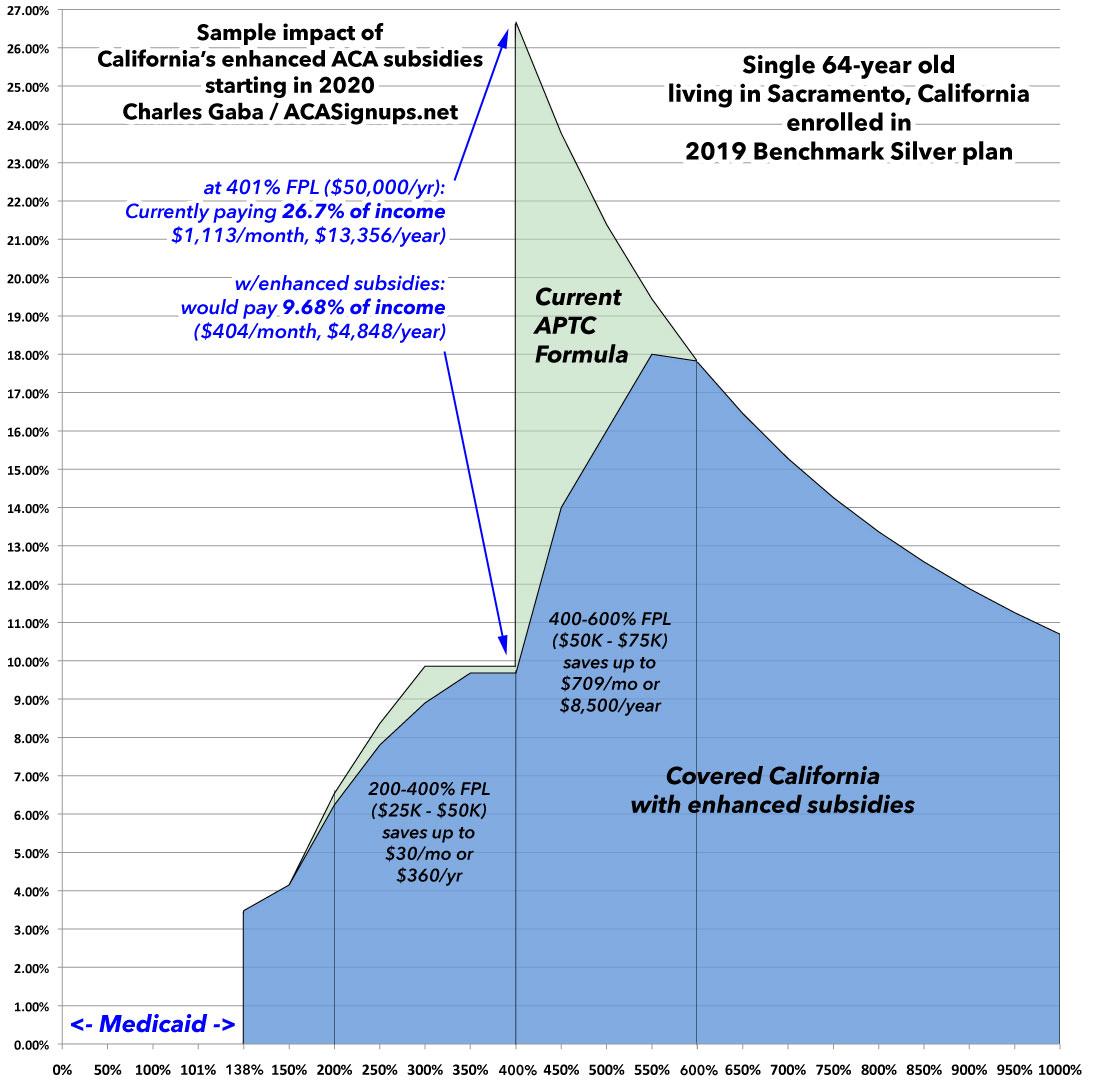

As I've noted several times, one of the biggest flaws in the Affordable Care Act is a very simple one on paper: The Subsidy Cliff. People who enroll in ACA exchange policies are entitled to financial assistance on a sliding scale...but only if their household incomes fall between 100-400% of the Federal Povery Level. Those below the lower threshold (actually, below 138% FPL) are expected to enroll in Medicaid, but those over the upper threshold of 400% FPL (around $50,000/year for a single person, roughly $103,000/year for a family of four) are completely on their own.

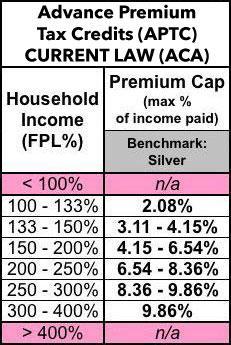

Here's the current federal premium subsidy formula (the precise premium cap percentages change slightly from year to year...and the Trump Administration is even messing with that a bit, so I'm not sure what it'll be in 2020):

There are two states which currently provide additional subsidies to some ACA exchange enrollees (Vermont and Massachusetts)...but those are only available to enrollees earning 100-300% FPL. Those over 400% FPL don't receive any assistance anywhere...and that's where the loudest complaints about the ACA have always come from over the past six years.

The good news is that House Democrats have introduced a bill which would, among other things, remove the 400% FPL income cap for subsidies while also beefing up the subsidy formula below that threshold. A similar bill was also introduced by Senate Democrats back in 2017 (that one would remove the 400% FPL cap only). The bad news is that neither bill has a chance in hell of passing the Senate as long as Mitch McConnell is in charge, and they'd both likely be vetoed by Donald Trump anyway.

That means any additional ACA subsidies are gonna have to come at the state level. Two states--Washington and California--are set to become the first ones to add their own supplemental ACA individual market exchange subsidies to those earning more than 400% of the Federal Poverty Line, starting in 2020.

UPDATE: California's expanded subsidies kick in starting in 2020, but it looks like Washington State's won't start until 2021.

Washington's supplemental subsidy law extends to enrollees earning up to 500% FPL. Assuming the Trump Administration isn't successful in WEAKENING the FPL formula, that should be around $63,000/year for an individual or $129,000/year for a family of four in 2020. The language of the bill is a little fuzzy about how much this would cost, but it's pretty clear about the results:

(1) The Washington health benefit exchange, in consultation with the health care authority and the insurance commissioner, must develop a plan to implement and fund premium subsidies for individuals whose modified adjusted gross incomes are less than five hundred percent of the federal poverty level and who are purchasing individual market coverage on the exchange. The goal of the plan is to enable participating individuals to spend no more than ten percent of their modified adjusted gross incomes on premiums. The plan must also include an assessment of providing cost-sharing reductions to plan participants and must assess the impact of premium subsidies on the uninsured rate.

(2) The Washington health benefit exchange must submit the plan, along with proposed implementing legislation, to the appropriate committees of the legislature by November 15, 2020.

Right now the ACA subsidy formula caps benchmark policy premiums at no more than 9.86% of income for those earning 300-400% FPL, so the 10.0% cap from 400-500% FPL is pretty close. In 2019, the average unsubsidized premium paid by Washington State exchange enrollees is around $551/month per enrollee, or $6,612/year. Average premiums are expected to only go up about $94/year in 2020, or $6,700/year. 10% of $63K is $6,300, so on average, a single adult at 500% FPL would only receive around $400 in subsidies next year...but that's the average. Due to the 3:1 premium age band allowance, unsubsidized premiums for younger enrollees could be well below that, while for older employees it could potentially be as much as twice as high. That means a 64-year old earning 500% FPL could potentially see their net premiums reduced by more than 50%, from $13,000/year down to $6,300...a whopping $6,700 in subsidies per year.

How much will this cost Washington State? I have no idea, because it greatly depends on what the demographics of the 400-500% FPL enrollees are next year. This year only 10% of enrollees (around 19,800 people) reported earning over 400% FPL...but that percentage should increase with the addition of these subsidies. Similarly, about 1/3 of WA exchange enrollees are 55 or older today...but that, again, is largely because older folks over the 400% threshold have to pay so much right now.

If you assume a total of, say, 30,000 enrollees earning 400-500% FPL, with average subsidies amounting to, say, $100/month ($1,200/year), that'd cost the state around $36 million/year...but again, that also assumes all 30K are in single-person housholds. The actual amount could be considerably lower or higher.

What about in California? The proposed supplemental CA subsidies are both more and less extensive than Washington's at the same time: They'll be available to more people than in WA, but they'll be less generous for those who receive them:

So that's additional subsidies from 200 - 400% FPL instead of 250% - 400%, and new subsidies from 400 - 600%.

...Again, the exact formula isn't laid out, but 75% of $295.3 million = $222 million. Assuming $1,200 apiece, that suggests they expect around 184,000 exchange enrollees in the 400-600% FPL range. The remaining $74 million would go to around 615,000 enrollees in the 200 - 400% FPL range at $120 apiece per year.

Around 660,000 Californians earning 200 - 400% FPL enrolled in 2019 ACA exchange plans this year, so after subtracting the ~10% who don't actually pay their first premiums and are never actually enrolled, that's right in the same ballpark (around 595,000 enrollees).

How much would this actually help? Well, the average 2019 ACA policy premium is around $595/month, or $7,140 per year.

For 2020, the mandate penalty should more than cancel out any average premium increase, so let's assume premiums will be around the same as they are now.

If so, this would knock down the average price for those in the 400-600% FPL range by roughly 17%, or by around 1.7% for those in the 200 - 400% range (remember, those folks are already receiving substantial subsidies to begin with).

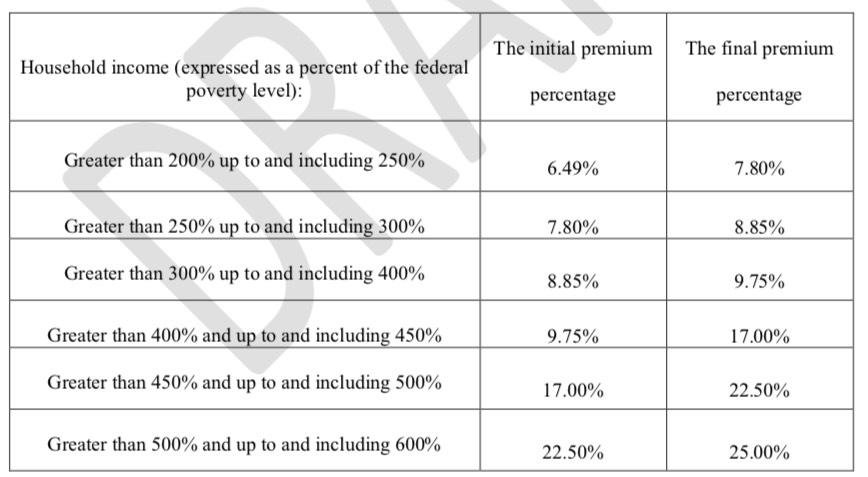

Covered California, the state ACA exchange, put out this draft program design report back in May which includes the following table showing what they have in mind for the subsidy distribution:

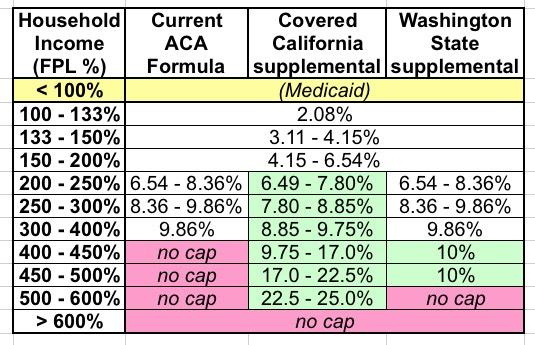

Here's a table which compares the current APTC formula vs. what it will look like in California using the above table (I also included Washington State for completeness):

It may sound absurd to put a "cap" of 25% on premiums at the upper end, but keep in mind that there are some parts of the country (Natrona County, Wyoming is the most expensive) where benchmark premiums for a single 64-year old are as high as $2,050/month, or a whopping $24,600/year. 600% FPL is about $75,000/year for a single adult, so that's an insane 32.8% of their income.

Average premiums are 40% lower in California than Wyoming, so there probably aren't too many cases that extreme in CA, but I could see the lower caps in the 15-20% range coming up pretty frequently.

However, it turns out the actual formula may end up being considerably more generous anyway. The above formula was developed by Covered California assuming the original subsidy funding of around $300 million/year. The final budget deal apparently increases this by about 45% to around $429 million in 2020, which should allow those percent caps to be lowered further:

The original proposal capped % of income at 17%, 22%, 25% at 600% FPL. The added investment allows CA to bring that cap down, hopefully to around 15% at 600% for the benchmark plan. Obviously, we want coverage to be cheaper, but we'd need more investment in future years.

— Anthony Wright (@aewright) June 14, 2019

I'm not sure whether Wright's tweet (from 6/14) is based on the proposed $300 million in additional subsidies or the final $133 million. If the former, then I'd imagine the final cap will probably be closer to something like 20% at the 600% FPL level. Depending on how it plays out, I could see the actual formula looking something like one of the following:

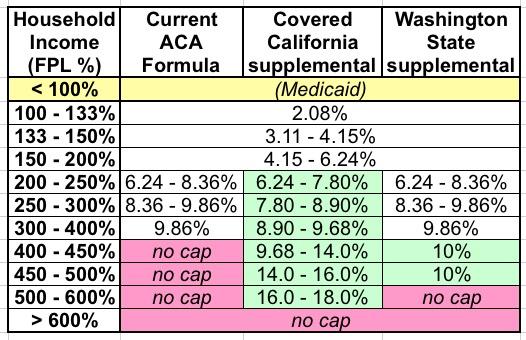

UPDATE 7/1/19: OK, the Covered California board has posted the final/official supplemental subsidy formula/spread. It's pretty good considering the limitations they're working with:

So how much of an impact could this make in the real world? Well, here's an extreme example: Consider a single 64-year old living in Sacramento, California (this is one of the most expensive rating areas in the state, I'm told). In 2019, the unsubsidized premium for the benchmark Silver plan with a $2,500 deductible runs over $1,100/month, or over $13,000/year.

Under the ACA, if our 64-year old earns less than- $49,960/year, they won't have to pay any more than about 9.8% of that, or around $4,900. If they go even $1 over that, however, they lose all subsidies and their cost skyrockets to the full $13,356. With California's enhanced subsidies, starting in 2020, this would drop back down to under 10% of their income, for a whopping 63% cost reduction, saving them over $8,500 for the year.

The savings would drop at higher incomes, of course, and would still max out at nearly 18% at around $68,000/year, but this is still a hell of a lot better than the current situation:

In any event, neither Washington nor California's enhanced subsidies are magic bullets for everything which ails the ACA by any means, but they'll both be hugely helpful in making coverage more affordable for tens of thousands of people. It's a start.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.