Democratic Senators OFFICIALLY introduce bill to fix the single most obvious problem w/the ACA

As I've written about more times than I can remember, for all the very real and highly damaging GOP sabotage of the ACA over the years, there are some problems which were, quite frankly, inherent in the law as passed itself. This should be no great revelation, since it is a major piece of legislation which impacts nearly 1/5th of the entire economy is always going to have some problems to deal with, just as the 1.0 version of any piece of software will always have to have updates and patches applied. If this wasn't the case, there wouldn't be any amendments to the U.S. Constitution (not even the 2nd, so beloved by the GOP).

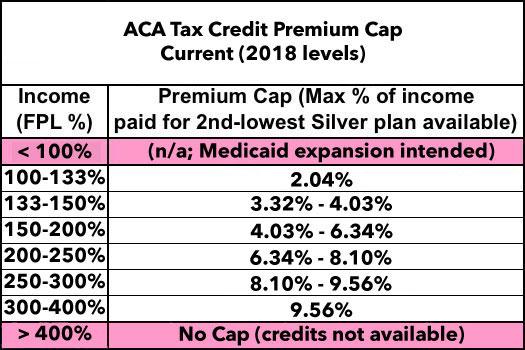

In any event, one of the biggest flaws with the ACA itself is that the formula and rules for individual market tax credit eligibility are, quite simply, too stingy. They only apply to those falling within 100-400% of the Federal Poverty Level (roughly $12,000 - $48,000 for a single adult, or $24,000 - $96,000 for a family of 4), Within that income range, subsidies drop off on a sliding scale, based on what percentage of household income the benchmark Silver policy costs. Here's the official chart for 2018 (the percentages change very slightly from year to year based on some IRS formula):

There are two problems with this formula, at the top and the bottom. The first problem is that the ACA assumed that all 50 states would expand Medicaid to everyone below the 138% FPL threshold. Since all of those folks were supposed to be eligible for Medicaid, there seemed to be no point in offering tax credits for purchasing private policies. The problem is that due to the 2012 Supreme Court ruling (on my birthday, no less!), each state was allowed to decide for itself whether to expand Medicaid...and to date, 19 states have refused to do so. This means that there's around 2.6 million people caught in the infamous "Medicaid Gap" across those states...they don't qualify for Medicaid but also earn too little to be eligible for ACA exchange tax credits.

The solution to this is pretty obvious: Get those 19 states to stop being douchenozzles and expand Medicaid. Failing that, however, there's another simple solution: Remove the lower-end income eligibility cap, allowing those below 100% FPL to qualify as well. Yes, they'd have to pay a small portion of their income, but that's what states like Indiana are already requiring Medicaid expansion enrollees to do anyway, and it'd still be a hell of a lot better than being stuck out in the cold with no options at all.

UPDATE: Hmmm...Commenter "joe" below points out that if tax credits were available to anyone under 100% FPL, non-expansion states would have less pressure to do so, and current expansion states might even reverse their policy since it would get them off the hook for paying even the 5-10% of Medicaid expansion costs that they do today. I'll have to think this part over a bit.

The other problem is at the other end: That 400% FPL cut-off. The assumption back in 2009-2010 was presumably that anyone earning more than 400% FPL should probably be able to afford to pay full price for a decent healthcare policy without needing any financial assistance...but this simply turned out not to be the case, at least for those right at or near the cut-off point. Furthermore, due to the formula jumping from a limit of ~9.6% of your income to no credits whatsoever, someone hovering just below the 400% FPL point who has a good year sees their credits wiped out entirely.

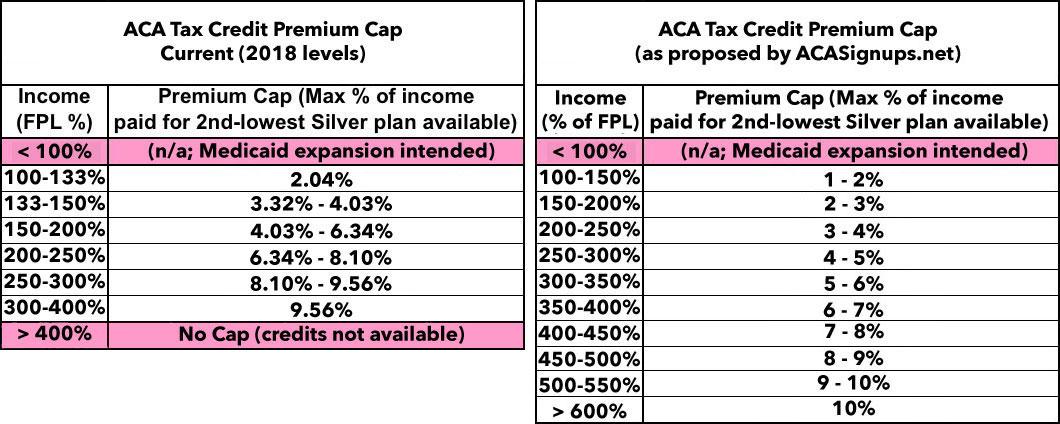

This is a real problem...with an easy solution: Either raise that 400% cap up to, say, 500-600%...or better yet, remove it altogether. This is exactly what I proposed in my "If I Ran the Zoo" compendium of ACA fixes, although to be fair, it's also exactly one of the major fixes Hillary Clinton proposed as part of her campaign platform.

Here's what I had in mind, although the precise percentages and income brackets could obviously be tweaked (Clinton's proposal was actually more generous than mine...she wanted 8.5% of income to be the cut-off point vs. my 10%; I'd be fine with that!):

In any event, until a couple of days ago, to the best of my knowledge, no sitting Democratic Senator or Representative has actually introduced a bill to achieve this change. Sure, there's the full Single Payer bills by John Conyers and Bernie Sanders, and of course the Dems have been clamoring for the GOP to formally appropriate CSR reimbursement payments to carriers...but nothing specifically calling for beefing up the APTC subsidies. Until now:

Senators Introduce Legislation to Improve Affordable Care Act, Make Coverage More Affordable for Middle-Class Families

Jun 07 2017

Washington—Senators Dianne Feinstein (D-Calif.), Patrick Leahy (D-Vt.), Elizabeth Warren (D-Mass.), Tammy Baldwin (D-Wis.), Kamala Harris (D-Calif.) and Maggie Hassan (D-N.H.) today introduced legislation to improve the Affordable Care Act by eliminating the cliff that currently blocks many middle-class individuals and families from receiving financial help to purchase insurance through marketplaces like Covered California.

“Defeating the Republican plan to repeal the Affordable Care Act isn’t enough—we need to make the ACA stronger. I want to make the law work better for families nationwide by addressing affordability issues within the individual market,” said Senator Feinstein. “One solution is to eliminate the sharp cut-off for financial help. A 60-year-old making $47,521 per year—one dollar more than the limit—has to pay more than $900 per month in premium costs for a standard plan in some areas of California. That’s simply not affordable. Our bill would fix this problem.”

“We should be looking for ways to improve our health insurance system – not tear it apart. This bill will help make insurance more affordable and strengthen the financial security of American families,” said Senator Warren.

“It’s time to stop the partisan nonsense, take repeal off the table and work to improve and strengthen our health care system,” said Senator Baldwin. “I have heard from rural and middle-class Wisconsinites across our state who are using nearly half of their income on health care costs and are in need of the financial help. This reform is a real solution that will allow these Wisconsin families and Wisconsinites living in rural communities to qualify for tax credits and afford the quality coverage they need.”

“Access to quality and affordable health care in America should be a right, not a privilege. It is not enough to defend the Affordable Care Act, we must figure out what more we can be doing to improve the lives of all Americans,” said Senator Harris. “Right now, many middle-class families are still struggling to afford insurance and that’s not acceptable. Let’s fix that.”

“We need to work together to strengthen the Affordable Care Act and bring health care costs down for hard-working people,” said Senator Maggie Hassan. “This bill is a common-sense step that will help to bring down the cost of premiums for middle class Granite Staters on the exchange, allowing more people to access affordable coverage and making our people and our communities stronger.”

“This is the kind of health care legislation the nation needs right now,” said Frederick Isasi, executive director of Families USA. “It improves current law to make health care more affordable for America’s families, especially our struggling middle class and older people close to retirement. This bill deserves wide bi-partisan support.”

Under current law, individuals and families making just one dollar more than 400 percent of the federal poverty level ($47,520 for an individual, $80,640 for a family of three) receive no financial help at all. This sharp cut-off contributes to affordability issues in individual markets nationwide.

Under the bill, no individual or family would pay more than 9.69 percent of their monthly income toward health insurance premiums. Currently, 9.69 percent of monthly income is the maximum contribution households are required to make toward their health plan if they make between 300 and 400 percent of the federal poverty level.

The bill would be particularly beneficial to individuals aged 50 to 64, given that plans are more expensive for older individuals.

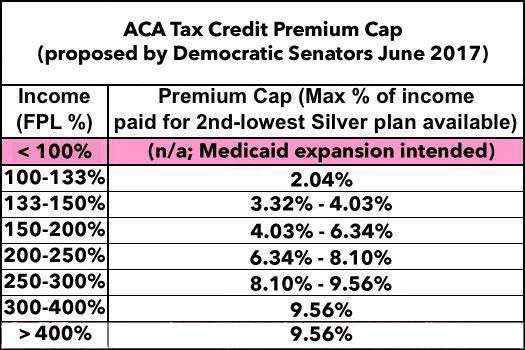

Their bill doesn't even change the formula or anything...it simply changes the "up to 400%" part to "over 300%". The only real flaw I see here is that it doesn't also resolve the lower-bound issue for those caught in the Medicaid Gap, but still. I believe this is the bill in question, although the actual text of it isn't listed yet. Here's what it would look like:

That's it...it would keep the formula exactly the same, just removing the 400% cap.

UPDATE 11/20/17: Here's the full text of the bill:

S. 1307

To amend the Internal Revenue Code of 1986 to expand eligibility to receive refundable tax credits for coverage under a qualified health plan.IN THE SENATE OF THE UNITED STATES • June 7, 2017

Mrs. Feinstein (for herself, Ms. Hassan, Ms. Warren, Ms. Harris, Ms. Baldwin, Mr. Leahy, and Mrs. Gillibrand) introduced the following bill; which was read twice and referred to the Committee on Finance

A BILL To amend the Internal Revenue Code of 1986 to expand eligibility to receive refundable tax credits for coverage under a qualified health plan.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the “Affordable Health Insurance for the Middle Class Act”.

SEC. 2. EXPANSION OF ELIGIBILITY FOR REFUNDABLE CREDITS FOR COVERAGE UNDER QUALIFIED HEALTH PLANS.

(a) In General.—Section 36B(c)(1)(A) of the Internal Revenue Code of 1986 is amended by striking “but does not exceed 400 percent”.

(b) Conforming Amendment.—The table in section 36B(b)(3)(A)(i) of the Internal Revenue Code of 1986 is amended by striking “up to 400%” and inserting “or higher”.

(c) Effective Date.—The amendments made by this section shall apply to taxable years beginning after the date of the enactment of this Act.

That's it. That's the whole thing. Around 200 words including all the preamble stuff. The actual text of the bill itself is only 94 words.

So, how much would expanding APTC to those over 400% FPL cost?

Well, let's assume that it added, say, 2.5 million people in 1 million households (~2.5 people per household) to exchange policies with an average income of, say, 450% FPL. 450% FPL would average around $82,500 per household, or $33,000 per person. 9.69% of that would be about $3,200 per person per year, or $267/month.

The way the ACA's APTC formula works, whatever the difference is between the benchmark Silver plan and 9.69% of the household income is how much the enrollees receive in tax credits. According to my analysis of the HHS Dept's silly "2013 - 2017 Rate Hike" report, the average full price premium on the individual market this year is $476/person per month. That means those 2.5 million additional enrollees would receive an average of $209/month apiece, costing the federal government about $6.3 billion more per year.

However, that's where the risk pool impact comes in. Presumably a substantial chunk of those 2.5 million people would be the much-desired Young Invincibles who HHS is always desperately trying to get to sign up. Why? Because they're relatively low-cost to the carriers. The total ACA exchange pool (roughly 10.5 million people strong) only has around 27% in the 18-34 year old range as opposed to the 40% desired. If most of those 2.5 million additions fit the bill, the risk pool should stabilize, which would in turn bring premiums down a bit and therefore reduce the amount of subsidies needed for everyone.

In 2017, there's roughly 9 million people receiving an average APTC subsidy averaging $361/month, for a total of around $39 billion. In this scenario, there'd be 11.5 million receiving subsidies averaging around $328/person per month. HOWEVER, if the improved risk pool were to lower premiums by even 5% ($23/month), that'd add up to around $3.2 billion less required in APTC. Therefore, instead of adding $6.3 billion to the total cost, it would only add $3.1 billion more, while covering 2.5 million more people. Obviously this example is pure speculation, but you get the idea.

UPDATE: As commenter "joe" also notes below, this logic is probably a bit off--those earning over 400% FPL tend to be older, so the risk pool might not be any better and could potentially even be slightly worse, although I'd have to dig up some actual demographic statistics to be sure. Worst-case scenario, you might be looking at perhaps $10 - $15 billion/year. Still a bargain given what you'd gain.

It's also worth noting that while Feinstein et al's proposal caps the premium cost slightly lower than my table above (9.69% instead of 10%), it doesn't beef up any of the income brackets below that. My proposal (along with Hillary Clinton's) would lower that premium max at the lower income levels as well, which would lower rates further for most current exchange enrollees, which would further increase the cost to the government.

If you added an average of, say, $25/month more in APTC to the existing 9 million recipients, that'd tack on another $2.7 billion to the tally, for instance.

I should also note that no, removing the cap wouldn't mean that billionaires like Warren Buffet and BIll Gates would get to mooch APTC subsidies. Remember, the subsidy is only triggered if the benchmark Silver premium cost more than 9.69% of your income. The only way someone earning, say, $1 million per year would qualify would be if the benchmark plan in their area cost $8,100 per person per month, which is...unlikely.

For instance, if the benchmark premium was $1,000/month in a given county ($12,000/year), that'd mean any individual earning more than $124,000/year wouldn't receive any assistance. The only state with average premiums that high is Alaska; even if rates continue to climb, I can't imagine anyone earning more than $200K would ever end up qualifying for the next 30 years or more.

Chances of this bill ever seeing the light of day in the next year and a half? Zilch. But it's still important for the Dems to show that they have specific real solutions to the real problems facing the ACA.