Arkansas: *Preliminary* avg. 2020 #ACA exchange rate changes: 2.3% increase

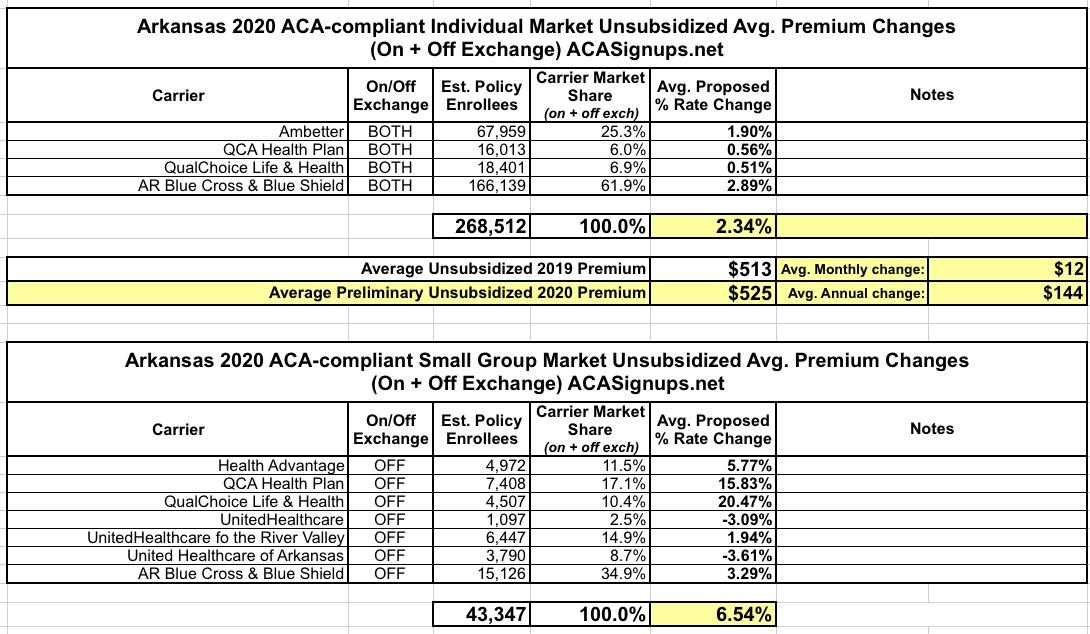

The Arkansas Insurance Dept. just posted their preliminary 2020 individual and small group market premium rate change requests. For the most part it's pretty straightforward: Individual market premiums are increasing about 2.3% statewide, while small group plans are going up 6.5% overall.

However, there's two interesting things to note about Arkansas' individual market: First, unlike most states where over 70% of enrollees do so through the ACA exchange, in Arkansas it's more like 20%, with nearly 80% are enrolled off-exchange. The main reason for this is the state's unique "Private Option" Medicaid expansion waiver, in which around 252,000 residents who would otherwise be enrolled in Medicaid itself are instead enrolled in enhanced ACA individual market policies...with the state paying for their premiums.

This is confusing, since the 268,512 total below leaves just 16,500 people for the rest of the individual market, including both exchange and off-exchange enrollees. That makes no sense, since over 67,000 people enrolled in on-exchange plans this year; even assuming a 20% attrition rate, that'd still be nearly 54,000 people, not including the off-exchange enrollees. I'm gonna look into this further.

The other odd thing about Arkansas' 2020 individual market filings is in the one-page summary of each of the four carriers:

...(4) the decrease in the Federal Exchange User Fee from 3% to 2.5% and the elimination of the Arkansas Health Insurance Marketplace Exchange User Fee of 1.25% beginning January 1, 2020.

...Changes in Taxes and Fees - the rate increase requested takes into consideration the decrease in the Federal Exchange User Fee from 3.0% to 2.5% and the elimination of the Arkansas Health Insurance Marketplace (AHIM) Exchange User Fee of 1.25% beginning January 1, 2020; and Change in Morbidity.”

...Changes in Taxes and Fees - the rate increase requested takes into consideration the decrease in the Federal Exchange User Fee from 3.0% to 2.5% and the elimination of the Arkansas Health Insurance Marketplace (AHIM) Exchange User Fee of 1.25% beginning January 1, 2020; and Change in Morbidity.”

...(4) the decrease in the Federal Exchange User Fee from 3% to 2.5% and the elimination of the Arkansas Health Insurance Marketplace Exchange User Fee of 1.25% beginning January 1, 2020. Other adjustments played a minor role in the increase, such as changing demographics, morbidity assumptions, expense trend, etc.”

Carriers in most states have been paying the federal government a flat 3.5% of their ACA exchange premiums in order to be hosted on the HealthCare.Gov exchange platform for years. That fee is dropping from 3.5% to 3.0% this year.

The dozen states which operate their own ACA exchange platform don't pay anything to HC.gov, of course; they have their own fees/funding mechanisms to cover the costs of their exchange platforms.

Here's the thing, though: There are five states (Arkansas, Oregon, New Mexico, Kentucky and Nevada) which technically have their own ACA exchange legal entity (including a board of directors, their own marketing budget and so forth)...but which "piggyback" on top of HealthCare.Gov for their actual technical platform for enrollment. Those states have been paying 3.0% of premiums each year, although that fee is being knocked down to 2.5%.

Recently, Arkansas' ACA "exchange without a platform" went through a structural change; while it still technically exists, it was absorbed into the main Arkansas Insurance Department earlier this year. That means that the operational budget now comes from the general Insurance Dept. fund instead of a separate revenue source. That's why they're able to eliminate the 1.25% exchange fees. So far, so good.

The confusing part isn't that...the confusing part is why they were paying the 1.25% fee in addition to the 3.0% (2.5% now) to HealthCare.Gov in the first place. According to the article I just cited...

As the entity responsible for Arkansas' health insurance exchange, the marketplace certifies the plans sold in the state through healthcare.gov, promotes enrollment in the plans and helps consumers sign up.

Kerr told the Insurance and Commerce Committee that his department already reviews the insurers' rates and policy details and that the marketplace simply signs off on the Insurance Department's work.

He has said his agency could take over the marketplace's duties at a cost of no more than $571,500 a year. By contrast, the marketplace's spending totaled about $2.6 million last year.

To be honest, I'm not sure how that works out either...Arkansas averaged around 54,000 on-exchange effectuated enrollees per month last year. At $513/month, that's around $332.4 million in premiums for the year. 1.25% of that would be roughly $4.1 million, far more than the $2.6 million they supposedly spent. The larger point, though, is that even $2.6 million sounds pretty absurd if the insurance dept. was already doing most of the Arkansas exchange's work for them anyway.

Anyway, 2.3% increases are what unsubsidized Arkansas residents are looking at next year:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.