Pennsylvania: 75% of next year's rate hikes due specifically to Trump CSR sabotage

Pennsylvania is the first state which has released their approved 2018 rate hikes since Donald Trump officially pulled the plug on CSR reimbursement payments last Friday. It's also one of just 16 states which had yet to do by then. Most of the remaining states are small or mid-sized, so plugging Pennsylvania into the 2018 Rate Hike Project leaves just Texas, North Carolina and New Jersey as missing states with more than 8 million residents.

Back in June, the PA Insurance Commissioner was pretty up front and clear about what the major causes of 2018 rate increases on the individual market would be:

Insurance Commissioner Announces Single-Digit Aggregate 2018 Individual and Small Group Market Rate Requests, Confirming Move Toward Stability Unless Congress or the Trump Administration Act to Disrupt Individual Market

Harrisburg, PA - Insurance Commissioner Teresa Miller today announced that the five health insurers that sell on Pennsylvania’s individual market will stay in the market and filed plans for 2018 with aggregate statewide rate increases of 8.8 percent for individual plans and 6.6 for small group plans. However, Miller warned that these increases will be much worse if the federal government takes actions that would change the Affordable Care Act or its enforcement.

“These low percentages show that Pennsylvania’s market is stabilizing and insurers are better understanding the markets and the population they serve,” said Commissioner Miller. “I sincerely hope that Congress and the Trump Administration do not take action that could negatively impact the progress we have made in Pennsylvania.”

Commissioner Miller warned of the significant impact that action from the federal government to change the Affordable Care Act would have on insurers’ aggregate proposed rate increases. If the individual mandate is repealed, insurers estimate that they would seek a 23.3 percent rate increase statewide. If cost-sharing reductions are not paid to insurers, the companies would request a 20.3 percent rate increase statewide. If both changes occurred, insurers estimate they would seek an increase of 36.3 percent.

I wasn't quite sure whether that mean a 20.3% rate spike on top of the 8.8% they were otherwise looking at, or if it was 20.3% total, but it doesn't really matter because today they announced the actual, official rate increases:

Acting Insurance Commissioner Announces Approved 2018 Individual and Small Group Rates, Highlights Opportunities to Lessen Impact of Trump Administration Actions on Pennsylvania Consumers

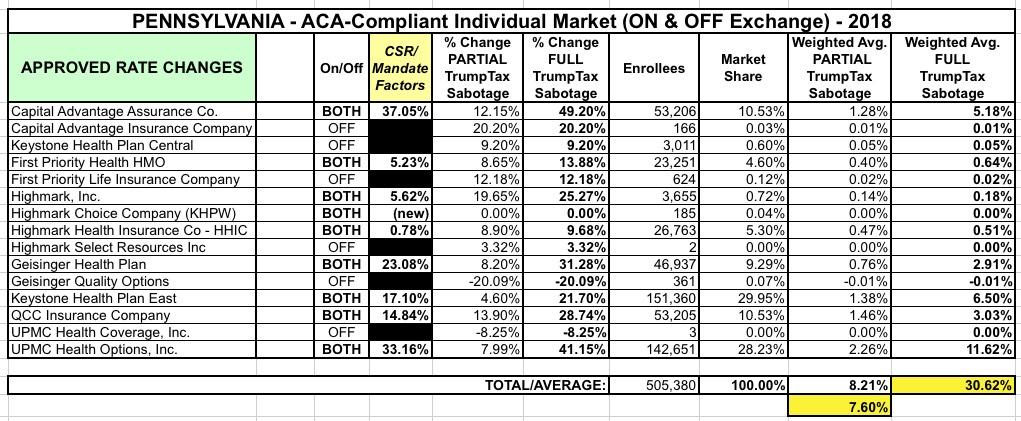

Harrisburg, PA - Acting Insurance Commissioner Jessica Altman today announced the approval of 2018 individual and small group health insurance rates. Because of President Trump’s deliberate disruption of the individual market by discontinuing cost-sharing reduction payments to insurers and Congress’s inaction to appropriate these funds, rates will increase by an average 30.6 percent in the individual market. Original projections indicated an increase of 7.6 percent.

I guess that answers my question; 20.3% + 8.8% = 29.1%, so it sounds like there was only a slight final modification made on top of that in the end.

“It is with great regret that I must announce approved rates that are substantially higher than what companies initially requested,“ said Acting Commissioner Altman. “This is not the situation I hoped we would be in, but due to President Trump’s refusal to make cost-sharing reduction payments for 2018 and Congress’s inaction to appropriate funds, it is the reality that state regulators must face and the reason rate increases will be higher than they should be across the country.”

Bonus points to Altman for not letting the GOP Congress off the hook here; they could have easily taken the CSR gun out of Trump's hand at any point over the past 9 months (3 years, really) by simply appropriating the funds via a simple, one paragraph bill.

Governor Wolf, Acting Commissioner Altman, and Former Insurance Commissioner Miller have warned President Trump and administration officials about the potential impacts of failing to make a long-term commitment to paying cost-sharing reductions. If the Trump Administration had committed to making payments for cost-sharing reductions and alleviated uncertainty regarding the individual mandate, rates would have increased by an average of 7.6 percent rather than 30.6 percent. Small group market rates sold to employers with 50 or fewer employees will increase by an average of 7.6 percent for 2018.

Actually, this makes it sound like the final rate hike is lower than the worst-case scenario described in June (36.3%), since it mentions the uncertainty about the mandate enforcement as well. In any event, 30.6% it is...75% of which is due specifically to Trump's sabotage efforts.

“The president’s deliberate action and Congress’s failure to appropriate these funds despite repeated requests is forcing large rate increases on consumers in Pennsylvania and around the country, but my department is doing what we can to help our consumers understand their options and hopefully shield them from these rate increases,” said Acting Commissioner Altman.

Here's the good news: Pennsylvania is joining at least 10 other states and is wisely going the full Silver Switcharoo route:

Under the Affordable Care Act, plans are available at four levels – platinum, gold, silver, and bronze. These levels represent different levels of cost-sharing based of monthly premiums and total out-of-pocket costs. A bronze plan will normally have the lowest premium but could have the largest out-of-pocket costs, whereas a platinum plan would have the highest monthly premium but lowest deductible. Because cost-sharing reductions are only available on silver plans, rate increases necessitated by the non-payment of these cost-reductions will be limited to silver plans. On-exchange bronze, gold, and platinum plans and off-exchange silver plans will not be impacted by these disproportionate increases.

Boom: Not just limited to Silver plans, but limited to on exchange Silver plans: Switcharoo to the Rescue!

Premium subsidies are calculated based on the cost of silver plans in each rating area, and subsidies increase in connection with rate increases. Because rates are rising on silver plans due to cost-sharing reduction non-payment, premium subsidies may be generous enough to allow an individual who qualifies to purchase a gold-level plan that has more favorable cost-sharing at a lower price than previous years.

That of course leaves the one tricky problem: Unsubsidized enrollees, especially those on Silver plans. Fortunately, they're following California's lead here as well:

Acting Commissioner Altman strongly encouraged individuals who do not qualify for premium subsidies to consider off-exchange options. The department worked with each of Pennsylvania’s five marketplace health insurers to ensure they would offer an off-exchange only option that is not impacted by the disproportionate rate increases for on-exchange silver plans. Off-exchange plans must be purchased directly through one of Pennsylvania’s five marketplace insurers or through an agent or broker licensed by the department to sell on behalf of these companies.

This is exactly the right way to do this. It's a bit confusing and counterintuitive, but it should work as long as all enrollees are on board. In fact, PA is going one step further:

The Pennsylvania Insurance Department is partnering with Consumers’ Checkbook again this year to create a shopping tool that allows consumers to compare both on-exchange and off-exchange plans available in Pennsylvania. Consumers can enter their income to see what subsidies may be available to them and estimate the monthly premium and total annual cost of plans in their area. If consumers find a plan they would like to buy, the plan comparison tool will take them to either Healthcare.gov or the company’s website to make a purchase. Consumers can visit https://pa.checkbookhealth.org to use the plan comparison tool.

Open enrollment for 2018 health insurance runs from November 1 until December 15 – a change from previous years. Consumers must sign up by December 15 in order to have coverage effective January 1. The open enrollment period may be the only time consumers can enroll for 2018, and those who do not purchase a plan may be subject to a penalty as well as being uninsured for the year. On-exchange plans can be purchased at Healthcare.gov. Consumers who need assistance enrolling may visit localhelp.healthcare.gov to find free resources in their area.

“While there has been much conversation this year regarding the Affordable Care Act’s future, it remains law. The benefits, consumer protections, and financial assistance that law provides are still available,” said Acting Commissioner Altman. “I strongly encourage all Pennsylvanians who need coverage to use our plan comparison tool to find the best plan for them and protect their and their family’s health by enrolling in coverage for 2018.”

Kudos to the PA team for handling this perfectly.

UPDATE: Here's the table breaking out the rate increase numbers by carrier. Note that I get an overall weighted average of 8.2% for the "partial sabotage" column, but the state insurance commissioner is quite specific about it being 7.6%, but I also had to mush together the "original request" and "revised request" numbers for a few carriers which could easily account for the discrepancy. In any event, there you have it:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.