How effective will the 2016 Mandate Penalty be in getting Young Invincibles to enroll?

Ever since I posted my latest article on the growing Individual Mandate Penalty (again, it's up to $695 per person or 2.5% of household income this year), I've heard the same response from many ACA detractors (and even some supporters): Even with the increase in the mandate penalty (technically, it's called the "Individual Shared Responsibility Payment"), it's still too small for it to make sense economically for most people when compared to the cost of enrolling in a compliant policy.

Even with tax credits, the reasoning goes, even the least-expensive Bronze plan (or Catastrophic for those who qualify) is still more expensive than the mandate tax. Of course, if you pay the penalty, then you're still stuck with absolutely no insurance whatsoever, whereas if you enroll in even a basic Bronze plan, you're at least covered for major medical expenses (ie, the type which can wipe out even a $10K deductible*), while also receiving many basic medical treatments like checkups, immunizations and cancer screenings at no charge or for a nominal co-pay. However, it's true that in some cases, the up front dollars paid are indeed higher for the policy than the fee.

*UPDATE: D'oh! Thanks to Esther Ferington for reminding me that the actual worst-case scenario might not be nearly as bad as this, due to the ACA's limit on total out of pocket maximums. For instance, a single, non-smoking 26-year old in Detroit making $20K/year would have an out-of-pocket maximum of $6,450 no matter how much they rack up in medical expenses. On the one hand, that'd still be a disaster on $20K/year. On the other hand, it's also still a lot better than $10K...not to mention the $100K+ which the expenses might rack up without any insurance at all).

Of course, much of this is subjective and, due to the very nature of insurance itself, inherently relies on unknowns. After all, if you knew for certain that you'll never need any medical treatment whatsoever over the next 12 months, paying anything for health insurance would technically be a waste of money. On the other hand, if you know for certain that you're going to rack up a million dollars in medical expenses next year, pretty much any ACA-compliant policy would still be money well spent. Unfortunately, no one knows one or the other for certain, which is kind of the point of insurance in the first place.

I cannot stress this point enough: I am in no way advocating that anyone NOT enroll. I'm basically just playing Devil's Advocate here as a thinking exercise.

The question is how many and what demographic of people this dilemma is true for. There are so many variables of age, income level (ie, tax credit eligibility), household size/dependents, carriers/markets/cities/states and so on that it would take forever to test out every single potential combination to see which ones are "better off" taking a pass and paying the penalty.

However, data nerd that I am, I decided to take on the challenge...with several assumptions and rules to keep me from going crazy trying to cover all the bases. Here's what I did:

- 1. Since the primary goal this year is to target the "Young Invincible" crowd to help out the Risk Pool, I stuck with single, childless younger individuals. No married couples, no children or other dependents. This also simplifies calculating the tax penalty.

- 2. I chose three ages: 26, 30 and 35 years old. Remember, the "Youth Demographic" for the Risk Pool is supposed to be 18-35. I went with 26 instead of 25 since you can stay on your parents' plan until you're 26.

- 3. I chose 5 income levels: $20K, $25K, $30K, $35K and $40K, which seems to be a good range according to this article on average millennial salaries published earlier this year. These roughly correspond to 170%, 210%, 260%, 300% and 340% of the federal povery line for a single adult.

- 4. I'm assuming no weird deductions, investments, write-offs, etc etc...the dollar amounts above are what we're working with here.

- 5. I picked 10 major U.S. cities (young people lovvvve large cities, right?), including Chicago, Las Vegas, Indianapolis, Houston, Philadelphia, Phoenix, Atlanta, Cleveland, Miami and Detroit.

- 6. You'll note that I deliberately didn't include Los Angeles, New York, Boston, etc. This was purely in the interest of saving time; I stuck with cities in states covered by HealthCare.Gov, since it was faster to run through all 10 cities using the same Window Shopping tool.

- 7. Obviously everyone in my tests is currently uninsured, but also not eligible for Medicaid, CHIP or employer-sponsored coverage. In addition, for purposes of this study and to simplify things, none of these people smoke or are pregnant (lord knows those two never belong together anyway!)

- 8. Again, for purpose of this study, I'm assuming that the people in question are choosing between being covered for the full 12 month calendar year vs. not being covered for any month of the year. I'm not gonna get into grace periods or "1/12th of the penalty" stuff here.

- 9. Just to reiterate: FOR PURPOSES OF THIS STUDY, I am ignoring things like deductibles, co-pays, network size, carrier reliability and so on. We aren't talking about people who are thinking deeply about the wisest choice or the best value for their particular situation (although people should do just that). The reality is, for most people at lower income levels, a Silver Plan makes the most fiscal sense overall.

However, in this case I'm instead looking at people who simply want to scratch the "health insurance" issue off their "to do" list in the least-expensive way possible. That basically amounts to checking the tax penalty against the dirt-cheapest plan needed to avoid the penalty (which generally means a Bronze plan or, in the case of the 26-year olds, possibly a Catastrophic plan). Basically, the mindset here is "What's the bare minimum I need to sign up for to get the government off my ass next spring?"

- 10. Finally, I am including one caveat to the above: Most people, when faced with paying $X for nothing vs. paying somewhat more for something will go ahead and choose "something". The question here is just how much more they're willing to pay before they decide that they're better off receiving nothing for the lesser amount. For purposes of this study, I'm assuming that the cut-off for most people is twice as much...that is, that most people are willing to pay up to twice as much as the penalty for a healthcare plan before they decide to pay the tax penalty instead. I have no idea whether this has been proven to be the case or not, but it "feels" about right to me. We're basically talking about up to $1,400 or so, give or take.

OK, with all that in mind, here's what I came up with.

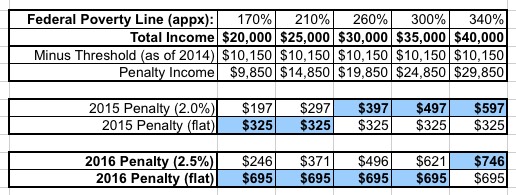

The first thing I needed to do was to figure out what the actual shared responsibility tax penalty would be. If I understand how it works, you first have to subtract the minimum federal tax filing income threshold from their total income. The threshold was $10,150 as of 2014. This may have gone up a bit since then, but that's what I have to work with:

As you can see, for 2015, the "flat" penalty was $325 even at $20K and $25K, but went up substantially after that. However, 2015's penalty will be what it will be at this point; what I want to know is the 2016 situation...and here, it's the flat $695 which these folks will have to pay for 4 of the 5 income levels. It's not until you get up to $40K that the 2.5% rate takes over.

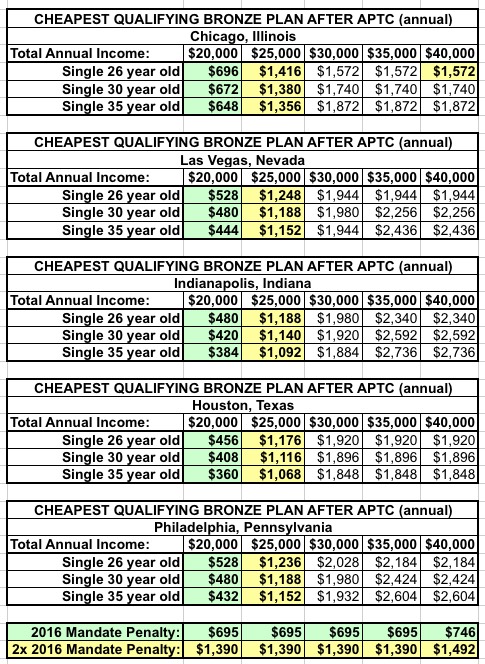

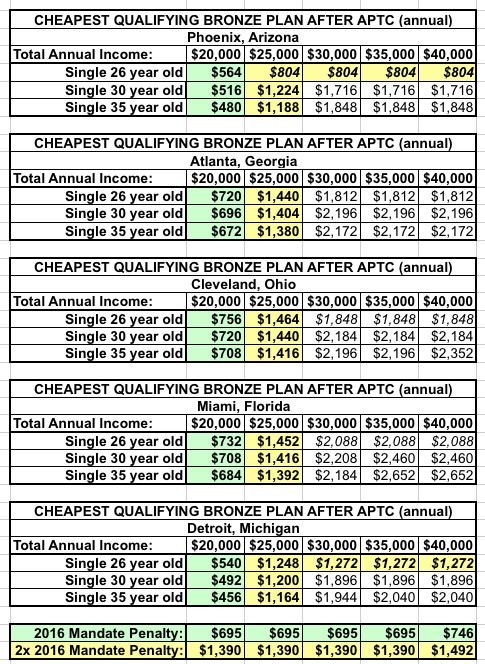

OK, so that's what we're measuring against. Now comes the tedious part: Plugging in all 3 ages at all 5 income levels for all 10 cities...that's 150 different cases in all. Here's the results; bear in mind that these prices are only available through the exchanges for the first few income brackets due to the Advance Premium Tax Credits which chop the prices down:

As you can see, enrolling in an exchange-based healthcare policy is an absolute no-brainer at the $20,000 level, and still makes sense at $25,000.

It's above $25K, or over 210% of the FPL, where the decision becomes more difficult, because aside from a few exceptions (Catastrophic plans in Phoenix and Detroit), even the least-expensive plan starts costing more than twice as much as the penalty at $30K and higher.

For everyone else, healthinsurance.org has a very handy calculator which lets you easily figure out just what your tax penalty will be if you don't get covered (along with a lot more details on exceptions, penalty maximums and so forth).

So, what's the solution here? Well, obviously it would be best if the cost of coverage were to come down further...either through switching to a Single Payer healthcare system (a guy can dream) or, failing that, by beefing up the Advance Premium Tax Credits and Cost Sharing Reductions (in both amount and the income range they're available at); in other words, strengthening The Carrot.

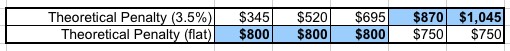

HOWEVER, if you want to go at it from The Stick side, it looks to me like jacking up the penalty. Going with $800 or 3.5% of income, for instance, would do the trick for just about all of the Young Adult population:

Once again, I'm not saying that individuals at $30K and up should pay the fee, I'm just noting that this is a legitimate issue which might cause 2016 enrollments to suffer as a result.

UPDATE: Thanks to Rick Gundlach for reminding me of another way of looking at the issue: For the upper 3 income levels ($30K, $35K and $40K), they'd still have to pay around $700 regardless of whether they enroll or not. That means that, in practical terms, a policy running, say, $2,000 for the year is actually only costing the enrollee around $1,300, since the first $700 or so would have to be paid out one way or the other anyway.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.