The 8 Most Important Pieces of Advice I Can Give For 2016 Open Enrollment.

With the 2016 Open Enrollment Period quickly approaching, here's the most important advice I can give:

- #1: SHOP AROUND. SHOP AROUND. SHOP AROUND.

Earlier today, the HHS Dept. released an in-depth analysis of the coverage decisions made for by the 4.8 million people who were still enrolled in HealthCare.Gov policies at the end of 2014 who went on to either renew their policies or switch to a different one for 2015 (note that the analysis only covers the 35 states run via HC.gov in both years. Oregon and Nevada ran their own ill-fated exchanges in 2014 and Idaho moved onto their own exchange in 2015, so these 3 states aren't included. Hawaii is moving to HC.gov for 2016 but was on it's own for both 2014 and 2015).

The report itself is quite detailed about how many people actively shopped around, how many of those kept their current plans, how many switched to a different carrier and/or a different metal level, but the bottom line is this:

Consumers that switched plans within the same metal level in 2015 saved $33 per month, or nearly $400 annually, relative to what they would have paid had they remained in the same plan as in 2014. Those who switched issuers as well as plans in the same metal level were able to save $41 per month, or over $490 annually. Consumers that switched plans and also changed metal levels or issuers saved even more, although changing metal levels can lead to higher cost sharing requirements.

That's what you really need to know here: Do not passively autorenew your current policy. Visit the exchange website (either HC.gov or your state-based exchange, depending on where you live) and shop around and compare plans before settling on one.

- #2: SHOP AROUND EVEN IF YOU DON'T THINK YOU CAN SHOP AROUND.

Some people will rightly point out that in their state/county there are minimal options for "shopping around". Maybe they only have one or two carriers to choose from. Maybe only one carrier includes the doctors/hospitals that they need to have in their network.

Even in those cases, you should still shop around...because you might discover that your current carrier has a better option than your current plan this year. You might be better off switching from an HMO to a PPO, or vice versa. You might be on a Gold plan and find that a Silver plan makes more sense. You might want to switch to a plan which includes dental coverage (or for that matter, you might want to add a standalone dental plan).

- #3: LOOK AT THE DEDUCTIBLE AS WELL AS THE PREMIUM.

The main focus of most pundits and reporters (including my own website, I admit) has been the premium rates. However, even finding a low premium doesn't necessarily mean that your total healthcare costs will be that low; deductibles are shooting up for many plans, which can cause the total cost to be considerably higher by the end of the year. (Co-pays and Coinsurance costs are also a factor, but it's the deductibles which are the biggest cost to keep an eye on besides premiums). Bronze plans tend to have much lower premiums, especially thanks to federal tax credits available to most people via the ACA exchanges...but they also tend to have much higher deductibles which can cancel out much of those savings. Silver plans are often a better value even with higher premiums due to having lower deductibles...which brings me to:

- #4: SILVER PLANS ARE GENERALLY THE BEST VALUE, ESPECIALLY FOR THOSE WITH A LOWER INCOME LEVEL.

(I debated making this #1 but decided to just make the font larger instead)

I've discussed the importance of Silver plans thanks to the Cost Sharing Reduction assistance for those under 250% of the federal poverty line many times before. Andrew Sprung is practically obsessive about how important Silver/CSR plans are. The bottom line is that anyone below 250% FPL (roughly $60K/year for a family of 4, give or take) is probably better off with a Silver plan...and those under 200% FPL (around $48K/year) should almost certainly go Silver.

Some of the state-based exchanges have started directing people to Silver plans by default, which is a very smart thing to do. Unfortunately, while HealthCare.gov is calling more attention to Silver/CSR plans than they did last year, they're still pushing the premiums only more than they should. Seriously: Strongly consider a Silver plan vs. Bronze.

Oh, and one more thing regarding the Advance Premium Tax Credits:

- #5: YOUR FEDERAL TAX CREDIT MAY CHANGE EVEN IF NOTHING HAS CHANGED AT YOUR END.

Let's suppose that for 2015, you chose a given healthcare policy via the ACA exchange. At full price it's $700/month, but you're only paying $500/month thanks to receiving $200/month in tax credits. For 2016, let's say that your income stays exactly the same, you don't move, you have the same number of dependents and so forth; nothing changes at your end other than everyone being 1 year older (which, by the way, can make a bit of a difference in your premiums, but I digress).

Let's further suppose, for the sake of argument, that your policy is one of the few where the full-price premium didn't change at all; it didn't go up, it didn't go down; it's still exactly $700/month.

In a situation like that, you're probably expecting to still receive the same $200/month tax credit, right?

Well, you might be right...but the formula used to calculate the tax credits is based on the premium rate of the Benchmark Plan in your rating area, which is the 2nd least-expensive Silver plan available. So even if your situation didn't change at all, if the benchmark plan premium changed, your tax credit amount might as well. This could actually be a good thing; the credit is just as likely to increase as decrease...but it's important to keep that in mind. That's another reason to actively shop around instead of just passively allowing yourself to be autorenewed.

- To be clear: The above points do not meant that everyone should change plans. You may turn out to be better off staying right where you are after all. All I'm saying is that you should shop around and take a look at the other options first.

UPDATE: I almost forgot another CRUCIALLY important point for those who aren't currently insured:

- #6: THE TAX PENALTY FOR *NOT* BEING COVERED IS $695 OR 2.5% OF YOUR TAXABLE INCOME THIS YEAR.

A lot of people got hit with the $95 / 1% of income fee back in April for not having ACA-compliant healthcare coverage. Those people may think "hey, $95 isn't that big of a deal! It's a lot cheaper than the insurance!" (which, of course, is only true until you or someone in your family is hit with a major medical expense, but I digress).

Some of them may be aware that the Individual Mandate penalty did go up, but think that it's "only" $325 this year (or 2% of your taxable income). That's true...except that applies to 2015, not 2016. $325 is the price you'll have to pay next spring for 2015.

No, if you fail to get covered this time around, for 2016, and don't qualify for a waiver due to low income/hardship, you're gonna be hit with a whopping $695 tax in the spring of 2017 (and, as Louise Norris reminds me, that's $695 per adult, not per household...plus $347.50 per child).

I'm not going to get into the question of whether this is "fair" or not, or whether any of your options are truly "affordable" by your definition of the term vs. the federal government's. I'm just saying that you're gonna get hit with a $695 fine (or 2.5% of your taxable income) in 2017 if you don't get covered for 2016.

UPDATE #2: And one more thing...

- #7: IF THERE'S *ANY* CHANCE THAT YOUR INCOME WILL BE *UNDER* 400% FPL NEXT YEAR, USE THE ACA EXCHANGE TO ENROLL!!

Around 85% of those enrolled in individual/family policies via the ACA exchanges receive federal tax credits, because their income falls below 400% of the Federal Poverty Line (roughly $47,000 for a single person with no dependents or $97,000/year for a family of 4). The other 15% enrolled via HC.gov or the state exchanges have incomes higher than that, and therefore don't receive subsidies of any sort. There's a simple reason why the >400% crowd is such a small portion of the exchange total...they have no reason to do so, since they can simply enroll in a policy off exchange, directly through their insurance carrier. Why go through the extra steps of an exchange plan if you're not gonna receive any benefit from doing so?

But what if your income is around 400% FPL? Or, what if you're self-employed and have a highly variable income which changes from year to year? Well, in that case, even though you may have been over 400% this year, that might not be the case next year...so you're still better off enrolling through the exchange. That way if your income next year turns out to be below the threshold, you'll be good to go; just report the change and you should be able to receive financial assistance after all.

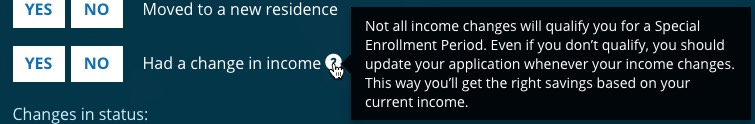

If you enroll directly through a carrier, however, you're pretty much stuck paying full price even if your income changes. Here's the relevant "Qualifying Life Change" from the Special Enrollment Period checklist:

As you can see, that's pretty iffy. You may qualify or you may not. To be certain, it's much better to simply enroll via the exchange in the first place; that way you're already in the system when you report the income change (which will simply change your tax credit amount from $0 to whatever it's supposed to be).

UPDATE #3: OK, make it 8 pieces of advice...

- #8: CHECK TO SEE IF YOUR PREFERRED DOCTOR/HOSPITAL IS IN THE PLAN'S NETWORK OR NOT

If you're getting insured for the first time, you may not have any particular preference when it comes to doctors, hospitals or specialists. However, many people do. One of the big complaints last year was that people had no idea whether "their" doctor was "in network" or not...and often got hit with a rude awakening when they were told that they'd have to pay full price (or at least more than expected) when they went to pay.

This year, some of the ACA exchanges have either added "In Network" lookup tools or have them in the works...but some aren't operational yet, and even the ones which are may not be 100% accurate/up to date. If you're really concerned about whether the doctors/hosptials/specialists you know you want are covered by a particular plan, I'd still recommend contacting them directly to find out to be certain. Hopefully this won't be an issue next year, but for now I'd double-check to be sure.