2026 Final Gross Rate Changes - South Carolina: +21.0%; over 600,000 enrollees facing MASSIVE rate hikes (updated)

Originally posted on 8/08/25

SCROLL DOWN FOR UPDATES

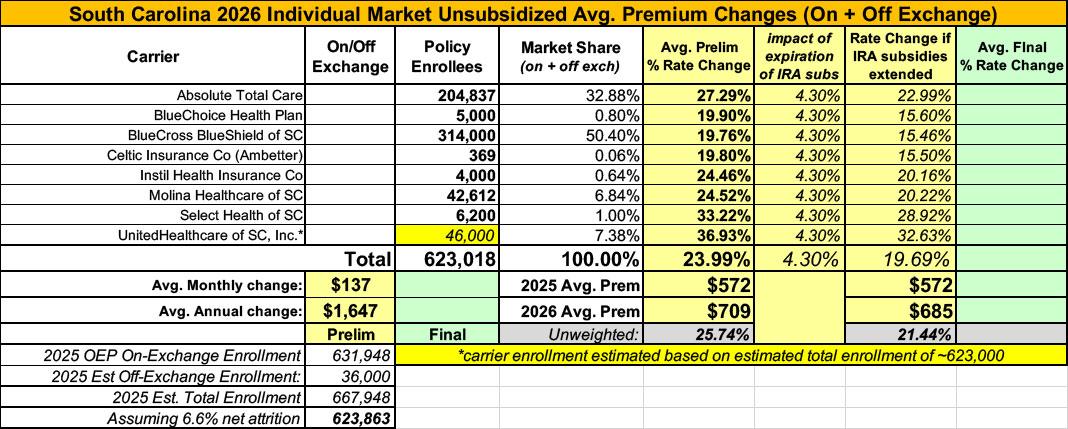

Overall preliminary rate changes via the SERFF database, South Carolina Insurance Dept. and/or the federal Rate Review database.

Absolute Total Care

The proposed rate change of 27.3% applies to approximately 204,837 individuals. Absolute Total Care’s projected administrative expenses for 2026 are $90.21 PMPM. Administrative expense does not include $17.94 for taxes and fees. The historical administrative expenses for 2025 were $78.35 PMPM, which excludes taxes and fees. The projected loss ratio is 82.6% which satisfies the federal minimum loss ratio requirement of 80.0%.

BlueChoice Health Plan

Scope and range of the rate increase:

Depending on the plan selected, approximately 314,000 members currently enrolled in a BlueEssentials, BlueExtend, Blue VirtuConnect, Blue Cooper, Blue Reedy, Blue Congaree, Blue Beaufort, Blue Direction, or Blue Pee Dee Individual health plan will see an adjustment to premiums effective January 1st, 2026. The average premium increase across all products is projected at 19.8%.

Financial experience of the product:

During 2024, premiums received have likely been sufficient to cover claims paid, administrative costs, commissions, taxes, and fees. The rate adjustment effective January 1, 2026, is needed to cover future changes in medical costs as well as regulatory policy and fee changes in the Individual market. If, in 2026, paid claims are significantly less than anticipated, rebates will be paid to Individual ACA members.

Changes in medical service costs:

BlueCross BlueShield of South Carolina will likely pay more claims in 2026 for the following reasons:

- Hospitals and doctors charging more for services.

- More individuals seeking treatment.

- Higher drug costs.

- Increases in ACA marketplace morbidity due to the impact of enhanced Advanced Premium Tax Credit (APTC) subsidies expiring in 2025.

BlueCross BlueShield of SC

Scope and range of the rate increase:

Depending on the plan selected, approximately 5,000 members currently enrolled in a Blue Option Individual health plan will see an adjustment to premiums effective January 1st, 2026. The average premium increase across this product is projected at 19.9%.

Financial experience of the product:

During 2024, premiums received have likely not been sufficient to cover claims paid, administrative costs, commissions, taxes, and fees. The rate adjustment effective January 1, 2026 is intended to cover future changes in medical costs. If, in 2026, paid claims are significantly less than anticipated, rebates will be paid to Individual ACA members.

Changes in medical service costs:

BlueChoice HealthPlan, Inc. will likely pay more claims in 2026 for the following reasons:

- Hospitals and doctors charging more for services.

- More individuals seeking treatment.

- Higher drug costs.

- Increases in ACA marketplace morbidity due to the impact of enhanced Advanced Premium Tax Credit (APTC) subsidies expiring in 2025.

Celtic Insurance

The proposed rate change of 19.8% applies to approximately 369 individuals. Celtic Insurance Company’s projected administrative expenses for 2026 are $84.01 PMPM. Administrative expense does not include $13.41 for taxes and fees. The historical administrative expenses for 2025 were $80.64 PMPM, which excludes taxes and fees. The projected loss ratio is 84.8% which satisfies the federal minimum loss ratio requirement of 80.0%.

Instil Health Insurance

Depending on the plan selected, approximately 4,000 members currently enrolled in an InStil Individual health plan will see an adjustment to premiums effective January 1st, 2026. The average premium increase across all plans is projected at 24.5%.

Financial experience of the product:

InStil first wrote Individual health insurance effective January 1st, 2025. As a result, there is no experience in policy year 2024 to consider. The rate adjustment effective January 1, 2026, is needed to cover future changes in medical costs as well as regulatory policy and fee changes in the Individual market. If, in 2026, paid claims are significantly less than anticipated, rebates will be paid to Individual ACA members.

Changes in medical service costs:

InStil will likely pay more claims in 2026 for the following reasons:

- Hospitals and doctors charging more for services.

- More individuals seeking treatment.

- Higher drug costs.

- Increases in ACA marketplace morbidity due to the impact of enhanced Advanced Premium Tax Credit (APTC) subsidies expiring in 2025.

Molina Healthcare of SC

1. Scope and range of the rate increase: Molina’s proposed rates represent an average rate change of 24.5% for the 42,612 Molina members enrolled in continuing plans effective January 2025. The proposed rate changes vary by metal tier. Members would receive premium changes ranging from 0.1% to 40.8% depending on their geographic location, metal tier, and age.

2. Financial experience of the product: Baseline claims experience was used from Molina’s 2024 South Carolina Marketplace business. 2024 South Carolina premium of $651.37 per member per month was received compared to allowed claims of $510.97 per member per month and risk transfer amounts of $55.25 per member per month. The proposed premium rates yield a medical loss ratio of 85.6%. The medical loss ratio represents the percentage of every premium dollar that Molina expects to spend on medical expenses and improving health care quality for our members. The projected medical loss ratio of 85.6% exceeds the Affordable Care Act minimum required loss ratio of 80.0%.

3. Changes in Medical Service Costs: Medical inflation related to the utilization and cost of covered services increased claims by 9.3%. Historical medical and pharmacy claims experience and prospective trend are the primary contributors to an increase in rates. Changes in provider contracting rates also contributes to the regional rate changes.

4. Changes in Benefits: Molina is renewing seven gold and silver plan offerings from 2025. The impact on rates from benefit design changes for all renewal plans is minimal.

5. Administrative costs and anticipated profits: Total administrative expenses are expected to increase, contributing to an increase in rates of approximately 0.2%. Targeted profit margin remains the same as the prior year’s filing.

Select Health of SC

Select Health of South Carolina, Inc. (SHSC) has offered comprehensive and fully insured coverage to members in the Individual ACA market since 2023. SHSC is filing a rate increase for 2026 products. All plans will be offered statewide on the Federally Facilitated Marketplace in South Carolina.

The products associated with this filing will cover a wide range of benefits, including all Essential Health Benefits (EHBs) required under the ACA. Some plans will have access to pediatric dental benefits. Standalone pediatric dental plans are available to satisfy the EHB requirements. All plans will utilize a HMO network. SHSC will offer plans at the bronze, silver, and gold metallic levels. Cost share reduction plans will be offered for those eligible. Services will be subject to deductibles, copays, and coinsurance; member cost-sharing will be limited to out-of-pocket maximums (OOPMs). A range of cost-sharing options will be provided to consumers, including deductible options ranging from $0 to $5,500, member coinsurance options ranging from 0% to 50%, and OOPM options ranging from $1,700 to $10,600 for single coverage. Some plans will feature copays for physician services and prescription drug fills.

The average rate change for individuals renewing in 2026 is 33.2%, with the minimum and maximum rate changes equal to 27.15% and 37.33%, respectively. The proposed rate changes vary by plan due to changes in the paid to allowed ratios underlying the actuarial value and cost sharing components of the Plan Adjusted Index Rates. The paid to allowed ratios for all plans were updated to reflect the anticipated claim costs associated with the projected 2026 SHSC Individual ACA population.

The primary drivers of the average rate change are summarized below:

- Carrier-specific experience and updated experience utilized for the manual rate development

- Revised trend and other projection factors

- Plan factor changes

- Changes in non-benefit expenses

The rate change is estimated to impact approximately 6,200 members.

UnitedHealthcare of SC

(unfortunately, USC has redacted their current enrollment figure; I've had to make an educated guess; see below)

Scope and Range of the Rate Increase

UHC is filing 2026 rates for individual products. The proposed rate change is [Redacted: TRADE SECRET] and will affect [Redacted: TRADE SECRET] individuals. The rate changes vary between [Redacted: TRADE SECRET] and [Redacted: TRADE SECRET]. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

Financial Experience of the Product

The premium collected in plan year 2024 was [Redacted: TRADE SECRET]. Incurred claims during this period were [Redacted: TRADE SECRET] and UHC expects to pay [Redacted: TRADE SECRET] in risk adjustment. The loss ratio, or portion of premium required to pay medical claims, for plan year 2024 is [Redacted: TRADE SECRET].

As noted above, the current enrollment for UnitedHealthcare is redacted. Total 2025 OEP enrollment was 631,948 people on-exchange; based on 2024 CMS liability risk score data, I estimate total enrollment including off-exchange enrollees to be around 623,000 people.

If so, that would put UHC's enrollment at roughly 46,000 people, which in turn would put the weighted average preliminary rate hike for South Carolina individual market plans at 24.0%.

It's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

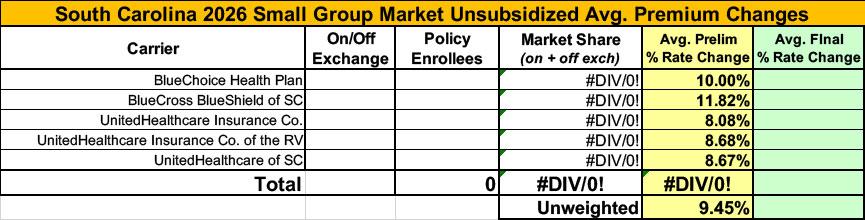

Meanwhile, I have no enrollment data at all for the small group carriers; the unweighted average 2026 rate hike there is around 9.5%.

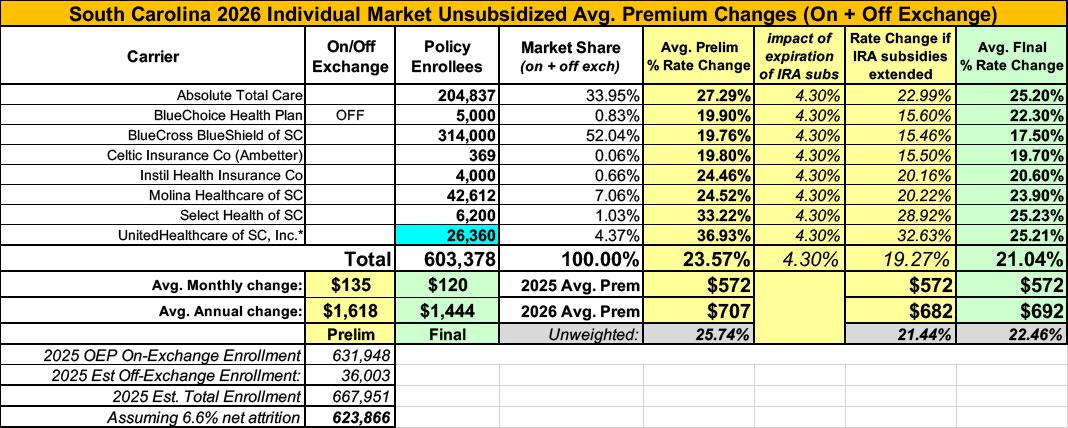

UPDATE 10/16/25: The SERFF database has the final/approved 2026 rate filings for 2026 ACA individual market carriers.

Nothing major leaps out at me, though I was able to fill in the missing enrollment number for UnitedHealthcare, which is lower than I estimated. Overall, the weighted average increase for unsubsidized premiums is +21.0%, down a few points from the 24% preliminary average.