2026 Final Gross Rate Changes - New Jersey: +16.6% (updated)

Originally posted on 8/08/25

SCROLL DOWN FOR UPDATES

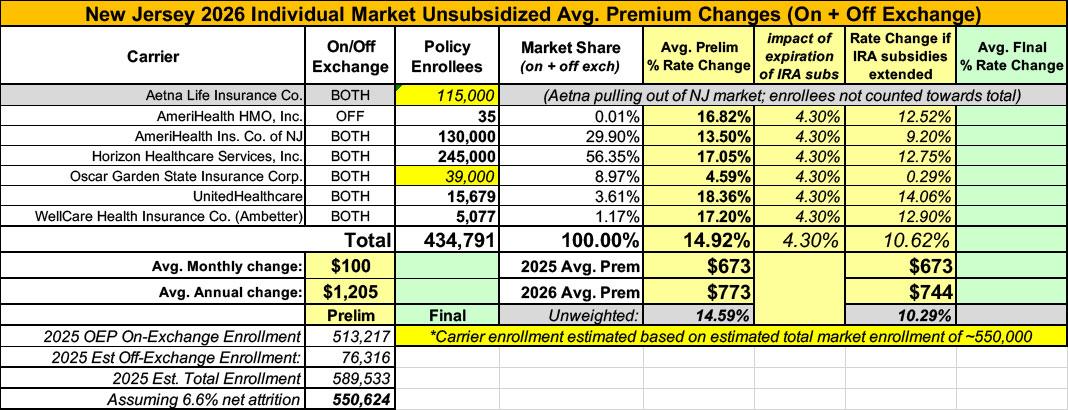

Overall preliminary rate changes via the SERFF database, New Jersey Insurance Dept. and/or the federal Rate Review database.

Aetna Life Insurance Co:

(Aetna/CVS is pulling out of the entire individual market nationally; I've estimated their current enrollment, see below for methodology)

AmeriHealth HMO:

AmeriHealth HMO, Inc. ("AHNJ”) is revising premium rates for the New Jersey Individual Health ACA compliant products, effective from January 1, 2026. Rate increases average 16.8%, ranging from 16.8% to 16.8%. The proposed revisions to each plan are shown on the last page of this exhibit. About 35 members will be affected.

AmeriHealth Insurance Co of NJ

AmeriHealth Insurance Company of New Jersey ("AHIC”) is revising premium rates for the New Jersey Individual Health ACA compliant products, effective from January 1, 2026. Rate increases average 13.5%, ranging from 11.1% to 15.2%. The proposed revisions to each plan are shown on the last page of this exhibit. About 130,000 members will be affected.

Horzon Healthcare (BCBS)

Horizon Blue Cross Blue Shield of New Jersey (Horizon-BCBSNJ) is increasing premium rates for the NJ Individual ACA-compliant products by an average of 17.0% for 2026 enrollments. Rate increases by product are displayed in the table below. Additionally, the final premium will depend on the member’s age and family composition.

Approximately 245K members are estimated to be impacted by rate actions exceeding 10%. Historical average yearly premium increases for Individual ACA-compliant products by Horizon-BCBSNJ:

- 2023: 9.4%

- 2024: 4.2%

- 2025: 6.1%

Horizon-BCBSNJ is subject to the State and Federal Minimum Loss Ratio requirements. This means that at least 80% of premium dollars – after risk adjustment and ACA-imposed fees and taxes - has to be spent on medical costs. The rate actions for 2026 are projected to meet this requirement. Reasons contributing to the increase in premium rates include the following:

- Medical and prescription drug costs inflation. Service costs increase each year. The contributing factors include: health care providers increasing their fees, members utilizing more services and supplies, advances in prescription drug development and medical technology (such as gene therapies), and heavy marketing of Specialty drugs, among other factors.

- Morbidity. American Rescue Plan Act (ARPA) introduced additional premium subsidies. They are scheduled to expire at the end of 2025. With their expiration, we expect the ACA market to shrink as healthier members leave ACA coverage. This would result in the ACA risk pool retaining less healthy members, leading to higher morbidity leading to higher rates.

Oscar Garden State Insurance

(Unfortunately, Oscar's current enrollment is redacted; see below)

Exhibit A summarizes the proposed rate changes by plan effective January 1, 2026. Rate changes vary by plan due to a combination of factors including shifts in benefit relativities in both benefit leveraging and cost-sharing indexing and modifications to the plan behavior change factors. Using in-force business as of March 2025, the proposed average rate change for renewing plans is (REDACTED). This rate increase is absent of rate changes due to attained age.

UnitedHealthcare

The overall average rate change is 18.4%. The rate change by plan varies from 16.5% to 22.8%.

There are 15,679 individuals impacted as of March 31st, 2025.

The premium collected between January 1st, 2024 and December 31st, 2024 was $95,739,850. Incurred claims net of reinsurance during this period were $58,073,719 and UHIC is estimated to pay $17,270,906 into the risk adjustment program. The loss ratio, or portion of premium required to pay medical claims, for this time period is 78.7%.

Key Drivers of Change in Medical Service Costs

- Increasing Cost of Medical Services: Annual increases in reimbursement rates to health care providers – such as hospitals, doctors, and pharmaceutical companies.

- Increased Utilization: The number of office visits and other services continues to grow. In addition, total health care spending will vary by the intensity of care and use of different types of health services. The price of care can be affected by the use of expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher Costs from Deductible Leveraging: While health care costs continue to rise every year, if deductibles and copayments remain the same, a greater percentage of health care costs need to be covered by health insurance premiums each year.

- Impact of New Technology: Improvements to medical technology and clinical practice require use of more expensive services - leading to increased health care spending and utilization.

- Demographics: Change in the projected age, gender, and metal mix of the underlying population can change the medical claims expected to be incurred.

- Morbidity: Change in the projected health status of both the New Jersey individual market and UHIC’s population lead to increased healthcare spending and a decrease in the offsetting impact of the risk adjustment program.

- Regulatory Changes: The expiration of enhanced premium subsidies passed under the American Rescue Plan Act (ARP) as well as the CMS 2025 Marketplace Integrity and Affordability Proposed Rule are expected to lead to higher costs as healthier enrollees exit the market.

Ambetter/WellCare

WellCare Health Insurance Company of New Jersey, Inc. is filing rates for the individual block of business, effective January 1, 2026. This document is submitted in conjunction with the Part I Unified Rate Review Template and the Part III Actuarial Memorandum.

This information is intended for use by the New Jersey Department of Banking and Insurance, the Center for Consumer Information and Insurance Oversight (CCIIO), and health insurance consumers in New Jersey to assist in the review of WellCare Health Insurance Company of New Jersey, Inc.’s individual rate filing.

The results are actuarial projections. Actual experience will differ for a number of reasons, including population changes, claims experience, and random deviations from assumptions.

WellCare Health Insurance Company of New Jersey, Inc. is submitting this rate filing for its individual health insurance plans, effective January 1, 2026. The proposed average rate increase is 17.2%, which would apply to approximately 5,077 members.

This rate change reflects expected increases in the cost of providing coverage in the individual market. The primary factors contributing to the proposed rate increase include:

- Statewide Average Morbidity (SWAM) projection. SWAM has emerged as the primary driver of the change. 2025 Wakely data shows 2025 statewide morbidity trending well above initial projections and exceeding 2026 expectations. Our 2026 projected statewide morbidity trend was updated for market dynamics and a deteriorating risk pool.

- Statewide Average Premium (SWAP) projection. The filing reflects updates to SWAP assumptions to align premiums with the elevated statewide morbidity and corresponding increase in anticipated market-wide claims costs. Specifically, the projected 2026 SWAP has increased reflecting the deteriorating risk pool and associated cost pressures.

Contributing to the projected SWAM is the expected expiration of the Enhanced Advance Premium Tax Credits. The federal eAPTCs, which have existed since 2021, are currently scheduled to expire at the end of 2025. With the expected expiration, net premiums are projected to rise significantly for many enrollees. This is anticipated to result in adverse selection, as healthier and more price-sensitive individuals are more likely to forgo coverage, leading to a higher average morbidity within the individual market risk pool. The resulting shift in risk is expected to contribute materially to higher claims costs and overall premium requirements for 2026.

In addition to these drivers, annually rising medical costs continue to affect premiums. Some of these drivers include increases in the price of services, the number of services used, and the shift toward more complex and intensive treatments.

This filing reflects the cost of providing comprehensive health coverage in the individual market under current federal and state policy expectations.

As noted above, I don't have the current enrollment for either Aetna (which is dropping out of the market and thus has no 2026 filing) or Oscar (which has redacted their enrollment data). This means I have to make educated guesses regarding the enrollment in each.

Using the 2024 CMS liability risk score data, I estimate there's roughly ~550,000 people enrolled in New Jersey's individual market total this year.

Since 395,791 of these are accounted for, that leaves roughly ~154,000 presumably currently enrolled in either Aetna or Oscar plans.

Normally I'd just assume an even split, but as Andrew Sprung reminded me, New Jersey is one of the few states which regularly reports their total individul market enrollment (both on & off-exchange). The most recent report only runs through December 2024, but I can use it as a guide.

In 2024, Aetna held around 4x as many individual market enrollees as Oscar did. It's certainly possible that those ratios have shifted this year, but in the absence of any other hard data I'm going to assume roughly ~70% of the "missing" enrollees are with Aetna and ~30% are enrolled via Oscar.

If so, that means a semi-weighted average rate hike in the New Jersey indy market of around ~14.9%.

It's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

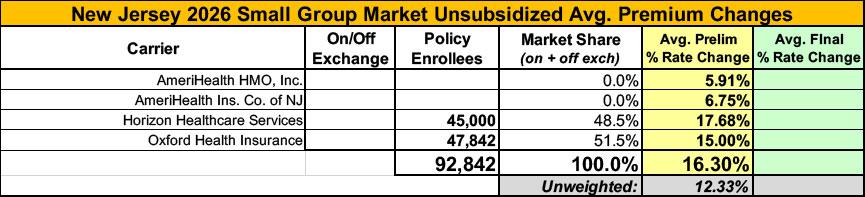

Meanwhile, I have no enrollment data at all for half of the small group carriers; the unweighted average 2026 rate hike there is around 12.3%

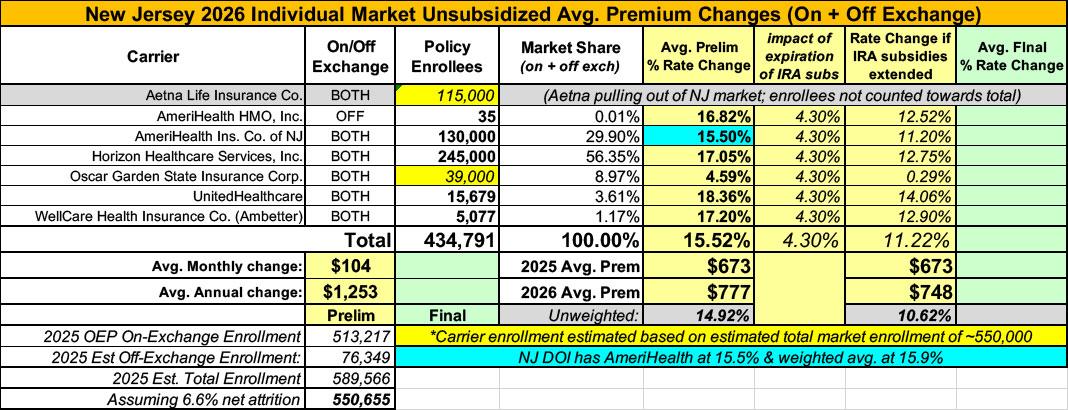

UPDATE 8/28/25: According to the New Jersey Dept. of Banking & Insurance, Amerihealth has bumped up their preliminary request by 2 points, which in turn raises the weighted average by one point to 15.9% (I actually have it down as 15.5% but whatever...)

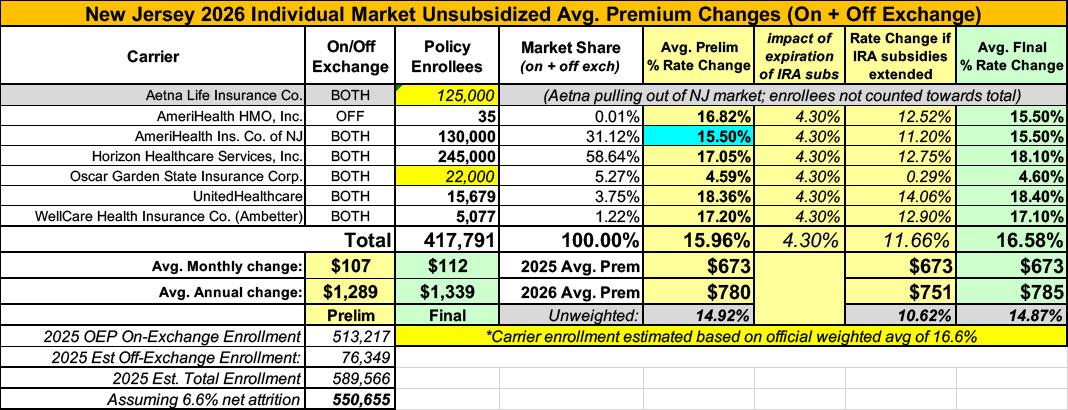

UPDATE 10/27/25: With just 5 days to go before the launch of the 2026 Open Enrollment Period, the New Jersey Dept. of Banking & Insurance has published their final, approved 2026 rate filing decisions:

NJ Department of Banking and Insurance Releases Final Health Insurance Rates for the Individual Market for Plan Year 2026

- Department Continues to Advocate for Federal Renewal of Enhanced Premium Tax Credits Ahead of Get Covered New Jersey Open Enrollment; Premiums to Increase for All Enrollees by Nearly 175% Based Upon the Loss of Enhanced Premium Tax Credits and Rate Increases

- Warns of Residents Dropping Health Coverage Over Premium Sticker Shock Due To Congressional Inaction to Extend Enhanced Premium Tax Credits

- Announces Consumers Can Begin to View Available 2026 Plans and Compare Costs Now Using the Get Covered New Jersey Shop and Compare Tool

TRENTON — The New Jersey Department of Banking and Insurance today released final plan year 2026 rates for health insurance carriers operating in the individual market, which includes Get Covered New Jersey, the State’s Official Health Insurance Marketplace. Rates and premiums are higher as a result of the expiration of federal enhanced premium tax credits due to continued Congressional inaction to extend them.

With Open Enrollment for Get Covered New Jersey set to begin on November 1st, the Department is urging residents to prepare. To assist consumers with plan shopping, Get Covered New Jersey offers free support from trained professionals to guide consumers through enrollment.

While plans and prices change each year, health insurance premiums and rates will be higher on average with enhanced premium tax credits expiring at the end of the 2025 calendar year. Congress still has time to act to renew the enhanced premium tax credits, which have boosted the program’s access and affordability, to avoid consumers dropping their coverage over premium sticker shock.

“Consumers will soon be shopping and comparing health plans, and without these enhanced tax credits, they will be confronted by startlingly higher prices for coverage. We are significantly concerned that many households will be forced to choose plans with lesser coverage or choose no coverage at all as a result,” said Commissioner Justin Zimmerman, who has continuously advocated for Congressional action on the expiring tax credits. “The Department stands ready to act as quickly as possible, at any time, if and when Congress takes action to ensure New Jersey consumers continue to have access to quality, affordable health insurance with enhanced premium tax credits.”

Rates will increase on average by 16.6% over 2025 in the individual market, which includes on-exchange and off-exchange plans (sold directly by insurance companies). Increases in premium rates are being seen across the country. Nationwide, health insurers for Affordable Care Act-regulated plans reported a median 18% premium increase in a recent Kaiser Family Foundation survey.

Carriers identified the underlying reasons for the rate increases as increased costs and utilization, including increases in both medical and pharmacy costs. The increase in rates is also attributed to the expiration of federal enhanced premium tax credits. Carriers reported that the average rate increase for consumers is approximately 3 percentage points higher than what it would be if federal action is taken to continue enhanced premium tax credits in the 2026 plan year.

The year-end expiration of the enhanced premium tax credits will have a significant direct impact on the monthly costs for consumers who purchase plans on the Marketplace. New Jersey will lose more than half a billion dollars in direct consumer support. The tax credits have enabled hundreds of thousands of New Jersey residents to enroll in quality, affordable health insurance through Get Covered New Jersey. Currently, 91% of consumers enrolled in a plan through Get Covered New Jersey — over 466,000 residents — receive the enhanced financial help.

Rate increases are in addition to the direct premium increases consumers will experience due to the loss of federal financial help from expiring tax credits.

Based on an initial analysis, released in May 2025, prior to the new rate increase, the average person receiving tax credits would see their costs go up by 110%, more than doubling their current premium, with costs increasing by $1,260 per person, per year on average, or $4,168 for a family of four. New Jerseyans approaching the age when they are eligible for Medicare would see the largest cost increases — an average of $1,860 per older person each year if expanded tax credits expire.

A new analysis by the Department demonstrates compounding harms to health coverage affordability. Due to the expiration of enhanced tax credits and federally imposed changes to the program, approximately 60,000 consumers enrolled in coverage through Get Covered New Jersey will lose federal financial help. When you take into account this loss of financial help, along with rates, as well as other federal changes, the average premium increase for all enrollees skyrockets to more than $2,780 annually, an increase of 174%.

For the population of enrollees receiving financial help, the average premium rises by 163%, jumping from $1,260 more each year on average to $1,850 more annually.

Consider these real-world examples of New Jersey families who would see among the most dramatic cost increases:

- A family of four in Ocean County, with a household income of approximately $131,000 would see a premium increase of $26,000 for the year without the enhanced tax credits, which would consume 26% of their income.

- A couple in their early 60s in Middlesex County with a household income of approximately $94,000 would see a premium increase of more than $22,000 for the year without the enhanced tax credits, consuming 31% of their income.

Get Covered New Jersey offers federal and state financial help to qualifying residents to help lower their monthly premiums and out-of-pocket expenses.

While Congress continues to not take action to help lower the cost of health coverage, New Jersey continues to do its part. The Department is estimated to provide $215 million this year to support state subsidies. Federal advanced premium tax credits will also remain available for those eligible, though not at the same levels as 2025.

“For the upcoming plan year, it is essential for all consumers to carefully shop and compare health plans to secure coverage that best meets their needs and budgets. Continued Congressional inaction on extending the enhanced premium tax credits will result in higher insurance costs for New Jersey residents who count on Get Covered New Jersey for health coverage for themselves and their families,” said Commissioner Zimmerman. “Get Covered New Jersey is here to help consumers navigate federal changes to the program. Residents can access free help from trained professionals who can help them find a plan that meets their needs. The Marketplace remains a source of quality, affordable coverage with financial help still available for the majority of consumers.”

The Department recently awarded $5 million to 30 community organizations that offer free, unbiased outreach, education, and enrollment assistance throughout the state to residents shopping for health insurance on Get Covered New Jersey and will also assist them in applying for financial help. Help is available in many languages. In addition to Navigators, Get Covered New Jersey can also connect residents to licensed brokers who are trained and registered by the Marketplace. Get Covered New Jersey consumers are encouraged to use the free assistance available in local communities throughout the state by visiting the “We Can Help” section at GetCovered.NJ.gov or calling the Customer Call Center at 1-833-677-1010 TTY 711.

A record 513,217 residents enrolled in a health plan through Get Covered New Jersey for plan year 2025 – a 108 percent increase in enrollment since the State first launched its marketplace. This progress is threatened by the expiration of enhanced premium tax credits made available through the American Rescue Plan Act of 2021 and continued through the Inflation Reduction Act of 2022.

The Murphy Administration has continuously warned of significant health insurance premium increases if the enhanced premium tax credits were allowed to expire. In September, Governor Phil Murphy joined the governors of 17 other states in sending a letterto Congressional leaders urging Congress to extend these tax credits. In May, Commissioner Zimmerman sent a letter and fact sheets to New Jersey’s Congressional delegation on the potential loss of enhanced premium tax credits and the devastating impact it would have on individuals and families.

The final rates for the Individual Market (on-exchange and off-exchange) are below. By law, rate filings in the individual and small employer markets are informational and not subject to prior approval; the Department may only disapprove an informational filing if the Department finds that the filing is incomplete and not in compliance with relevant laws or that the rates are inadequate or unfairly discriminatory.

Individual Market 2026 Rate Change

- AmeriHealth: 15.5%

- Horizon: +18.1%

- Oscar: 4.6%

- United Healthcare: 18.4%

- Ambetter from WellCare of New Jersey: 17.1%

- Total Avg. Rate Change: 16.6%

Based on the weighted average of 16.6%, I've reduced my estimate of Oscar enrollment to bring it in line like so: