2026 Final Gross Rate Changes - New York: +7.1% avg. (updated - down dramatically from preliminary)

Originally posted 6/02/25

Hot off the presses via the New York Dept. of Financial Services:

MVP Health Plan, Inc.

Generally, once a year MVP files for a change to the current premium rates on file for their products based on a review of the adequacy of the rate level. Premiums need to be sufficient to cover all medical and pharmacy claims submitted from covered members, cover the administrative cost of operations, Federal and New York State taxes/assessments levied and New York State statutory reserve requirements.

MVP is proposing a premium rate adjustment effective January 1, 2026. Policyholders will be charged the proposed premium rates upon renewal in 2026 pending New York State’s Department of Financial Services review. There are 13,062 policyholders and 19,125 members currently enrolled in Individual MVP Health Plan, Inc. plans. The proposed premium rate adjustment represents an average increase of 8.00%. Premium changes will vary by plan design.

Premium rates are changing due to the following reasons:

- The rising cost and utilization of medical services and prescription drugs (+9.0%)

- A change in claim projection from the prior year which includes the impact of changes in anticipated payments/receipts in the Federal Risk Adjustment Program (-8.9%)

- A change in non-claim expense items including taxes and fees (+1.4%)

- A change in the covered benefits mandated by the State of New York (+0.1%)

- A change in the availability of enhanced Advanced Premium Tax Credit subsidies, which will adversely impact market morbidity (+7.1%)

United Healthcare Insurance Company of New York, Inc.

The new premiums will apply to all individuals that sign-up or renew during 2026. Please see the attachedNumerical Summary with the average requested rate changes. 113 members are impacted by this requested rate change. The rate filing we have submitted is seeking an increase mainly related to the high cost of the Individual enrollees and the inadequacy of the current rate level. The rate increase is also needed due to rising medical costs. Medical costs are the single largest part of the premium dollar and continue to rise significantly. There are many different medical cost trends that contribute to increases in the overall U.S. health care spending each year. These trends cause us to request a higher premium to cover costs.

We develop estimates of future medical costs based on a number of considerations. When deciding whether to seek a premium increase or decrease, we review claims data and administrative expenses to determine the expected costs and expenses for the future period. We review recent claims data for utilization (number of services), unit cost (reimbursement cost for a health service), and benefit leveraging (impact of member cost-share). Future trends are developed based on a projection of each item. The projected annual trend factor for 2026 is 9.1% percent. This breaks down into the following components:

4.4% percent unit cost, 3.2% percent utilization, and 1.0% percent benefit leveraging.

A part of the medical costs includes a pooling technique established under the Affordable Care Act (ACA) called Federal Risk Adjustment. This attempts to equalize risk within the New York Individual market and requires carriers to set rates at the statewide average risk level. The estimated risk adjustment value reduces the costs by 24.8 percent.

Changes in state-mandated benefits related to network adequacy requirements and biomarker testing requirements account for 0.1% of the requested rate change. Additionally, a 1.1% impact can be attributed to coverage of medically necessary GLP-1s.

The impact of the expiration of the American Rescue Plan Act expanded subsidies and the CMS Marketplace Integrity and Affordability Proposed Rule account for 8.6 percent of the requested rate change.

UnitedHealthcare of New York, Inc.

The new premiums will apply to all individuals that sign-up or renew during 2026. Please see the attached Numerical Summary with the average requested rate changes. 5,969 members are impacted by this requested rate change. The rate filing we have submitted is seeking an increase mainly related to rising medical costs. Medical costs are the single largest part of the premium dollar and continue to rise significantly. There are many different medical cost trends that contribute to increases in the overall U.S. health care spending each year. These trends cause us to request a higher premium to cover costs.

We develop estimates of future medical costs based on a number of considerations. When deciding whether to seek a premium increase or decrease, we review claims data and administrative expenses to determine the expected costs and expenses for the future period. We review recent claims data for utilization (number of services), unit cost (reimbursement cost for a health service), and benefit leveraging (impact of member cost-share). Future trends are developed based on a projection of each item. The projected annual trend factor for 2026 is 9.1% percent. This breaks down into the following components:

4.4% percent unit cost, 3.2% percent utilization, and 1.0% percent benefit leveraging.

A part of the medical costs includes a pooling technique established under the Affordable Care Act (ACA) called Federal Risk Adjustment. This attempts to equalize risk within the New York Individual market and requires carriers to set rates at the statewide average risk level. The estimated risk adjustment value reduces the costs by 20.2 percent.

Changes in state-mandated benefits related to network adequacy requirements and biomarker testing requirements account for 0.1% of the requested rate change. Additionally, a 1.1% impact can be attributed to coverage of medically necessary GLP-1s.

The impact of the expiration of the American Rescue Plan Act expanded subsidies and the CMS Marketplace Integrity and Affordability Proposed Rule account for 8.6 percent of the requested rate change.

MetroPlus Health Plan, Inc.

We are proposing a 10.1% weighted average increase for CY 2026 per member per month premium rates effective 1/1/2026. The rate increase will vary across plans, ranging from 7.9% to 15.5%. The increase will affect 5,663 members (4,929 policyholders).

The approximate percentage contributions of each factor to the overall rate increase are as follows:

- Emerging experience (including risk adjustment & member mix): -0.9%

- Trends due to higher utilization of health care services, higher payments to health care providers, and higher prescription drug costs: 3.9%

- American Rescue Plan Act subsidy ending: 2.3%

- Administrative cost increase: 2.4%

- Benefit and AV changes: 2.0%

New York Quality Healthcare Corporation (Fidelis)

Having recently completed this evaluation, Fidelis Care is requesting premium increases shown in the attached Exhibit 13a. If approved, this increase will be added to your current premiums starting January 1, 2026. The rate increase affects 70,431 policyholders and 95,605 members.

It is important to note that your final premium increase or decrease will likely differ from the initial letter you received, which represents a requested but not yet approved premium adjustment. Please contact us to confirm your final rates. Most Fidelis Care members receive premium subsidies from the Federal government to lower their premiums. These subsidy levels depend on family income, size, and market premiums.

Fidelis Care’s rate filing is driven by seven primary considerations:

- Adjustment from actual to expected experience

- Anticipated higher medical and pharmacy costs and increased use of services by our members

- The impact of the expected expiration of the eAPTC

- Risk Adjustment transfer payment that considers the level of illness of our members

- The regulation changes of the marketplace integrity rule and the MCO tax

- The migration of the 200-250% FPL population from the Individual Market to Essential Plans (EP)

- • Changes in the age and gender of those we cover as well as their level of health and wellness

Based on the drivers of the premium changes listed above, we will increase the rate by approximately 8.1% from 2025 to 2026.

...The breakdown of the drivers is included in the following table:

- Key Drivers 2026 Rate Increase Requested

- Adjustment from actual experience to pricing 7.8%

- Trend 6.1%

- Expiration of eAPTC 3.9%

- Risk Adjustment Transfer Payment 1.9%

- Impact of regulation changes 0.7%

- Impact of EP Expansion -3.0%

- Demographic and Morbidity Shifts -8.6%

- Total 8.1%

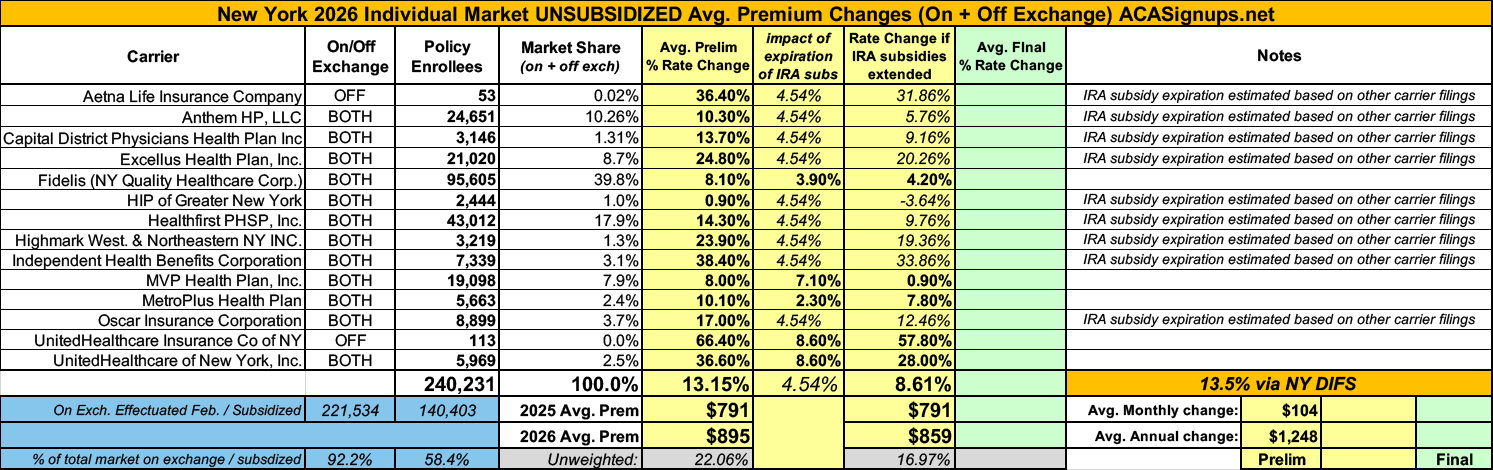

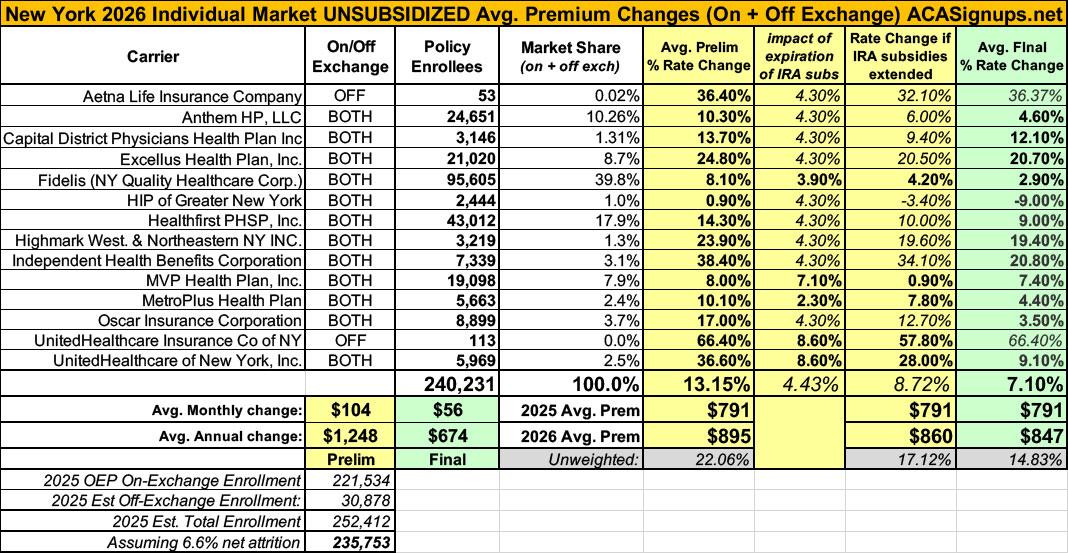

Unfortunately, the remaining 9 carriers don't specify how much of their proposed rate hikes are due specifically to the expiring IRA subsidies and/or the CMS "Integrity Rule," although a couple of them do at least mention it as a factor (see below for snippets from the remaining filing narratives). Fortunately, the five carriers which do break it out specifically hold over 50% of total NY individual market share, giving me reasonable confidence to assume their combined average is representative across the market.

If so, this means that the average rate increases being requested by NY carriers would only be 8.6% for 2026 if the IRA subsidies were to be extended as opposed to the 13.2% they're actually asking for with the subsidies expiring (NY DFS actually puts it at 13.5% for some reason).

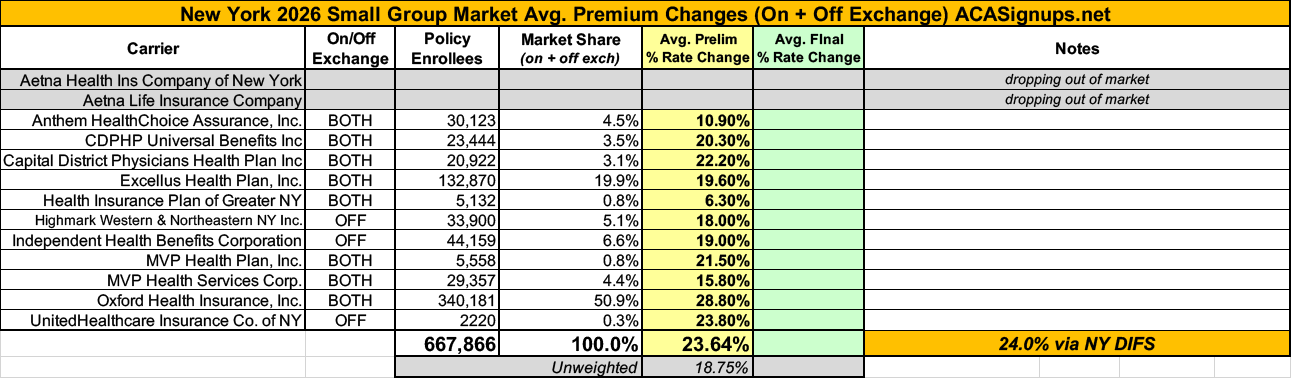

Meanwhile, the picture is even uglier for the NY small group market, where carriers are requesting a 23.6% average rate hike (24.0% via NY DIFS)...and where Aetna appears to be pulling out of the market as well, just as they already announced they're dropping out of the individual market nationally recently.

ANTHEM HP, LLC

II. FACTORS CONTRIBUTING TO THE PROPOSED RATE INCREASE

Escalating Health Care Costs

The cost of health care services and equipment continues to be the primary reason for rate increases. A report by Mercer shows health care cost grew by 4.5% in 2024 and projects another sharp increase of 5.8% for 2025.Health care cost and spending trends reflect underlying changes in the demographics and health status of America’s population. The aging population is driving some of the increase – as people age, they typically utilize more health services. Between 2010 and 2050, the population aged 65 and older is expected to double, as the “baby boomer” population ages and life expectancy continues to rise.

Indeed, the first baby boomers have now turned seventy and the percentage of workers over 65 is greater than at any period in history. As this population ages it will correspond to a further escalation of costs. Moreover, the country’s general declining health and the increase in obesity and other health concerns, even at younger ages, forces average costs upward.

Hospital

Hospitals (inpatient and outpatient care) account for the largest share of the health care premium dollar in New York, a percentage that continues to grow. Factors driving this growth include increasing demand for care, rising costs to hospitals of the goods and services needed to provide care, and the growing intensity of care needs.Prescription Drugs

Specialty drugs account for one of the biggest health benefit cost drivers. A report by Mercer explains that in 2024, the drug benefit cost per employee rose 7.2%. Additionally, specialty drug trends are expected to increase as more breakthrough gene and cellular products enter the market.American Rescue Plan Act

The 2026 rate filing reflects the expected impact to the health of the ACA risk pool as well as the financial and membership impacts due to the expiration of the enhanced ACA premium tax credits under the American Rescue Plan Act.

CDPHP

...What Goes Into Your Premium Costs?

The expected change in medical and pharmacy cost is +9.6%.

The federal risk adjustment program requires insurance carriers with low-risk members to pay into a fund that covers high-risk members. CDPHP is anticipating a lower receivable from this program, resulting in an increase of 1.7% to the rates.

CDPHP is required by New York state insurance law to meet a minimum medical loss ratio (MLR) standard of 82%. This means that 82% of premiums must be used to cover health care costs. CDPHP will exceed this minimum requirement in 2025 with an MLR of 85.5%.

Highmark Western and Northeastern New York

Health insurance premiums must correspond with the cost of our members’ medical care, which continues to rise at an unparalleled rate year after year and is projected to increase significantly in 2026. Rising medical costs are the primary driver of our proposed individual rates, in addition to regulatory mandates, taxes, and fees.

With more than 90 cents of every dollar of revenue the company collects from premiums, which is well above the state-mandated medical loss ratio (MLR), going back out to pay for our members’ medical care, it’s becoming unsustainable to offer preferred individual products. Over the past year, the company has experienced over $15 million in losses in individual products, demonstrating the critical need for sufficient premium rates.

While health care costs continue to rise, our affiliation with Highmark Health provides ongoing strength and stability to our organization, as it allows access to shared innovation and strategic partnerships that help drive down costs for individuals, including helping to minimize the proposed rate increases for 2026.

This rate change application affects only the members enrolled in community-rated products for individuals. Based on current membership numbers, we estimate that 3,219 members will be affected by the rate change.

Based on the reasons explained above, we are requesting that the Department of Financial Services grant our submitted premium rate increase of 23.9% for its community-rated individual products to take effect on January 1, 2026. This increase is primarily due to cost and utilization increases, along with costs to cover GLP-1 drug usage.

Company Name: Oscar

We never base premiums on your age, gender, or health. There are two main reasons for higher premiums: prices for drugs and health care services are on the rise, and members are projected to use more care.

When our costs go up, we unfortunately have to raise premiums, as do all other carriers. We expect to pay at least $0.85 of every $1 we collect in premiums towards our members’ medical care, and sometimes we pay even more than that. We use whatever is left to cover the cost of

running our business.

Healthfirst PHSP, Inc. (Healthfirst)

Healthfirst is applying for a rate adjustment to account for marketplace trends and to reflect actual and anticipated claims costs. While several market forces continue to drive health care costs higher more generally, Healthfirst continues to strengthen the effectiveness of its care management and quality improvement programs and robust network.

Healthfirst is requesting a higher rate for 2026 because several market forces continue to drive health care costs higher. These forces include:

• Cost and utilization increases for inpatient hospital, outpatient hospital, and physician services of approximately 10%.

• Cost and utilization increases for prescription drugs, including the increased use of expensive specialty prescriptions of approximately 16%. Healthfirst has requested a rate increase of 15.5% for Region 4, which is composed of the five counties of New York City (Bronx, Kings, New York, Queens, Richmond), Rockland County, and Westchester County. For Region 8, which comprises Long Island (Nassau County and Suffolk County), the requested rate increase is 11.5%.

Excellus Health Plan, Inc. doing business as Excellus BlueCross BlueShield

The cost of health care services, equipment and products continues to be the primary reason for rate increases.

Medical cost “trend” is a very important consideration in determining the need for a premium rate adjustment. This “trend” is the anticipated change in the cost to treat patients year over year. Upstate New York is not immune to national trends in health care costs given our state’s population and demographics. The trend forecast below takes into account projected increases in costs attributed to what Excellus Health Plan pays out in claims expenses for hospital inpatient and outpatient care, professional services, pharmacy benefits, and other goods and services.

...Rising drug prices are having a significant impact on overall medical spending trends. Substantial savings have been achieved over the years with broad acceptance of competitively manufactured generic medicines. However, the savings trend associated with generics is being eclipsed by another trend around the rising cost and utilization of specialty medications including biologics. Every year more and more highly complex specialty medications are approved by the FDA to treat both rare and sometimes more common diseases. Specialty medications are used by approximately 2 percent of our members, but they account for more than 50 percent of total drug spend. Drug trend is a result of both increased utilization and increased unit cost.

Local hospital systems have been challenged financially due to both economic inflationary pressures as well as staffing shortages. Excellus Health Plan has responded to these provider challenges through additional contractual cost increases for our provider systems, resulting in more spending for hospital services.

The impact for drug rebate credits and non-system claims’ trends is applied to the base trends above. This further reduces the base trend by 0.3 percent for small group and 0.3 percent for individual.

...Health care costs for each of the benefit components noted above take into account the compounding effects of both the price of the goods or services provided, as well as the quantity of the goods and services consumed. For example, if the price of a service was $100 in 2025 and the number of services provided was 100, the total amount spent in 2025 related to that service would be $10,000. If the price of the service increases 10 percent in 2025 and the number of identical services rendered increases by 10 percent, the impact of both the price change and utilization increase is compounded for an overall increase in spending of 21 percent. (110 services x $110 new price = $12,100 spending, or a 21 percent increase over the prior year’s spending of $10,000.) The same impact on spending occurs if the intensity of services rises for treating patients.

The trend factors forecasted for each of the benefit component considers that compounding effect. The impact that each trend has on the overall cost of coverage is related to the proportionate size of the benefit component. For example, overall spending would rise faster as a result of a 5 percent increase in professional services versus a 5 percent increase in hospital inpatient costs because professional services represent a larger share of medical benefit spending.

Leveraging

For the lower-priced high-deductible products, an additional rate adjustment is necessary in addition to trend. The overall cost of health benefits can change at different rates from year to year as deductibles and copayments remain unchanged. This occurrence is generally referred to as deductible leveraging and is a result of benefit costs increasing faster than trend when deductibles and copays are unchanged.

While leveraging can occur in any product with fixed cost sharing components, it is most noticeable in high-deductible products. The table below is an example illustrating the leveraging effect:In this example, an 8 percent trend results in a benefit cost increase of 10 percent with a resulting leveraging impact of 2 percent. This is an additional driver of premium increases.

Risk Adjustment Program:

Under the federal health care reform law, a risk adjustment program was established as a permanent provision that applies to both the individual and small group insurance markets. This federal program assesses a charge on health plans that have low-risk members and uses the revenue to compensate plans with higher risk members.In 2026, Excellus Health Plan anticipates that it will have to pay more into this program for the small group business, resulting in an increase to the Plans’ proposed premium rates of approximately 2.8 percent. Also, it is anticipated that the Plan will receive more payments associated with the individual business, resulting in a decrease to the proposed premium rates of 2.6 percent.

...A portion of what is reported to the state as “administrative expenses” is attributed to what Federal Health Reform considers “quality improvement expenses.

Those quality improvement expenses include such items as:

- Improvements in health outcomes brought about by case management and disease management programs

- Actions taken to help prevent hospital readmissions through such things as discharge planning and counseling

- Wellness and community health promotional activities

- Health information technology that is used to help measure clinical effectiveness and predictive modeling Excellus Health Plan’s operating expenses represent an average of 7.7 percent of premium for small group plans and individual plans. These expenses include quality improvement initiatives, but exclude federal and state taxes, fees and assessments, and broker commissions.

Insurance taxes and assessments are built into the costs of health coverage representing 5.0 percent of small group and individual premium.

Independent Health Benefits Corporation

Claim Expense Trends

Premium rates tend to rise each year because of the normal inflation of healthcare claim costs. Moreover, in addition to cost increases, utilization of healthcare services also tends to rise as new technologies, services, and prescription drugs are introduced to the marketplace.

For 2026, IHBC is projecting an overall claim expense trend of 10.8%. All else being equal, this would require a corresponding premium rate increase to keep pace with costs. However, because of other factors, IHBC is requesting a rate change higher than the overall claim expense trend.

...In 2026, IHBC projects that approximately 82.1% of every premium dollar will be spent on paying claim expenses. This meets the statutory minimum requirement. The remainder of each premium dollar will be used to cover taxes and fees, administrative expenses, and contribution to margin:

(1) Taxes & Fees.

...How the Taxes & Fees changed from last year:

The Risk Adjustment User Fee increased by $0.02 Per Member, Per Month from what was included in the 2025 premium

The PCORI Fee increased by $0.02 Per Member, Per Month from what was included in the 2025 premium The MCO tax is a new tax beginning in 2025 which was not included in the 2025 premium(2) Administrative Expenses. In 2026 approximately 14.9% of every premium dollar will be spent on administrative expenses, which cover (among other things) activities such as customer service and claims processing and payment. State-mandated assessments used to fund the operations of the Department of Financial Services (DFS), which regulates insurance carriers in New York State, as well as the New York State Department of Health, which oversees the health plan marketplace, are also included as part of administrative expenses.

(3) Contribution to Reserves. All insurance carriers in New York must maintain sufficient cash reserves necessary to meet solvency requirements. In 2026, approximately 3% of each premium dollar will be earmarked for contribution to these “rainy day” funds.

Risk Adjustment

The ACA introduced several provisions, commonly referred to as the “3Rs” (reinsurance, risk adjustment, and risk corridors), designed to help level the playing field among insurers and promote competition based on quality and efficiency. Under the risk adjustment provision, insurance carriers which cover a population that is less risky than the overall insured population in their region must pay a certain portion of their premium receipts into a fund, from which carriers that cover higher-risk populations receive disbursements. IHBC received money from this fund for years 2014 through 2023 for the Individual Market, however, these amounts have been declining each year. For 2026, IHBC expects to become a net payer to Risk Adjustment and pay approximately 7.3% of the revenue required

for the Individual Market from this fund. Without these funds, the overall rate change would have been about 31.1%.State and Federal Taxes

New York adds more insurance taxes and assessments than any other state in the country. These consist of both direct taxes and a number of indirect taxes amounting to an annual total of over $5 billion in taxes passed on to New York healthcare customers in the form of higher premiums.These taxes include:

• NYS Premium Tax – this 1.75% tax is on all HMO and insurance contracts (and there is an additional amount for customers in the Metropolitan Transit Authority service area).• Covered Lives Assessment – this indirect tax is a charge on all fully and self- insured “covered lives”. The purpose of the Covered Lives Assessment is to raise funds for a variety of state programs and for the state budget. The Assessment is included in claims costs for purposes of calculating the MLR. This assessment is currently a charge ranging from $3.52 to $15.93 per individual contract per month and from $11.62 to $52.57 per family contract per month.

• HCRA Surcharge – this is a 9.63% surcharge on all hospital discharges. The purpose of the HCRA Surcharge is to raise funds for a variety of state programs and for the state budget. The Surcharge is included in claims costs for purposes of calculating the MLR.

• NYS Insurance Department “206” Assessment – while this assessment is intended to fund the cost of the Department’s regulatory activities, it constitutes an indirect tax whereby a large portion of the revenue generated by the assessment continues to be used to fund other programs not directly related to insurance regulation. This assessment is charged to insurers based on their premium volume.

UPDATE 9/2/25: Well, now. The NY Dept. of Financial Services has issued the final, approved rate changes for 2026, and the increases for both the individual and small group carriers have been chopped down dramatically compared to what the carriers had been requesting:

- Individual market carriers: Avg increases reduced from 13.2% to just 7.1%

- Small Group carriers: Avg. increases reduced from 23.6% to just 13.2% (13.0% according to NY DFS)

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.