CMS SEP enrollment report to justify not offering a #COVID19 SEP actually proves that they should have.

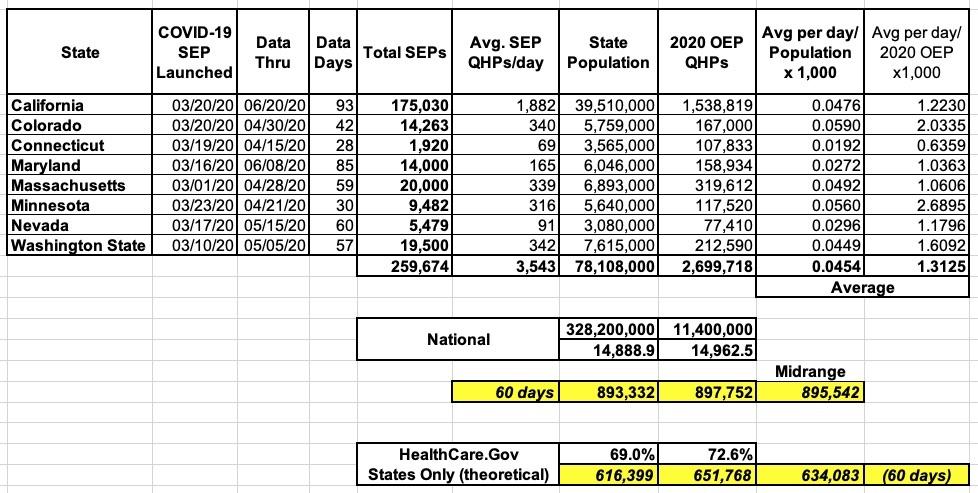

For the past few months, I've been keeping track, to the best of my ability, of how many people have been enrolling in ACA exchange policies utilizing the COVID-19-specific Special Enrollment Periods which have been offered by 12 of the 13 state-based exchanges (SBEs). My most recent update brings the grand total of confirmed SEP enrollments to at least 260,000 across 8 states, averaging around 3,500 per day.

The actual number is obviously higher than this, of course, since I don't have any data from the other four state exchanges (DC, New York, Rhode Island and Vermont), although three of those four are pretty small anyway...and even in New York, their unique "Essential Plan" (the Basic Health Plan program established under the ACA itself) has likely been sucking up the bulk of individual market enrollees earning up to 200% FPL anyway...and you can enroll in the Essential Plan year-round regardless of the pandemic. I therefore doubt that NY's COVID SEP numbers for those earning more than 200% FPL are that dramatic. All told, I'd expect NY, RI, VT & DC to only add perhaps another 25,000 or so QHP enrollees to the table below:

UPDATE 7/16/20: Covered California just released their latest data update and now reports that nearly 210,000 Californians have enrolled utillizing their COVID-19 SEP as of July 11th. This brings the total confirmed across these 8 states up to nearly 300,000 QHP selections.

The four states which have offered COVID-19 SEPs but which haven't released their enrollment data yet made up roughly 11% of all QHP selections during Open Enrollment this year; assuming proportionate enrollment in the COVID SEPs, they've likely added another 40,000 or so to this tally.

Muddying the waters a bit is the fact that while the vast bulk of the numbers above only include COVID-19-specific SEP enrollments, in a few states they may include all Special Enrollment Period enrollees (i.e., the normal life changes like moving, getting married/divorced, turning 26, and so forth). On top of this, the start and end dates of the COVID-19 SEPs have varied (some of them are still ongoing). Also, in California, they already happened to have an "open" SEP happening prior to the COVID pandemic hitting anyway; total non-COVID SEP enrollment in CA to date this year is around 67,000 other people. Meanwhile, Maryland had a unique SEP for residents who haven't filed their state taxes yet.

Still, by extrapolating from the data I do have, I'm reasonably sure that if every state had offered a full, open, 60-day SEP this spring, national COVID-19 SEP enrollment would total around 900,000, with perhaps 630,000 of those coming in via HC.gov states.

Throughout all of this, there's been a growing cry for the biggest ACA exchange, HealthCare.Gov, to launch their own COVID-19 SEP. HC.gov is operated by the Centers for Medicare & Medicaid under Trump's CMS Administrator, Seema Verma, and controls ACA enrollment periods for 38 states (though this will drop to 36 starting this November, and to as low as 30 over the next couple of years as Pennsylvania, New Jersey, New Mexico, Virginia, Kentucky and potentially Oregon, Maine and Kansas all split off onto their own full state exchange...something which was considered unthinkable a few years ago by almost everyone...well, almost everyone).

CMS has continuously refused to open up HC.gov for a COVID-19 specific SEP, instead utilizing the "normal" SEP rules, which do allow people a 60-day period to enroll for a variety of reasons, including losing their employer-sponsored health insurance coverage (which, of course, tens of millions of people have experienced over the past three months or so).

Today, CMS issued, to my surprise, a report regarding just how many people have enrolled via HC.gov this past spring utilizing "normal" SEP rules:

Special Trends Report: Enrollment Data and Coverage Options for Consumers During the COVID-19 Public Health Emergency

This special trends report provides enrollment data for consumers in states with Exchanges using the HealthCare.gov platform who made a plan selection through a special enrollment period (SEP), from the end of the Open Enrollment Period (OEP) through May of the 2017-2020 coverage years. Because of the coronavirus disease 2019 (COVID-19) emergency, many consumers have experienced life changes that allow them to enroll in health coverage through the Exchanges using existing SEPs. This report examines coverage gains through SEPs, with a particular focus on the SEP for people who recently lost other qualifying health coverage (i.e., the “loss of minimum essential coverage” or loss of MEC SEP).

Key Findings

- The number of consumers gaining coverage in states with Exchanges using the HealthCare.gov platform through the loss of MEC SEP is higher for the 2020 coverage year than for any of the prior coverage years in this report with approximately 487,000 consumers gaining coverage through the loss of MEC SEP, an increase of 46 percent from the same time period last year.

- By month, the largest gain in loss of MEC SEP enrollments occurred in April 2020, with enrollments increasing by 139 percent when compared to April 2019.

- The number of consumers gaining Exchange coverage through the loss of MEC SEP dropped by about one-third from April 2020 to May 2020, but continued to be significantly higher— by 43 percent—than in May of 2019.

- Looking at enrollments across all SEP types, there was a 27 percent increase in total SEP enrollments from the end of OE through May from 2019 to 2020. The percentage change was actually higher during the period from 2017 to 2018, with an increase of 33 percent. However, the higher increase in SEP enrollments from 2017 to 2018 could be attributed to the longer open enrollment period for 2017, which extended to January 31 and substantially shortened the period of time SEPs were available after the end of 2017 OE.

I agree with this last point, by the way: It's nearly impossible to compare SEP enrollment apples to apples when Open Enrollment ended on 1/31 one year vs. 12/15, nearly 7 weeks earlier, the next; that 33% increase in 2018 is pretty irrelevant here.

Trend Analysis: Impact of COVID-19 Job Losses on Demand for SEPs Remains Unclear

Millions of individuals have lost their jobs as a result of the COVID-19 pandemic and the associated suspension of many routine business activities. Some number of these recently unemployed individuals have also lost their job-based health coverage and may want to transition to a new source of coverage. Based on current regulations, anyone who loses job-based minimum essential coverage (MEC) will qualify for a SEP, and would be eligible to enroll in individual market coverage through the Exchange serving their state, if they meet the applicable criteria for enrollment through an Exchange. Consumers typically have up to 60 days following the loss of job-based coverage to enroll in a plan.

Bureau of Labor Statistics (BLS) data show that nonfarm payroll employment dropped by an unprecedented 20.7 million people from March to April as states across the country issued stay-at-home orders. In May, the number of employed increased by 2.5 million compared to April, and the unemployment rate declined to 13.3 percent from a high of 14.7 percent in April.

Actually, that "drop" to 13.3% isn't quite what happened--there was a "misclassification error" by BLS in the May report which, had it not happened, would have meant that the unemployment rate would actually have been reported as being 16.3%...although the April rate using that methodology would have been more like 19.7% rather than 14.7%, so...(shrug)

However, looking more closely, the BLS data shows that when job losses spiked in April, 97 percent of those surveyed identified their job loss as a temporary layoff3 —meaning either they had been given a date to return to work by their employer or that they expected to be back to work within the next six months. In addition, many of the newly unemployed may be able to maintain their prior job-based health coverage due to the fact that many employers have reported they are continuing to provide coverage to laid-off and furloughed employees.

Overall, due to a combination of factors including expectations of eventually returning to work, employers’ ongoing contributions to their furloughed or laid-off employees’ health insurance premiums during the public health emergency, COBRA continuation coverage through their former employer, and access to other coverage such as through a spouse, it remains unclear how many people will eventually look to Exchanges using HealthCare.gov to replace job-based coverage. As discussed below, while the magnitude may be unclear, job losses due to COVID-19 have led to increased enrollments on HealthCare.gov through the loss of MEC SEP. CMS has taken a number of steps, detailed below, to assist consumers who may have lost their coverage or experienced another SEP qualifying event in obtaining coverage through an Exchange using HealthCare.gov.

As far as I can tell, this report was basically issued as a defense of CMS's refusal to open up a COVID-19 SEP for HealthCare.Gov by claiming that 1) not nearly as many people are banging on the doors as Democrats have been claiming and 2) They're already taking other measures short of a full-blown "open" SEP to encourage/streamline enrollment anyway.

CMS Actions to Help People Enroll through Exchanges Using HealthCare.gov

For people who have lost coverage through their jobs and need new health coverage, CMS has taken a number of actions to help them understand their options and make it easier to gain coverage through Exchanges using HealthCare.gov. Individuals who lose qualifying employer coverage and live in a state with an Exchange using HealthCare.gov can enroll in health coverage using a special enrollment period by visiting HealthCare.gov, if otherwise eligible to enroll through an Exchange; calling the Marketplace Call Center at 1-800-318-2596 (TTY: 1- 855-889-4325); contacting an agent, broker or other assister (who can be located on Find Local Help); or visiting a certified enrollment partner.

That's all great...but none of that has anything to do with a COVID response; all of those resources have been there all along, so I give CMS no brownie points for listing them.

Any consumers who qualified for a SEP but missed the deadline as a result of the COVID-19 pandemic—for example, if they were sick with COVID-19 or were caring for someone who was sick with COVID-19—may also be eligible for another SEP. Consumers should contact the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325) to see if they are eligible for this SEP.

Now this one is interesting--this is the first time I've heard of a unique SEP for those who missed the normal SEP deadline due to being sick. I don't know if this falls under the "hardship" rule or "extraordinary circumstances" or if it's something new CMS came up with, but I've never heard about it before now.

To further support people during this public health emergency, CMS updated HealthCare.gov to make it easier for consumers to find important information on how to best take advantage of existing SEP opportunities in light of the COVID-19. These updates to HealthCare.gov include the addition of a webpage on HealthCare.gov specifically designated for COVID-19 information as it relates to Exchange coverage. Additionally, CMS released new resources for assisters, agents/brokers and other partners who are helping consumers during this time.

Again, that's nice, but "adding a webpage with additional information" isn't exactly worth a round of applause...every government website down to the smallest village has pretty much done that by now (and if they haven't, why the hell not?).

Along with helping people determine whether they are eligible for advance payments of the premium tax credit (APTC) to help lower the cost of Exchange coverage, HealthCare.gov also helps people assess if they or their family members may qualify for coverage from Medicaid or the Children’s Health Insurance Program (CHIP).

Again...that's something they're suppose dto be doing anyway, pandemic or no pandemic.

One action which CMS is supposedly taking which they don't say one peep about is "waiving the documentation requirement for lost employer coverage" which I wrote about back in April. The fact that this policy (?) has never been mentioned anywhere else to my knowledge and isn't included in the list of CMS actions above strongly suggests that this is sort of a "non-policy policy"...something which is technically in place but is sort of buried.

Data Show that People Who Need Coverage are Enrolling Through Exchanges Using HealthCare.gov

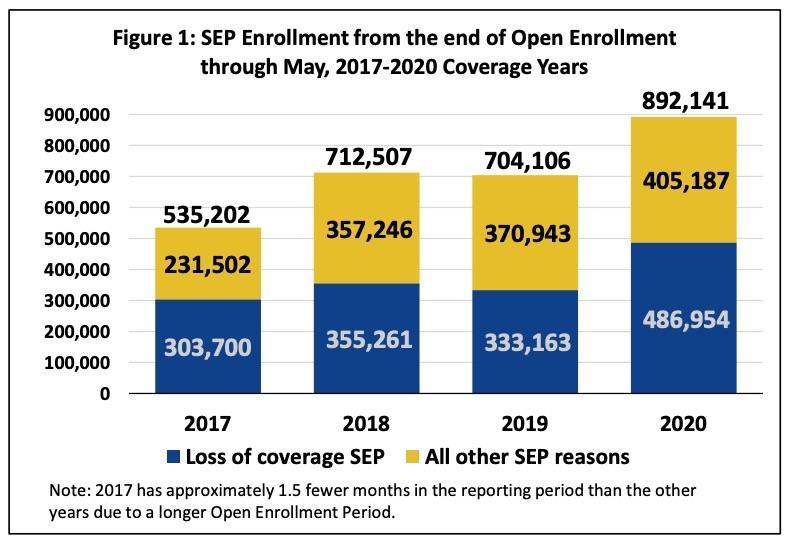

As of June 2, enrollment data for 2020 show that thousands of individuals who lost their health coverage through jobs due to COVID-19 are using existing SEPs to enroll in coverage through the Exchanges using the HealthCare.gov platform. Figure 1 shows that more consumers used SEPs for the 2020 coverage year than in any other year of the reporting period, from 2017-2020. Compared to last year, 188,000 more people enrolled in coverage through a SEP; the loss of MEC SEP is responsible for 82 percent of this increase.

And there you have it: CMS is bragging about how normal SEP enrollment is still up 188,000 people from 2019 even without an "open" COVID-19 SEP being offered, so everyone should STFU and leave them alone already.

The problem with this is that, as I noted earlier, if CMS had offered a 60-day "open" COVID SEP this spring, they likely would have enrolled up to 630,000 more people. There's some overlap between these numbers, of course, since some of those who are eligible for a normal SEP would have "used" the COVID SEP instead if one had been offered...but even if every one of those 188,000 people did just that, I'd estimate that at least 440,000 more would have utilized the COVID SEP on top of this.

Another bit of data supporting my conclusion is the most recent Covered California report, in which they state that all SEP enrollments combined since the end of January (via both "regular" and COVID SEPs) have added up to 242,600 people, which they state is "nearly twice as many as seen durign the same time period last year".

If you assume "nearly twice as many" is, say, 95% higher, then assuming it extrapolates evenly, HealthCare.Gov would have seen roughly 1.373 million SEP enrollees through the end of may this year with a full, "open" 60-day COVID-19 SEP...or around 480,000 more than they actually did. Even if "nearly twice as many" was only 90% higher for CoveredCA, that would still translate to 445,000 more people.

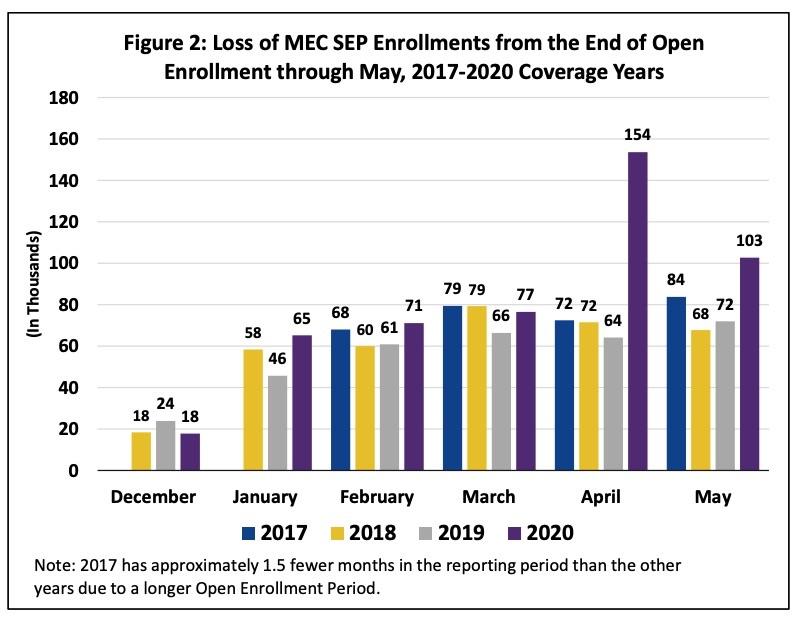

Focusing on SEP enrollment data for April and May of this year provides a clearer picture of the increased use of the loss of MEC SEP at the time job losses due to COVID-19 rose sharply. In April 2020, approximately 225,000 consumers enrolled in coverage through Exchanges using HealthCare.gov through an existing SEP. As shown in Figure 2, this includes 154,000 consumers who enrolled through the loss of MEC SEP, a 139 percent increase from the same month last year.

In May, as the labor market improved, the number of people using the loss of MEC SEP declined by 33 percent from April to 103,000. However, this still represents a 43 percent increase from May 2019, showing more people were continuing to use the loss of MEC SEP in May 2020 when compared to last year.

Conclusion

These enrollment numbers show that individuals who lost their jobs or experienced other qualifying life events due to the COVID-19 pandemic are using existing SEPs to enroll in coverage through HealthCare.gov. As Americans consider their health insurance options during this crisis and as the country re-opens, CMS will continue to provide assistance to help inform those choices. CMS strongly encourages individuals to visit HealthCare.gov to explore their coverage options.

Background

In the Exchanges, most consumers select a plan during the Open Enrollment Period (OEP). Consumers who experience one of six types of life events can also select a plan during a Special Enrollment Period (SEP).

SEPs are a longstanding feature of employer-sponsored health coverage, giving people who lose coverage during the year (for example, through non-voluntary loss of MEC provided through an employer), or who experience other qualifying life events (for example, marriage or the birth or adoption of a child) the opportunity to enroll in new coverage or make changes to their existing coverage. While the annual OEP allows uninsured individuals to enroll in new coverage, SEPs are intended, in part, to promote continuous enrollment in health coverage during the plan year by allowing those who were previously enrolled in coverage to obtain new coverage or make changes to existing coverage without experiencing a gap in coverage. The application of SEPs helps protect the risk pool by minimizing the opportunity for individuals to wait until they are sick to enroll in coverage.

Methodology for Counting SEP Enrollments

This special trends report provides SEP enrollment counts from the end of the OEP through May for the 2017-2020 coverage years (see below for OEP end dates for each coverage year), broken down by: coverage year, month of plan selection, and loss of MEC SEP versus all other SEPs reasons. Consumers were only included if they “gained coverage” through a SEP, meaning the application was submitted after the end of the OEP (including the extra 36 hours provided to certain consumers after the 2020 OEP), the consumer did not have coverage at the time of application submission, and the consumer made a plan selection that was sent to the issuer (i.e., plan selections that were pended—for example, while the Exchange waited to receive documents from an applicant to prove a SEP-qualifying event—but that were not ultimately sent to an issuer, were excluded). We counted each consumer only once. If a consumer enrolled through multiple SEPs, we only counted the first SEP enrollment. In addition, consistent with our reporting during the OEP, plan selection counts do not reflect whether a consumer has paid any initial premium amount, if applicable.

Other methodological notes:

- Open Enrollment for 2017 ended January 31, 2017; Open Enrollment for 2018, 2019, and 2020 ended December 15 of the year preceding the coverage year. Therefore, 2017 has approximately 1.5 fewer months in the reporting period than the other years.

- Nevada became a state-based Exchange for coverage year 2020, and therefore has no HealthCare.gov SEP enrollments for that year. NV SEP volume across all SEP types was about 5,300 for 2017; about 7,500 for 2018; and about 6,600 for 2019.

UPDATE: This story in Inside Health Politics by Amy Lotven adds some additional context to both the CMS SEP report as well as to some of my data and estimates.

The agency’s special report on SEP enrollment trends appears to respond to a series of questions that Democrats demanded the department answer by June 19.

Ah, yes...I had forgotten about that. This explains why they issued such a report at all.

...So far, at least 310,000 people have signed up via the state exchanges, and several state-run exchanges will continue to take sign-ups through the end of July or later.

OK, I pegged it at at least 260,000 in my spreadsheet above, plus an estimate of perhaps 25,000 more via the other 4 states, which would be at least 285,000. This is perfectly in line with that, since my estimate is a couple of weeks out of date.

HHS also faces legal trouble over the decision, with House Democrats and a coalition of attorneys general backing a lawsuit filed by the city of Chicago that aims to compel the department to open an emergency special enrollment period. Congress also has repeatedly demanded HHS open a broad SEP, or at the very least launch a marketing campaign to inform Americans about their existing options, to no avail.

This quote from Josh Peck is amusing as well, and pretty much sums up my entire piece above:

Josh Peck, who ran marketing for the exchange under the Obama administration before founding the group Get America Covered, says the 200,000 more enrollments may be something to celebrate if 27 million people hadn’t just lost their employer-sponsored coverage. “A Special Enrollment Period for everyone and a major public awareness campaign, neither of which are happening, are the bare minimum this administration should be doing to ensure every American is aware of and has access to affordable health coverage,” he says.

UPDATE 6/26/20:

Democratic Health Leaders: New Data Suggests Trump Administration Failing to Protect Uninsured and Underinsured Americans

WASHINGTON, DC – After ignoring numerous calls from bicameral Democratic health committee leaders to create a broad special enrollment period and release data on health care enrollment trends, the Centers for Medicare & Medicaid Services (CMS) finally released limited data yesterday. In response, House Ways and Means Chairman Richard E. Neal (D-MA), House Energy and Commerce Chairman Frank Pallone, Jr. (D-NJ), House Education and Labor Chairman Robert C. “Bobby“ Scott (D-VA), Senate Health, Education, Labor, and Pensions (HELP) Ranking Member Patty Murray (D-WA), and Senate Finance Ranking Member Ron Wyden (D-OR) issued the following statement:

“As congressional health leaders, we have been asking for this data since early April. The data provided shows far fewer Americans accessing special enrollment periods during the coronavirus pandemic than anticipated. In a related briefing, senior CMS officials were unable to provide clear answers regarding what, if anything, CMS is doing to make it easier for consumers to enroll and the full scope of its outreach and marketing. Based on the unexpectedly-low enrollment numbers, it seems the agency’s efforts were wholly inadequate and put too much burden on consumers. While the Trump Administration urges the Supreme Court to eliminate the Affordable Care Act in the middle of a pandemic, the data serve as proof that the broad open enrollment period we have repeatedly called for is a necessity. CMS has disregarded its duty to comply with congressional oversight and has left both the public and lawmakers in the dark during a time of national crisis.

“This needs to change immediately. Now is the absolute worst time for CMS to be missing in action. CMS must live up to its mission to serve the American people and do more to guide consumers and protect their well-being.”

I should also note that even the limited data released by CMS yesterday does provide a bit of useful info going forward regarding SEP enrollment:

- 2017: 535,202 total SEP enrollments from 2/01 - 5/31 = 4,460/day over 120 days

- 2018: 712,507 total SEP enrollments from 12/16 - 5/31 = 4,266/day over 167 days

- 2019: 704,106 total SEP enrollments from 12/16 - 5/31 = 4,216/day over 167 days

- 2020: 892,141 total SEP enrollments from 12/16 - 5/21 = 5342/day over 167 days

If you disregard 2020 for obvious reasons, this means HC.gov has averaged around 4,300 QHP selections per day during the off-season from the end of Open Enrollment through May in prior years.

This is somewhat lower than my (admittedly very rough) earlier estimate of perhaps 6,000/day...although that was based on 2015 enrollment only, and included the entire off-season year. This means that either a) average SEP enrollment has dropped off by 28% since 2015 or b) SEP enrollment tends to increase dramatically in the later part of the year. In order to get a daily average of 6,000 QHPs, average enrollment would have to be something like 7,700/day on HC.gov from June - October to balance it out...and I find it difficult to believe that SEP enrollment would increase by 80% per day in the second half of the year, especially considering that the new enrollee's annual deductible would be exactly the same as if their coverage started in January. Every month that passes a policy with a deductible becomes less and less attractive.

It's worth noting that California appears to average around 950 SEP enrollees per day for a similar time period (February - early June). You'd expect CA to have roughly 19% as many SEP enrollees as HC.gov given that CA's open enrollment numbers are round that...but CA's are apparently more like 22% of HC.gov's instead. I'll keep that in mind in the future.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.