Colorado: APPROVED 2019 #ACA rate hikes: 5.6%, but likely would've DROPPED ~5% w/out #ACASabotage

This Just In from Connect for Health Colorado:

Most Connect for Health Colorado® Customers Will See Decrease in Premiums for 2019 as Marketplace Stabilizes

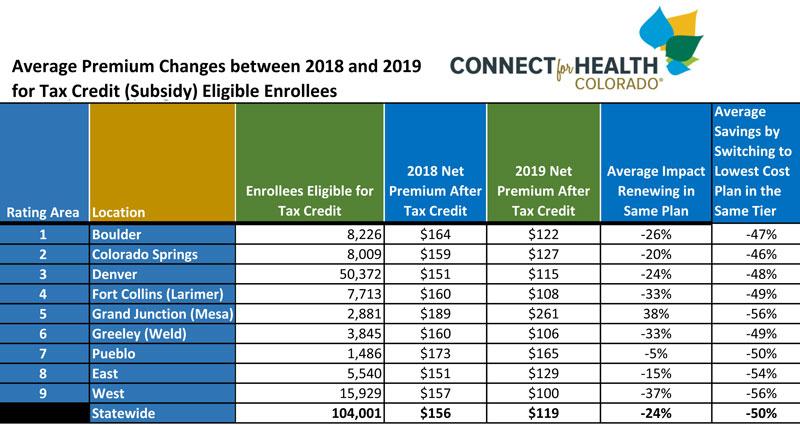

DENVER — With rate increases lower than the state has seen in years, Connect for Health Colorado® customers who qualify for financial help are looking at an average decrease in their net (after tax credit) premium of 24 percent next year.

The Colorado Division of Insurance today issued final approval for individual health insurance plans that will increase by an average of 5.6% in 2019. The relatively small increase in monthly premiums and the return of all seven health insurance companies to the Connect for Health Colorado, the state’s health insurance Marketplace, are signs of a stabilizing market for Coloradans who buy their own health insurance coverage.

“I am happy that so many of our customers will be seeing premium decreases,” said Connect for Health Colorado CEO Kevin Patterson. “But I remind everyone that it is still important to look at all your options. Things change and the best value for your family in 2019 could be different than what it was in 2018. We have tools to evaluate the whole cost of coverage and compare offerings side-by-side. I urge everyone to use them when they renew or shop for new coverage in 2019.”

Analysis shows that three out of four of Coloradans who bought their health insurance with financial help through the Marketplace this year will have an option for health insurance with a net premium (after financial help) less than $50 per month in 2019. Two out of three of the more than 100,000 Connect for Health Colorado customers who qualify for financial help will be able to find a bronze level plan for $0 net premium. Bronze level plans are the lowest premium tier but come with higher deductibles and other out of pocket costs than silver and gold level plans.

“The news is just as good for new customers coming to Connect for Health Colorado for 2019,” Patterson said. “Those who qualify for financial help will, on average, see their premiums reduced by 80%.”

There's a couple of things going on in Colorado which are fairly unique this year, but first let's look at the actual rate increases:

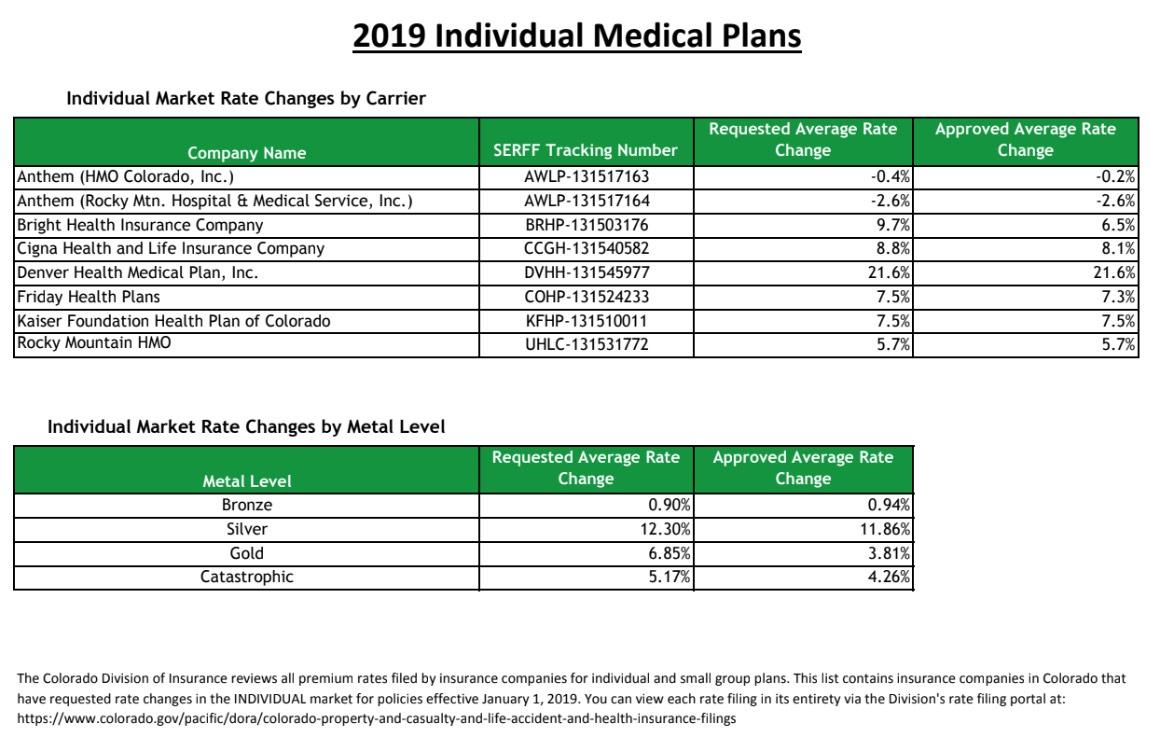

Here's the table comparing the requested and approved 2019 rate changes. The state insurance regulators didn't change much...they shaved a couple of points off of a few carriers while actually increasing rates slightly for one of them (Anthem requested a 0.4% drop but was approved for a 0.2% drop). This brings the statewide average increase down slightly, from 6.0% to 5.6% overall:

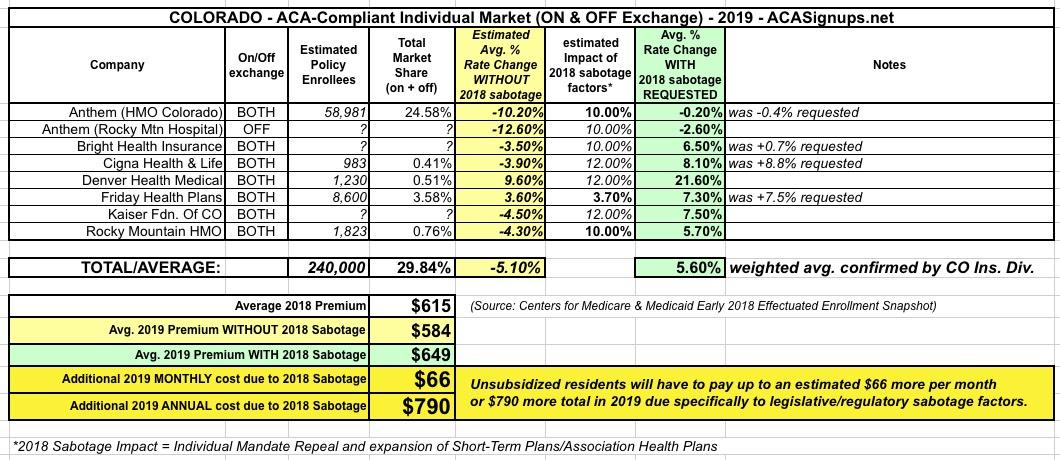

The average unsubsidized ACA enrollee in Colorado is paying $615/month this year. As I noted back in July, repeal of the individual mandate, combined with expansion of #ShortAssPlans, is likely responsible for roughly an 11 point increase, which means the Centennial State (yes, that's their nickname...I looked it up) will likely end up paying around $790 more apiece due to those factors:

There's another important thing to note about Colorado, however: Last year, Colorado was one of only a handful of states which used the "broad load" strategy to deal with Donald Trump cutting off Cost Sharing Reduction reimbursement payments. That is, they spread the additional CSR cost out across every ACA policy both on & off-exchange at all metal levels. Most other states went with either "silver loading" or "silver switching", in which they dumped the full CSR cost onto only silver plans (either both on & off-exchange, or on-exchange only).

For 2019, Colorado has wisely chosen to go the full "silver switcharoo" route.

This means that they're loading all of the CSR costs onto on-exchange Silver plans only...which you can see reflected in the fact that Silver plans are going up nearly 12% while Bronze, Gold and Catastrophic plans are only increasing by a small percent. In fact, Gold and Catastrophic plans only account for 6% of Colorado exchange enrollment while Bronze plans make up 49% of the total (CO is among the few states where Bronze enrollment is higher than Silver), which means that Bronze, Gold and Catastrophic combined average only around 1.3%.

In other words, Colorado is raising on-exchange Silver plans by 10.6% specifically to cancel out the cut-off of CSR payments.

Technically speaking, this should be added to the #ACASabotage factor, but that gets kind of confusing for most folks so I'll leave it as is for now.

What this does mean is two things: Currently subsidized enrollees should be able to save a ton next year thanks to the #SilverSwitcharoo effect, while unsubsidized enrollees should be able to avoid that additional 10.6% hit by enrolling in off-exchange "mirrored" Silver plans. Alternately, of course, they can upgrade to Gold or downgrade to Silver instead: